TMTB EOD Wrap

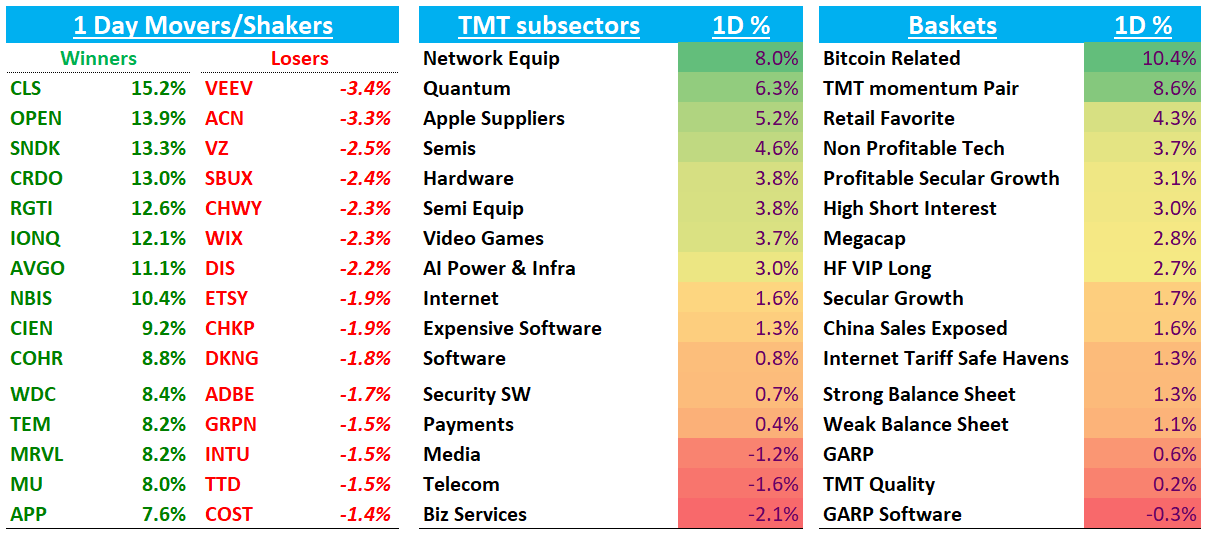

Solid price action all around underneath the surface. Semis +4.6% significantly outperformed Software (pair -3%) and the AI winners basket surged 4.2%. BoFA said this is the Best day their AI baskets have had in over a year and both having their 3rd best day since AI trade began in late 2022. The big winners today were the GOOGL +6.3% supply chain beneficiaries with LITE +17% to new highs; CLS +15%; AVGO +11% (10th biggest single day move ever); CRDO +13%. VIX was down 12% as investors chased momentum and cyclical growth while defensive and quality-factor underperformed.

There’s a new king in town and investors aggressively shifting exposure away from NVDA +2%/OAI ecosystem to GOOGL exposed names (this continuing in the after hours after TheInformation’s article on TPUs — more below…). Neutral names exposed to both TPUs and GPUs also outperformed: WDC/STX +8%; SNDK +13%; MU +8%.

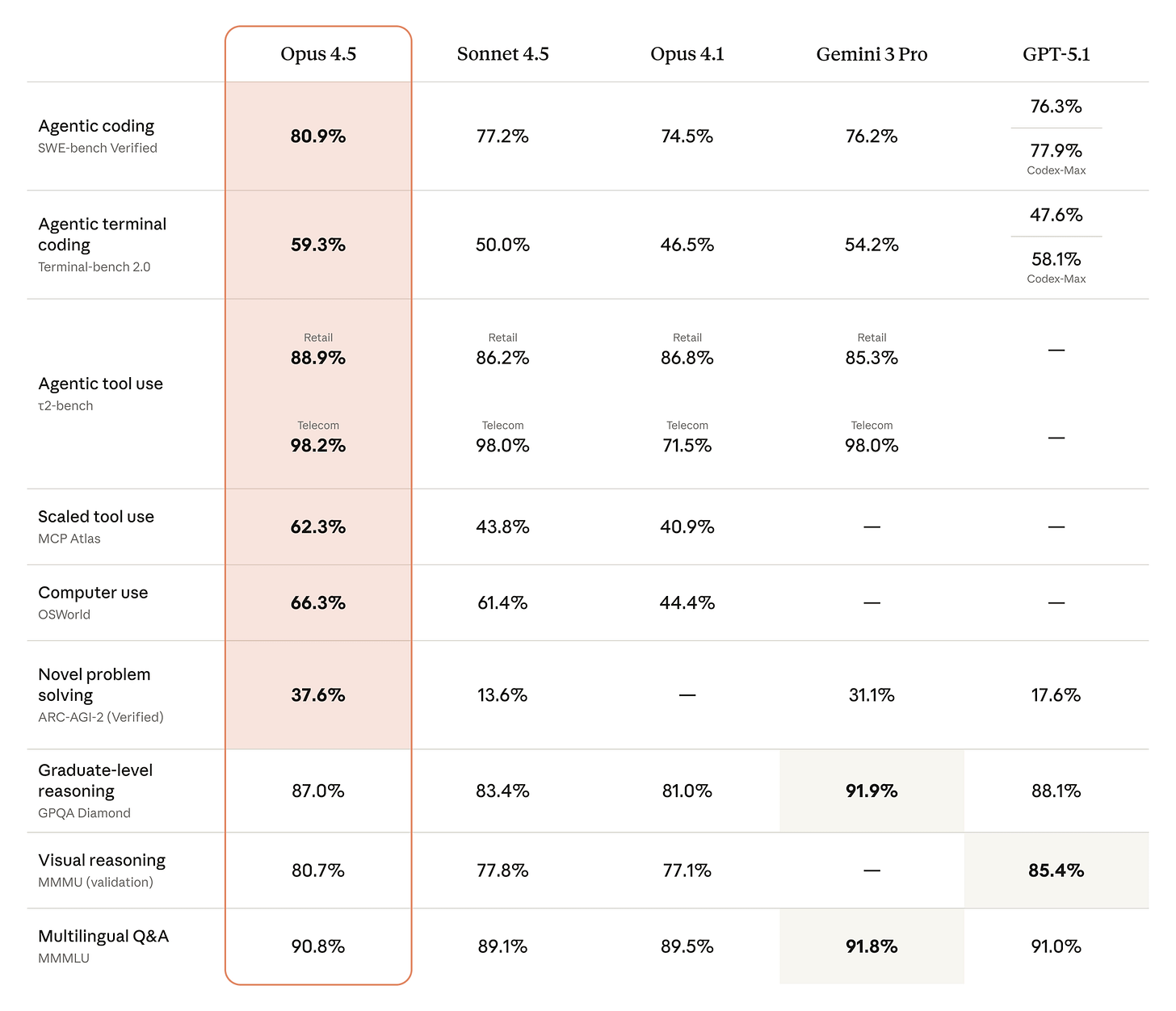

In the LLM wars, Anthropic released Opus 4.5, which leap-frogged them back into first place across several benchmarks:

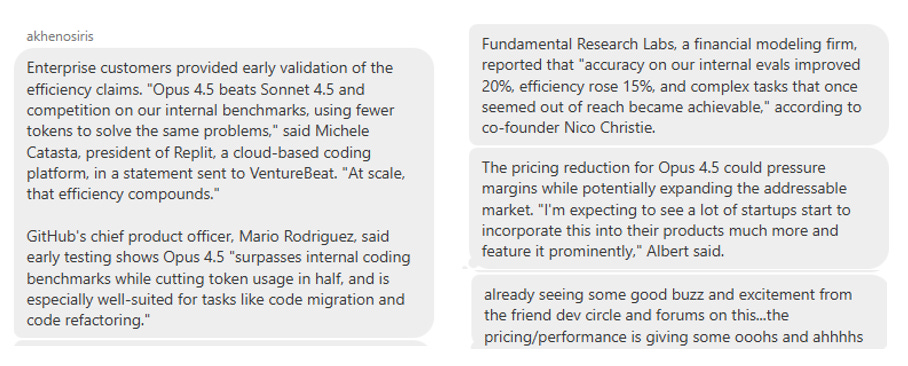

The mode looks very token efficient in practice. At the highest effort level, Opus 4.5 exceeds Sonnet 4.5 performance by 4.3 percentage points while still using 48% fewer tokens.

The Opus 4.5 release is a good tea leaf that acts as a critical counter-narrative to the “scale is all you need” narrative that built quickly on the back of Gemini 3 release, demonstrating that architectural efficiency can still beat brute force compute in certain areas. Opus 4.5 beat Gemini 3 in agentic utility and token efficiency, two areas which are key for enterprise/coding/API use, Anthropic’s home turf where the ability to execute multi-step agentic workflows matters more to enterprise ROI than marginal gains in general knowledge. We think better efficiency is a good thing for compute demand as we’re believers in Jevon’s Paradox at this stage of the cycle. OpenAI faces a different challenge/debate in the consumer market.

We took the majority of our short-term long trade from early Friday off today. While our base case remains ~$615+ on the QQQs near-term on this move off the lows, we always love a good risk/reward here at TMTB, and the highest reward trade we can make right now is giving up some pnl for a stress-free Thanksgiving break where we’ll aim to think about the markets as little as possible (a task much harder than nailing a trade!). On that note, tomorrow will be our last post until the following Monday.

Let’s get to it…

INTERNET

GOOGL +6% (and up another 2% in the post on TheInformation article saying META is exploring Billions in spending on TPUs, including for its own Datacenters…NVDA -2%/AMD -2% on the news):

“The software, known as TPU command center, appears to be Google’s way of chipping away at one of Nvidia’s biggest advantages: its Cuda software, a de facto standard for AI developers, who are deeply familiar with how to use it to get their models working on Nvidia chips.

Jax, Google’s comparable programming language for TPUs, is less familiar to developers, though Google has told customers they can use other software tied to PyTorch, a popular AI framework that developers use to operate TPUs without needing to be Jax experts. Customers can use the PyTorch-related software to interact with the TPU command center software that controls the TPU server clusters. (Meta invented PyTorch and made it open source.)”

Good discussion on the article in TMTB chat here

Reports floating around X today that some users getting errors due to high traffic

RDDT +6%: Interesting snippet from the PCMag article that was out midday on ChatGPT’s new shopping tool: I Was Among the First to Try ChatGPT’s Ambitious, But Half-Baked Online Shopper (PCMag)

One issue is the tech can’t distinguish between real and fake customer reviews, and it doesn’t know if a product appears popular simply because it’s being advertised by the company. “It’s impossible to know which is real; it’s a hard task,” an OpenAI employee explained at the event.

To get around this, the model leans heavily on Reddit reviews since the company has deemed them more “organic.”

Read here is that OAI appreciating value of RDDT’s content more, especially as it shifts into shopping/monetization, which has positive implications for what a licensing renewal would look like. Didn’t see that link get passed around by the sell side yet.

Some commentary on the App launch in TMTB chat here, which didn’t seem ready for primetime

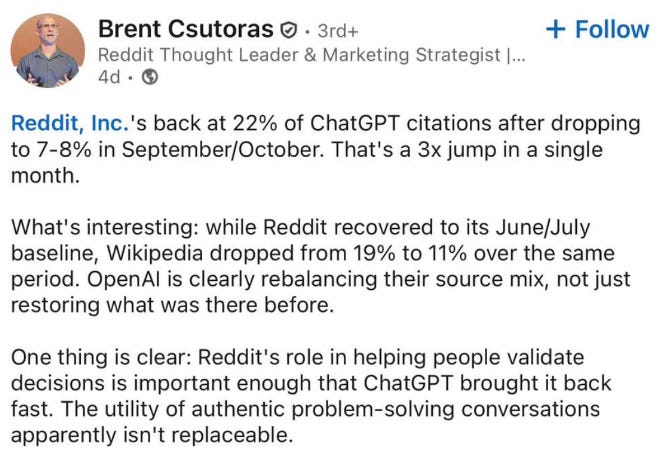

Secondly, ChatGPT citations are back to where they were in June/July, back at 22%

Lastly, both the web and app US DAU # have trended up and improved in November. This is the first time the app data has showed a sustainable uptick all month since the beginning of last year. Intra q checks here look decent as well. RDDT also seen as a key non-commoditized human input for larger training models so the Gemini 3 release was a good read-through.

All-in all, the ingredients here line up for a solid B+ long.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.