Another doozy as QQQs - 1.8%. More de-grossing/de-rising as investors continue to grapple with increasing evidence of a slowing economy along with continued uncertainty surrounding DOGE/tariffs and what that means for future growth, along with what it means for earnings going forward. Today felt like a day where that was finally hitting home for many investors.

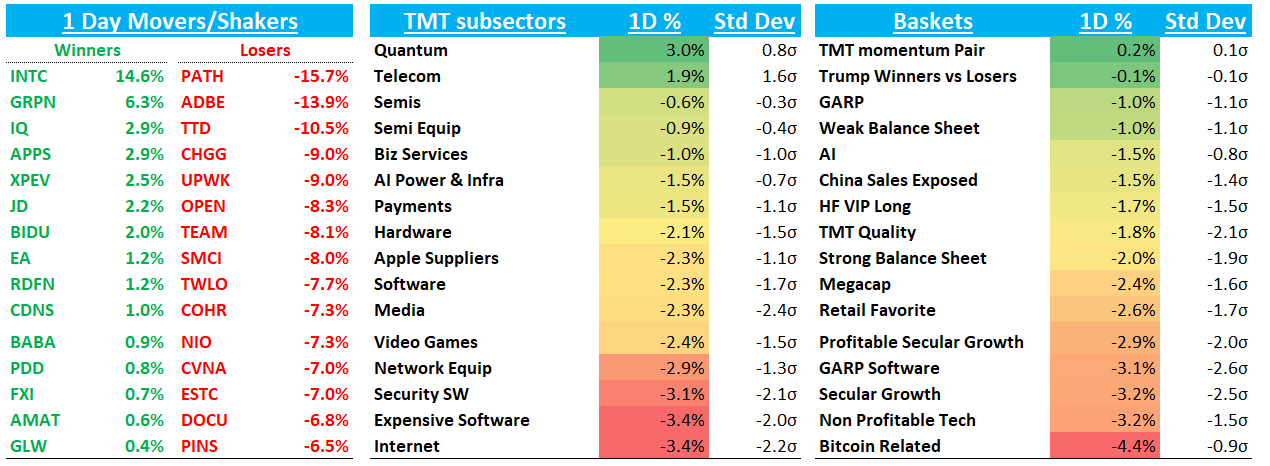

One example of that is ad names today, which got hit hard: META -4.7%, PINS -6.5%; RDDT -7%; SNAP -6%. As more consumer companies - AEG/Colgate yesterday the latest ones - are coming out calling out a slowing consumer, investors wonder when that will flow through to consumer facing internet companies. Ad companies are after all cyclical - all companies saw a big deceleration in growth in 2022, including META which decelerated from a Covid helped 37% in 2023 to -1% in 2022 - and one of the first thing companies cut is ad spend when end demand slow. To put it in other words: investors are questioning whether they can believe street estimates right now - and as a consequence, risk/reward math - as it’s unclear exactly how much the economy will slow. So yes, everyone is screaming “multiples are cheap!” but is the “E” in P/E the right one? The market is quickly recalibrating from what was likely upside to “E” to asking how big a potential downside there could be. There is so much uncertainty in the trajectory of the economy right now, I don’t think anyone knows what the real answer is — but the market is, after all, a discounting mechanism and recession probabilities are going up. Top down regime shifts always catch the bottoms up people off guard - and this growth expectations reset has happened hard and fast.

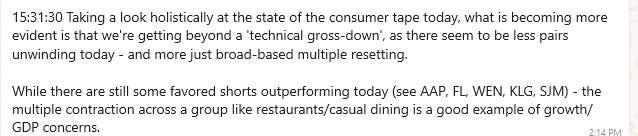

A v smart consumer friend said same thing happening in his space, which de-grossed earlier than others:

That’s today’s px action, but name of the game for us remains 1) protect pnl (low gross/net) 2) continue to be flexible/adjust as things change 3) FOMO will kill you both ways 4) take shots but bar for conviction has to be higher

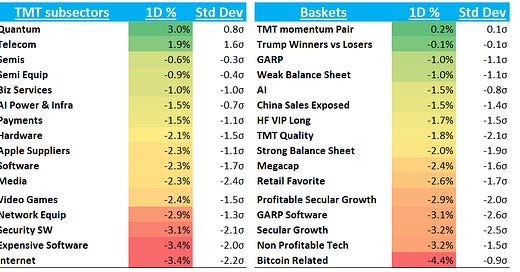

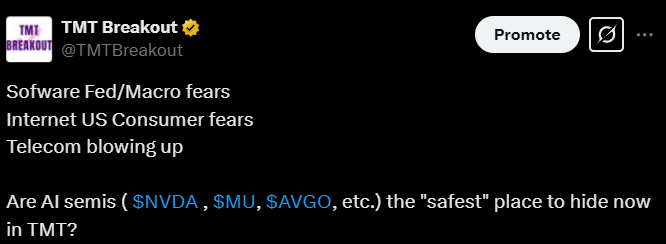

Semis with some outperformance today as SOX only down -60bps, helped by INTC and AI semi outperformance while software was hit after weaker earnings from S, PATH, and ADBE where the read-through to enterprise/fed spending was less than stellar.

On the macro front, China continues to outperform with FXI rising 66ps. Treasuries fell 4-6bps across the curve after a cooler PPI and rising macro worries. Fed easing expects remains in 75-80bps range. BTC -4% back to $80k

Onto the recap…

Internet

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.