TMTB Weekly: The Charts Are Bending Backwards

Happy Sunday. We’re going to focus on some bigger picture talk this week — we’re working on a Sentiment/Positioning/Narrative Roundup for next week ahead of earnings preview season where we’ll dive into individual names.

Let’s get to it…

Bigger Picture

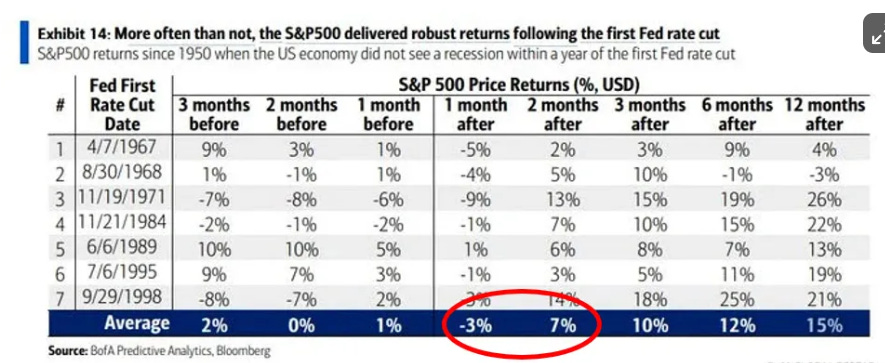

Since early August, we’ve described our market view as ‘choppy but trending higher,’ likely resolving in a bigger move up. That’s mainly been a result of the table below, which shows that in 6 out 7 rate cut cycles which have avoided recessions, the market has been down in the following month, with the only winner up a measly +1%.

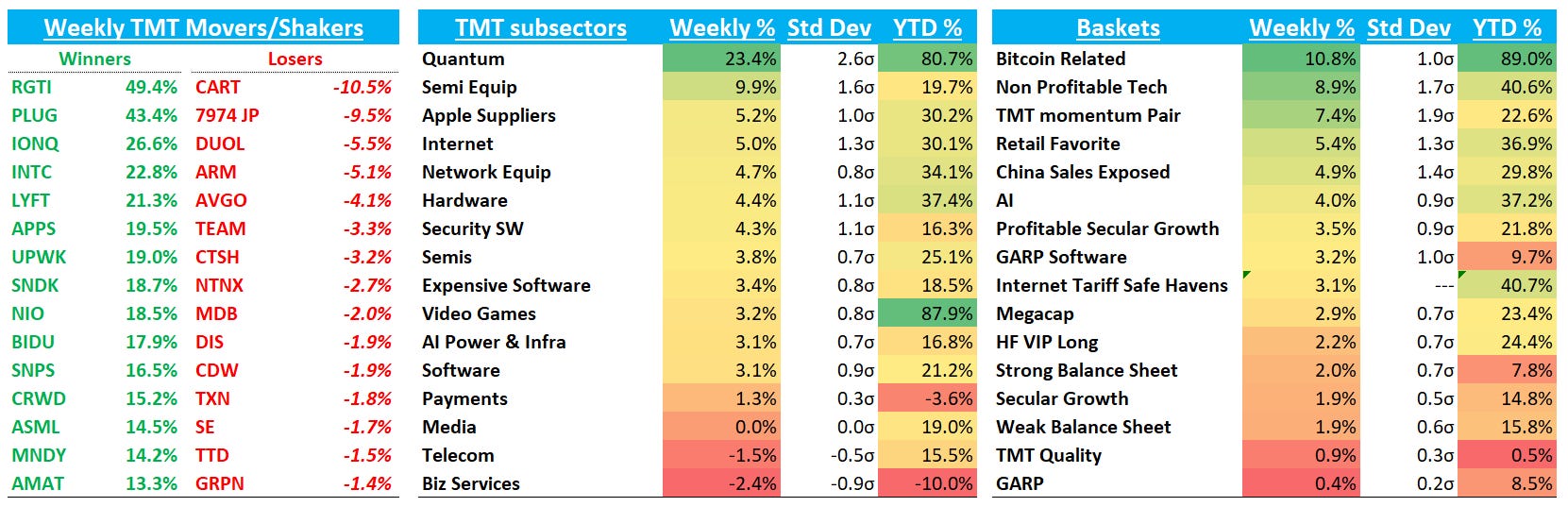

The past three weeks have been anything but choppy: QQQs are up 7% in an almost straight line (11 of the last 13 days), with many charts ‘bending backwards’ as stocks go vertical. The Long GS Momentum basket is up 25% over that same time period with an RSI of 86:

This has been driven by excitement over the easing cycle (financial conditions at multi year lows) and a blistering finish to the HOT AI Summer - just on Friday alone we got news OAI was spending $450B over next 4 years on compute, xAI raised at $200B, and ORCL secured a $20B AI contract from META.

While it’s possible this freight train keeps going straight up, we’re not ready to back off our “choppy” call yet. We added to our net at a great spot at the local low a few weeks ago and want to continue to play offense. That means we’ll continue to make “offerings” to the market Gods in the form of short dated put premiums. On Friday, we added some more short dated (2-3 week) puts. Vol is low and the last thing we want is a 4-5% pullback to shake us off our longs - instead we want to stay in a position of strength so we can add as this week’s price action gave us more conviction we could be moving towards a big move up.

We think the last two weeks of Septembers offers the best chance for a pullback before takeoff. Why?

First off, the chart above which points to below average returns following the first rate cut.

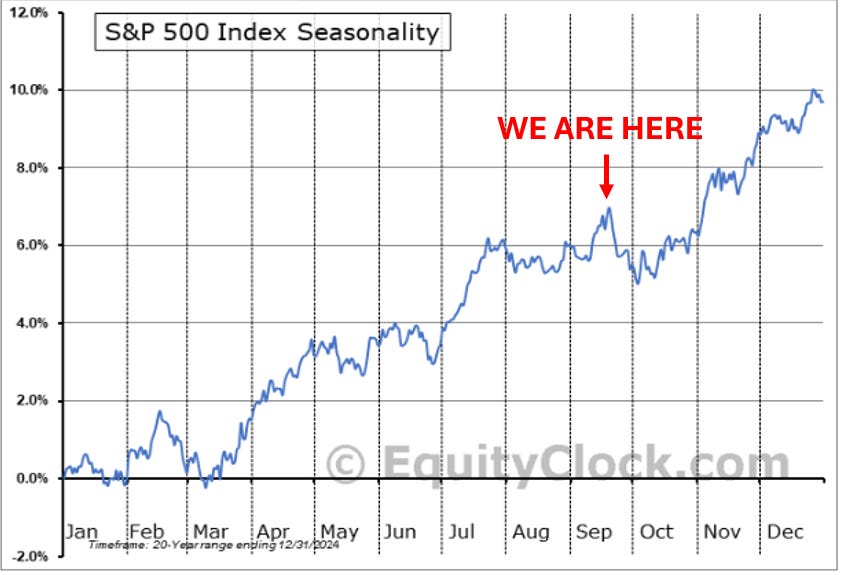

Second, we are entering the seasonally weakest 2 weeks of the year:

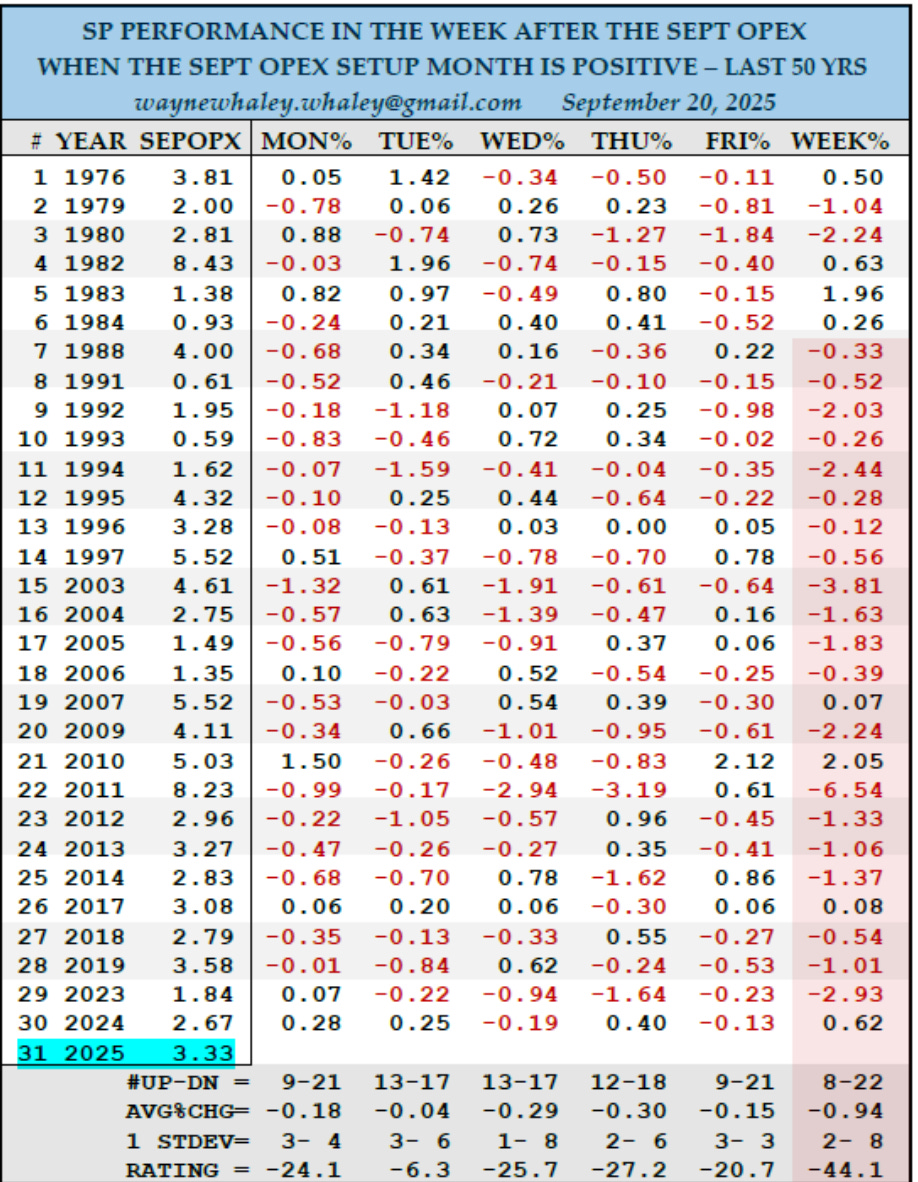

Third, we’re in a post-opex week which is usually a good window for weakness. Over the last 40 years, when the Sept Opex month has been positive, the Sept Post Opex week is 4-20 with an avg loss of 1.18%:

Lastly, lots of stocks are overbought and sentiment is euphoric, which means some digestion/pullback here would make sense (and likely coils us up for a bigger move up).

In sum: the ingredients are there for a short pullback in the next two weeks. But it’s important not to lose sight of the bigger picture: we’re entering a bullish rate cut cycle, the AI supercycle continues to ramp, charts look really good (although some very extended), and price action continues to point to a bigger move up. That’s why we like using short-dated puts — every 20bps of premium allows for 10% short exposure. Worst case: we lose some premium. Best case: it allows us to stay long and continue to play offense.

Bubble Talk & Animal Spirits

Lots of talk in the market around bubbles this week, with seemingly a “new” $1B+ “AI play” surfacing every day and rallying 20%+.

It’s important to distinguish what people mean when they talk about bubbles as I see the word used interchangeably for the two types of bubbles: