TMTB Morning Wrap

If you thought last week was exciting…

QQQs -4% as Deepseek fears took a very large step up over the weekend. We wrote our thoughts on it yesterday in our weekly.

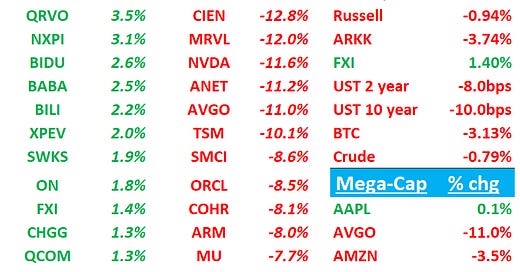

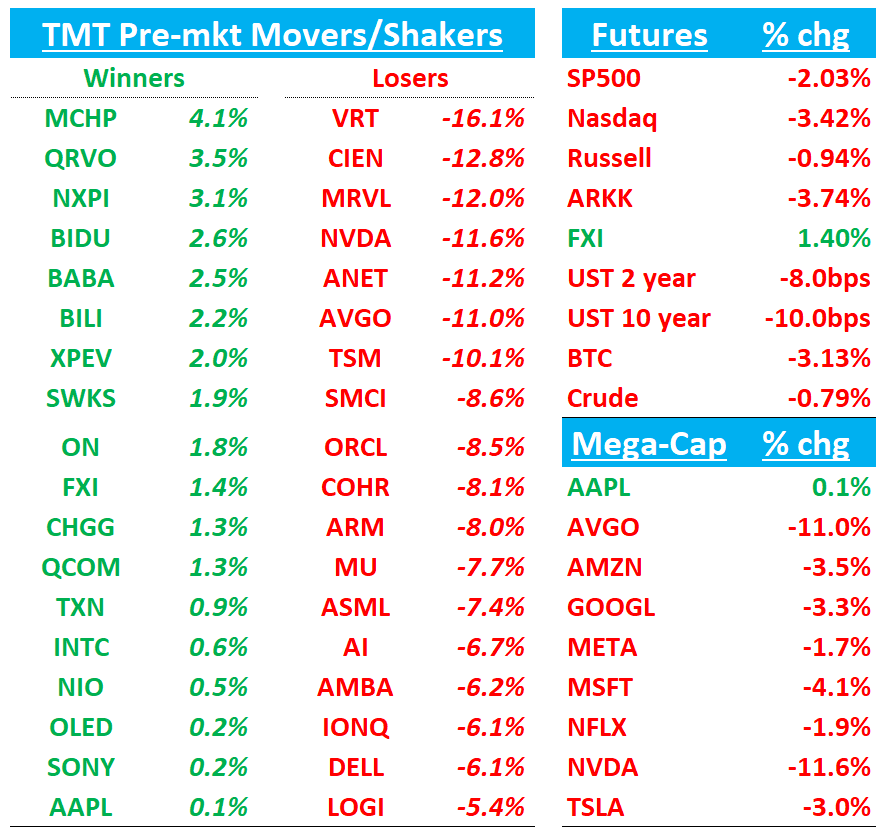

Anything AI capex related down big in the pre: NVDA -12%; AVGO -13%; VRT -16%; MRVL -14%; TSM - 10%; ANET -11%; MU -7%; OKLO -16%; NBIS -14% and so on…these are all names that are very well owned both by institutions and retail and could argue peak ownership came last week following Stargate announcement.

Software that trades as an AI proxy down: ORCL -8.5%; MSFT -4%; PLTR -6.5%

BTC -3%

Yields down 8-11 bps across the curve

Some interesting early movers:

BABA/BIDU +2% → Chinese beneficiaries

Analog names up: MCHP +4.5% / ON +2.7% / ADI +2%; TXN +1% → Long AI / Short Analog names unwinding. INTC +70bps also up early.

QCOM +1.2% / QRVO +2% / AAPL -50bps → Early outperformance from handset names as lower inference compute means future models will be able to run at the Edge

CRM -1.3% → software down early, but generally outperforming. In theory, this should be good for AI Agentic software and anything commercialization as lower inference costs/prices will drive greater demand.

IWM -1% as small caps outperforming early

Not surprisingly sell-side generally saying this is an overaction and defending AI semis - not much new in their notes you likely haven’t read already, so won’t bother posting those this morning.

Will we see some green on our screen today in names outside of AI semis as $’s flow into areas that are likely to benefit for lower compute/have no exposure to Deepseek? Or will the AI deleveraging lead further overeall market de-leveraging (remember % of americans holding assets in the stock market is at an all-time high and exposure leans towards Mag 7). My sense is the former but on a day like today it’s always good to remain open-minded.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.