TMTB Weekly

Hope everyone is having a good weekend. QQQs were roughly flat in the week as earnings slows down a bit this week…

We’ll hit up macro first, dive into a chart-storm to see what Tech charts are telling us, get into what we learned from Earnings this week, then talk about GOOGL, NET, JBL, SAP, and CRWV.

Let’s get to it…

On the macro front, let’s recap the bull vs. bear debate. Skittishness has died down but investors are still nervous as evidence by the freakout over the Chinese and U.S. delegations stepping away for lunch in Switzerland earlier today:

More talks tomorrow…

Bulls continue to point to bullish price action (lots of “thrust” indicators close to being triggered” which usually point to v positive forward returns), Trump is saying buy stocks again and seems back to caring about the market (UK trade deal an example - it was insignificant but revealed Administration’s eagerness to reach any type of agreement) very healthy Q1 earnings, China and U.S. are de-escalating, potential for more deals to get signed any day (India, South Korea, Japan might follow UK’s initial deal), admin’s focus will shift to tax cuts and de-regulation in 2H, and hard data still holding up (NFP, April services ISM) pointing to no recession. DOGE has lost its teeth and fed job cuts being held up in courts. Oil is at $60. The yield tantrum seems to have subsided for now and the 10 yr sits at 4.35%. Investors have significantly reduced net exposures and a cross over the 200d will force investors to begin to re-gross up and CTAs to start buying again and the pain trade is higher to $6k on SP500.

Bears will say the view that the worst of the tariff-related economic damage is behind us is premature as the true impact will now begin to filter through the data while pointing to companies like AAPL and AMZN where brunt of tariff hit will only begin to be felt after the June Q. Bears will say while tariff rates will go lower, they are poised to stay well above where they stood back in January, particularly China’s. If Trump is saying no lower than 80%, it likely means we probably end up somewhere around 40-60%. The impact of supply chain disruptions and increasing prices will begin to filter through the econ data over the next few months. The index still trades at 20x+ EPS of $265 , which likely has 2H downside risk and bears will argue than in times of uncertainty, the index should at best trade in high teens. The snap back has been a sentiment/positioning rally off extremely oversold levels.

Seems pretty even to me. Choppy and upwards trending remains our base case.

What is the price action in Tech telling us? - Chart time!

Going through all the charts in Tech this weekend, a few interesting patterns emerged.

First, I am seeing a lot of tariff/China safe haven digesting strength — a lot of charts show something along the lines of a double top on negative RSI divergence:

SPOT: Poster child #1 for recession resistant / tariff safe haven: Break below previous resistance after making new highs on neg RSI divergence

NFLX: Poster-child #2 for stay at tariff safe haven:

PLTR: One of strongest stocks up from the bottom (+80%) — double top and gapped down on strong earnings…One I have my eye on - if this makes new highs gives me confidence buyers in control. Looking for good long entry set up here to ride 10d/20d up…

RBLX: Still one of our favorite longs, but exhibiting similar price action. Pulled back as expected early in the week given Fortnite iOS launch, but we think tailwinds from Epic/AAPL ruling outweigh. Wedbush had mgmt on the road this week and they sounded good. 3p continues to track well above QTD. We’ve mentioned our positive medium-term view bc of structural/secular tailwinds. No tariff/China exposure. One of strongest relative strength stocks. Want to see this one break out to new highs to give us confidence overall mkt can head higher.

DASH pulling back after a 2x acquisition and mixed guide

CHWY: Hitting resistance on neg RSI divergence. Strong chart as 3p remains strong.

EBAY: Lower tariff exposure than other e-comm players

MELI: The one exception - no U.S. exposure. Making new highs

SAP: Even European darling SAP getting close to breaking below previous highs

CVNA: Similar double top on neg RSI divergence. Couldn’t break out on better long-term guide. Down 6% on Friday.

CRWD: Another similar pattern from a strong stock:

BKNG: Another one….

UBER: Same…mixed report although Q2 seems ok so far…stock exhibiting strength. Investor perception here has done a 180 from beginning of the year - now seen as AV platform winner…TSLA FSD Austin launch next catalyst to watch then Waymo/UBER Atlanta launch

Three scenarios:

1) Stocks that led us off the bottom are digesting before making new highs;

2) Stocks that led us off the bottom are exhibiting weakness, a potential tea leaf for upcoming broader market weakness…

3) money is flowing into more tariff-sensitive names as trade news flow improves;

4) money is shifting further out the risk curve in tariff/China safe havens…

While we remain open—minded and stocks at a pivotal point, but the charts right now are telling us the answer is a combination of 1 and 4 and stocks with cleaner tariff/China exposure are likely to continue to outperform.

In other words - the charts support choppy but upwards trending…

First off, heavy tariff exposed names (e-comm + ads) are all still below Liberation Day:

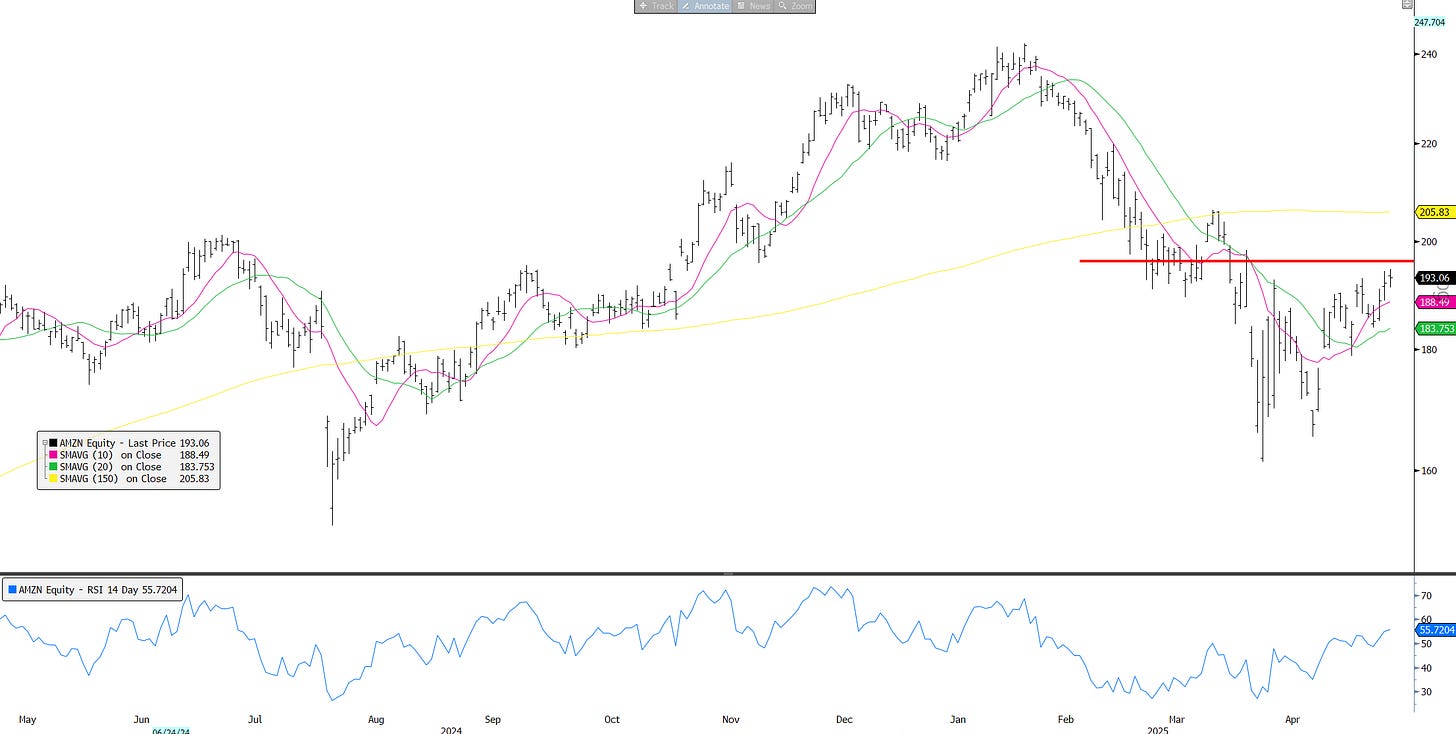

AMZN: Lots of uncertainty regarding 2H EBIT headwinds although 3p continues to point to strong NA trends - tracking 4-5ppts ahead of street

SHOP: Lots of questions around SMBs, dropshippers, and China mfg exposure among merchants despite mgmt sounding positive on smaller tariff impact. Added to Nasdaq 100 (news out over the weekend)

PINS: Rejection at Liberation Day Gap...We liked the print but ad cyclicality + CPG exposure still worries

APP: No follow through after beat and raise

Risk isn’t pulling back - plenty of money shifting further out the risk curve:

BTC: We’ve talked about positive price action dynamics here: in risk off → acts like digital gold and in risk on → acts like it has been acting recently breaking above $100k

TSLA: Why hello there…FSD Austin catalyst on the horizon

HOOD: Retail trading darling - chart looking strong…announced they will allow Europeans to get in on U.S. stock action through blockchain = more retail…Good story/narrative here…

Quantum acting better - watch this space as a couple sell-side calls around Quantum this week. Here’s IONQ:

Enterprise software (tariff/China safe haven) showing plenty of strength…Lagged some of the names in the first group off the bottom so still room for catch up:

NOW: Holds up well post-print

WDAY:

MSFT:

ZM:

NET: One of our favorites - more below…

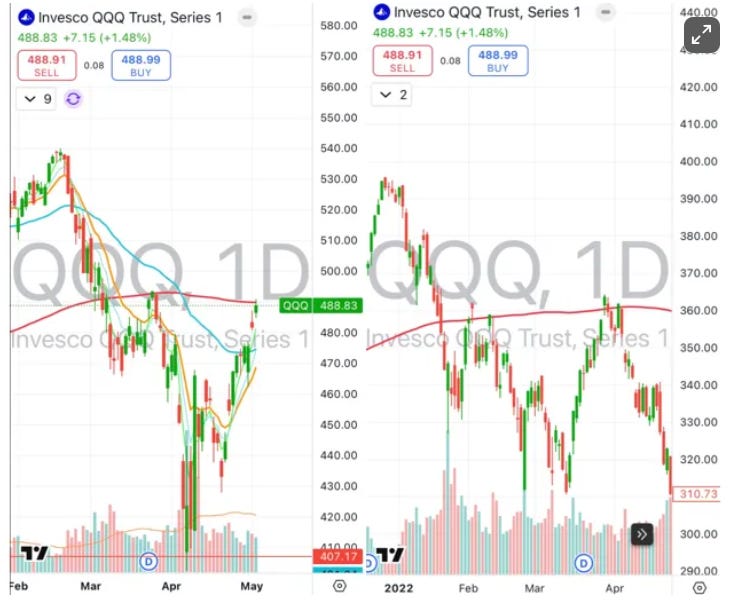

This analog vs. 2022 still in play

We are watching this closely as its tracking very closely. It points to a big red candle either Monday or Tuesday.

We are actually more interested in this analog breaking down. In our experience, when an analog has been tracking very closely and then breaks down, it’s a big tell that the market wants to go the opposite direction hard.

Open minded here…

What we learned this week from Earnings - Some key quotes from TMT companies

Consumer demand:

DIS – “Right now, the advertising market is quite healthy for us… restaurants and healthcare are showing considerable demand, and we continue to see robust demand going into the Upfront season.”

AMD – “Desktop channel sell-out increased by more than 50% year-over-year… first-week Radeon 9070 demand set a record and we’re working closely with partners to replenish inventory weekly.”

UPST – “Credit demand continues to be strong… we’re definitely experiencing seasonally higher appetite for personal-loan consolidation and see ‘a lot of demand out there.’ ”

EXPE – “US demand was soft, driven by declining consumer sentiment and we saw pressure on key inbound US corridors.”

Lyft – “We had year-on-year growth across regions, modes and use cases…we’re not seeing in our data signs of weakening; in fact Q1 delivered our strongest ride week ever.”

CVNA – “Our consumer offering has been very stable…historically, demand has not been the governor on our growth.”

SHOP– “April and May have been strong in terms of GMV performance…a continuation of the very good Q1 we just reported.”

AFRM – “Growth accelerated across the quarter, with March being our strongest month at 40 % GMV growth year-on-year and strength ‘incredibly broad-based.’”

Macro environment

PINS: Management called the overall ad market “healthy” but noted selective pullbacks from Asia-based e-commerce sellers tied to tariff uncertainty and continued pressure on CPMs; advertisers are reallocating spend toward Europe and ROW, which are growing faster.