TMTB Weekly: NVDA Preview

Just a quick note on the macro then we’ll get into the main event this week which is NVDA on Wednesday.

Powell delivered what most took to be a dovish turn at Jackson hole (vs how he sounded in July). While he noted inflation is seeing some upward pressure from tariffs, he expressed incremental concern about the jobs market, basically cementing a Sept cut. However, other than that, Powell didn’t give much tea leaves on what happens in the last two meetings of the year and policy likely will depend on the data. The language also seemed to indicate that the Fed is stepping back from its 2% inflation target, shifting it more into an “aspirational” goal.

Here’s Neil Dutta’s take on the speech:

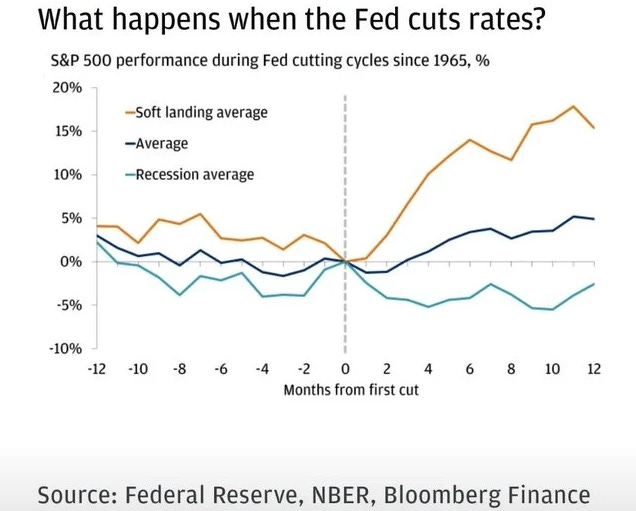

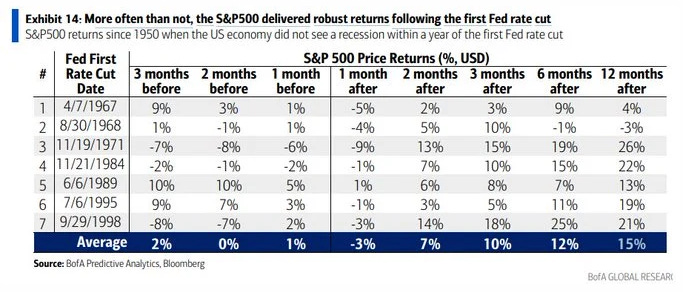

These two charts continue to be the most important for us:

Last week we said our base case over the next 1 month+ was a relatively choppy environment (more detail on market dynamics at work in our EOD wrap from Wednesday). That played out this week with the QQQs slightly down for the week but suffering a peak to trough decline of 4%+ before bouncing back 1.5% on Friday. We thought 5-7% was a reasonable drawdown, but that 4%+ might have been all we’re getting…

We’ll stick to our base case of a choppy environment for the next ~1-2 months, but the dovish shift from Powell on Friday means a more “choppy & upwards trending” market is likely. Let’s not lose sight of the bigger picture: Over a 3-6+ month time frame we remain bullish and our base case is the market will resolve higher (gold line above). That gives us comfort in continuing to buy dips over the next 2 months if we get more choppy weeks like the one we just had.

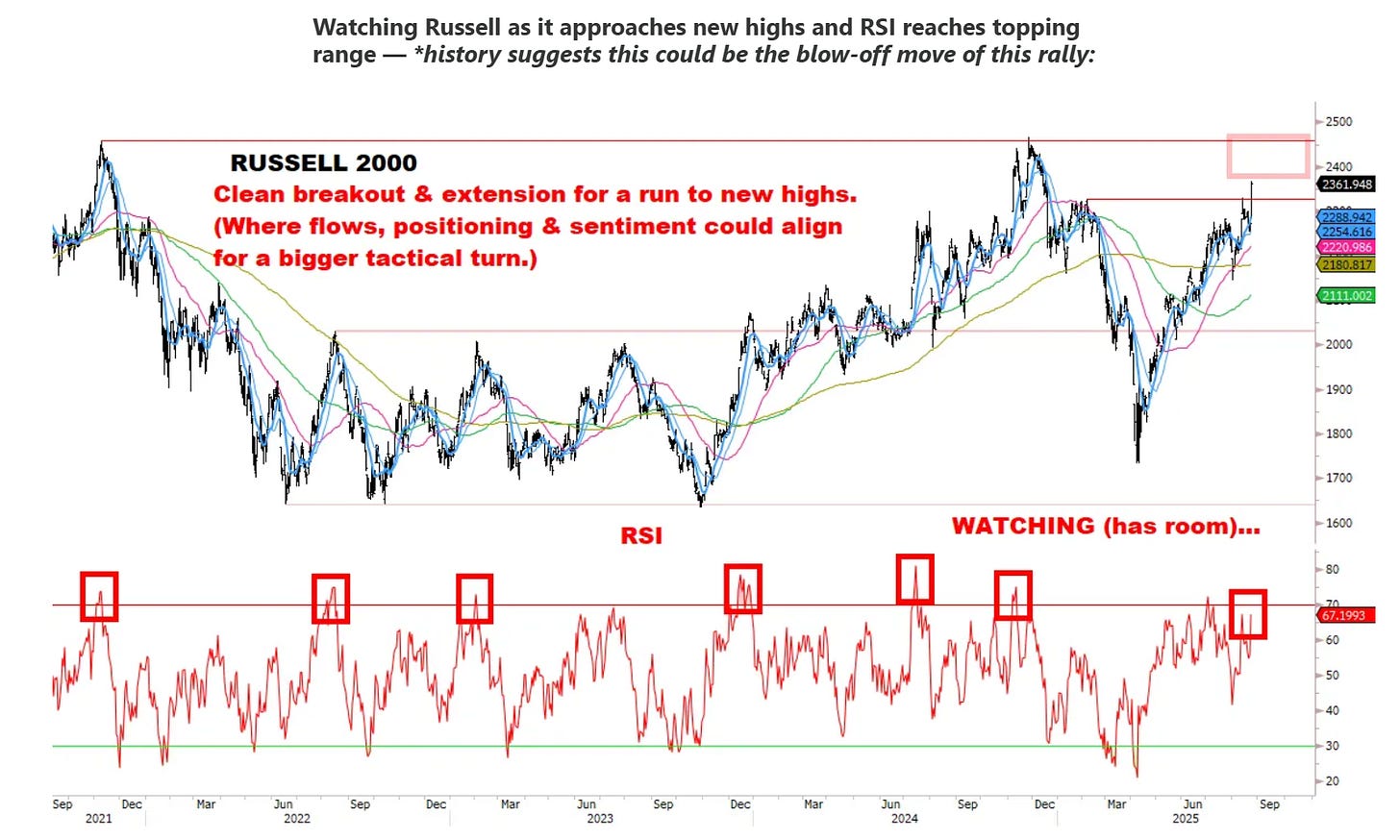

The other big story this week was the big outperformance in small caps and continued lackluster performance in momentum names. We don’t think the speech on Friday was an all-clear to pile into cyclicals: there still concerns around trajectory of economy & tariff impact on prices - see WMT comments on Friday. However, the IWM chart looks like it could see some more near-term strength:

We rather stay balanced in our factor exposure rather than chasing any single factor over the next 1-2 months as we think there will be a lot of head fakes…in theory, some of the longs we like such as RDDT, APP, U, and RBLX should outperform even in an environment where IWMs rally.

On the macro front, key event is PCE on Friday, but more important than that is the main event…

NVDA Reports Wednesday Post-close

Implied Move: 5.8%

Avg Move: 7.25%

Bogeys:

Q2 Rev: $47.5B vs. street at $46.15B

Q2 DC Revs: $43B

Q3 Rev Guide: $54.5B vs. street at $53.2B

FY27 EPS: ~$7.50

Here’s our take on the print:

Positioning is clearly long with the stock at $175 and up 30% from last earnings as investors have gotten more comfortable with Hyperscaler + Sovereign AI demand in 26 and beyond. The near-term set up is all about the Q3 Revenue guide where bogeys have landed somewhere around $54.5B, with Asian investors leaning more towards $54B and US investors thinking closer to $55B.

Before we get to the Asian datapoints, here at TMTB we like to keep it as simple as possible. The following table shows how NVDA has handled the guide on previous prints: