TMTB Weekly

QQQs finished the week -2.5% with Semis outperforming down less than 1%. Our tactical bounce call from last week was a dud - luckily the market didn’t even give us a chance to get too excited about it and we were stopped out quickly. Still, we find ourselves with the same view we expressed last week - a tactical bounce and then continued chop and we re-increased our length tactically on Friday.

We won’t go over all the reasons again - just take a look here at the write up from last week. Short-term, there are several other pieces of the mosaic that have us playing the long side again in the very short-term:

We think most market participants are viewing the Fed meeting on Wednesday in a positive light. While both DOGE, Tariffs, and Bessent/Trump have generated significant uncertainty in business environments, we think Powell has proved himself as a level-headed Fed head who understands and appreciates the risk of further economic slowing - in other words: Powell is a policy leader who is likely to assuage feelings around uncertainty instead of adding fuel to them. We thought his speech in early March was a good one and alleviated some concerns that Powell was going to be too scared of inflationary risks and not act quickly enough if growth slowed. In the speech, he focused on the ‘net effect’ of all actions and reminded people he cut 3x last time Trump did tariffs.

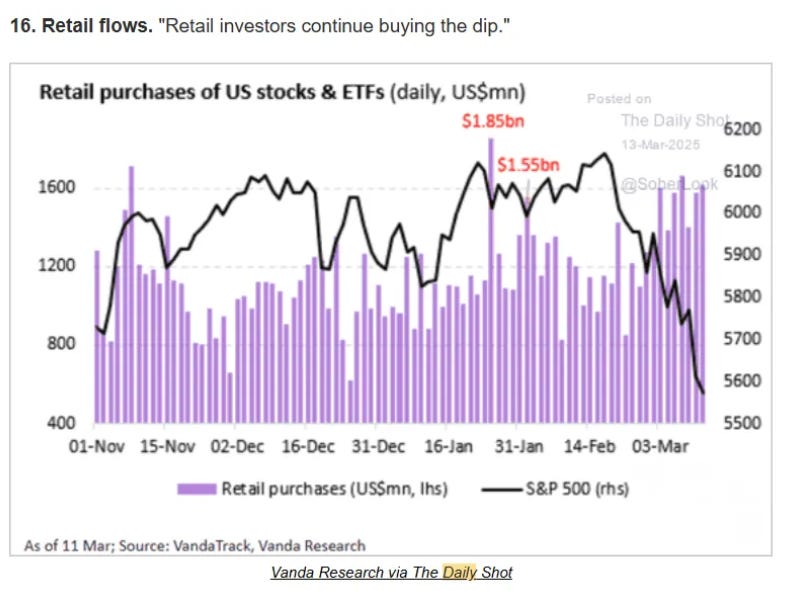

While the QQQs were down close to 3%, we began seeing early signs of positive tea leaves in the middle of week with many names not making new lows as the market did. Names like APP, MU, NVDA, and SPOT were up 8%+ on the week showing some real buying and a return to a focus on fundamentals and r/r prices. We’re even seeing some positive tea leaves in animal spirits as the Quantum basket was +20% heading into GTC’s quantum meeting with Jensen next week. Retail investors haven’t given up and as we get closer to tax day, retail headwinds begin to abate:

We wrote on Thursday afternoon how the price action was beginning to price in a recession in certain stocks and felt a bit like near-term exhaustion to the down.

If the market can’t go down on a horrendous UMich on Friday, what kind of economic data is going to take it down? (yes, I know the caveats around UMich data becoming more political). We got a bit of a black hole in terms of big econ data until PCE on March 28th then Tariffs 4/2 big date.

Trump/Bessent have caused a lot of uncertainty that could very well lead us into recession. At the same time, humans adjust to new environments very quickly - at what point does tariff uncertainty become a “new normal?” I’m reminded of the phrase: “keep calm and carry on.”

Still, not all is roses and hard to get more positive than just a tactical bounce. The pace and frequency we have heard of slowing consumer/enterprise/federal from companies over the past week is v. concerning. A few examples just from this past week:

DAL -7% said: "outlook impacted by recent reduction in consumer/corporate confidence caused by increased macro uncertainty, driving softness in Domestic demand. Premium, Int'l & loyalty revs growth trends are consistent w/expectations." Feb saw shift in GDP sentiment/output and consumer confidence coming down a bit, corp & consumer spending started to stall....

Edgewater called out some macro concerns for the first time in their META checks on Friday

TER fell after warning that tariff and trade uncertainty is negatively impacting its business causing pushouts and capital budget reviews at customers

VZ -7% warned that gross adds in Q1 would be soft as industry competitive intensity remains elevated amidst a weaker consumer

HelloFresh (HFG) -18% guided down citing “weakening consumer confidence in North America” alongside uncertain impact of “potential prolonged tariffs on agricultural and packaging products”

American Eagle CEO:".. They have the fear of the unknown. Not just tariffs, not just inflation, we see the government cutting people off. .. They see programs being cut, they don't know how that's going to affect them. .. And when people don't know what they don't know, they get very conservative."

Colgate CEO:" that slowdown that we've talked about over the past couple of quarters and we're seeing that sort of filter through across the businesses right now. as we look at the underlying trends, what's really changed, I think is the slowdown in consumer demand that we've seen over the past couple of months…Yeah, I think it's relatively broad based. I think what we're seeing is a little bit of a reduction in traffic. I think we're seeing, again, some hesitancy in the consumer given all the news flow that’s going out there."

PATH: “while we remain optimistic about the long-term opportunity in the US Public sector, the ongoing transition has created short-term uncertainty for deal closures, and we have factored this into our guidance for fiscal 2026 with a more pronounced impact in the first half of the year.” “There has also been a significant increase in volatility in the overall macroeconomic environment, particularly in the last two weeks. In recent discussions with customers, the external environment has created uncertainty around their budgets.

So it’s unclear how earnings are going to look in April.

And the same caveat I wrote last Sunday still applies this week:

Good article on Tariffs in CBC in this weekend:

After a lengthy meeting with U.S. President Donald Trump's top trade officials on Thursday, Canadian representatives say they have a clearer understanding of the rationale behind Trump's insistence on tariffs — not just on Canada but on the whole world.

"Tariffs are now a global policy of the United States," said David Paterson, Ontario's representative in Washington. "And this is a historic change to global trading patterns, and [the Americans are] very aware of that."

In an interview on Power & Politics, Paterson told host David Cochrane that the Canadians and Americans had a 90-minute meeting and the first half-hour was "a master class" from Lutnick in breaking down the U.S. position on tariffs.

The focus of the U.S. government is dealing with its yearly deficit in federal spending, Paterson said. The first is a major budget resolution that calls for trillions of dollars in spending and tax cuts, which is "something that must not increase that deficit further while keeping tax levels and competitiveness low," Paterson said.

The other two are measures to help make the spending and tax cuts happen without growing the deficit

This quote also interesting:

Paterson said the American plan is to impose tariffs by sector across countries all around the world on April 2. From there, the countries that get along with the U.S. the best will be "first in line" to adjust or mitigate the tariffs.

So a big jolt in early April (and potentially some sabre-rattling before then), but that would imply that news flow would get better (or less bad) after 4/2…still we’re pretty far away from the growth-positive policy changes (tax cuts, deregulation, less crowding out, etc.) that likely arrive in 2H of the year. So Trump/Bessent game plan seems to be —> hit economy now, try to thread needle by not causing too big a slowdown (although unclear to me if they actually might prefer a bigger slowdown/stock market pullback) , then take credit for big bounce back with “Trump” policies in 2H.

To us that tells us to be patient: last year was a great year and there is potential for 2H of the year to be a much easier environment. This all might make for a better trading/investing environment — its hard to remember, but the market was freaking out before Trump’s election + DOGE as the 10 year was close to 5% and dollar above $110.

Still a very tricky market environment with lots of cross currents. Name of the game remains: 1) protect pnl (low gross/net but increase with high conviction ideas) 2) continue to be flexible/adjust as things change 3) FOMO will kill you both ways 4) take shots but bar for conviction has to be higher and always risk manage.

Very short-tactical game plan: Add exposure if down Monday as we think Tuesday likely a good day heading into the Fed.

Some other things have our eye on:

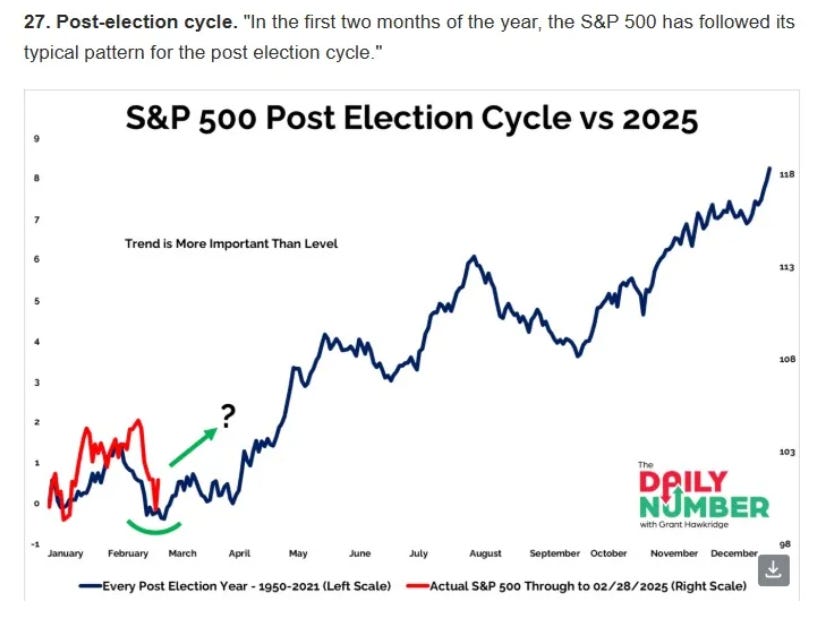

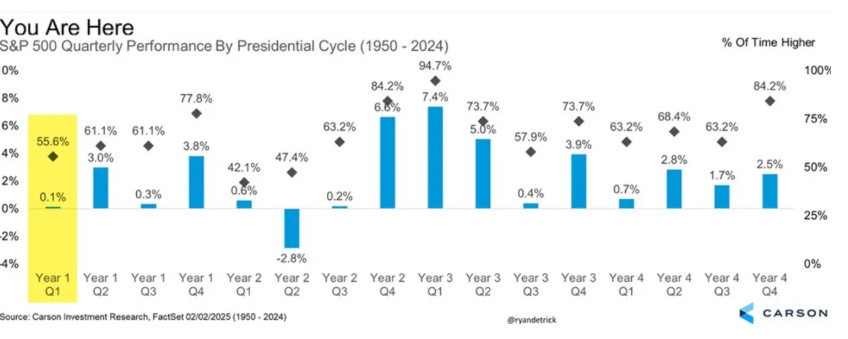

Despite all noise, the market is actually doing exactly what it has done over the last 20 years from a seasonal perspective and we are now entering a more seasonally friendly period

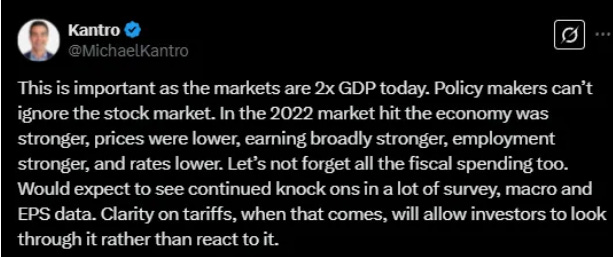

The stock market’s impact on the economy is reflexive in both directions:

A reminder to stay on our toes and remain open-minded:

A quick reminder of how vicious counter-rallies can be. I count 5 counter-trend rallies in 2022 decline: +11%, +17%, +12%; +21%; +16%. This is also a reminder of how far we can go if an economic slowdown takes hold: QQQs were down 35% in 2022 from peak to trough!

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.