TMTB Morning Wrap

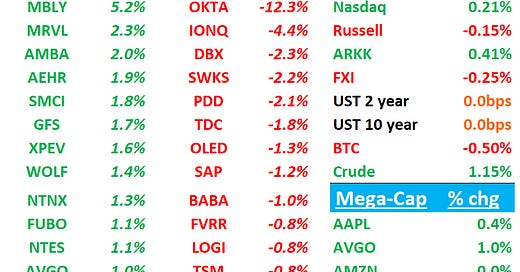

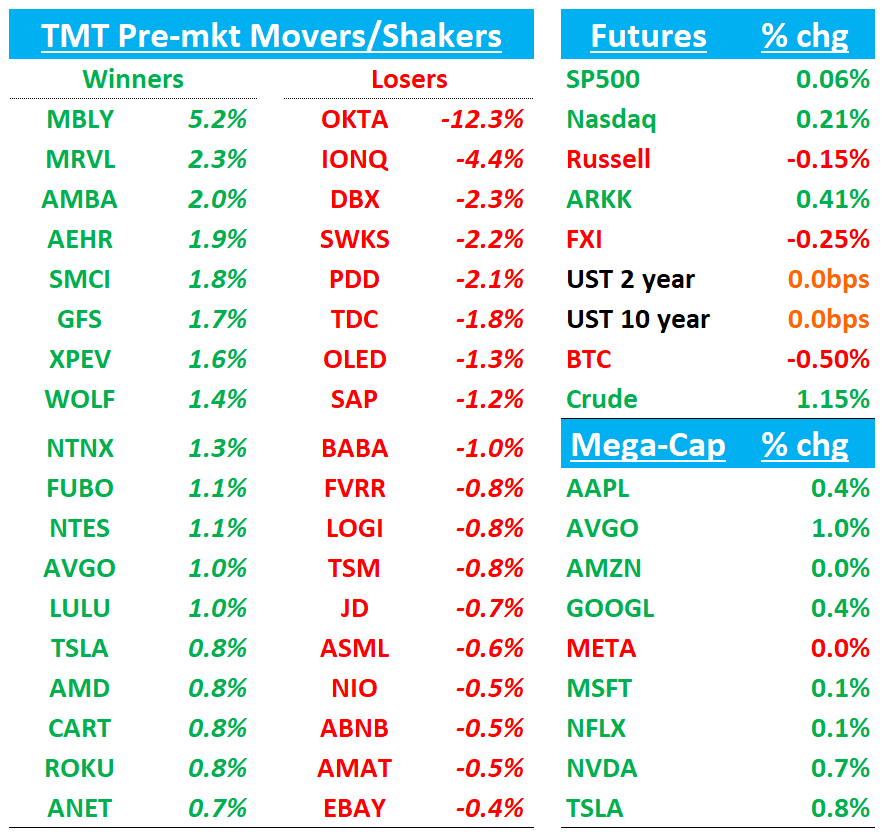

Good morning. QQQs +20bps ahead of a busy day: NVDA and CRM earnings post-close among others, Cowen TMT Conference starts today (agenda here) as well as Bernstein’s SDC conference. Otherwise, fairly slow morning news/research-wise.

We’ll cover OKTA earnings first then move onto News/Research/3p, including CRM/NVDA bogeys. Let’s get to it…

OKTA: cRPO misses Q1 bogeys while Q2 Guide Falls Short

Bears clearly have it this morning. Stock was a bit crowded sitting at ATHs before the print as sentiment had crept up given the easier compares and cyber tailwinds- we think sw investors will use this as a funding short vs CRWD + PANW going forward as go-forward story/#s less exciting.

Key takeaways

cRPO grew 14 % YoY to $2.227B, beating guidance but shy of buyside hopes for ~15 %. The 2Q26 cRPO guide of $2.20-2.21 bn (+10-11 % YoY) implies the first sequential drop in company history.

1Q26 revenue rose 12 % YoY to $688M, edging Street by $8M but also the smallest beat in history (1% beat vs average of 2-3%). Subscription revenue was $673M vs. $667M, also missing bogeys. Operating margin reached 26.7 % vs. street at 24.9 % , driving a 34.6 % FCF margin (Street 26 %).

FY26 revenue guide stays at $2.85-2.86 bn (+9-10 % YoY) but FCF-margin guidance rises 100 bp to ~27 %, reflecting sustained cost discipline.

Net-retention rate slipped to 106 % (-1 pt QoQ, -5 pts YoY). Management still sees this level holding unless macro worsens, with a path back above 108 % as new products scale.

Macro: Management described the first quarter and early May as macro-steady, with no April softness and pipeline strength in March–April, yet it layered “incremental prudence” into guidance to hedge a possible downturn and U.S. federal budget noise. Bears will take this more conservative stance as validation that buyer urgency is fading; bulls will view it as another bar the company can clear if the economy holds.

Bull vs Bear Narrative

Bulls point to widening profitability, a step-up in free-cash-flow guidance, and evidence that specialization and new products (IGA, PAM, AI-driven Identity Threat Protection) are resonating—especially with large enterprises and the public sector (strongest new customer additions in well over a year). They argue that mgmt has embedded extra macro cushion, so even muted guidance leaves room for sequential re-acceleration in the back half and for NRR to rebound once heavy COVID-era renewals roll off. At ~6 × EV/CY26 sales, valuation already discounts low-teens growth.

Bears counter that growth momentum has peaked: cRPO bookings rose just 9 % vs. 19 % last quarter, the 2Q guide implies two straight quarters of bookings declines, and NRR keeps slipping despite easier comparisons. They worry that macro caution masks intensifying competition and looming federal-sector renewal risk, while Okta’s October-2023 breach still overhangs sentiment among clients. Without a top-line inflection, they see limited catalysts and potential multiple compression if growth stays sub-10 % - with comps getting tougher over the next couple quarters, very possible cRPO could dip into single digits

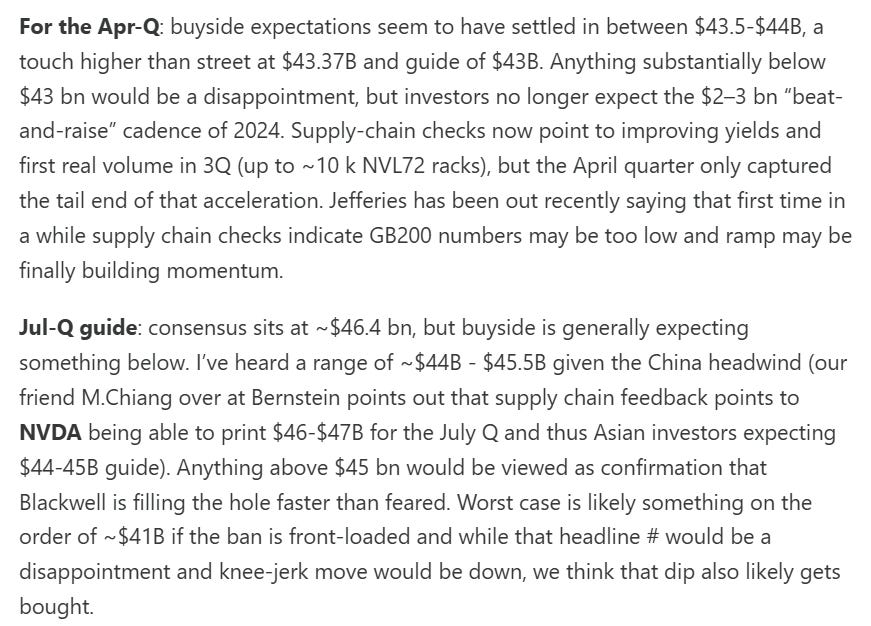

NVDA Bogeys

Full Preview here for TMTB Pro subs

CRM Bogeys

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.