TMTB Weekly

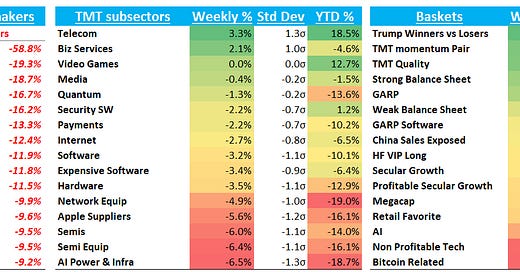

Happy Sunday. Another volatile week as QQQs - 2.5% testing the lows from early/mid March by the close on Friday. We got the bounce we were playing for early in the week given the better Trump Tariff news flow last weekend but were quick to take our net/gross back down as we’re sticking with our game plan: 1) protect pnl (low gross/net but increase with high conviction ideas) 2) continue to be flexible/adjust as things change 3) FOMO will kill you both ways 4) take shots but bar for conviction has to be higher, don’t get greedy (time to focus on singles not HRs) and always risk manage.

News flow turned for the worse mid-week as Trump’s Tariff rhetoric ramped up. AI semis led the way lower starting mid week following Tsai’s comments about DC overbuild + Deepseek passing other US models in performance and lots of skepticism around Coreweave’s IPO. Fuel was added Wednesday with the now infamous Cowen note saying MSFT abandoned 2GW of DC plans + Edgewater talking about some Trn 2 cuts + talk around slow GB200 uptake + press around China H20 curbs and Trump adding new export restrictions. A mouthful!

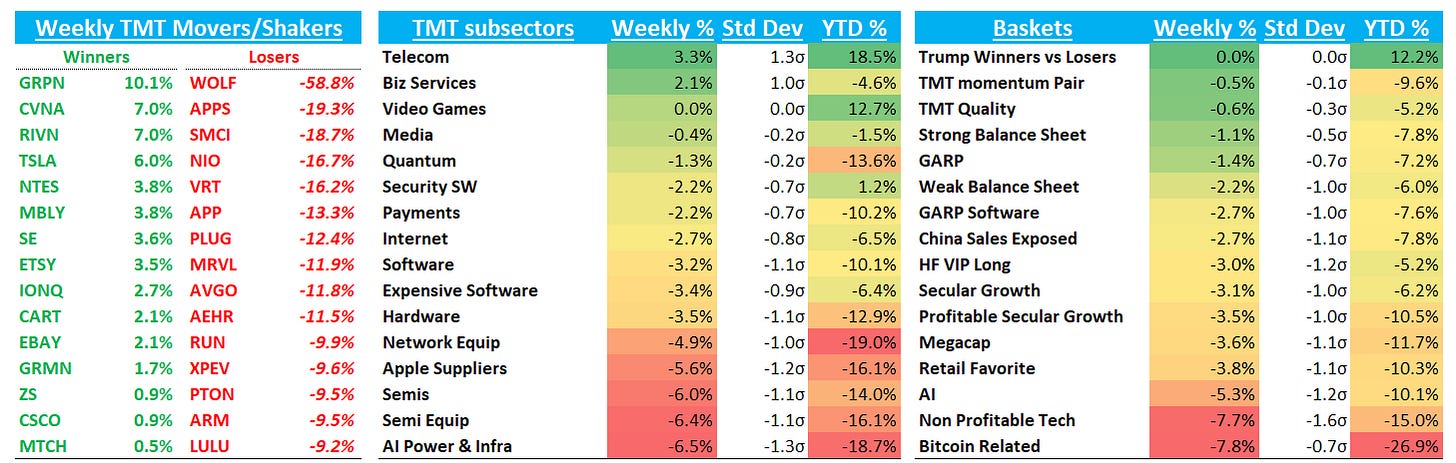

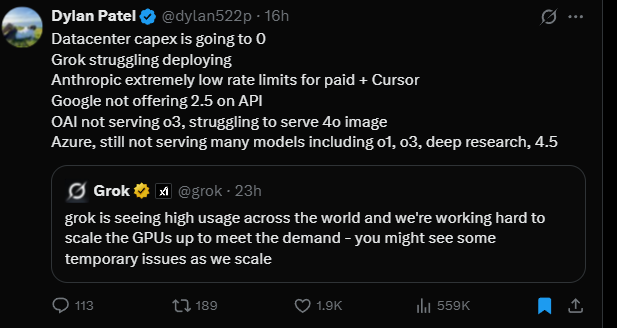

Despite all this negativity, big model/inference usage continues to surge as Dylan notes this weekend (first line sarcasm):

However, as the macro wobbles and MSFT is starting to blink on spend, investors continue to worry about capex spend in 2026 as it has been largely driven by hyperscale spend. TheInformation adds some fuel to that fire with an article over the weekend saying Some Large Cloud Customers Slow Down AI Spending as Prices Drop:

But Palo Alto Networks recently found that open-source models from DeepSeek, a Chinese developer, could handle the same tasks for just 5% of the cost of the OpenAI models, CEO Nikesh Arora said. As a result, Arora’s firm is expecting to spend less on AI to power its existing products in the near term, he said. “For the tasks where we’re getting efficiencies and driving lower costs, I don’t think the model’s IQ needs to be much higher than it already is…and I don’t want to pay a dollar for that. I’d rather pay five cents,” he said.