TMTB Weekly

Happy Sunday. Lots to get to this week…

QQQs finished down 2.5% in the shortened week - semis -2.1% outperformed while internet -7% and software -5% underperformed (expensive software the big underperformer at -8%).

Why the pullback and what should we expect going forward? Let’s dive in…

Let’s start with some bottoms-up price action and make our way up to the macro…

Last week we wrote about the increasing bi-furcation in performance between winners and losers - beats were being rewarded T+1 and following through while misses were being punished and following through to the downside. This was fairly healthy price action and what we’d expect in a choppy but upwards trending market. However, mid-week we noticed a marked change in price action:

CFLT/HUBS’s lack of follow through after their beat, along with ROKU/ABNB’s failing to follow through as well is a marked change in px action post-eps vs the last couple of weeks- a couple of tea leaves I’m paying attn to especially in light of the seasonal 2H Feb weakness mentioned above…

As usual - we got some tea leaves foreshadowing the weakness in the indexes on Thursday and Friday. Add to those a big move down in retail darling PLTR on Wednesday which followed a day where both MS and GS called out a fading retail bid in the 2H of Feb through tax day. GS:

Retail euphoria has persisted throughout the start of the year, which could create opportunities with US Tax season approaching. The factors (Res Vol, Beta, Short Interest, Momo) and themes (Non-Profitable Tech, Most Short, Bitcoin Sensitive Equities and Unprofitable Russell) that caught a ride from retail could be at risk if retail needs to sell to pay for capital gains.

March and April have historically been challenging months for these factors, especially since Covid with Res Vol underperforming in 3 of the last 4 years, Beta underperforming during every March/April period, and Short Interest also lagging behind. A flight to higher quality would make sense to us to fade the animal spirits and retail euphoria ahead of Tax Day.

This hit retail and momentum stocks. Just a sign of how quickly narratives can take hold, especially if the two most impt brokers call out the same thing on the same day. This also jives with the chart we posted last week about seasonal 2H weakness in Feb:

In addition, investor anxiety about uncertainty from Trump + Washington + DOGE is finally beginning to weigh too heavy on investor psychology. Weak economic data - PMIs and a Mich report which showed a big deterioration in confidence along with a further upward shift in inflation expectations - on Friday added fuel to a new piece of the puzzle: a potential growth scare. It jives with why Steve Cohen out a bit bearish on Friday (tariffs + DOGE = weakening economy…we think Steve has a great nose for mkt direction - we remember in early ‘24 when people were worried about the macro and he said AI would outweigh any weakness, which was a differentiated call at the time). The Citi surprise index is already rolling over:

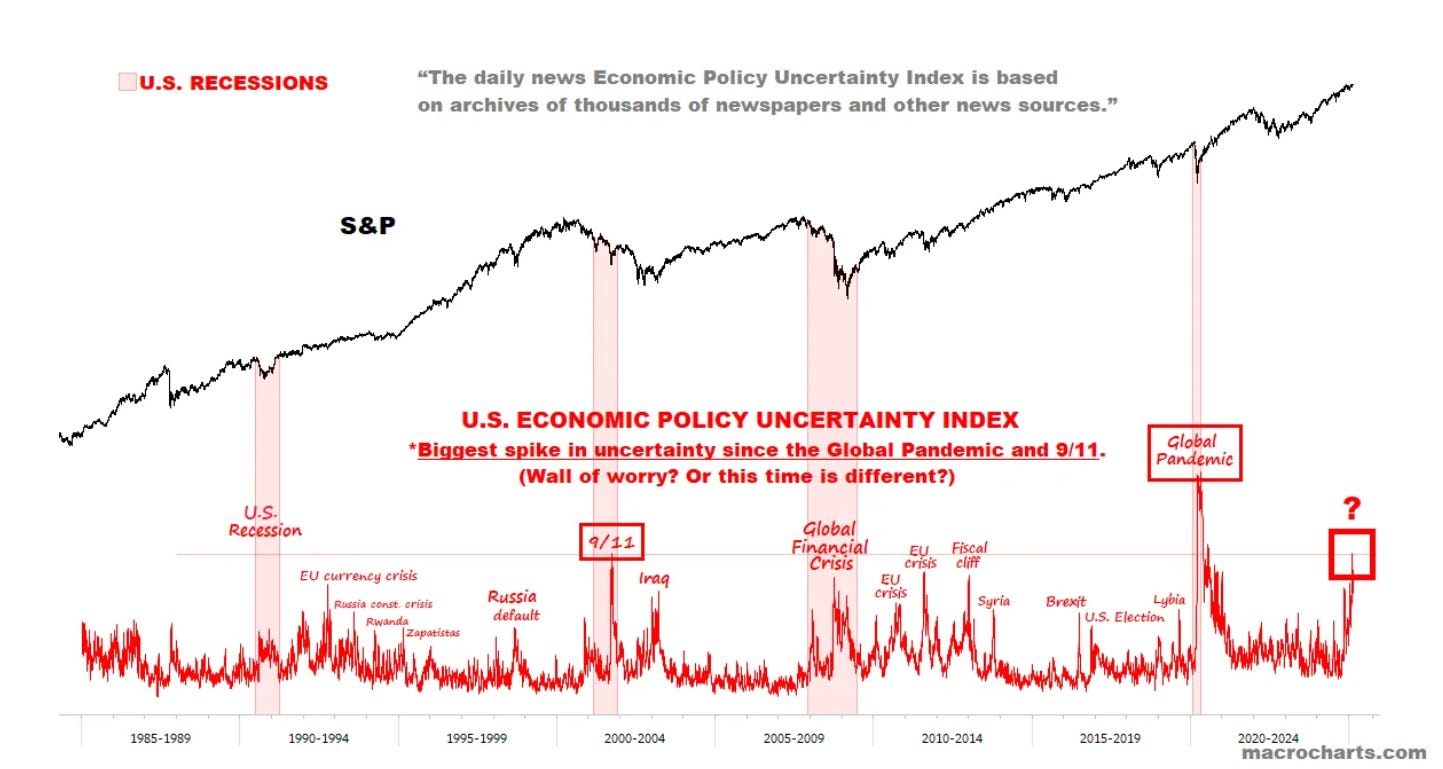

MacroCharts points out that this is the biggest spiky in uncertainty since the Pandemic (not necessarily bearish however):

We liked this take from our friend Citrini as well on equities signal to Trump:

The better BABA print on Thursday and increased confidence around China also shifting some flows out of US Tech and in that direction.

So the market was already on edge heading into Friday. Then we got some recycled comments on Friday from Satya on Dwarkesh’s Patel podcast talking up overbuilds, some rumors floating around that MSFT backing out of DC contracts and power agreements, and bearish comments from Steve Cohen, all of these coming on an opex day, and whoosh! big move down in the markets.

So where do we go from here?

We think the macro narrative following this past week is more balanced than last week. Last week we wrote:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.