TMTB Morning Wrap

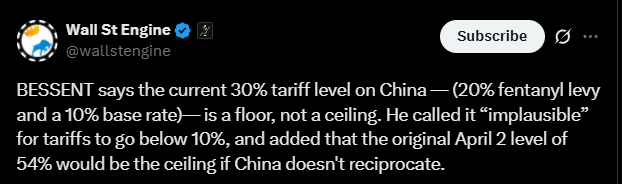

Risk on to start this beautiful Monday morning! QQQs +4% as China/U.S. de-escalation much better than feared with rates down to 10% +20% fetanyl = 30% for a 90d day pause. Better tariff news has several knock on effects: higher stock market → +ve reflexivity with economy, suppresses some inflation pressures giving Fed some more room to cut (although fed expects moving in a more hawkish direction this morning), and removes uncertainty and buys companies time to move mfg elsewhere if they want. Bessent also implied other countries could continue to get pauses as long as negotiations continue.

Lots of investors caught offsides and CTAs will have to chase above the 200d. GS pointed out this weekend that U.S. long/short net leverage had declined last week and remains near five-year lows while managers have been selling into strength in Tech—now marking the fourth consecutive week of net selling, noting that positioning in Software has dropped to new multi-year lows.

We laid out some tariff safe haven charts all exhibiting topping patterns in our weekly over the weekend - amazing how market sniffs these things out. Tariff Safe havens will clearly underperform today — NFLX (some mixed 3p news here), SPOT, SAP, TTWO (video game stocks dn in Asia), etc. Things like RBLX and PLTR less clear to me since they have a lot of beta. Semis probably outperform enterprise software today. Given the better than expected China de-escalation, we think this is the news that causes the underperformance to last more than just a day this time (unlike previous false starts).

For us - the two names that were hurt from Tariff/China uncertainty which investors will flock to for quick re-gross are META and AMZN. SHOP another high quality one getting a Nasdaq 100 add. We think the PINS print on Friday was more worthy of +12-15% instead of 5% if tariffs weren’t a concern and so a name like that should o/p today. W the more spicy one which has some positive idio tailwinds and benefits significantly from lower China tariffs.

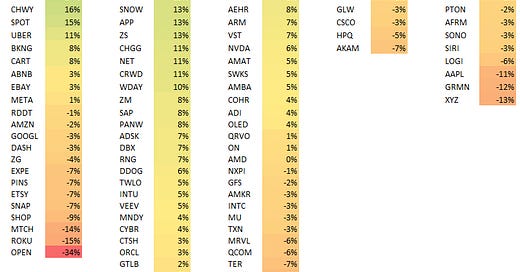

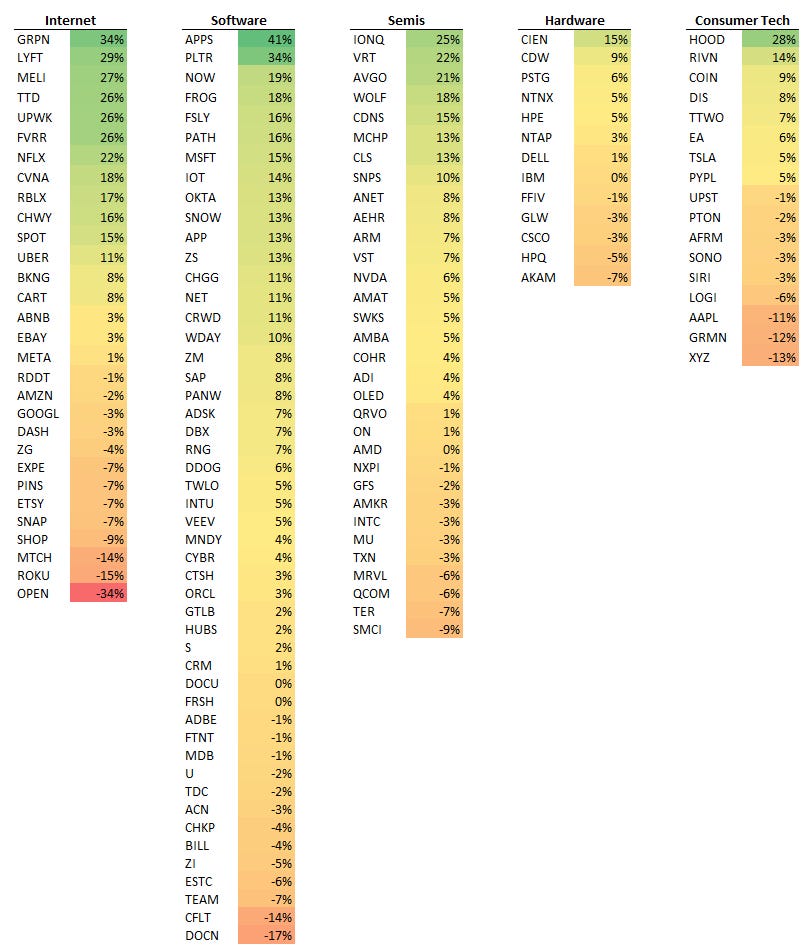

Here’s performance of stocks since Liberation Day:

After the last couple weeks, we have seen Tech stocks trade more on fundamentals/idio and this should add a lot of fuel that trend, which is good news for alpha/stock picking going forward. With more than half the year left, that has us very excited.

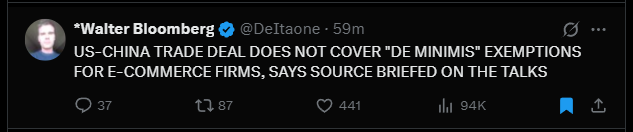

Here’s Bloomberg on the Tariff news:

The US and China will temporarily lower tariffs on each other’s products in a dramatic ratcheting down of trade tensions that buys the world’s two largest economies three months to work toward a broader agreement.

The combined 145% US levies on most Chinese imports will be reduced to 30% including the rate tied to fentanyl by May 14, while the 125% Chinese duties on US goods will drop to 10%, according to a joint statement and from officials in a briefing Monday in Geneva.

“We are in agreement that neither side wants to decouple,” Treasury Secretary Scott Bessent said, adding that “we had a very robust and productive discussion on steps forward on fentanyl” and that talks might lead to China buying more American-made products.

“We would like to see China open to more US goods,” Bessent said. “We expect that as the negotiations proceed, that there will also be the possibility of purchase agreements to pull what is our largest bilateral trade deficit into balance.”

Bessent added that the tariff reductions don’t apply to sectoral duties imposed on all US trading partners, and the tariffs applied on China during the first Trump administration remain in place. Asked what would happen at the end of 90 days to avoid tariffs ratcheting back up, Bessent indicated there’s a chance to extend the truce further.

“Just like with all our other trading partners, as long as there is good faith effort, engagement and constructive dialog, then we will keep moving forward,” he said.

This week we have ad upfronts with AMZN’s presentation today at 6:30pm today and NFLX at 2pm on Wednesday (NFLX has typically announced some ad MAUs at these upfronts).

JPM’s TMT Conference in Boston starts this week with a pretty stacked lineup. Schedule below:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.