TMTB EOD Wrap; GOOGL DOJ First Takes

QQQs finished the day down 85bps although rallied more than 1% off the bottom and up another 50bps post-close as GOOGL +7% and AAPL +3% after a much better than feared DOJ ruling. The judge knocked out the scariest asks (break-ups and a blanket payments ban) and left GOOGL’s core disti economics largely intact, while adding targeted data-sharing and syndication obligations that help rivals over time.

This is likely a clearing event for GOOGL and the ruling long-onlys were hoping for to get more excited on the stock and also opens door way for potential AAPL/GOOGL AI integration (although the ruling bars exclusivity of it). The vibes/narrative/sentiment on GOOGL have all been trending in a positive direction given the pace and quality of their AI product rollouts, improving GCP/search revs, and perception that Sundar and co are finally getting down to business. This inarguably takes a big overhang away and bulls will argue it should come with some multiple expansion as well. A friend put it well:

The vibes are strong on googl, like 6-10% was my range. So much going well there - gcp, Gemini, search growth. And a sea of buyers who waited to buy bc of this…So this is def a fair move

At $230, we are getting close to my CY26 $10.75 x 22x ($240-$245) and I struggle with giving GOOGL much more than 22x so I can’t bring myself to add. But bulls say roll it forward to ‘27 and you get another 10-15% upside. That’s fair - we’ll keep a small long on (which we had trimmed going into this event).

Just to give the other side of the coin, here are things that GOOGL will have to contend with on the less positive side:

Apple leverage jumps in both search and AI:

Annual default flexibility + ban on Gemini exclusivity improves Apple’s walk‑away options and forces annual bids for share of Safari traffic. Expect TAC outcomes to be noisier and potentially richer for partners.Entrants can ship quality now while they build:

The 40% syndication cap (tapering later) means a ChatGPT‑style service can answer a large minority of queries with Google‑backed results, while using index snapshots & user‑signals to improve its own stack—an on‑ramp that simply didn’t exist before.Long‑tail moat erosion risk:

The court targets the long‑tail difficulty explicitly; sharing docIDs + signals lowers the cost/time to close the nasty last 20% of queries where Google shines, especially when paired with RAG‑enabled GenAI front‑ends.Auction transparency → margin discipline:

The new disclosure regime is engineered to catch “ad launches” or changes expected to exceed a price‑impact threshold—meaning future price‑mix gains from auctions must be more overt/defensible.A longer runway (6 years) with an active overseer:

The six‑year term (vs. Google’s ask for three) gives the Committee time to tighten parameters as the competitive landscape shifts

For AAPL, the result is better than feared; however, it’s unclear to me whether no exclusivity actually means something better for them than the current payment agreement with GOOGL.

Also shoutout to reader “Mike” for posting the DOJ ruling PDF before I saw it posted anywhere else

Really great quick takes and discussion in the chat after the ruling came out. Love it.

Mike’s been on fire in the chat, so we are giving comp’ing his Pro Tier subscription for the next year. We’ll continue to comp those readers who are providing exceptional value to others in the chat. Thanks, Mike.

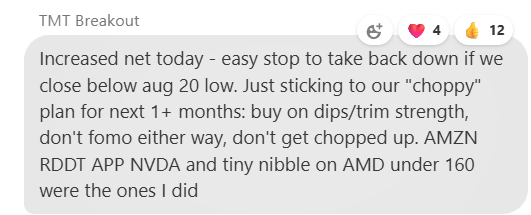

Back to the market, here’s what we posted mid day:

“Choppy” that eventually resolves up is our base case. We thought today was a good risk/reward spot to increase our net a bit more than normal — it’s very possible this could have been the low for the year and if so we are positioned accordingly now. If we’re wrong, then easy to trim our net back down if we break below the Aug 20th low. We’ll continue to adjust accordingly.

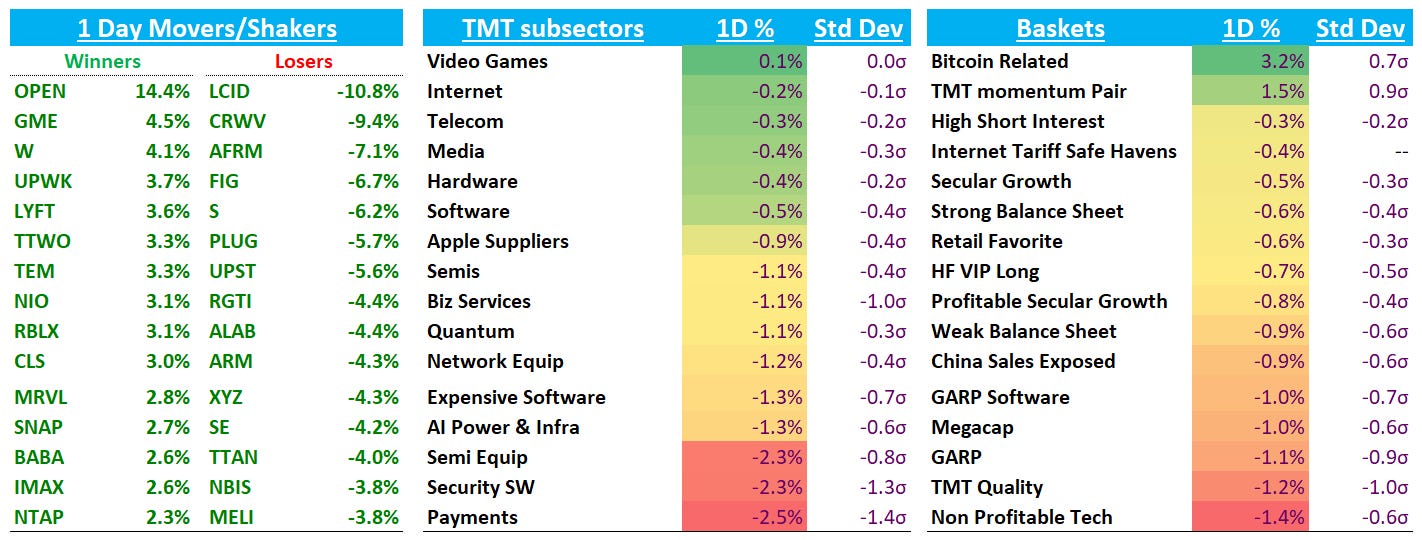

We’ll keep the recap short today given lack of news flow, but just call out a few moves which we found notable:

UBER -1%: Waymo had a blog post out before the close saying they were launching self-driving in Denver this week, but it’s unclear if they are going solo or partnering with someone as the rollout starts in an “exploratory phase”

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.