TMTB Morning Wrap

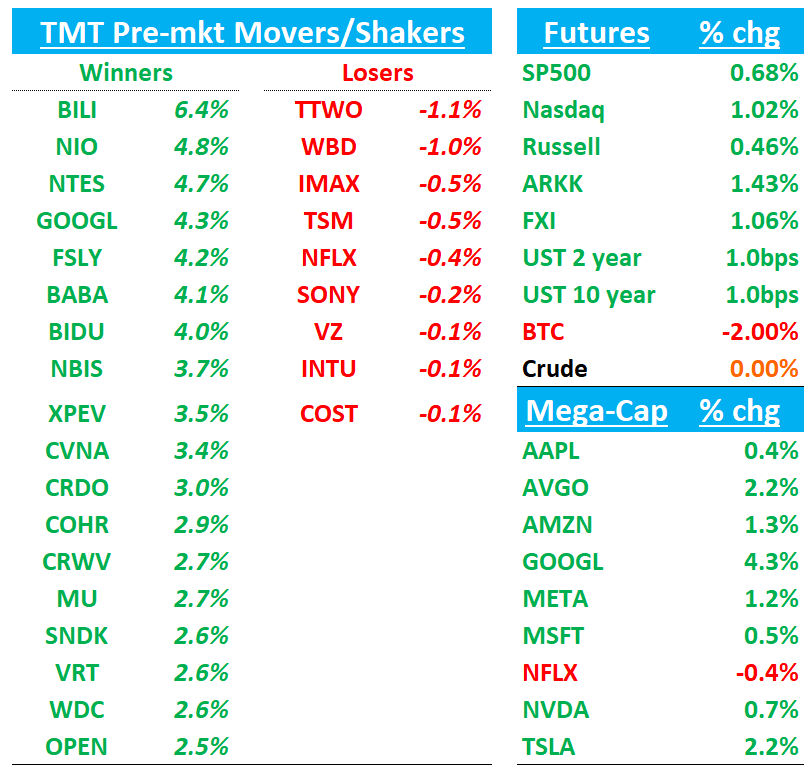

Good morning. Futures +1% as we start the shortened holiday week. GOOGL +4% following through early on last week’s strength — yet to see capitulation buying today looks like it could be it as it finally breaks $300. Asia was mixed overnight with China the standout: Hang Seng +1.97%, HSCEI +1.79%, SHCOMP +0.05%, Shenzhen +0.87%, Taiwan TAIEX +0.26%, Korea KOSPI -0.19%. BTC back above $85k.

Let’s get to it…

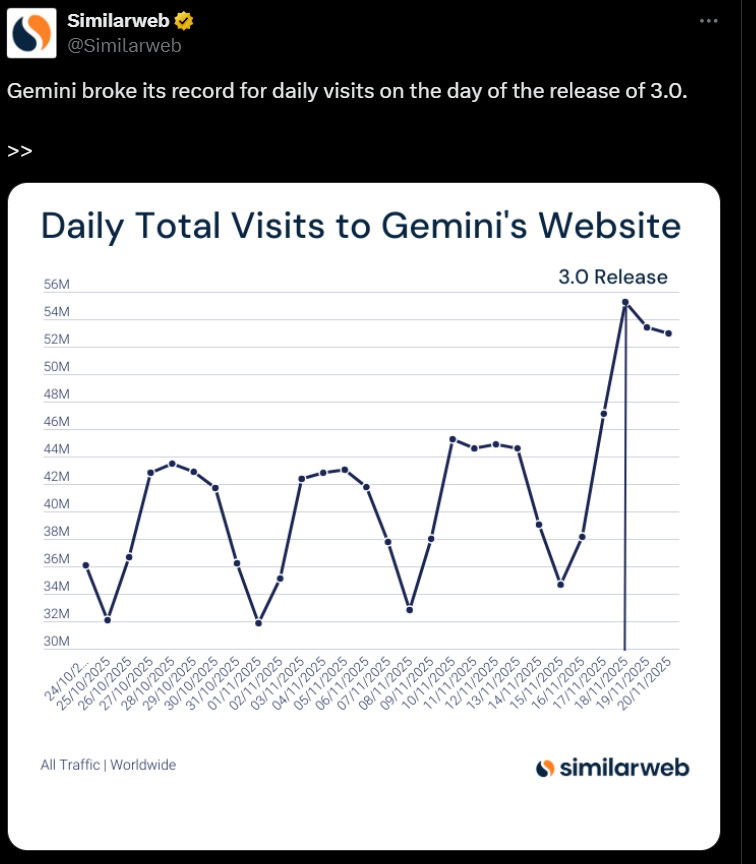

Gemini: SensorTower still has ChatGPT as #1 in app store in U.S. but saw Gemini jump to the top spot Globally Friday. Below is what we have so far on web data

CVNA: Wedbush Names Carvana the “New Used-Car King,” Upgrades to Outperform

Wedbush lifts Carvana to Outperform (from Neutral) and raises its PT to $400 from $380, arguing the stock’s recent pullback looks excessive and offers an attractive entry point. The firm says the risk/reward skews favorably, with its valuation work showing only modest downside from here. Wedbush also highlights that management has stacked several quarters of strong execution, and in the near term the firm sees clear potential for estimate upside as fundamentals continue to improve.

BKNG/OTAs

BKNG: BofA Upgrades to Buy as AI Selloff Creates Opportunity

BofA upgrades Booking to Buy from Neutral, arguing the market has overreacted to AI-driven disintermediation fears and that BKNG’s supplier relationships, proprietary data, and Genius ecosystem leave it better positioned than peers. The firm highlights that AI tools from Google/OpenAI may shift some traffic, but BofA thinks Booking can offset this through its large base of direct traffic (>60% of B2C bookings), high-value Genius members, and its ability to negotiate favorable economics with platforms still rolling out AI travel features. BofA sees margin and EPS expansion in 2026 even with ongoing AI investment, citing the company’s raised cost-savings target and room for accelerated buybacks after the recent stock pullback. The bank also notes resilient travel trends into Q4, easier 1Q comps, and a more attractive valuation—2027E P/E ~18x, with potential to rerate toward 20x, supporting a $6,000 PO.

BKNG: BTIG Reiterates Buy, $6,250 PT as AI Fears Look Overplayed and Trends Re-Accelerate

BTIG says Booking’s recent pullback opens a window, arguing the AI disintermediation narrative has been overstated and that BKNG’s positioning as a preferred AI-era partner (rather than a disintermediated OTA) is being overlooked. The firm notes that despite modest QTD deceleration, Booking’s trends are tracking well ahead of October, with November showing the strongest pickup of the year—even against tougher comps. BTIG’s reservation work shows Q4 shaping better than feared, with room-night growth improving from ~4.5% in Q3 to mid-6% in early November, and potentially ending the quarter up ~4% y/y after layering in its proprietary tracking data. The analysts add that December—typically the quarter’s hardest month—should still translate to LDD reservation growth when normalized, supporting BTIG’s view of solid underlying demand. With BKNG trading at just under 25x ’26 EPS versus peers near 30x, BTIG keeps a Buy and $6,250 PT, calling the setup attractive as strong trends collide with sentiment that’s “too anchored” on AI risk.

OTAs: Bernstein Maps Out a Credible AI Bull Case

Bernstein says OTAs could ultimately benefit from AI, with trip planners pulling more offline hotel bookings online, lowering acquisition costs, and weakening Google’s pricing power. The firm also notes that hotel chains may limit AI-direct bookings, pushing more traffic back to OTAs to protect rate parity and loyalty programs. Structural advantages—like no-data booking leverage plus superior yield management, fraud tools, and customer support—remain hard for AI agents to replicate. To validate the bull case, Bernstein wants to see clearer monetization models from LLM platforms (especially CPC setups favoring OTAs) and continued willingness from hotels to offer exclusive member rates to OTA partners.

AMZN: BNP Paribas Exane Initiates at Outperform with $320 PT on Cloud, Commerce, and AI Strength

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.