TMTB EOD Wrap

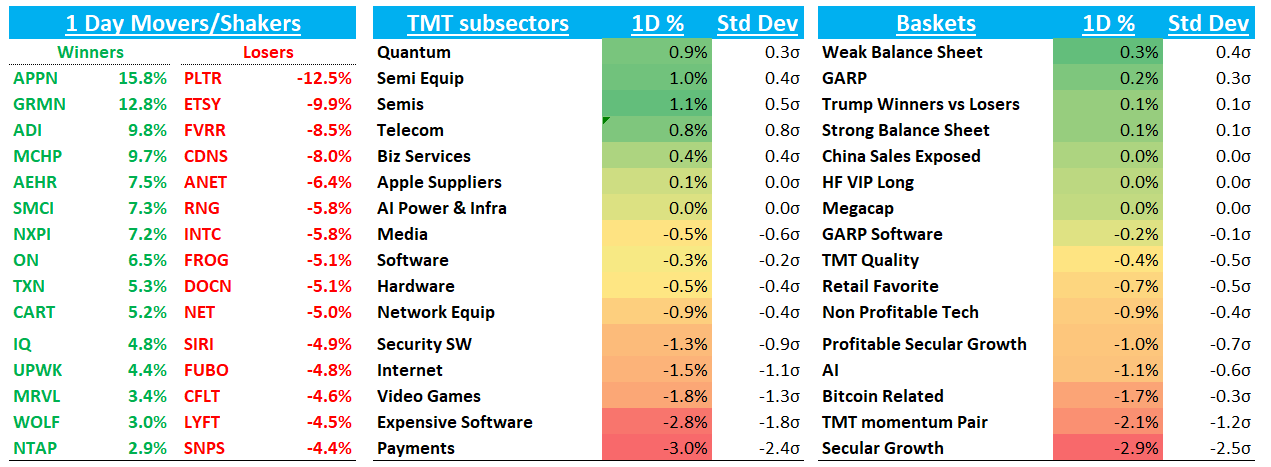

QQQs flat although plenty of red on my screen. Treasuries caught a modest bid after FOMC minutes hinted at an end to the QT process (yields flat to down 4bps across the curve) although Fed expectations for a cut didn’t move much.

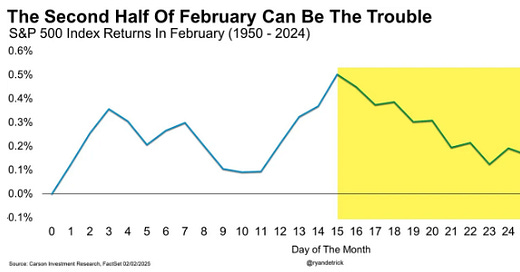

MS had an interesting note out today saying that retail demand for stocks typically slows during the 2nd half of Feb and underperform until tax day (tax day means retail investors owe Treasury lots of $ from cap gains). Seems like already coming true with PLTR - the biggest retail darling - down 10% today on news Def Sec looking for 8% cuts at Pentagon. This is also inline with 2H seasonal weakness typically observed in 2H of February:

Expensive software led the way down today - NET -5%; CFLT -5%; HUBS - 4.5%; TWLO -4% TEAM -4%. CFLT’s lack of follow through after their beat, along with ROKU/ABNB’s failing to follow through as well is a marked change in px action post-eps vs the last couple of weeks- a couple of tea leaves I’m paying attn to especially in light of the seasonal 2H Feb weakness mentioned above…

Internet

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.