TMTB Morning Wrap

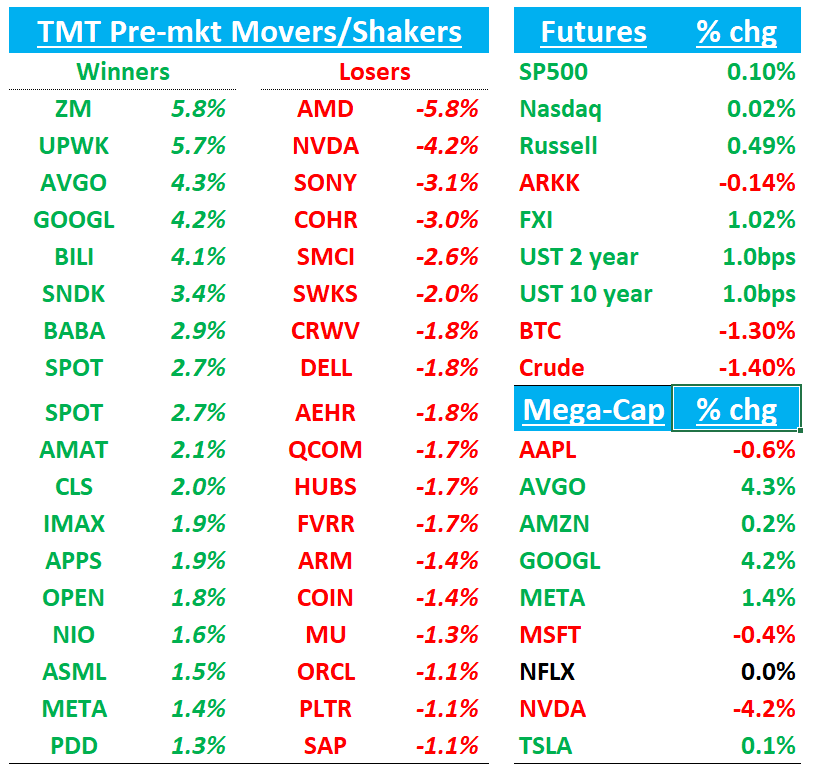

Futures flat but lots of movement underneath the surface with NVDA -4% and AMD -6%. The sell OpenAI levered names vs Buy GOOGL/TPU exposed names was in full force yesterday and likely continues today after TheInformation calling out META possibly buying TPU chips. The NVDA and AMD narratives continue to get more muddied post-Gemini release (see our weekly for more details on the NVDA narrative post last week). Rocha from WF raises a key question this morning: Is the TPU news a function of incremental TPU eating share from NVDA or META’s MTIA (AVGO)? Softbank — OpenAi proxy - -7% overnight

Google Further Encroaches on Nvidia’s Turf With New AI Chip Push

Google is talking to Meta and other cloud customers about letting them run Google’s TPU chips in their data centers. The effort could help expand the appeal of Google’s alternative to Nvidia’s AI chips.

Meta, the parent company of Facebook and Instagram, is currently in talks with Google about spending billions of dollars to use TPUs in Meta’s data centers in 2027, as well as to rent Google chips from Google Cloud next year, according to a person involved in the talks. Meta currently relies on Nvidia’s graphics processing units.

Nvidia CEO Jensen Huang closely monitored Google’s technical progress with TPUs and sprung into action to entice existing and potential TPU customers such as OpenAI and Anthropic to make big commitments to Nvidia’s GPUs. It’s possible Huang could preempt a Meta-Google deal over TPUs by hammering out a deal of his own with Meta, which is already one of Nvidia’s biggest customers.

Jax, Google’s comparable programming language for TPUs, is less familiar to developers, though Google has told customers they can use other software tied to PyTorch, a popular AI framework that developers use to operate TPUs without needing to be Jax experts. Customers can use the PyTorch-related software to interact with the TPU command center software that controls the TPU server clusters. (Meta invented PyTorch and made it open source.

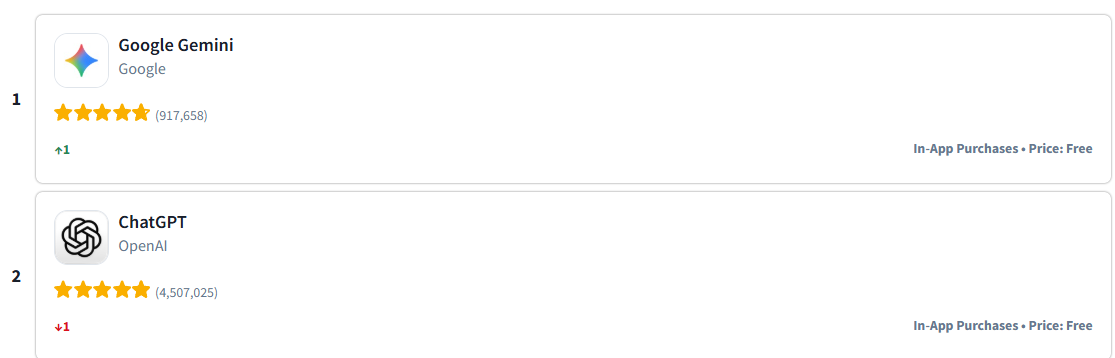

New Leader on top of U.S. iOS app store:

Asia stocks mixed overnight: TPX -0.21%, NKY +0.07%, Hang Seng +0.69%, HSCEI +0.87%, SHCOMP +0.87%, Shenzhen +1.42%, Taiwan TAIEX +1.54%, Korea KOSPI +0.3%,. BTC -1%

We get earnings from ADSK, DELL, HPQ, NTAP, WDAY, ZS later today

Let’s get to it…

BABA: Solid Top-Line & Cloud Beat (and accelerates to 35%); EBITA Better-Than-Feared, EPS Below Street

Cloud results and AI talk should outweigh weakness elsewhere…call onging

Revenue: Rmb247.8bn (+5% y/y) vs Street Rmb245.2bn (~+1% beat).

Cloud Intelligence: Rmb39.8bn (+34.5% y/y) vs Street ~Rmb37.9bn (~+5% beat); ex-internal usage +29% y/y, with cloud EBITA margin at 9%, roughly inline with Street.

Non-GAAP net income / EPS: NI Rmb10.5bn (-71% y/y) vs Street Rmb13.51bn (~23% miss); EPADS Rmb4.36 vs Street Rmb6.34 (miss), mainly on lower gross margin and higher R&D and opex.

China e-commerce: Revenue Rmb132.6bn (+16% y/y); CMR +10% y/y, broadly inline with Street expectations, while quick commerce revenue Rmb22.9bn (+60% y/y) was well ahead of market expectations.

International digital commerce: Revenue Rmb34.8bn (+10% y/y) came in soft versus forecasts, but AIDC adj. EBITA of Rmb162mn was a positive surprise vs Street’s expectation for a small loss.

Profitability: Total adj. EBITA was Rmb9.07bn (4% margin vs 17.2% a year ago), better than feared given reinvestment and mix headwinds.

Capex: Rmb31.5bn (+80% y/y), with trailing-12-month capex around Rmb120bn, underscoring heavy spend behind cloud and AI infrastructure.

TECH RESEARCH/NEWS

SPOT: Spotify to raise US prices in first quarter of next year- FinancialTimes

JPMorgan analysts have projected a $1-a-month US price rise would boost Spotify’s annual revenue by $500mn. Spotify declined to comment.

AMAT: UBS Upgrades to Buy, Citing Sharply Stronger 2026–27 WFE Outlook

UBS lifts Applied Materials to Buy with a $285 PT, saying its view on 2026–27 wafer-fab-equipment spending has turned “significantly more bullish,” especially on the memory side. The firm now models 2026 WFE growing 20%+ to roughly $136.5B, which the analyst says positions AMAT as the most meaningful beneficiary of the coming DRAM cycle. UBS argues its updated EPS outlook of $13.00 for 2027 versus the Street’s $11.56 justifies a materially higher valuation. The report frames AMAT as the cleanest way to play the memory-led capex inflection, with the reset earnings power supporting additional upside.

SNDK +4%: Will be added to SP500

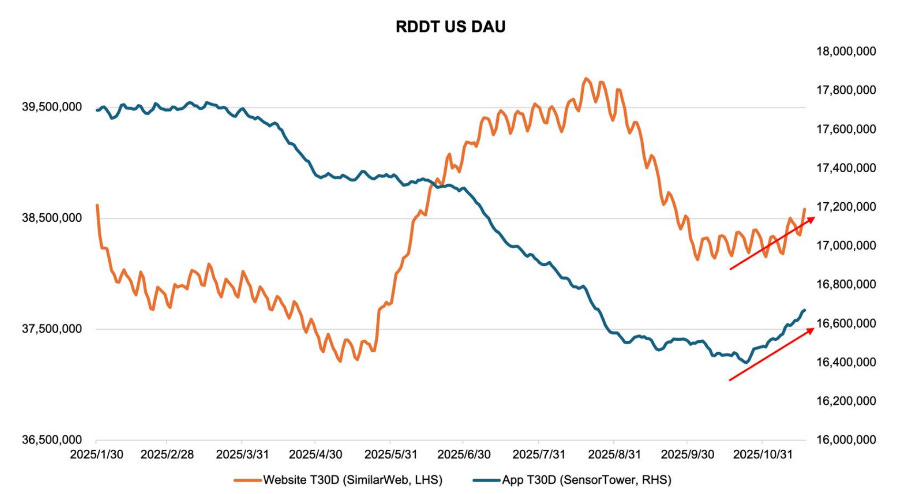

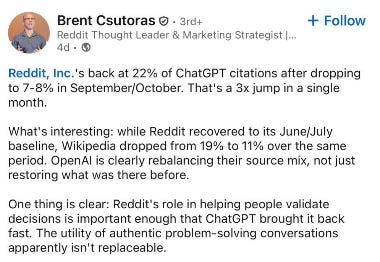

RDDT: ChatGPT citations back to June/July levels helping DAUs / does a shift to Gemini help?

We called this out in our EOD wrap yesterday, and a reader sent me the latest data, showing nice uptick in US DAU (web and app)

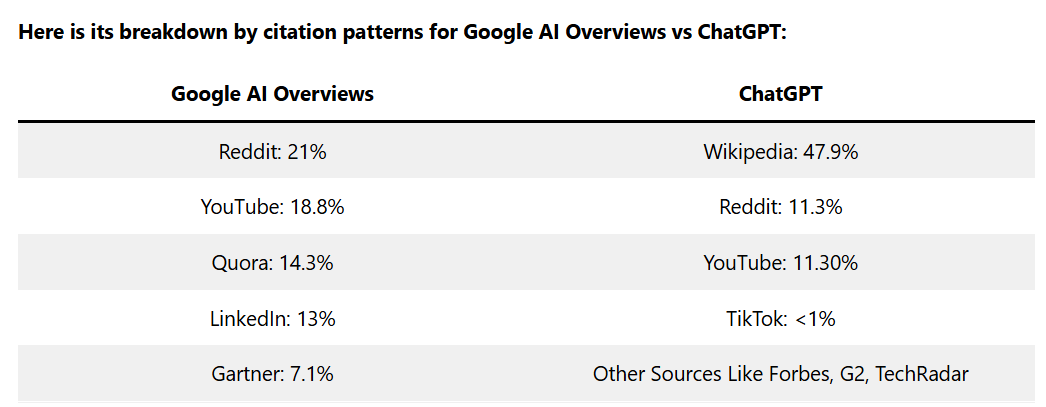

Trying to dig into whether a shift to Gemini from ChatGPT would be beneficial for RDDT….Anecdotally, would seem like this would be a good shift as we’ve heard news of Google prioritizing RDDT results and trying to keep them health and there was that Bloomberg article in September talking about deeper integration (although likely leaked by RDDT)…Main source of #s I found was this article from DigitalBloom on Nov 1:

Between March and June 2025, Reddit’s citation rate surged from 1.30% to 7.15%—a staggering 450% increase in just three months. In Google AI Overviews specifically (as distinct from AI Mode), Reddit commands an even more dominant 21% share of citations, positioning it as the premier source for user-generated perspectives.

Seems like on the margins a shift in share would be helpful to RDDT, but it’s not completely clear to me. One could also argue a good read-through from the past two weeks is bigger models and more competition means RDDT’s leverage in deal re-negotiation is better.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.