TMTB Morning Wrap

Good morning. Futures -15bps to start the week as all eyes in Tech this week on Gemini 3 release and NVDA earnings on Wednesday. In case you missed it, we wrote about the AI non-bubble and Sam’s Splurge over the weekend.

Stocks in Asia mixed overnight: TPX -0.37%, NKY -0.1%, Hang Seng -0.71%, HSCEI -0.74%, SHCOMP -0.46%, Shenzhen +0.01%, Taiwan TAIEX +0.18%, Korea KOSPI +1.94%….BTC is hovering around $95k while the odds of a fed cut on 12/10 now stand slightly below 50%.

Should be a fun week, let’s get to it…

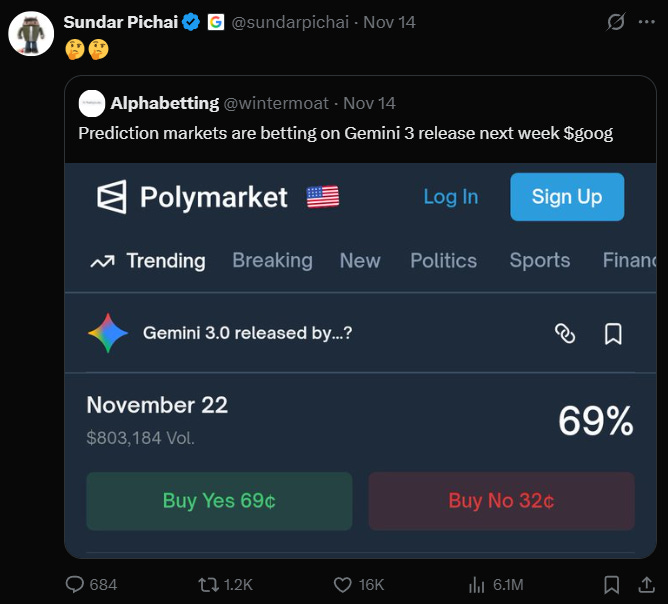

GOOGL +4%: Berkshire takes a $5B stake in GOOGL (1.8%) / Gemini 3 expected to launch this week (most expecting tomorrow as release date)

Global Hardware OEMs — MS Cuts Ratings on Margin Risk from Memory ‘Supercycle’

Morgan Stanley says the rapid surge in NAND and DRAM pricing — up between 50% and 300% in recent months — now represents a meaningful headwind for hardware OEM earnings into 2026, given how much of each product’s BOM is tied to memory. MS notes that past “memory supercycles” have typically translated into margin compression 6+ months after costs begin rising, and the firm now models a median 60bps Y/Y gross-margin decline for global OEM/ODM peers in CY26 rather than the ~10bps expansion the Street expects. The analysts flag that PC and server OEMs are especially exposed, with Dell, Lenovo, and Asustek screening as most at-risk given higher DRAM sensitivity and weaker pricing power. With memory inflation colliding with softer non-AI hardware demand and valuations sitting near cycle highs, MS says the setup creates “a clearer path to negative EPS revisions and multiple compression.”

They downgrade DELL, HPE, and HPQ and other Asian OEM/ODMs

DELL: MS Double-Downgrades to Underweight on AI Server Mix + Rising Memory Costs; New $110 PT

MS double-downgrades DELL to Underweight, arguing the combination of heavier AI server mix and sharp increases in DRAM/NAND costs will squeeze margins and reset expectations post the stock’s major rerating since early 2023. The firm lifts its FY27 revenue outlook by 8% to $123.1B (+13% Y/Y), driven almost entirely by stronger AI server demand, but simultaneously cuts gross-margin forecasts by 220bps Y/Y to 18.2% as Dell is the most exposed OEM in their coverage to memory inflation. MS writes that PC and storage revenue estimates move lower as broader hardware spending softens, partially offset by some ability to raise prices. The new $110 PT (from $144) reflects an 11x P/E on FY27 EPS of $10.00.

We’ve been calling out the memory headwinds to DELL and on Thursday we also wrote about another headwind MS didn’t mention:

In addition to NAND/DRAM prices spiking and hitting AI and PC EBIT margins, and getting bucketed in AI exposure, another reason short is working is that NVDA is rumored to be changing up their racks assembly strategy:

Under the current model Nvidia sells GPUs to DELL and DELL designs the full system/rack, adds CPUs, networking, storage, etc, then contracts Wistron and others to build the physical systems. Under the rumored new model: NVDA defines and owns the full rack design and sells the Level-10 systems (full racks) itself, not just the board and uses Wistron as its contract manufacturer for assembly. Nvidia moving to Level-10 systems re-routes the biggest, highest-growth piece of Dell’s server revenue back to Nvidia’s P&L. MS had a note on this on Oct 1st

OpenAI: OpenAI’s Fidji Simo Plans to Make ChatGPT Way More Useful—and Have You Pay For It ….Wired interviews Fidji

What opportunities do you see to get it on a path to profitability?

With ChatGPT we could give everyone that team—a personal shopper, a travel agent, a financial adviser, a health coach. That is incredibly valuable, and we have barely scratched the surface. If we build that, I assume that people are going to want to pay a lot of money for that, and that revenue is going to come.

Meanwhile, on the enterprise side, we sell an API and ChatGPT Enterprise, which is a great product but a very thin layer compared to all the things that we could be building for enterprise. If you think about building agents for every industry and function, there is so much to build, either by us or by enabling third parties to build on top of our platform.

So I’m like, OK, the markets are huge. The depth of value is huge. That’s the basic formula for monetizing. Then the real question becomes, will we have the compute to deliver that?

Weirdly didn’t mention ads in that answer…

AAPL

AAPL: Berkshire decreased its holding to ~238M shares from 280M i.e. (-15%)

AAPL: Apple’s iPhone Overhaul Will Reduce Its Reliance on Annual Fall Spectacle

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.