TMT Breakout + Macro Charts: Sentiment/Positioning/Narrative/Chart Roundup

Nothing is more powerful than when fundamentals and a strong narrative align with a good chart.

TMT Breakout and Macro Charts are joining forces for this week’s roundup to show case the best of both worlds — MC will provide the charts and TMTB the analysis — as we dive into the current Tech landscape & more.

First a quick intro:

TMTB readers know I love combining charts and fundamentals — a good chart can turn a “B” idea into an A+ risk/reward one. Browsing charts has always been a quick and efficient way for me to get a lay of the land and an astounding way to idea generate and risk manage. It was a big boon to my process when I first came across Macro Charts. Now, every Sunday before I log in to Bloomberg to prepare for the weekly, I open Macro Charts’ weekly first and go through it. Easy to digest global market charts focused on BIG trends & ideas derived from his 30 years of market studies & investing and working with some of the world’s best funds & investors.

If you want up-to-date analysis on broad Asset Classes, Momentum signals, and commentary on big trend opportunities, I recommend giving Macro Charts a look. They’re offering Free 1-Week Trial to new Subscribers, check it out here:

Macro Charts: below is a snapshot of our broad market overview, taken from our flagship Weekly Review publication. In it, we analyze key Global Market signals and are continuously evaluating new opportunities & risks:

KEY TAKEAWAYS:

✅ Evidence still favors Stocks rallying into a bigger Top.

✅ Monitoring the data closely as it evolves, and will be updating subscribers in real-time:

It may seem like stocks have rallied “too far too fast”, and maybe the market pauses here (as discussed in the Short-Term signals) — but ultimately the conditions for a top are not fully there yet.

Big tops —even Bubbles— turn with *loss* of momentum, not strength like what is on display today.

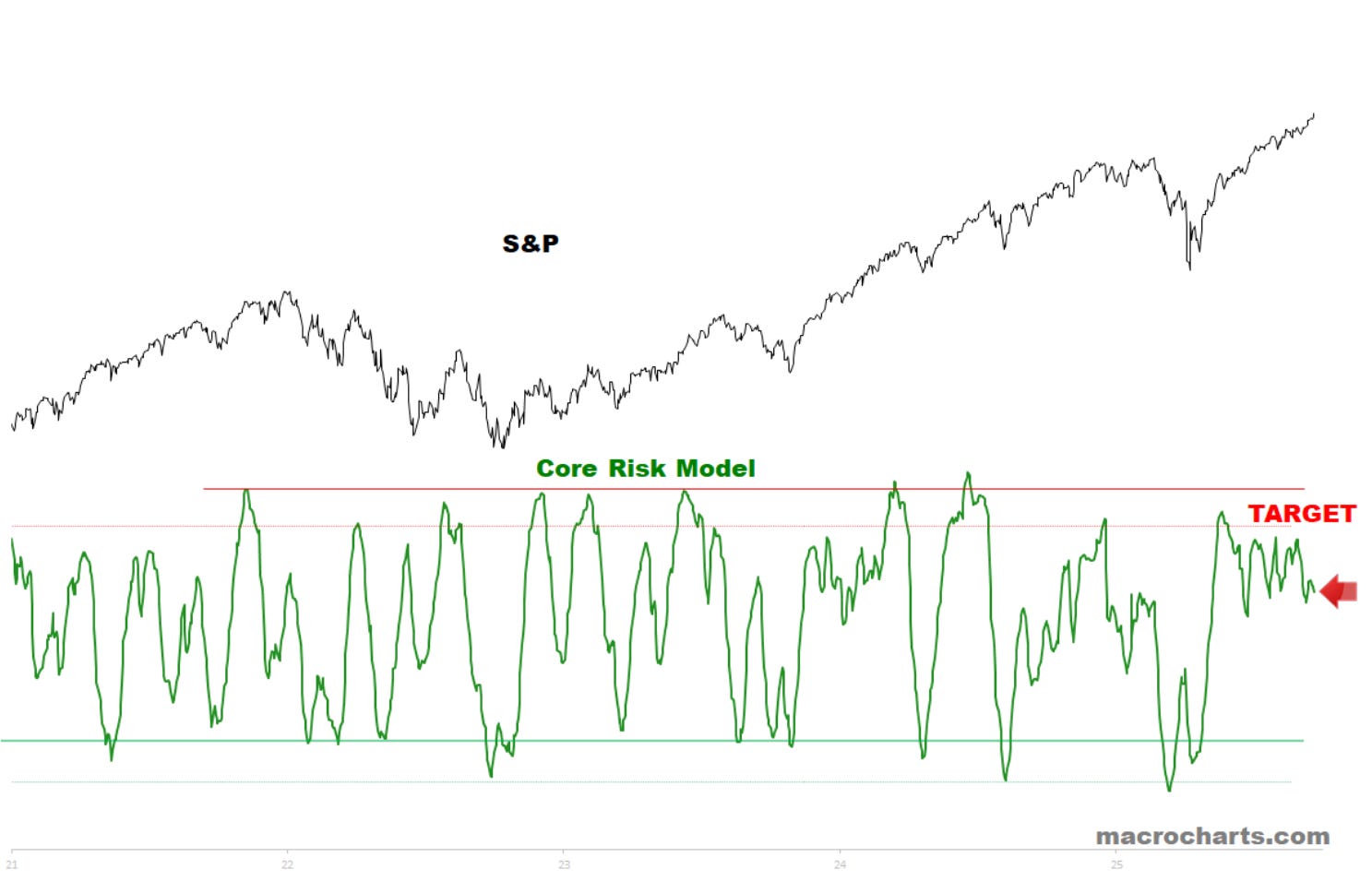

Core Risk Models still have room to catch up:

“MC, will you put on tactical hedges on the next overbought signal?” We follow *almost* every signal. Especially when they appear at an important market juncture. For example: remember we did NOT Sell the last overbought signal in May, when we made the case for the rally to extend to Summer/Q3 and ideally produce another Sell signal at the top. That turned out to be the right move for now, as stocks ran relentlessly higher. Fast forward to today, and looking at Rates/FX, markets may be approaching an important inflection point — and we think Models could nail down timely turn signals. Stay tuned.

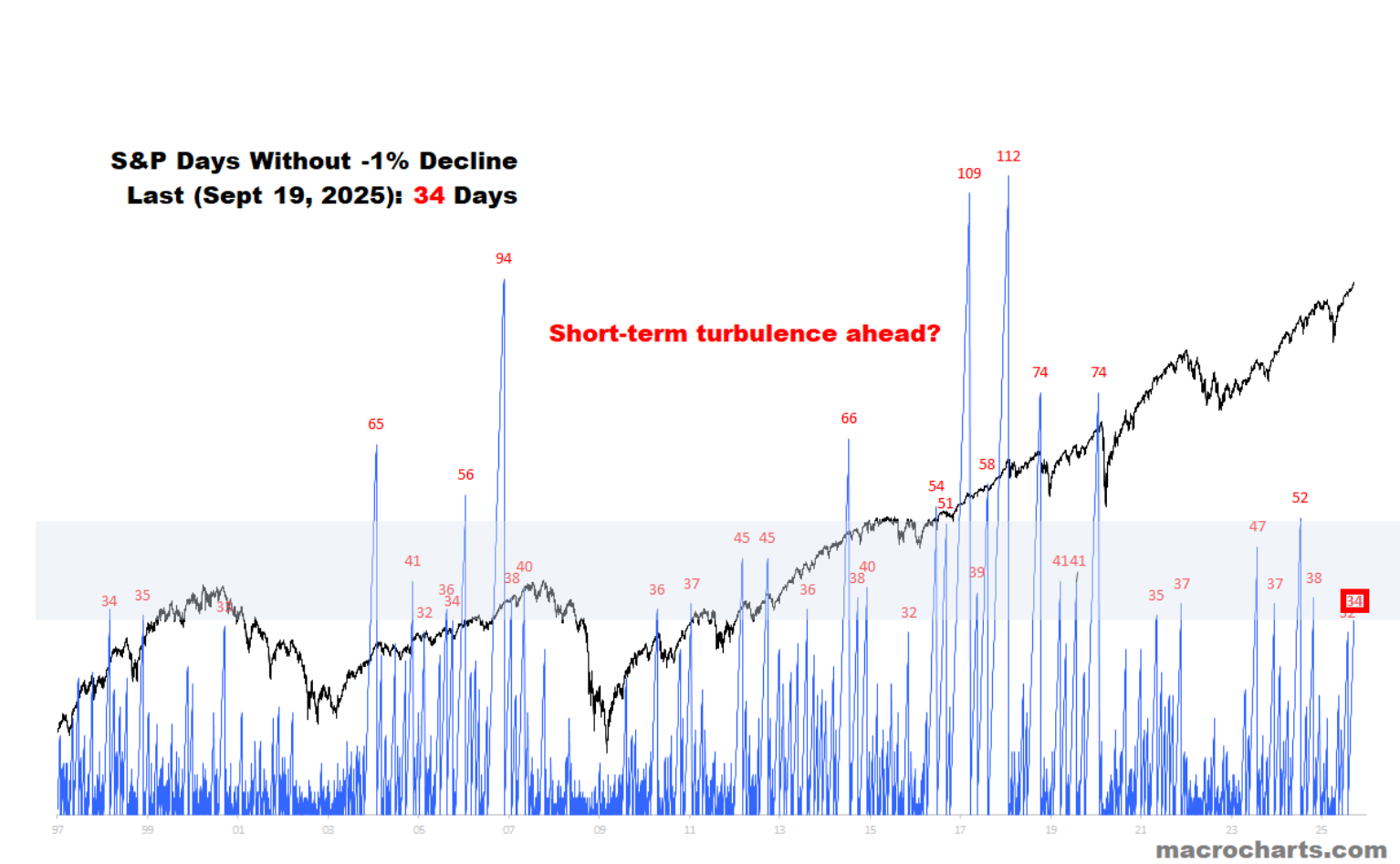

Short-Term, we continue to monitor the Volatility Clock:

As discussed recently, expect some Short-Term turbulence if/when the first -1% day hits. Indexes may pause for a bit, retesting & filling the gaps that were left open (aligned with weaker seasonality into October) — *as discussed in our Weekly Review.

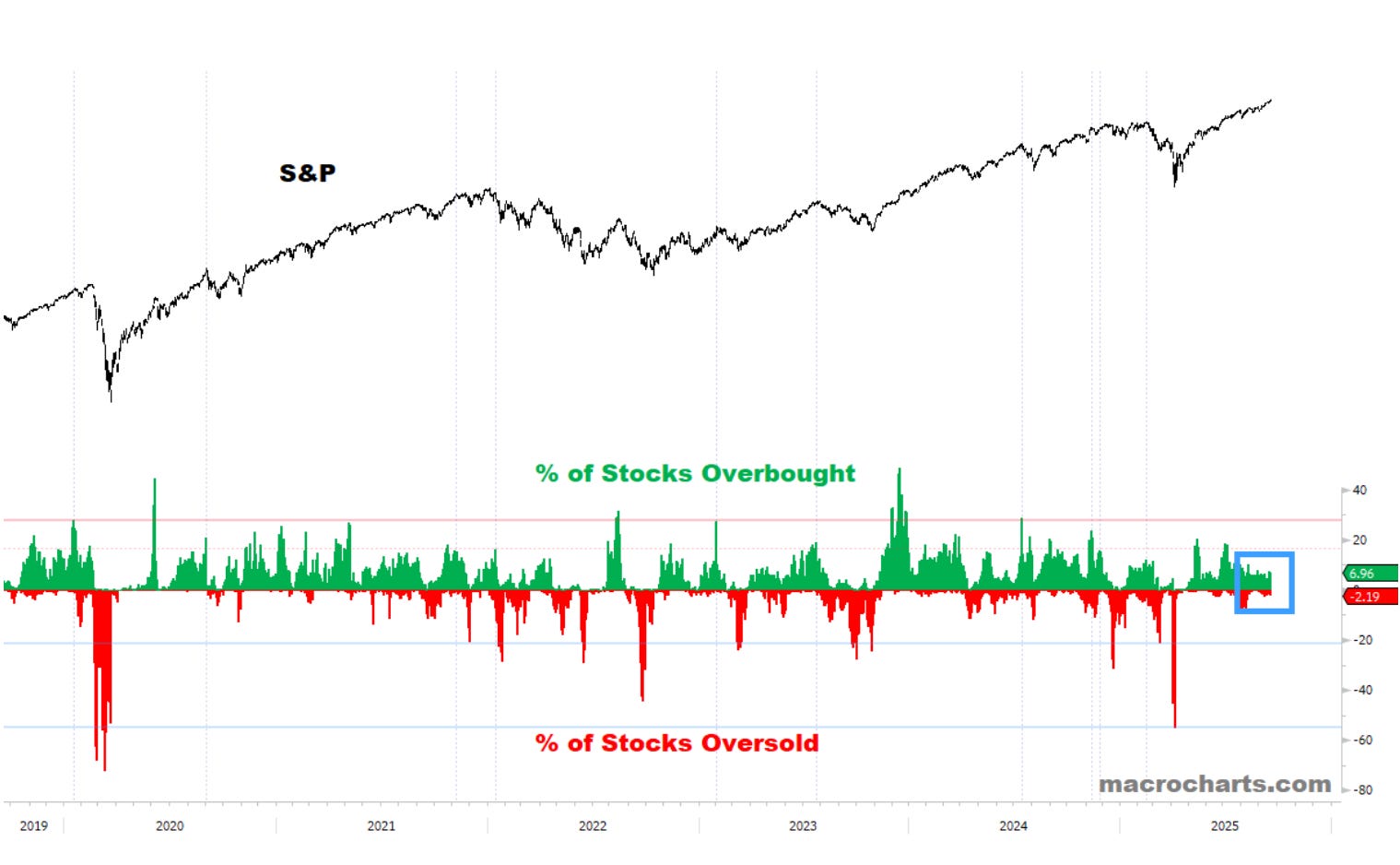

Big picture, Individual Stocks are not overbought — unlike at previous tops of significance:

This Bull Market may still have a card up its sleeve… in other words.

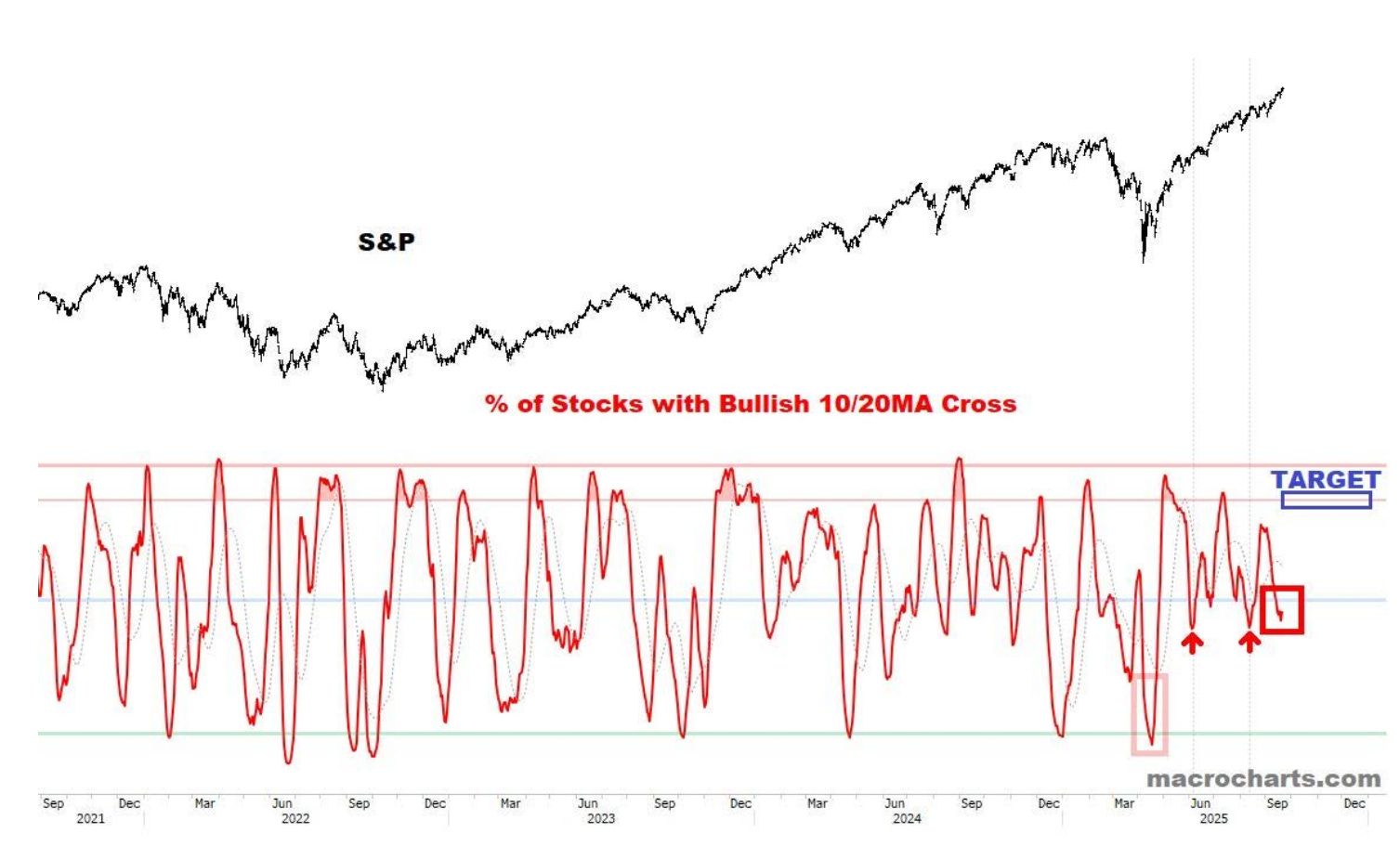

Stocks with a Bullish Cross are turning up again — note the last two occurrences in this rally:

Stocks should ideally get overbought at the next top of importance. Almost every top in the last 15-20 years was overbought/extended — let’s wait & see how this rally evolves…

*For a comprehensive look at Stocks and other Asset Classes – including key themes & momentum/trend signals, check out MC’s latest Weekly Review

Sentiment/Positioning/Narrative Roundup

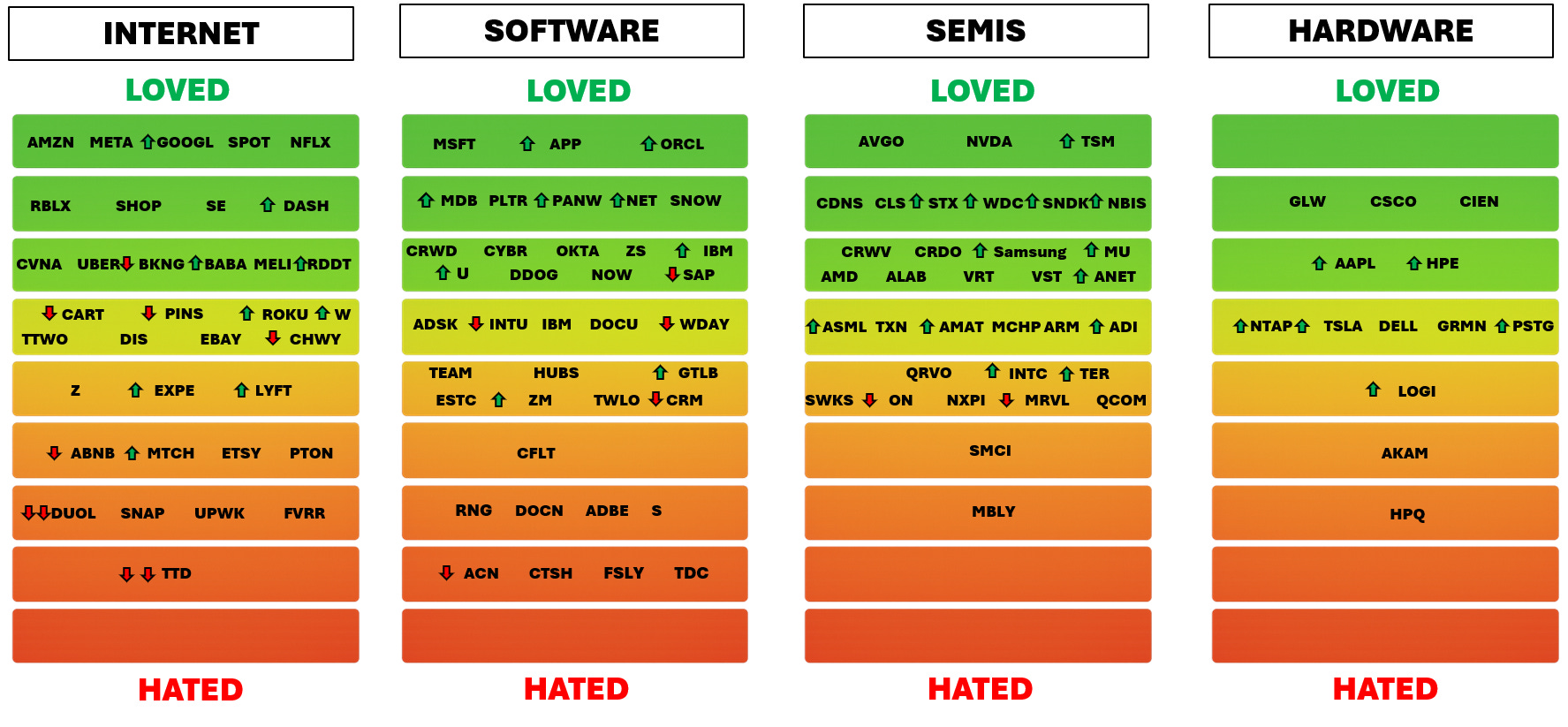

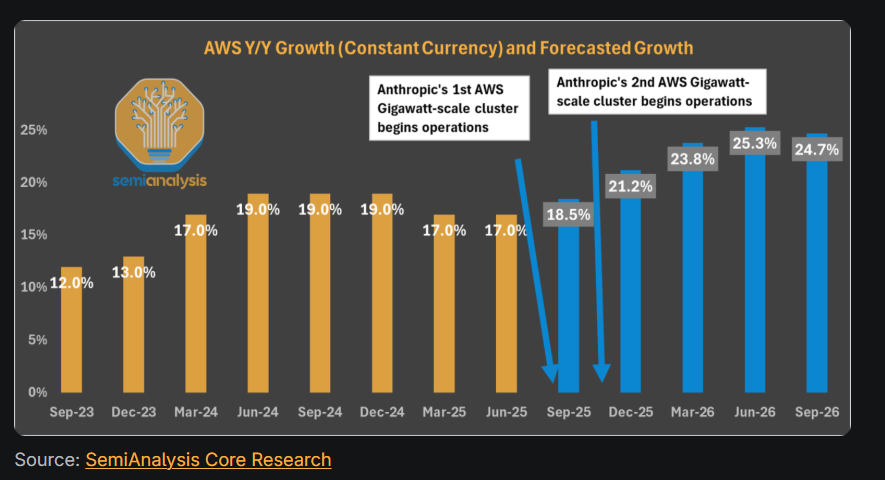

TMT Breakout: For new TMTB readers, below is our Sentiment/Positioning/Narrative piece which we usually put out 1-2 times a quarter for our Pro subs. We dive into each sector in Tech and lay out the most important narratives and investor sentiment/positioning driving each stock.

Let’s get to it…

*Individual Stock charts shared by Macro Charts

AMZN remains one of the most loved names among internet investors despite the usual frustration items we hear from longs around the stock (Jassy, sub 20% AWS growth, lack of shareholder return). The bulls here are focused on the holy grail: AWS accel as we head in 2026. While the retail bull margin thesis is alive and well, AWS acceleration has eluded investors as AMZN has been capacity constrained over the past couple of years, keeping AWS growth at sub 20% vs. GCP near 30% and Azure at ~40% and fanning fears that AWS is falling behind both in the AI race.

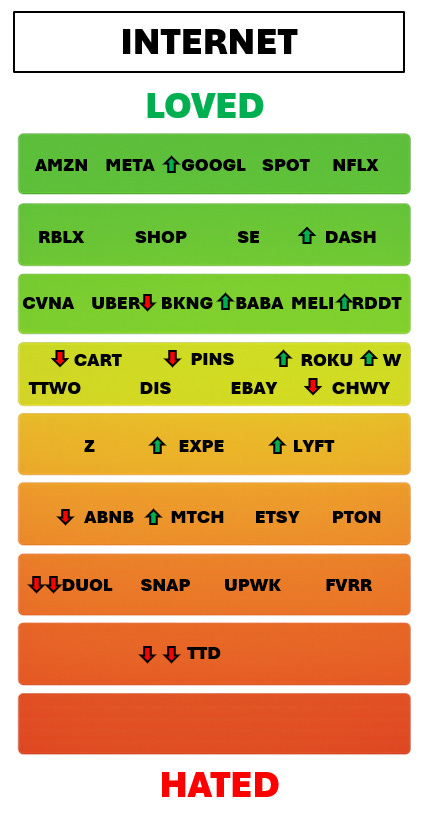

However, the signs are adding up that capacity will come online ‘26: SemiAnalysis points to mid 20s growth by mid’26 as Anthropic Data Centers come online:

MS had a good note several weeks ago pointing out that if revenue per foot normalizes as supply bottlenecks ease, they think we could get close to mid 20s AWS growth in ‘26.

Cowen’s Datacenter analyst also added to the fun with a note last week talking about ~2GW out of a 7GW expansion to Project Raimer coming online in 2026. To give rough numbers, if you assume $10-11/mw, that’s $20-$22B incremental revs on $120B current AWS revs - layer that in over 1-2 years and the accel picture becomes clearer (5-6 ppts of growth each year). Wells Fargo jumped on board the train this week upgrading the stock on a similar view. M-science has also pointed to slightly easing capacity constraints in July / August / Sept.

Capacity math is capacity math, but long-term bears (I don’t hear many) will say in an agentic world, customers pick whatever gets work done fastest and most reliably, not the cheapest tokens and AWS’s focus on cheapest price risks them falling behind other vendors. Stratchery laid it out well:

In this world what matters most is performance, not cost, which means that Amazon’s obsession with costs is missing the point; it’s also a world where the company’s lack of a competitive leading edge model makes it harder for them to compete, particularly when there is another company in the ecosystem — Google — that not only has its own custom chip strategy (TPUs), but also is integrating those chips with its competitive leading edge large language model (Gemini).

Some concerns have also risen about GOOGL’s TPU taking Anthropic workloads.

3P data here shows an AWS result of 18.5-19% in Q3, above street at 18%, which should be good enough for the bulls as that means they’ll pencil in a 20% exit growth rate in 2026.

META has become a bit more controversial over the past couple of months, but still remains loved among internet investors. Some investors have expressed concerns around opex/capex ramp (see Zuck’s recent comments: “if we end up misspending a couple hundred billion dollars, that’s unfortunate…But what I’d say is I actually think the risk is higher on the other side”), D&A ramp causing FCF revisions to go down, and noise around re-shuffling of the new AI team.

However, bulls will counter that accelerating growth and revenue tailwinds outweigh the above. Early sell-side checks and 3p data point to another 4-5ppts acceleration to high 20s growth on top of last quarters 6ppts acceleration. As the comp gets easier in Q1, we think a 30 handle on top line growth is possible. Why is this happening? META is one of the few companies that is already turning incremental GPU spend into ROI: more training/inference capacity feeds Reels/Ads ranking, Advantage+ automation, & more engagement (video + better commendation/targeting), helping lift relevance, CTR, conversions, and advertiser ROAS.

On top of this add Threads + Whatsapp monetization optionality (Barclays had a note out this week saying close to $20B in revs was possible from both in CY27) and we can see why buyside sits close to $37 in EPS in CY27 (we’re even higher): 26x $37 EPS = $1k over the next 6-12 months.

A possible catalyst to watch: Sept 30th Display Glasses release.

GOOGL (along with RDDT) has undergone the biggest narrative and sentiment shift among internet investors recently and the vibes are very good here post a DOJ ruling that amounted to a slap on the wrist and helped get Long Onlys involved in the stock again. The AI search bear case has taken a back seat as co. continues to grow search double digits. 3p data/sell-side checks are pointing to a 2-3ppts beat to ad/search revs this q.

GOOG’s Gemini has reached the top of the app charts buoyed by nano-banana image generating virality and continues to ship great AI product with Gemini 3 on the horizon. GCP continues to perform well signing deals with META and OAI. Talk of further tailwinds from renting/selling TPUs and future AI tailwinds from monetizing every pixel on YT add feathers to the “AI Winner” narrative hat. Bulls are at $13+ in 2027, and 22-23x that number gets you close to $300. Path of least resistance continues to be higher here.

NFLX continues to be liked by investors although the main gripe continues to be valuation. As investors roll their #s to ‘27, that should ease a bit. Bulls point to Q4 positive slate/seasonality, NFLX continuing to ramp ads, intra-q data that is showing a nice beat to net adds, and mgmt at GS who sounded bullish talking up engagement. Bulls will say they can pencil in $42+ in EPS in ‘27 and 35x gets you close to $1,500. Don’t hear much from fast-money on this one as it’s become less of a trading stock since they pulled net adds disclosure.

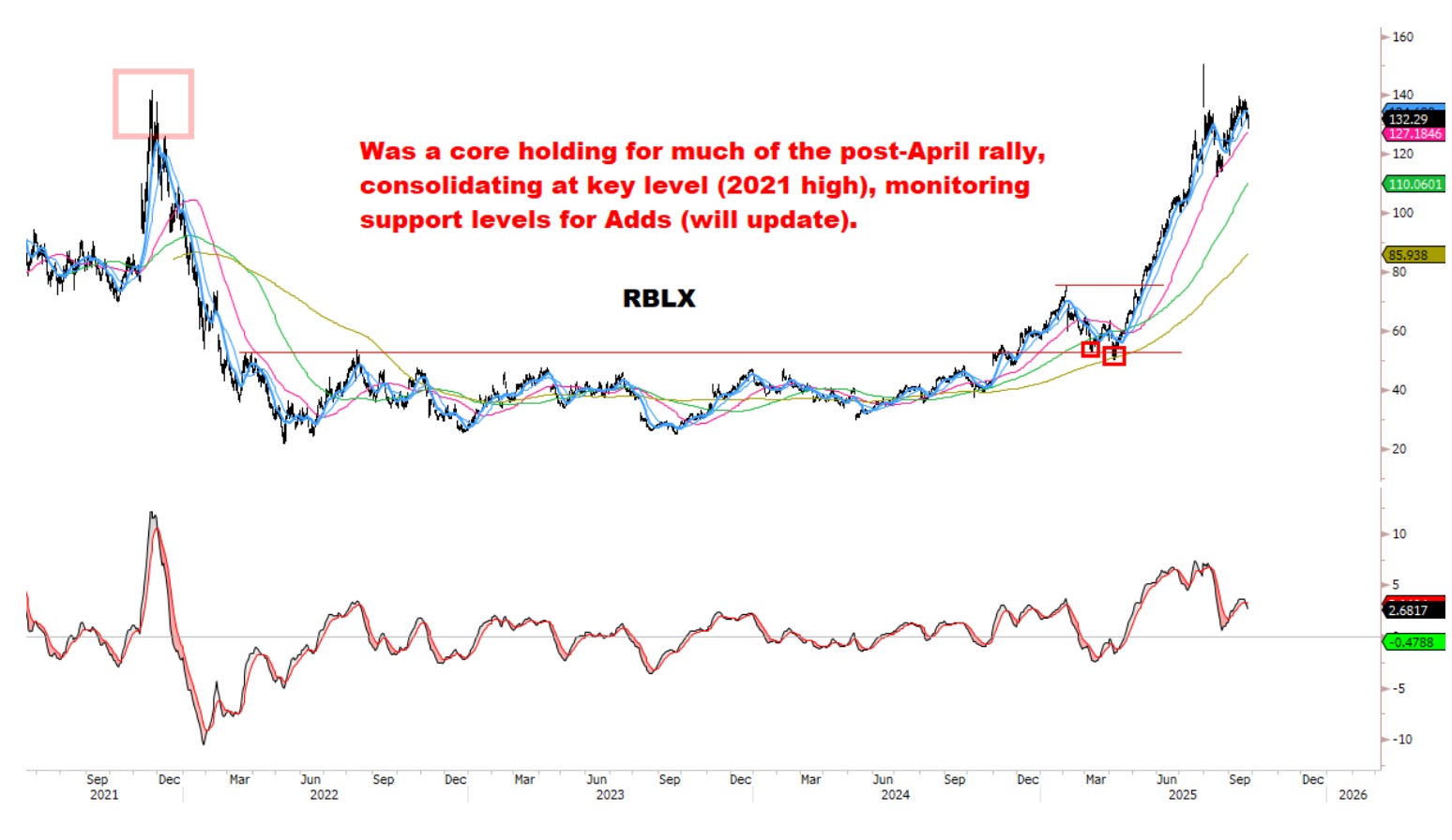

While RBLX has moved up the sentiment/positioning table as CCUs continue to hold up well despite Grow-a-Garden beginning to decline and what is typically a weaker September given back to school. Despite bookings tracking to 60%+ QTD and what will likely be a great quarter, there continues to be lots of skepticism in the long-only community surrounding sustainability of recent rise in bookings. Bulls say higher platform growth is here to stay given discovery algorithm changes while Ads + GOOGL/SHOP partnerships have yet to ramp and AAPL/Epic ruling provides a tailwind to bookings.

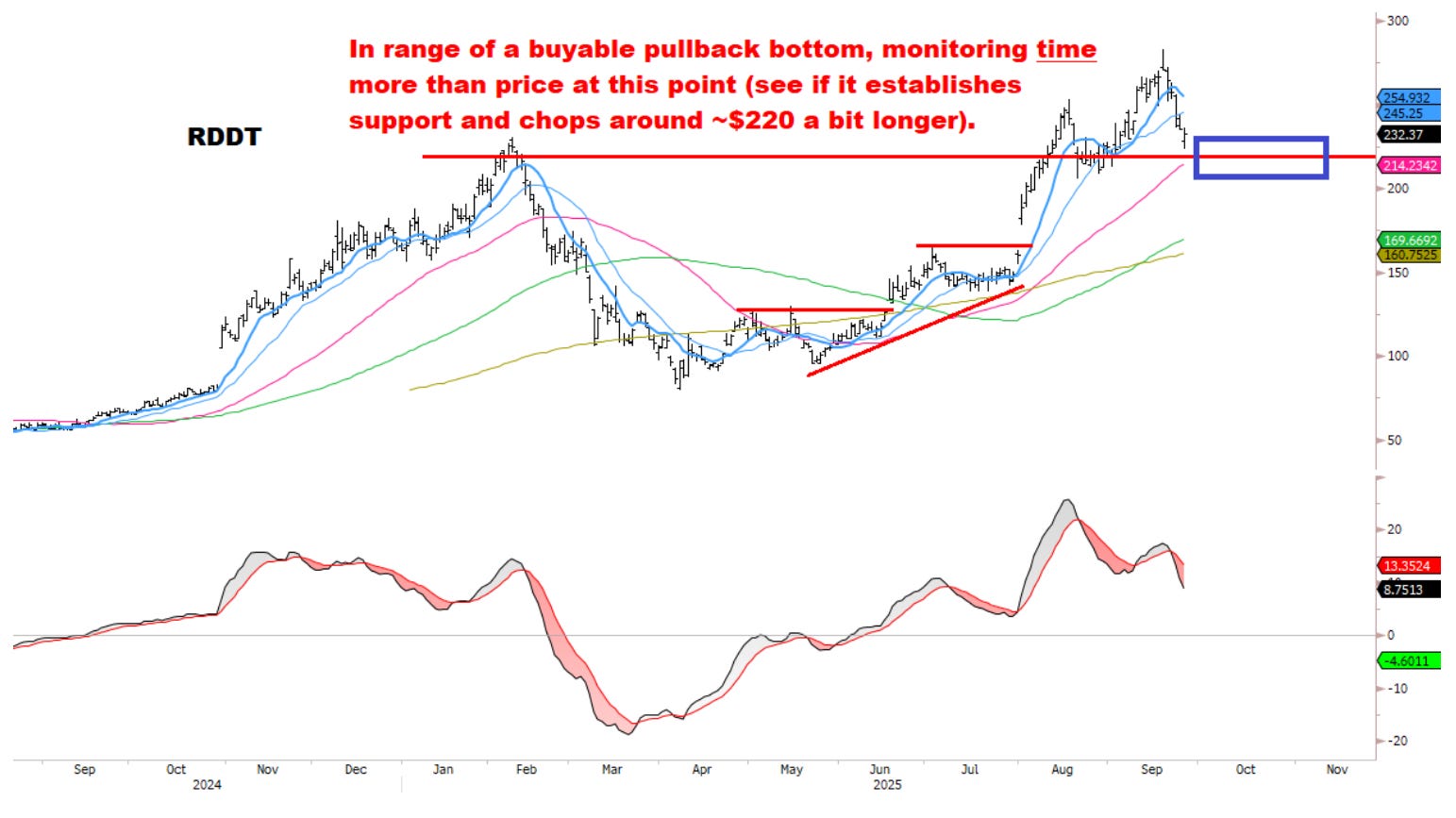

RDDT perception has shifted from AI loser to AI winner over the past 6 months as the site is now seen as increasingly strategic to LLMs with some data showing that 20-30%+ of AI responses cite Reddit. While sentiment has shifted more positive, there has been more debate as of late with RDDT trading near 30x EBITDA. We decided to take (majority) profits on our long call from June as US DAU data is mixed QTD, sentiment has moved way to the right (an investor recently told us they think RDDT deserves a NET-like multiple…), checks show a decel from last q (although street already expecting this), and LLM news has likely reached its peak near-term (GOOGL + OAI renewals aren’t up until mid/late ‘26).

The stock is now down 15%+ in a week since we said to take chips off the table. Still, there are some good ingredients here: long ARPU upside runway, this quarter likely crushes revs, comps begin to get less hard next quarter, and potential for some sort of Anthropic licensing deal as part of a settlement over the net 6 months. We’re not opposed to sizing up the name again, but we are waiting for the right set up.

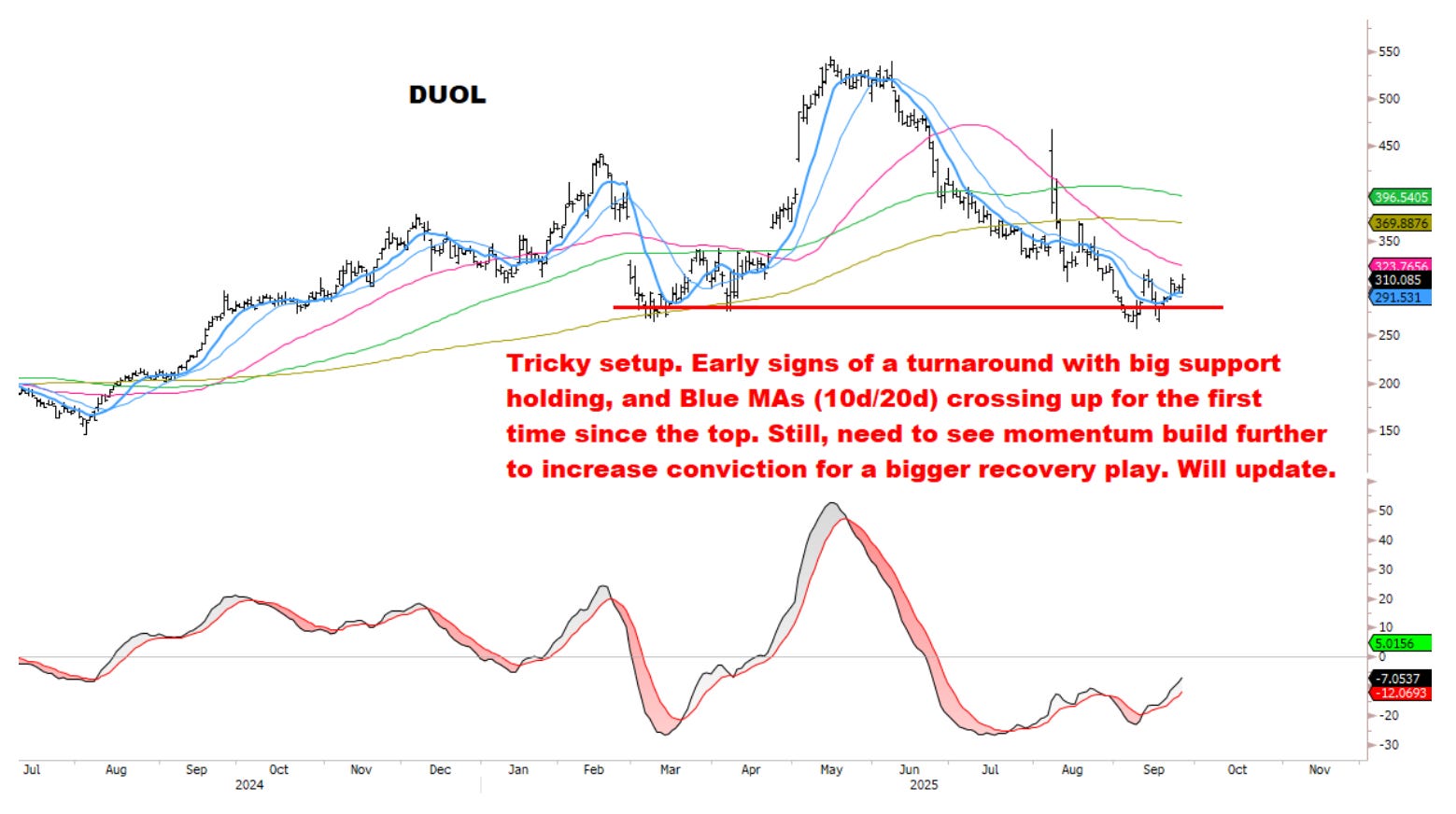

DUOL has moved from potential long-only darling into a stock no one wants to touch faster than you can say buyao in Chinese. Slower 3p data continues to fuel top-of-funnel concerns although user data seems to have stabilized as of late as DUOL has turned on “edgy” marketing again. Mgmt has sounded ok on the road in meetings with investors. Stock has also begun to act a bit better on bad news recently. It seems like every week there is a new announcement that looks to encroach on DUOL’s home turf, with the most recent being live translation from AAPL airpods 3. Stock still trades at 50x+ so plenty of re-rating left lower if DUOL can’t turn around user growth/narrative.

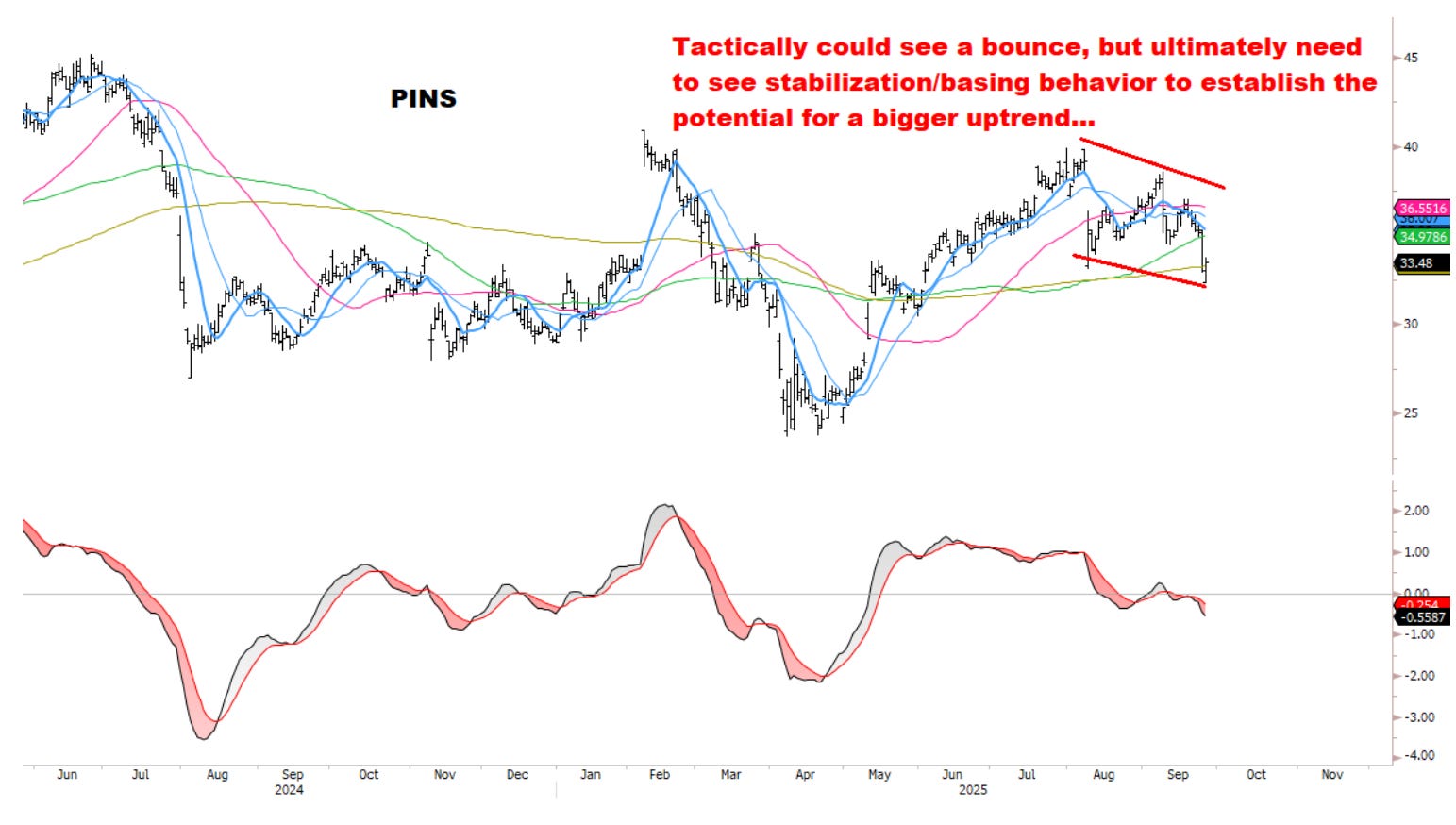

PINS is being used as a funding short for APP/META logs. Checks from the sell-side have been mixed so far, with some pointing to CPM & AMZN partnership upside helped by an improvement in Travel/CPG categories. MAUs look to be tracking inline to slightly below street and have decelerated in the last month while Depop just launched a competing fashion site and GOOGL just launched Mixboard, sw that enables anyone to create AI -powered mood boards, causing the stock to hit 3 month lows mid week. Bulls are still hoping for an elusive acceleration to 20%, but this remains a show me story for many investors. Stock seems like a do nothing to us at 16x '26 numbers.

SHOP blew out GMV numbers last q (accelerated to 30% from 23%) and 3p data points to more acceleration this quarter with cc data showing a 2-3ppts beat to GMV. Stock generally is loved by long-onlys and long-term hedge funds like Coatue, who are playing the multi-year bull thesis. That thesis rests on AI as both a margin driver (no new hiring unless “AI can’t do it”) and a GMV accelerant (thanks to partnerships like OpenAI and Perplexity), alongside merchant-facing tools that could push FCF CAGR above 30% There is also the emerging AI-related bull case here captivating some investors attention: optionality in agentic commerce as agent-led buying through chatbots could open a new top-of-funnel channel.

SPOT continues to be loved by long-term investors as bulls framed the recent fx-related revenue shortfall as transitory and still see upside to pricing driven by improved product rollout (mgmt has signaled pricing increases a key part of their playbook now) layered on top of audiobooks rollout and a lean cost structure which could drive another leg of margin expansion. Story remains one of the cleaner ones in internet.

UBER sentiment continues to seesaw around FSD news and the debate on whether UBER will benefit or get hurt in an AV world doesn’t seem like it will be settled any time soon, which means the multiple will remain somewhat capped. Although to be fair, the stock seems to be taking Waymo rollouts more in stride these days and stock sits near highs. Dara sounded good on the macro and FSD opportunity at GS. From a numbers perspective, bulls highlight the stock trades at a mid-teens FCF multiple despite FCF growing close to 30%. The main bear concern now centers on incremental margins. After 500bps of expansion from 2021 to 2024, UBER is signaling slower operating leverage as it ramps investment in lower-priced offerings (like Go-Get), expands into less-dense markets, and integrates international acquisitions.

LYFT sentiment has gotten better as of late — although I still don’t hear a lot of interest from investors — given Waymo Nashville partnership, potential ad ramp, insurance tailwinds from the recent Cali ruling, and 3p data which is showing a slight acceleration in rides. LYFT FREENOW’s acquisition should help them expand in europe and headline numbers will look a lot better near-term. They’ve also lined up a Baidu partnership to launch robotaxis in Germany and the UK in 2026, building on that footprint.

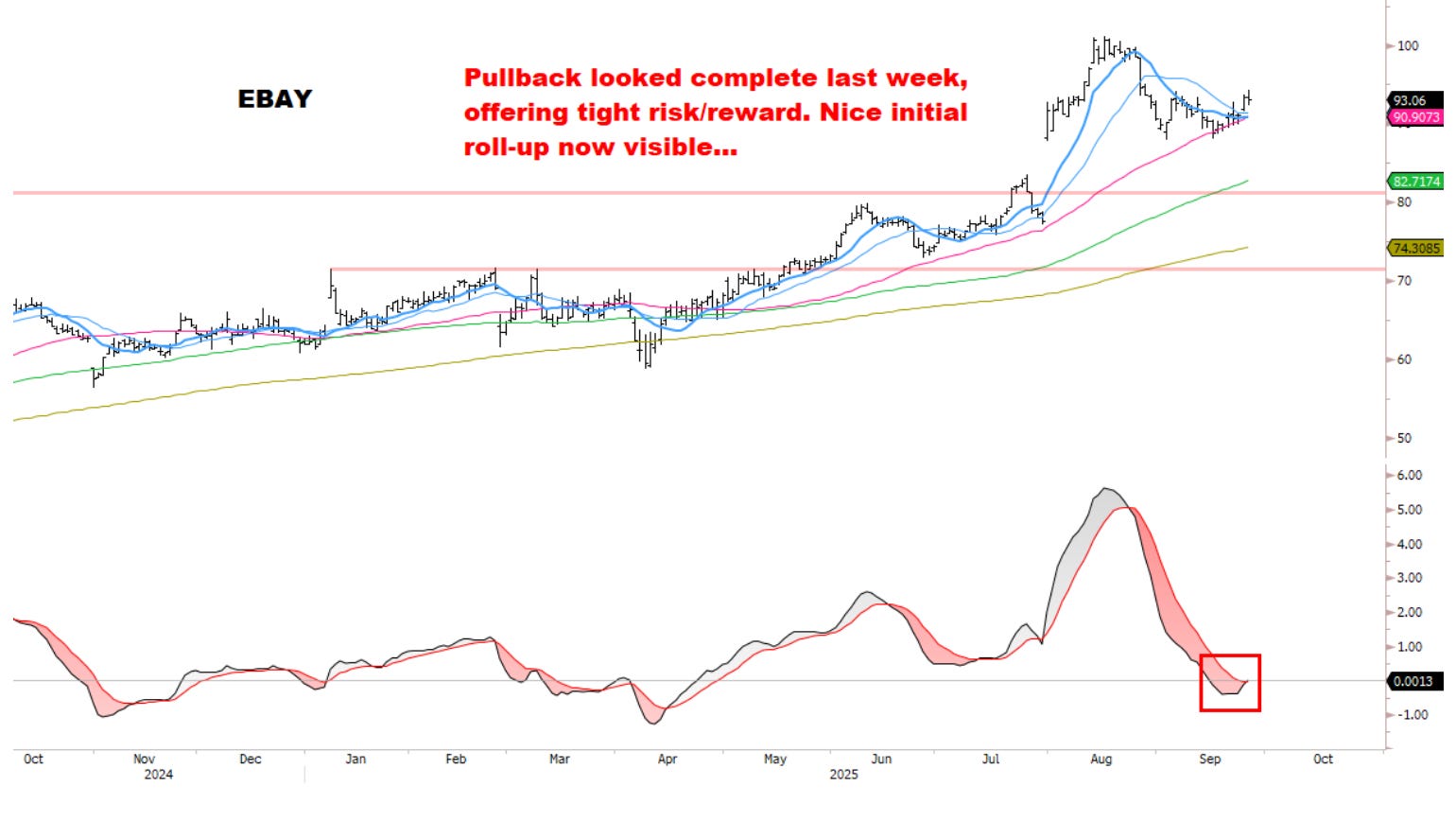

EBAY: 3p data has been good here as Pokemon trading cards are helping drive upside to GMV but investors question how long that is sustainable. GMV looks to be tracking 2-3 ppts ahead of street. Don’t hear a lot on the name but stock has been a sneaky good long over the past 3 months (+30%).

TTD is squarely in the dog house as concerns around AMZN compeition and take rate continue to take center stage while NFLX recently. Checks here have been pretty awful recently, taking a step lower. News hasn’t been great either with NFLX recently announcing Amazon DSP as a programmatic partner starting in 4Q25, following integrations with DIS & ROKU, benefiting MGNI (Netflix supply partner) and challenging TTD’s competitive narrative. We covered around $50 given it was trading at 15x EBITDA, which is a lesson that one should never underestimate how low investors can take multiples on a name that is viewed as a structural loser.

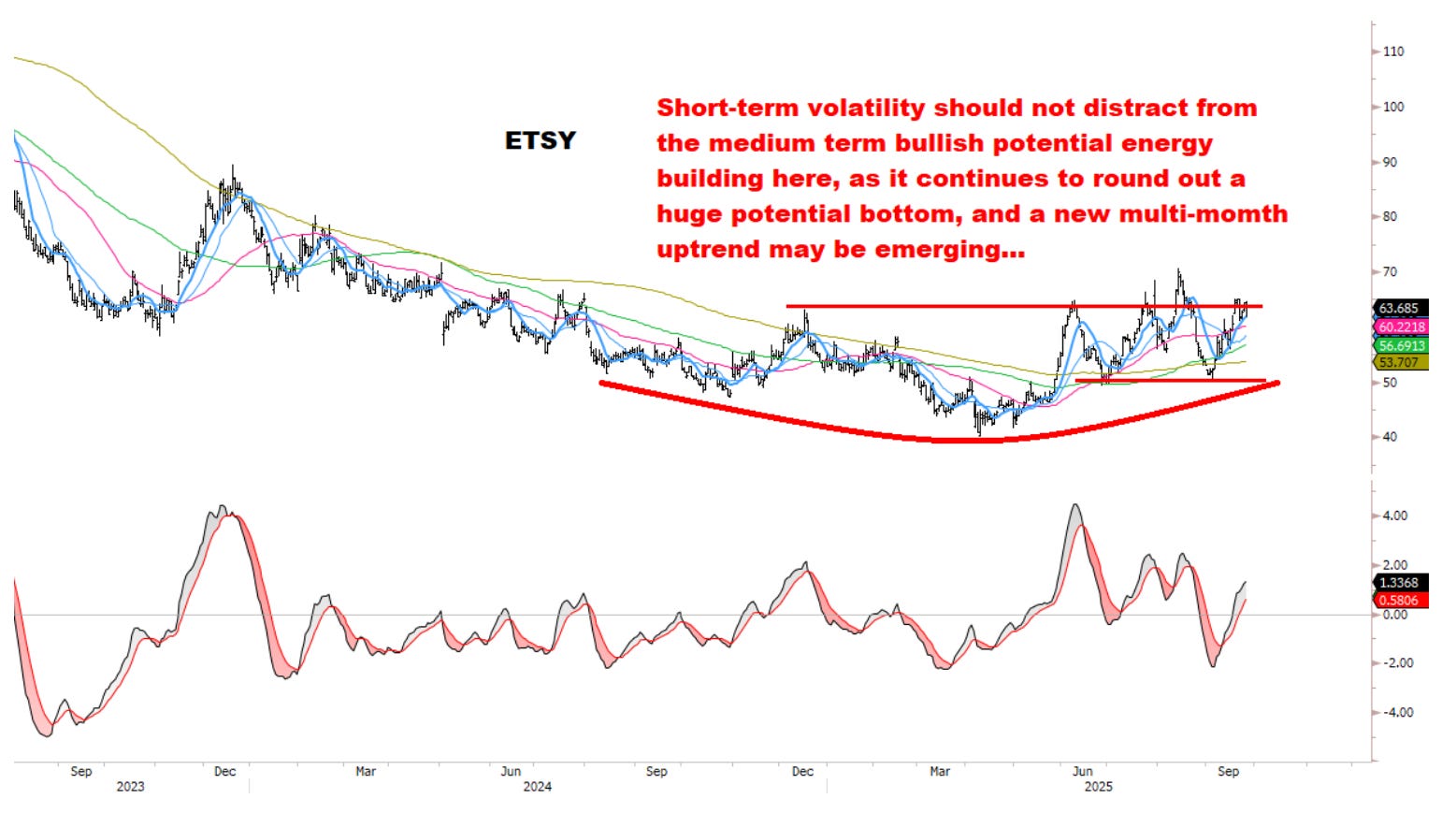

ETSY 3p/cc data continues to be mixed although has improved as of late and is tracking to a slight beat. Bulls will say product and marketing fixes (more app usage, deeper personalization, loyalty, creator/social programs) can lift conversion and frequency, while Depop momentum and higher take-rate (ads + payments) support revenue per buyer. They wait for the elusive GMS re-accel which should drive a re-rating higher. Bears will say active buyers remain under pressure, forcing heavier paid acquisition just as CAC rises and LTV/CAC compresses, which, along with a higher paid-traffic mix, weighs on margins while de-minimis could still raise end prices and mute demand. Doesn’t seem compelling to us on either side and the stock seems to just trade on what the latest 3p data is saying that week.

DASH remains loved among internet investors with a clean story, best in class mgmt team, strong narrative, and 3p data that shows a 2-3ppts beat to GOV.

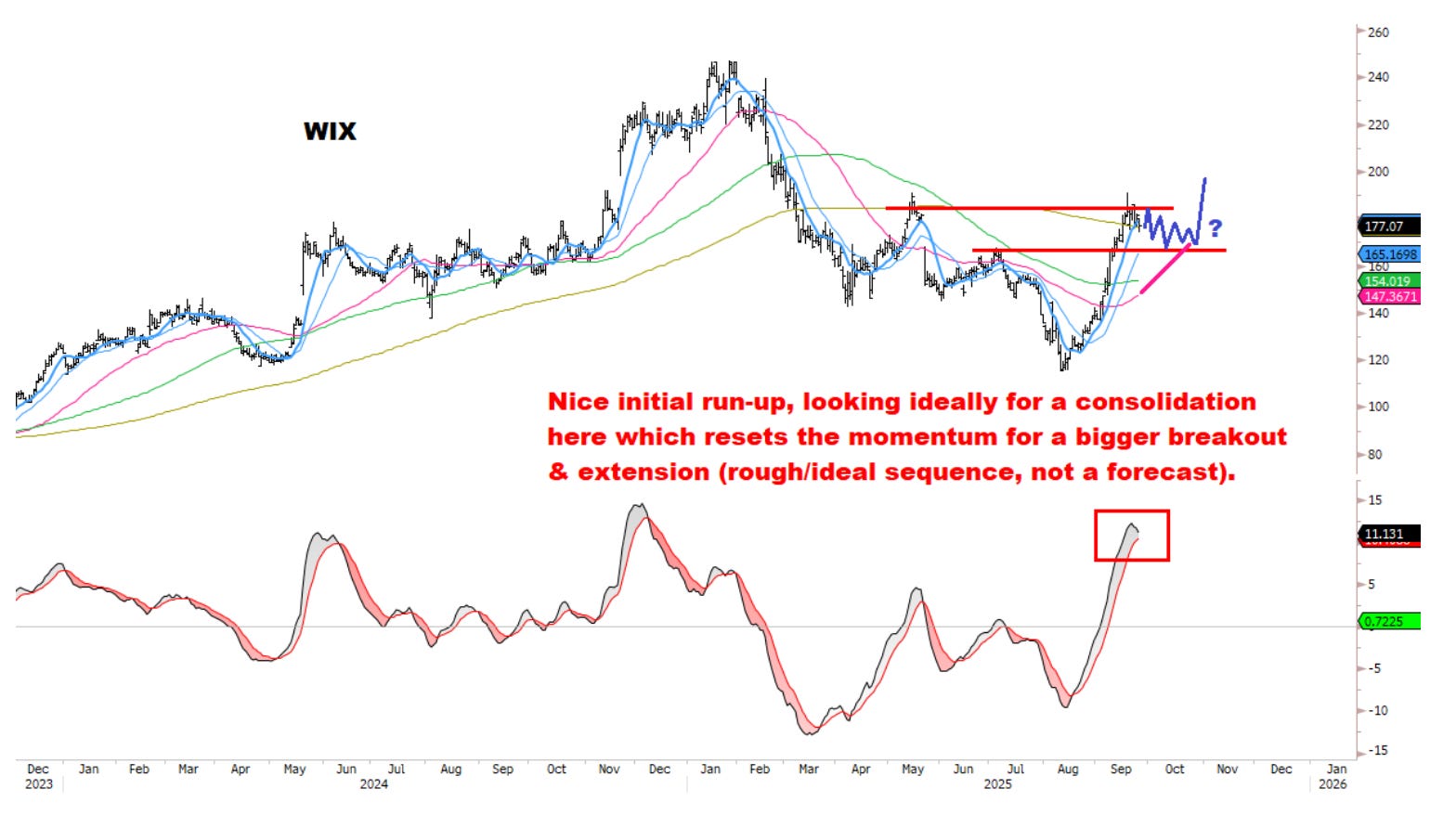

WIX was sitting squarely in the “AI Loser” bucket a little more a month ago until investors began appreciating the massive ARR ramp from their June acquisition of Base44, vibe-coding competitor to Cursor and Replit, which could potentially add MSD growth to next year’s top line. Base44 growth has continued to tick higher in September after the CEO update in Aug. Has become a bit of a retail favorite as well with lots on X pitching the stock.

CART sentiment has nosedived after CEO left to OAI although there is talk it could be takeout candidate. Amzn’s recent grocery push is also weighing on bull’s minds and finding favor in bears’ hearts. The push back is online grocery penetration is in the low-teens and reducing free delivery thresholds could drive TAM expansion and CART continues to have a selection advantage; retailers like COST could also lean further into the on-demand platforms to compete with AMZN. 3p/cc data continues to be mixed here - seen some data calling for a small beat, others for a miss led by slower orders and share loss.

Travel names continue to be used as funding shorts in internet, especially ABNB where 3p data is mixed and their new initiatives don’t seem to be driving much growth. EXPE data has looked better than BKNG, although both seem to b e tracking above street QTD; I still hear investors worrying about how the OTAs look in an AI agentic world and both names usually get a lot of questions around this on calls and at conferences. The “AI loser” case: AI trip-planning assistants can capture demand and execute bookings end-to-end, disintermediating OTA funnels. At the same time, hotels/hosts can use AI to drive direct bookings (chat, personalized offers), reducing OTA volumes and bargaining power.

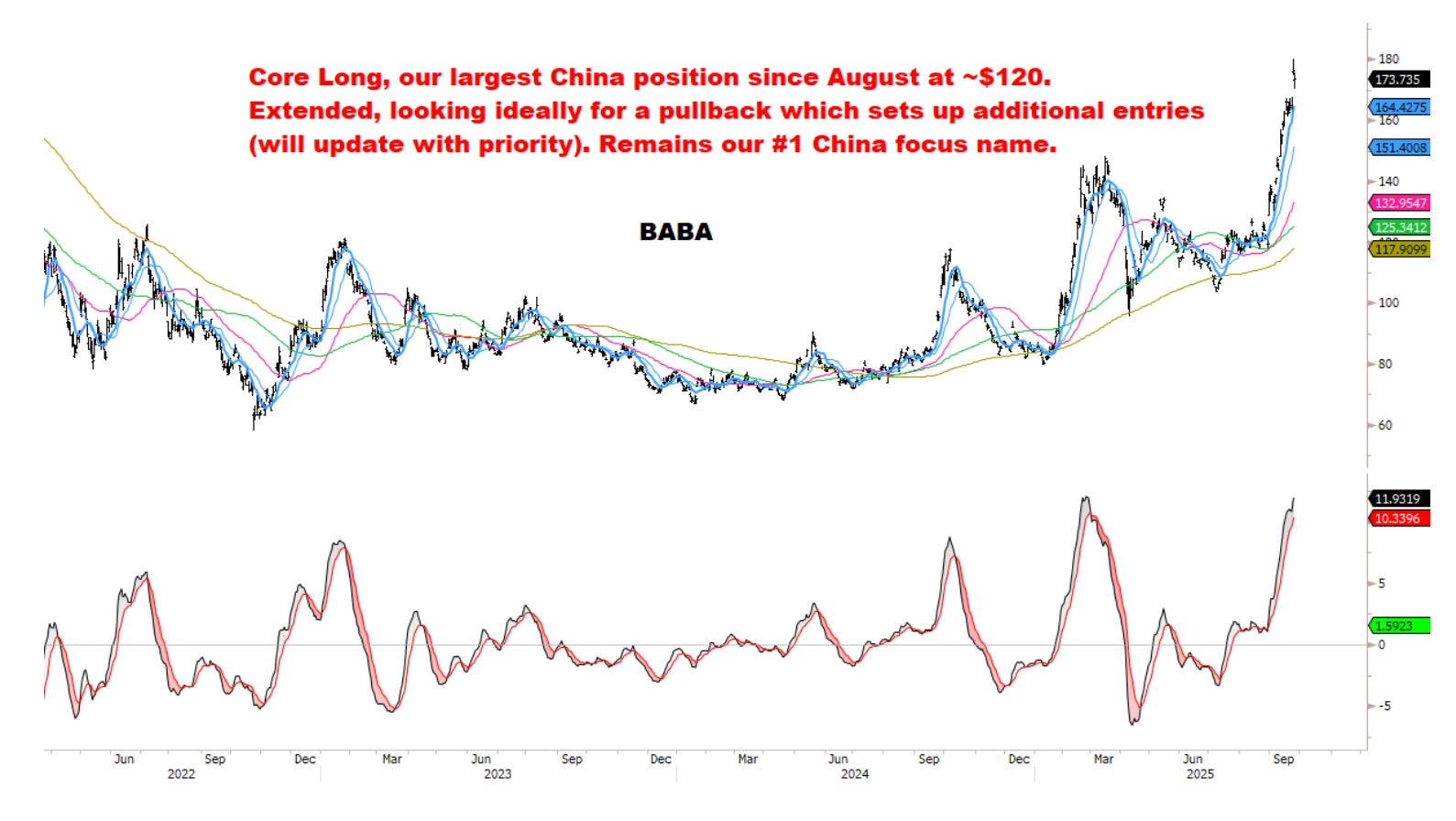

BABA has benefitted from excitement around cloud growth which accelerated to mid 20s last quarter, recent optimism around capex #s and is being helped by better China sentiment overall. A potential NVDA/China deal would further boost cloud growth/sentiment here. VNET / GDS also potentially beneficiaries from BABA’s big cloud push (see the Morgan Stanley notes earlier this week).

For full TMTB Weeklys, more positioning/sentiment write ups, trade ideas, earnings previews + upgrade to TMTB Pro. For more info + Trial: sales@tmtbreakout.com

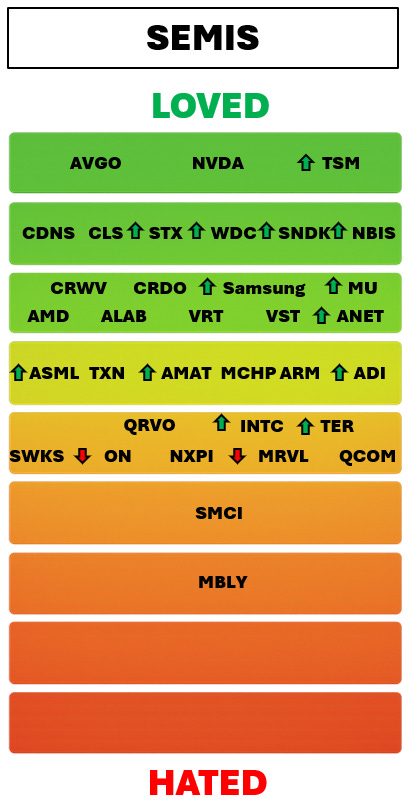

AI vs. non-AI continues to be the main bifurcation within semis as AI-exposed names have handedly outperformed handsets/analogs all year and the trend doesn’t seem to be stopping. It seems like every week we get new massive numbers around AI buildouts and my sense is even the bulls are feeling a little bit of AI HOT Summer fatigue as things are moving so fast (stocks included) — conversations have shifted to trying to find new ideas/longs as many names have already rallied a ton / been “discovered.”

Let’s dive into the names , starting with NVDA…