TMTB EOD Wrap

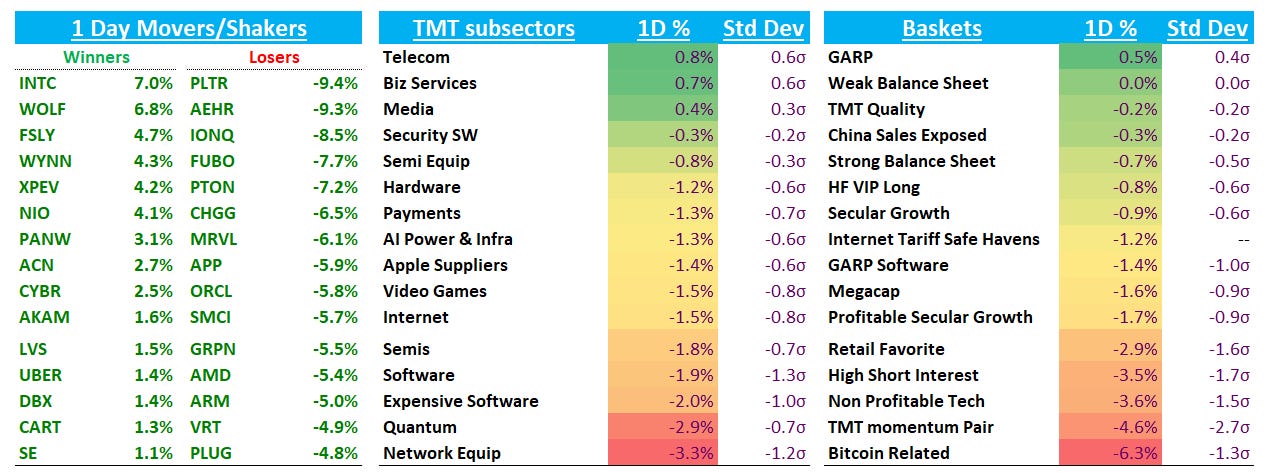

QQQs -1.4% on a big momentum unwind as YTD winners were sold hard, although the non-profitable tech & high short interest factors also underperformed. Momentum and AI winners had close to a 3 standard deviation move today.

Here’s BofA:

This latest momentum degrossing pain started last week. However, today woke folks up to the under surface pain. Why today? For one, the degrossing spilled over to the long side of the equation (ie “winners”). This coupled with the fact that positioning is extremely skewed to the long side means that on days like today, no one can hide from the pain. Oh and our Retail friends didn’t seem willing to step in as dip buyers…GOOD NEWS … Our backtests tells us we’re about 70% of the way there in terms of the Momentum unwind when compared to historic Momentum drawdowns of a similar magnitude and period. The NOT SO GOOD NEWS is that there is likely further pain over the next couple of sessions. The backtests give >50% hit rate of continued Momentum underperformance over the next 5 days (T+5).

Here’s VitalKnowledge:

On the macro front, the narrative is pivoting in the direction of a Fed easing cycle, which (according to the standard playbook) is positive for cyclical companies (whose earnings are directly tied to underlying economic conditions) at the expense of secular growers (it’s not that Fed cuts are bad for tech, but they are better for many non-tech industries). "

What’s our take on the price action? Let’s dig in.

First these are the most important charts we have our mind on right now:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.