TMTB Morning Wrap

Good morning. QQQs +2.7% as Trump blinked yesterday, opening the door for a possible meeting with China, also walking back recent Powell comments. Key comments:

TRUMP SAYS ULTIMATE CHINA TARIFF WON'T BE NEAR 145%

TRUMP: IT'LL COME DOWN SUBSTANTIALLY BUT WON'T BE ZERO

TRUMP: NEVER HAD INTENTION OF FIRING POWELL

TRUMP ASKED IF HE’LL PLAY HARDBALL WITH CHINA, SAYS "NO; WE'RE GOING TO BE VERY NICE WITH CHINA IF THEY DON'T MAKE DEAL, WE WILL SET DEAL

While nothing has changed and Bessent described a possible deal as taking months, if not years, headlines are important because it shows if things are going to get too bad - both economically, systemically, and from a stock mkt perspective - Trump will blink. He’s already blinked twice and so the signal this sends is that he will blink again if things get too bad, providing a level of psychological support for the markets and taking more left tail risk off the table.

So what to do today? We had already taken some profits on our safe-haven trade the last couple days and we don’t think the trade makes sense any longer in the short-term. We still think it might make sense to re-enter it at some point (maybe soon, maybe later) as any deal likely will take time, but we’ll have to read the tea leaves in real-time as they come out.

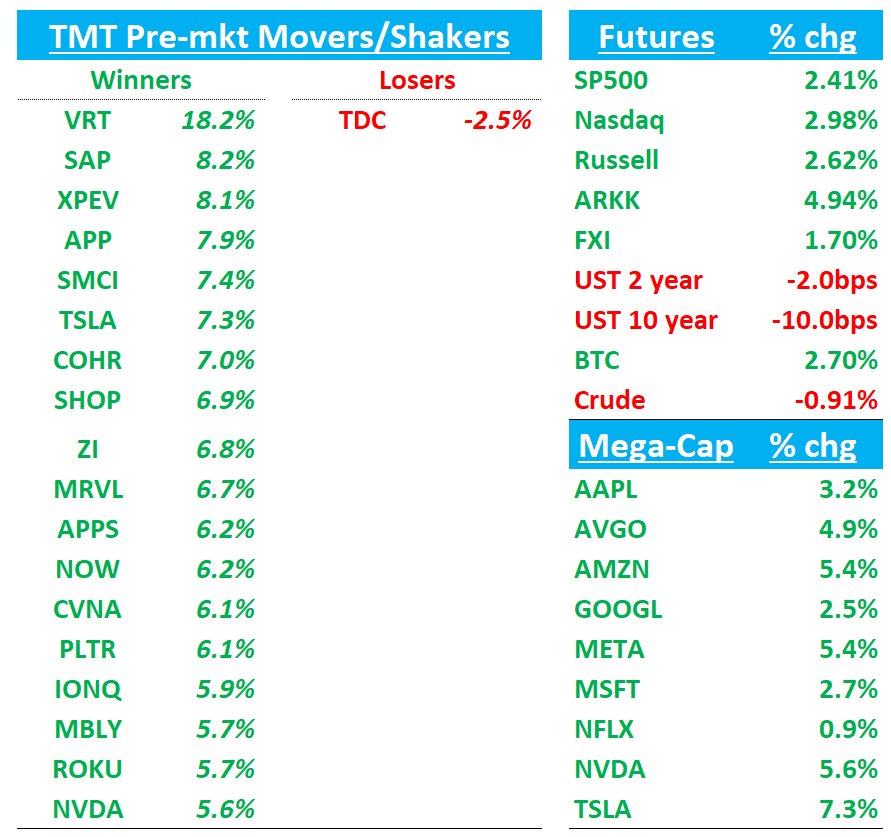

On top of the better China vibes, we also have SAP/PEGA/MANH beat (which helps enterprise sw), VRT/GEV beats (which helps AI power/semis), APH +12% beat, and Musk confirming he is leaving DOGE to spend more time at TSLA.

Bessent on the docket at 10am (can be watched here). Some speculation the talk will be a signal to some potential Treasury support down the line in case plumbing gets too bad - unclear if that’s true (we’ll find out soon enough) but if it is could add some fuel to the fire. We’re already seeing a higher dollar and lower yields as the long end of the curve is dn 10-13bps.

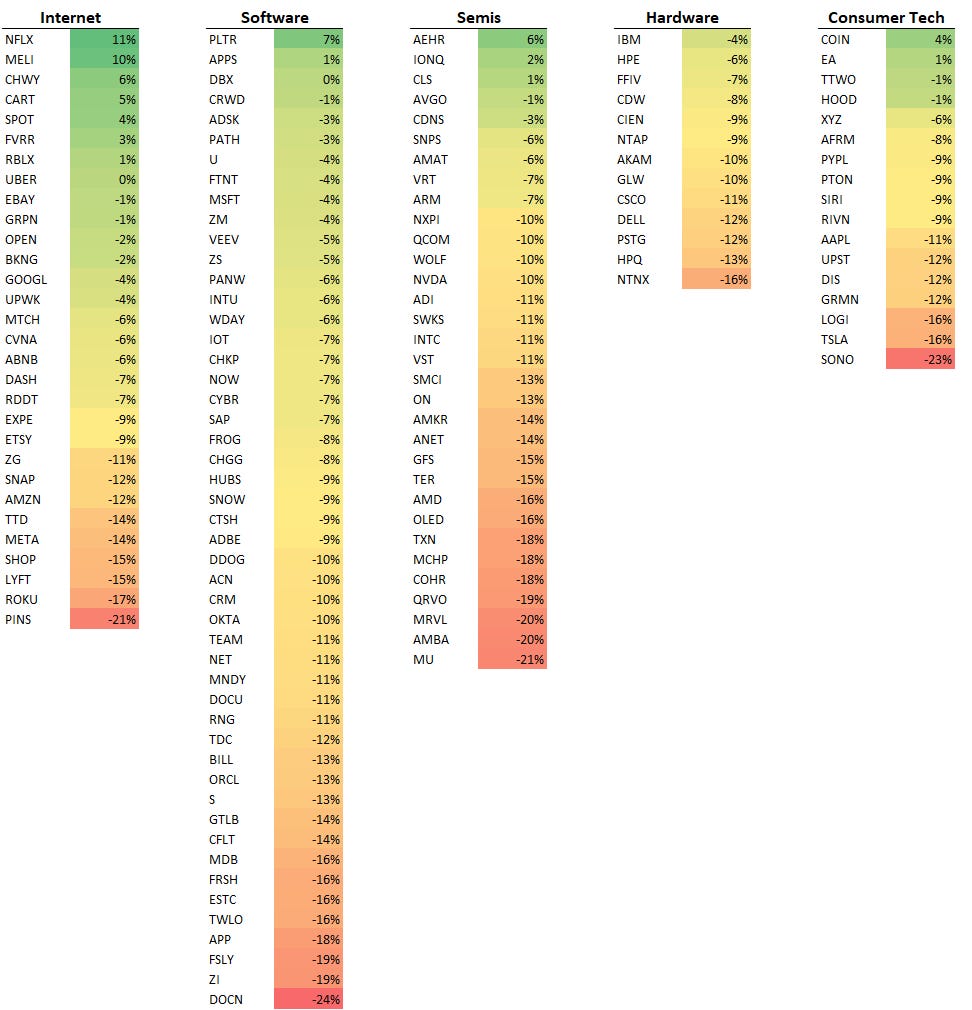

What should outperform today? We’re obviously focused on China tariff specific beneficiaries. Let’s not overcomplicate things: AMZN, SHOP, W (we wrote this one up in our weekly as one that has some near-term stock specific tailwinds as well), META, etc…Here’s a list of how stocks have performed since “Liberation Day”:

What will underperform: obvious China/Tariff safe havens like NFLX, SPOT, CART, RBLX, video games, etc. One would have expected sw to underperform, but good prints from SAP + PEGA complicates that today. We’re also looking for names that are up but have some neg idio news out to pair up against longs we like: for example, Clev out neg on ANET and Yipit shows a decel at CVNA (which has been viewed as a beneficiary from that China tariffs). One would think both of those names underperform other China beneficiaries today, even though they are both up 5-6% in the pre.

China is +1.6%, BTC +2.5%,

We’ll hit up Macro, then Earnings, then 3p/Research/News

Should be a fun one…Let’s get to it…

MACRO

China Signals Openness to U.S. Trade Talks—but Not Under Duress

WSJ:

China signaled it was open to trade talks with the U.S. a day after President Trump said he was willing to cut tariffs on Chinese goods, though Beijing warned it wouldn’t negotiate under continued threats from the White House.

“China’s attitude towards the tariff war launched by the U.S. is quite clear: We don’t want to fight, but we are not afraid of it. If we fight, we will fight to the end; if we talk, the door is wide open,” Foreign Ministry spokesperson Guo Jiakun said at a daily press briefing on Wednesday.

While Chinese officials have used similar wording previously in discussing the possibility of trade negotiations with Trump, taken together the latest comments from Beijing and Washington appear to be part of efforts to seek an off-ramp from the recent spiral of tensions.

The expressions of openness to a deal from both sides represent a shift from much of the past month, as the world’s two largest economies exchanged reciprocal tariff increases and testy words, helping push stock markets around the world to their worst weeks in many years.

The CEOs of three of the nation's biggest retailers — Walmart, Target and Home Depot — privately warned him that his tariff and trade policy could disrupt supply chains, raise prices and empty shelves, according to sources familiar with the meeting.

"The big box CEOs flat out told him [Trump] the prices aren't going up, they're steady right now, but they will go up. And this wasn't about food. But he was told that shelves will be empty," an administration official familiar with the meeting told Axios.

Another official briefed on the meeting said the CEOs told Trump disruptions could become noticeable in two weeks.

While that was happening, financial markets were slumping — stocks, bonds, the dollar — as investors panicked about Trump's latest threats to oust Fed chair Jerome Powell and step on the central bank's independence.

Auto groups lobby Trump administration against parts tariffs in rare unified message- CNBC

EARNINGS:

We posted summaries of TSLA and SAP Earnings Calls here last night

SAP +8%: Solid beat with CCB at 29%, high end of bogeys, EBIT coming in 9-10% ahead of street (300bps stronger margin), 50% FCF beat, and F’25 guide inline with street. More detail in the call summary above, but Mgmt sounded decent on the macro saying no deterioration in conversion rates so far in April. Overall, another solid print for SAP and should have investors feeling a bit more comfortable with the NOW print tonight, as well as rets of enterprise space.

TSLA +7%: GMs better at 16.3% vs street at 16.1% (Auto GMs 12.5% ex credits vs buyside expecting 10%) but top line worse. They’ll re-look at their guide at end of Q2 and omitted “return to growth” guide from last call.. Importantly Musk said on the call he will start spending more time at TSLA next month and less at DOGE and they re-iterated timeline for 3 major initiatives bulls have their eye on (as expected, unlike Elon to ever back off a timeline, no matter how aggressive it is):

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.