TMTB EOD Wrap

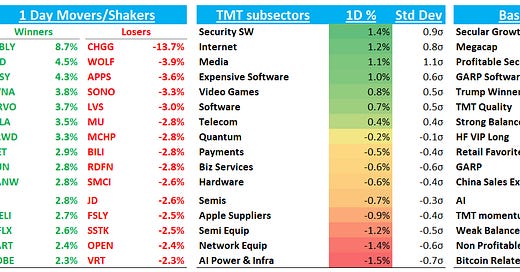

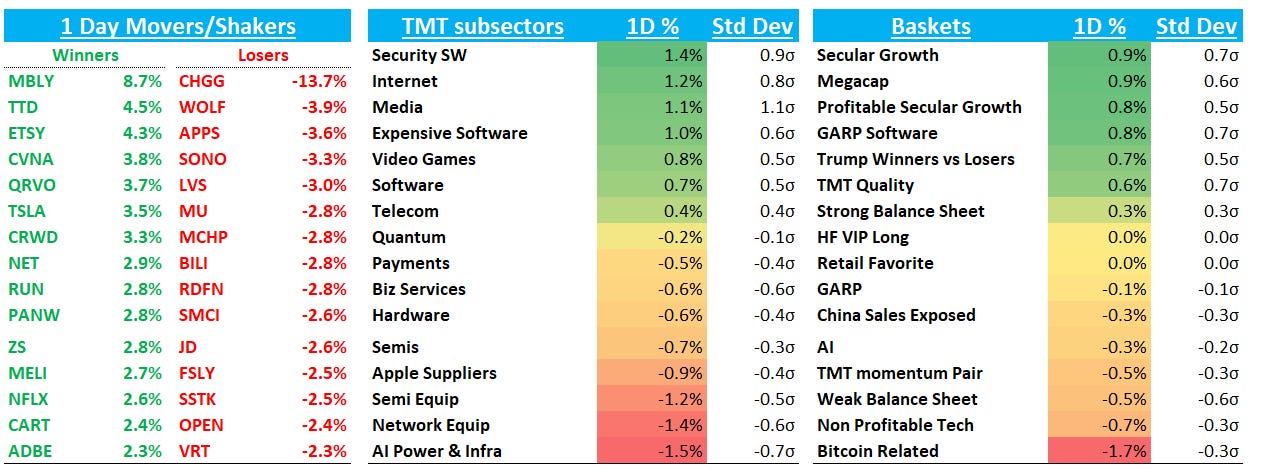

QQQs +57bps as software and internet led the way higher and semis -70bps lagged led lower by AI power and Infra. Why semis weakness? BABA’s Joe Tsai’s comments about a Datacenter AI bubble might have contributed although nothing new there — everyone knows and is aware of the capex overbuild debate. We think he was likely talking his book given BABA is just ramped up their capex spend a ton a couple weeks ago. Susq also had a bit a mixed note on the group saying tariff" is the common theme driving broad-based "pull ins" from Q2 to Q1 and potentially Q3 to Q2, creating downside risk to 2H25 consensus if sell-through doesn't strengthen.

On the macro front, yields dipped 1-3bps across the curve while fed expects held steady at 60-65bps worth of cuts for the year as the Philly Fed showed a big drop in non-mfg activity. We got the bounce we were playing for early in the week and took our net/gross back down a bit. Tomorrow we should get a positive update to the Atlanta Fed GDPNow model followed by the PCE+Umich on Friday, two latter two releases which carry some risk.

Let’s get to it…

Internet

TTD +4.5% as Citi had a note out saying their channel checks made them more positive on the name saying AMZN share loss didn’t really show up in their checks. Key quote: "While $AMZN is winning some budget, we didn’t speak to a single buyer who was actively taking dollars off of $TTD and placing it onto $AMZN...no buyers or agencies we spoke to (particularly larger ones), are near a point where Amazon would become the primary, or only, DSP of record.” Citi hosted a bull/bear debate early in the morning where their analyst said he was “getting ripped apart this morning.” Shows how many bears still out there. He basically explained at their conference a couple months ago he left more negative but after checks and talking to buyers, he came away more positive as he didn’t hear in any of his conversations that dollars were moving yet. Short probably got a little long in the tooth when it was sitting at 15x EBITDA.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.