TMTB Morning Wrap

Note: We sent it out our Weekly on Friday in a sentiment/positioning/chart roundup with Macro Charts. We think it’s a great read to get a lay of the Tech land heading into Earnings season.

If you missed it, it can be found here.

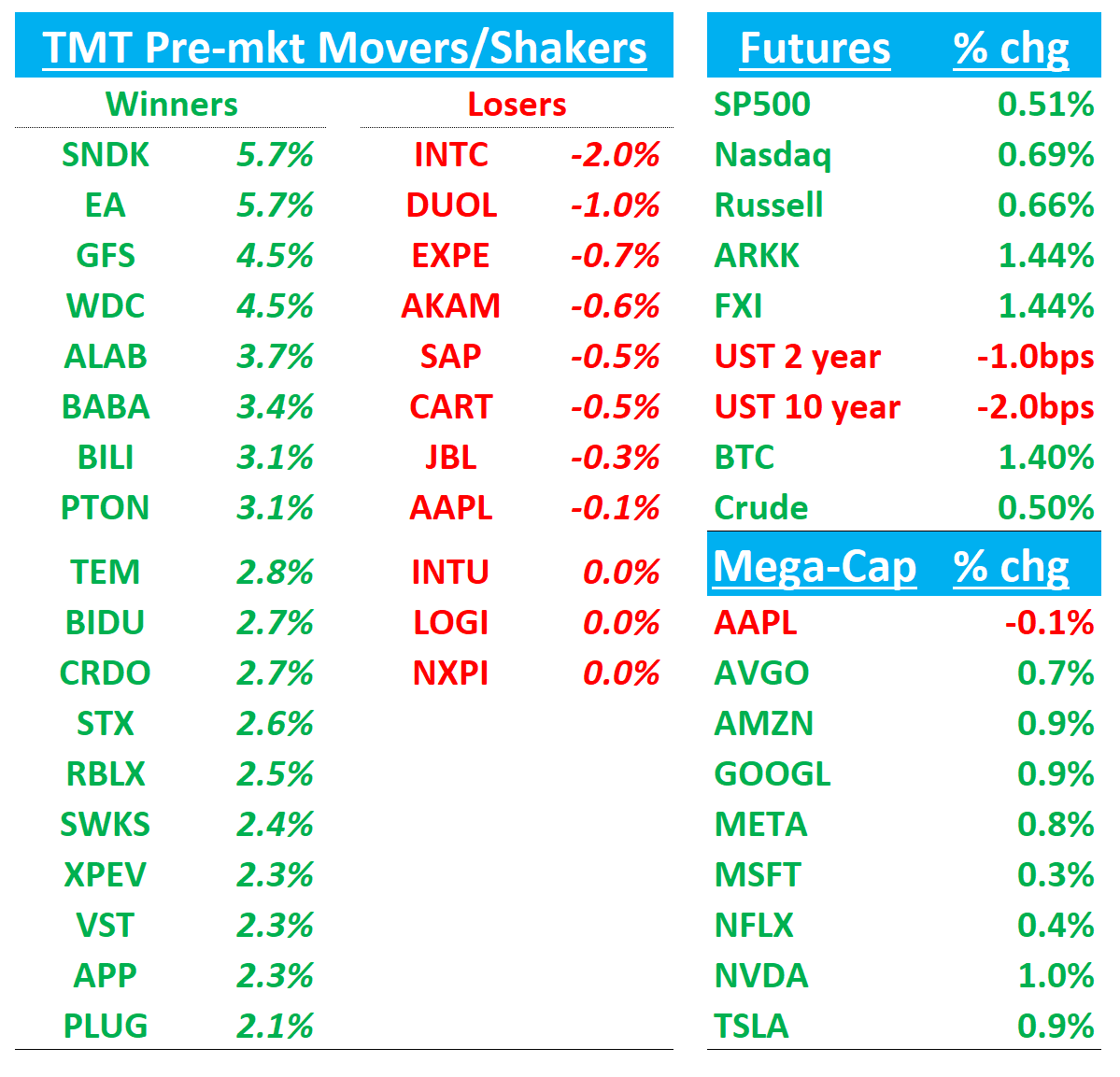

Good morning. Futures +65bps to start the week. China +1% strong overnight with Tech leading the way (HSTech +2%) and KWEB +2%+ in the pre. A relatively slow week on the Tech calendar with most focus on a busy week of macro data, with the main event Friday’s NFP report.

A bit of digestion in the AI trade last week — we call it a bit of HOT AI Summer fatigue. GS noted that last week was the largest weekly decrease in net exposures since early April and largest de-grossing since July ‘24 with Tech seeing largest net selling since early August. However, our sense is the AI vibes are still hot — maybe too hot given the news flow over the last few weeks. Sometimes it’s better to climb the mountain a bit slower so you don’t get altitude sickness. AI spec names back to outperforming early in the pre today…

Lots to get to, so let’s get to it…

WDC/STX: Morgan Stanley Reiterates Overweight on ‘Stronger for Longer’ HDD Cycle; WDC Top Pick

Morgan Stanley says strengthening demand for data-enabling technologies, including cloud and AI inferencing, has pushed the HDD cycle into a “Stronger for Longer” phase expected to extend into CY28. The firm highlights that nearline HDD demand remains up to 10% undersupplied, with visibility now stretching an unprecedented 18+ months (similar to what we heard from Edgewater checks last week), supporting mid-20% exabyte growth annually and firming pricing. Based on its updated model, Morgan Stanley projects >35% EPS growth and >30% operating margins for both Western Digital and Seagate through FY28, well above prior forecasts and 40–70% above Street estimates. The analysts note HDDs are transitioning from cyclical commodities to oligopoly-like assets critical to powering AI, warranting structural re-rating.

TMTB: Rosenblatt also out raising PTs on WDC/STX saying positive things about HDDs. We continue to think a good place to be as multi-modal AI (where we are still very early in adoption) ramps up warm/cold storage demand

APP: Morgan Stanley Raises PT to $750 on Non-Gaming Self-Serve Launch

Morgan Stanley says AppLovin’s October 1 launch of Axon Ads Manager, a self-serve tool for non-gaming advertisers, is a key catalyst that could significantly broaden its customer base. The firm notes the pilot has so far been limited to just 600–700 advertisers but expects that to multiply as the product opens more broadly, including international markets. MS sees this launch as the most important proof point yet for the scalability of APP’s non-gaming ad platform, with potential upside if ROAS and spend per customer track above expectations. MS now models $1.75B in non-gaming ad revenue for 2026, where every $100M of incremental spend could add ~$90M to EBITDA. Reflecting stronger conviction, Morgan Stanley lifts its FY25/26 EBITDA estimates by 5%/22% and raises its price target to $750 from $480, based on a 35x EV/EBITDA multiple.

APP: Phillip Securities Initiates at Accumulate, PT $725 on Strong Ad Tech Position

Phillip Securities initiated coverage of AppLovin with an Accumulate rating and a $725 price target, citing the company’s leadership in performance-driven mobile game advertising and its expanding product pipeline. The firm highlights APP’s end-to-end tools that support both advertisers and publishers, along with its ad exchange and MAX Mediation Platform, which are fueling rapid growth. Upcoming catalysts include the October 2025 launch of its self-serve ads platform, global expansion, and integration of generative AI to boost accessibility and targeting. Phillip Securities notes robust results with 2Q25 revenue up 77% Y/Y to $1.26B and forecasts FY25 revenue growth of +55%. The firm says APP’s strong market position, monetization strategy, and new initiatives provide a solid foundation for continued growth.

NVDA/AVGO/OpenAIHow Jensen Huang is Using Nvidia Cash to Rule the AI Economy

Some pointing out this quote re: OAI/AVGO from this article from TheInformation:

OpenAI and Broadcom, for example, have hit snags with the development of OpenAI’s chip, according to two people involved in the chip production. OpenAI wanted something more powerful and sooner that Broadcom could deliver on its initial effort. OpenAI had been pushing to roll out the chip in the second quarter of next year, but Broadcom has said the third quarter is the earliest it can be ready, one of the people said.

Even when that chip is done, it won’t compete with Nvidia’s general-purpose GPUs, which can handle both the training of AI models and inference—the stage when the models are fully operational. OpenAI’s chip will only handle inference chores.

OpenAI’s initial plans to deploy the chips appear modest, a strategic approach given that this is its first shot at designing server chips for AI workloads. But if the rollout proves successful over subsequent generations, these chips could have greater potential to replace Nvidia’s silicon. On a recent call with investors, Broadcom CEO Hock Tan said an unnamed customer, widely believed to be OpenAI, plans to spend around $10 billion with Broadcom next year, including on chips and servers.

EA Buyout Talk Highlights Gaming Struggles as Growth Slows

Deal will be done at $210… implies ~17-18x FY27 street. EBITDA estimates, in line with the multiple Microsoft paid for Activision Blizzard on FY23 estimates.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.