TMTB Weekly

Happy Easter! We’ll start off with some quick tariff stuff (of course!) then dive into Tech…

Despite the 3-day weekend, we didn’t get any crazy tweet storms that will crash or rally markets (although that might have all changed by the time you read this). The markets remain in wait and see mode - despite Trump arguably sounding a bit less hawkish on China post-close on Thursday, investors at this point want to see some tangible evidence of progress rather than just rhetoric.

Given the untrustworthy and conflicting rhetoric of the Trump administration, we thought @DynamicMoats on X took an intelligent approach, gathering up what foreign countries are saying about progress.

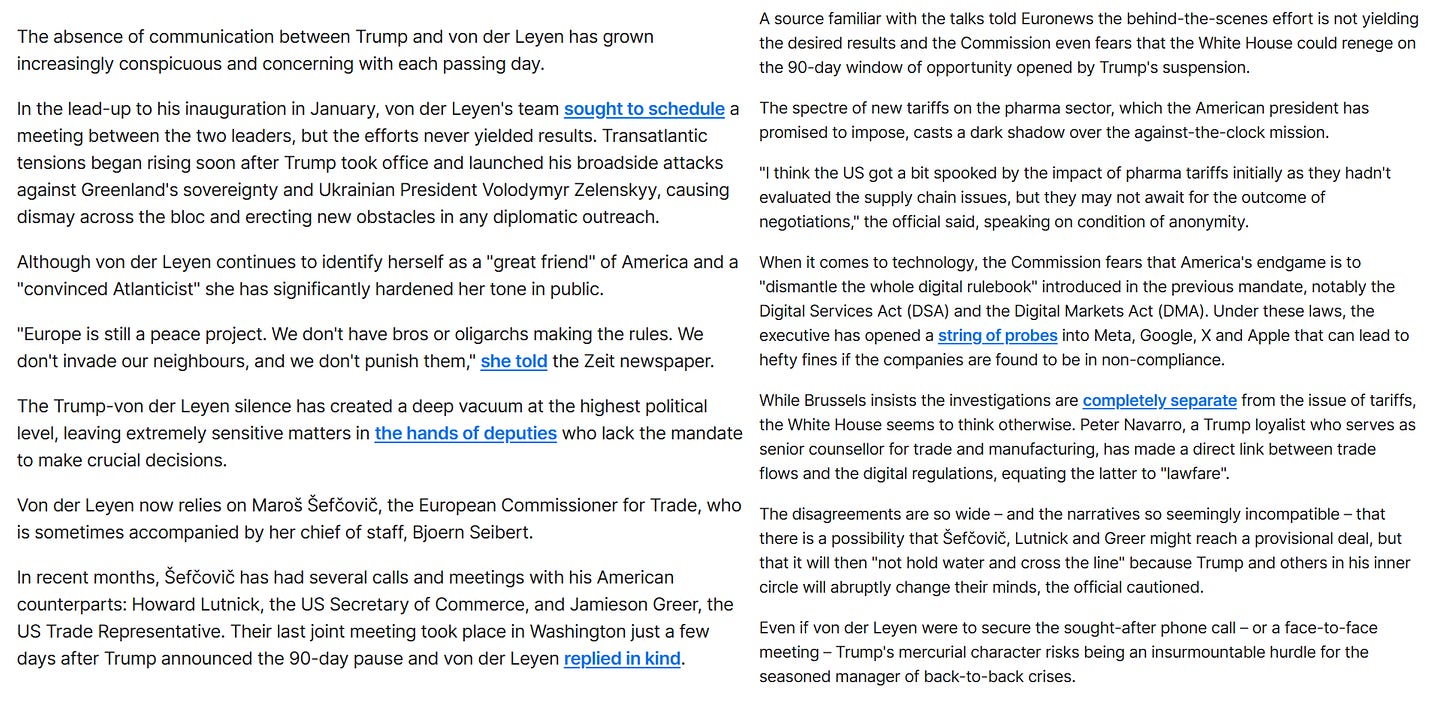

Here’s EU:

EU Commissioner Von der Leyen and Trump have not spoken… "The Trump-von der Leyen silence has created a deep vacuum at the highest political level"…. "The disagreements are so wide"…

Things with UK look better:

Japan

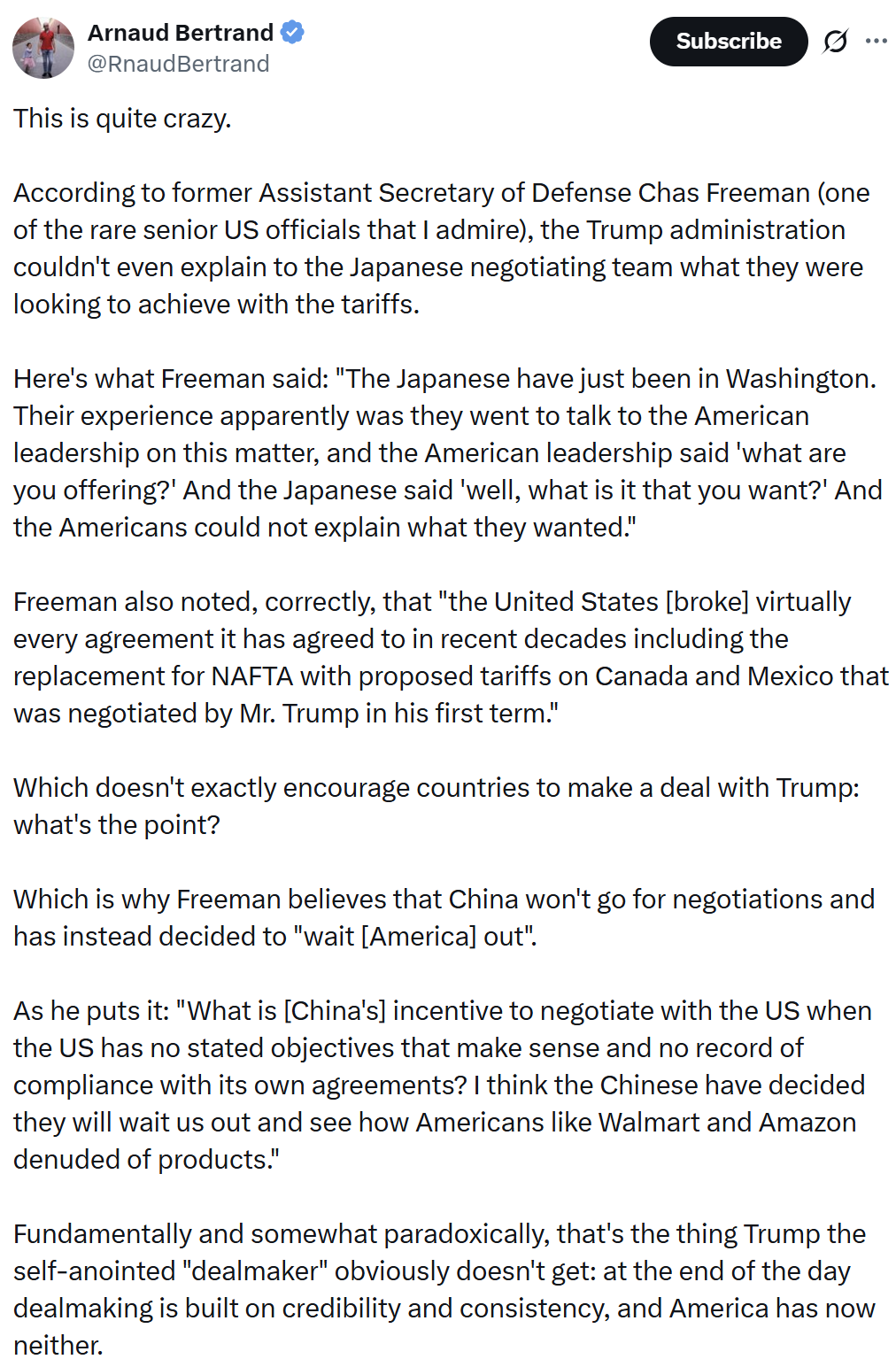

One more thing on Tariffs, then we’ll move on…

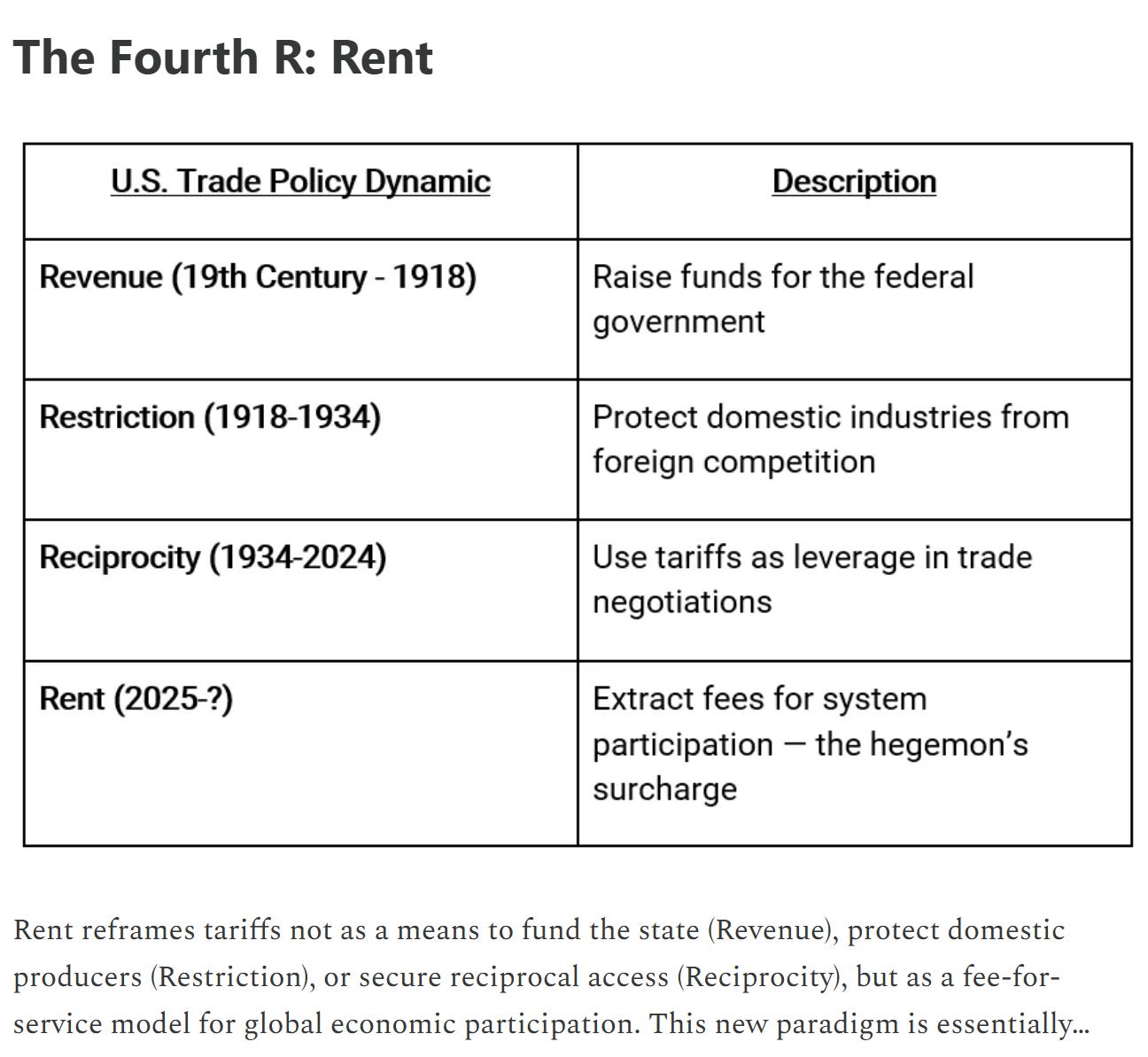

We thought our friend Citrini had a good historical piece on tariffs and framed the current US Trade Policy dynamic as globalization - as- a - service:

The whole piece is worth reading (not behind a paywall), but we liked these bigger picture takeaways:

Tariffs are a blunt tool, and it’s clear that Trump is using them as part of a broader negotiation in an attempt to upset this system. This is nowhere more evident than the tariff rate on China - 125%. With tariffs that high, trade simply stops. So why not use sanctions or quotas? Because it’s integral to start that negotiation from a place of “paying a fee”….

But the fact remains: for now countries are stuck negotiating with someone ready to blow up the system, consequences be damned. It is not difficult to see how many countries could simply acquiesce rather than deal with the reality of a deglobalized world & hardship.

Is there an outcome to this that’s not devastating to the global economy? Yes, but there’s no outcome where global trust in the U.S. is restored with haste.

No matter how the negotiations go, it’s clear that trade policy is going to be the primary driving factor for cross-asset returns and economic growth this year. And it’s clear that we are witnessing a regime change that will have macroeconomic consequences for years to come.

In this new regime, tariffs aren’t policy as much as they are precedent. The U.S. has shown it will use market access like a dial, tightening or loosening trade conditions based not on economic efficiency, but on geopolitical compliance. Regardless of whether the administration proposes extensive tax cuts or other supportive measures, it will all come down to how and when US-China trade talks progress.

The most uncomfortable part of this whole thing is that there is no historical framework. You can borrow from the 1970s and the 1930s and any other events that rewrote the plumbing layer of the system, but it’s not going to account for everything.

The world didn’t de-globalize in the 1930s, it had barely globalized to begin with. Now, for the first time, we are watching a superpower voluntarily jam a stick in the spokes of the very wheel it built.

And here’s the kicker: it may work. Temporarily. Politically. Until it doesn’t.

Just like Smoot–Hawley “worked” for about three months - - until Canada retaliated, Europe rearmed its tariffs, and global trade fell into a trapdoor. Until U.S. farmers went bankrupt in record numbers while still voting for the men who doomed their prices.

Let’s be honest: no one fully understands how our complex, multivariate global system functions in real time. Not the Fed, not CEOs, not the IMF and, sure as shit, not me or you. The ripple effects are impossible to comprehend. On the course we’re on, however, it seems we will be increasing our collective understanding in the most uncomfortable way possible.

Which leads us to Tech…

We expected the 2025 investing environment to be trickier and more dynamic than in 2024, but not like this. :shakes head: Not like this.

Still, we had more fun this past week than we have in a while as narratives, positioning, sentiment, and trends in Tech began to emerge: all things we love here at TMTB.

As things have settled down from the hectic pace of the first 2 weeks of April, we’re finally beginning to see narratives/positioning emerge in a more clearer light: the “tariff safe haven” theme we wrote about last week went into overdrive this week. We think this will continue as long as China/tariff uncertainty continues. It’s not surprising this is happening: investors love certainty so $’s are flowing into the least uncertain names. The price action is reminding me of Covid times when a lot of $'s shifted into perceived winners from the lock-downs like ZM, NFLX, etc.

There are many overlapping cross-currents in Tech right now and another high-level theme we have been focused on is the possible regime change in US vs. ROW with $’s shifting back overseas. Something to think about: META/AMZN/GOOGL A LOT of market cap, and they are all exposed to China/Tariffs in one way or another. It's not surprising to see $’s quickly shifting into NFLX and SPOT as the other large caps in tech, but even they are a lot smaller than the former 3. Think about smaller names like RBLX, DASH, CART etc....Just do the math: if a fund sells a 1% position in META/AMZN/GOOGL...That 1% in $ terms is a significant greater % of mkt cap of smaller names, even NFLX/SPOT, which means you can get some outsized moves like you saw this week. Our sense is that the solid NFLX print will only reinforce this dynamic.

(Does the foreign investor flow back into other countries mean we’ll have a whole new set of compounders? What does it mean for the multiples of large cap tech cos on a go forward basis? These are questions top of mind for Tech investors right now…)

How long can the stay-at-home tariff safe haven trade last? Well, in covid, these performance gaps continued to widen call it 3-6 months from March lows through Sept 2020 and the difference in spreads were massive between perceived beneficiaries and losers.

However, this is different for many reasons. The main one being that everything can be fixed with a simple Trump tweet. Any perceived real progress on the China front could cause a quick and violent snap back in the other direction. For now, our sense is that investors are tired of the “rhetoric” and want to see real progress, which means meetings, etc. Our guess is that comes in the form of the announcement of a meeting between Trump and Xi or two other very high level officials from each country.

We continue to remain open-minded and nimble and will continue to adjust as the facts change.

As we head into earnings seasons, my sense is we’ll get more narrative/positioning shakeups, although mgmt teams sit in a similar position we investors do: an inability to think or know how things will look like in a month or two from a business perspective given mixed signals from the administration and what the real impact of initial tariffs will be on the economy. As Citrini said it: “no one fully understands how our complex, multivariate global system functions in real time.”

While plenty of co’s will call out macro headwinds, our sense is there will be other companies like NFLX who will say they aren’t seeing any impact on their business yet. But will investors care if the brunt of the impact hasn’t been felt yet? NFLX is almost a unique case study as not only are they tariff/China proof, but also one of the most recession proof companies out there given their $7.99 ad tier. As our smart friend put it: “NFLX was likely the easiest print of the season.” There will be a lot of real-time tea-leaf reading during earnings season — in commentary, narratives, and price action.

Given the uncertainty in the macro, we think third-party data will become especially relevant for investors during this time.

Here’s a few names where we think the third-party data is especially interesting: