TMTB EOD Wrap; TSLA SAP First Takes

QQQs +3% as Politico reported the WH is “close’ on Japan and India tariff agreements although details are light (again) and Bessent saying yesterday evening that he expects tariff standoff with China to de-escalate, although language sounds like timing isn’t in the near future:

US Treasury Secretary Scott Bessent told a closed-door investor summit Tuesday that the tariff standoff with China cannot be sustained by both sides and that the world’s two largest economies will have to find ways to de-escalate.

That de-escalation will come in the very near future, Bessent said during an event hosted by JPMorgan Chase & Co. in Washington, which wasn’t open to the public or media. He characterized the current situation as essentially a trade embargo, according to people who attended the session.

Bessent said that it was not the US’s goal to decouple from China and that the current status quo of 145% tariffs on Chinese goods by the US and 125% tariffs on US products by China was not sustainable. He expressed optimism that tensions could cool in the coming months, which would bring relief to markets, but cautioned that a larger deal could take longer.

The Treasury chief told attendees that a comprehensive deal between the two countries could happen in two to three years.

Leavitt also said Trump is “setting the stage for a deal with China.”

A reader in the TMTB chat put it well:

Consumer seems to be holding up ok through 2nd week of April, which jives with what Netflix said:

But business confidence has been shattered:

Lots of cross-currents in policy + macro land. It will be interesting how those two cross currents play out throughout earnings season: weak business confidence vs. a still decent consumer.

Elsewhere, yields were slightly down while BTC +4.5%. We wrote a little yesterday about how BTC was acting more like digital gold than tech-beta. Well, with Gold down 1% today, BTC still rallied and it seems like px action is win-win here for the time being: risk on—> BTC = tech-beta…risk off—> BTC = digital gold…Chart looking better here too:

Note how BTC topped about a couple weeks before the indexes back in January - something I’m watching.

In terms of price action in Tech, we saw some more outperformance from some China/Tariff safe haven names: NFLX +5.3% almost at closing ATHs, SPOT +5.6%, CVNA +8% but not all (CART +1.5%) and the rally today was a lot broader based as AI semis, Large cap, and software all participated — a welcome sign. We trimmed a bit more off our Tariff/China safe haven theme (we give thanks), but we still think the trade could have legs, especially since the timeline Bessent is talking about re: China is “months” at earliest. After all, Covid “stay at home” names outperformed for about 3-6 months following initial Covid shock.

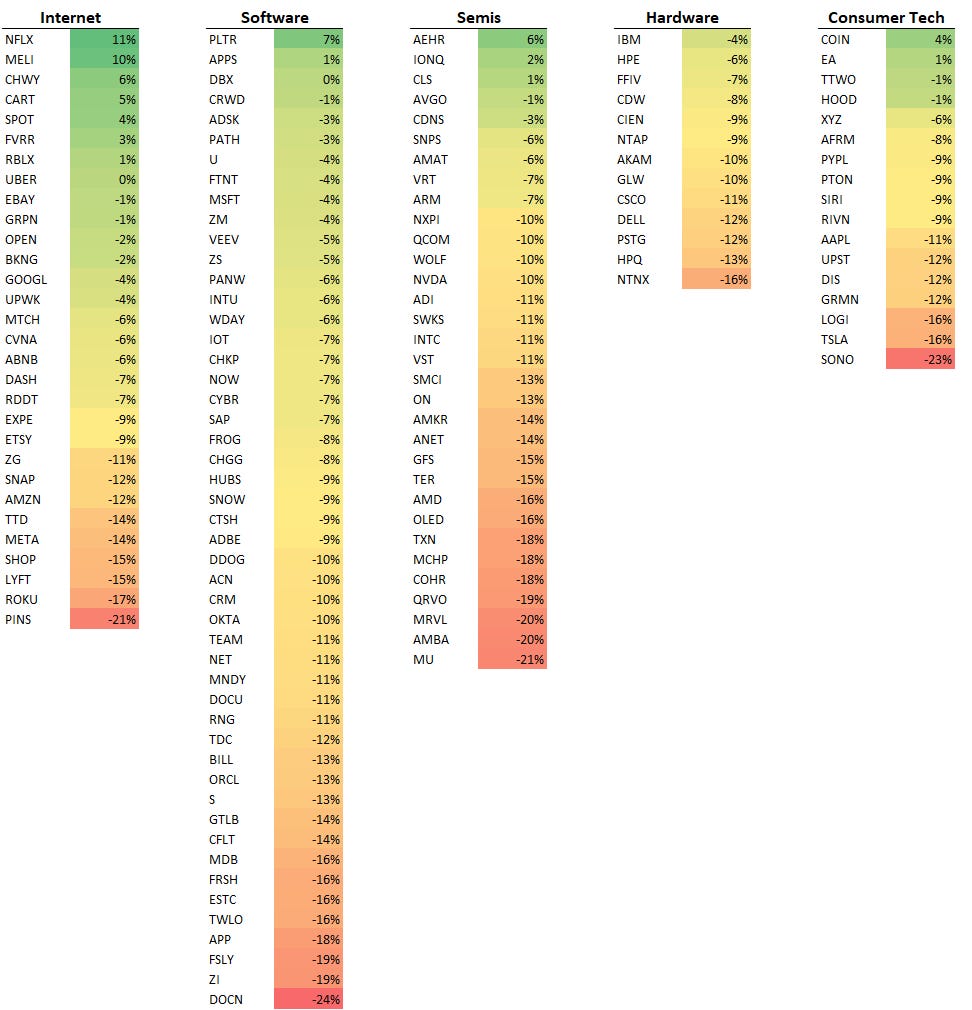

Here’s a look at how names have performed since “Liberation Day” — some of the difference in performance in each sector has been massive and that one “Tariff/China safe-haven” theme has generated massive alpha if positioned correctly:

Let’s get to the recap:

Post-close Earnings:

SAP +5% looks solid as CCB and EBIT beat. Q1 CCB came in at 29% cc, at the high end of bogeys and above street. Cloud Revs +26% cc, inline with bogeys. EBIT beat again coming in 9-10% above street at 2.46 vs 2.25B. F’25 guide roughly inline with street.

TSLA +1% GMs better at 16.3% vs street at 16.1% (Auto GMs 12.5% ex credits vs buyside expecting 10%) but top line worse. They’ll re-look at their guide at end of Q2 and omitted “return to growth” guide from last call.. Importantly they re-iterated timeline for 3 major initiatives bulls have their eye on (as expected, unlike Elon to ever back off a timeline, no matter how aggressive it is):

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.