TMTB Weekly

Happy Monday as the unofficial start to summer kicks off this weekend. QQQs took a bit of a breather -2% this past week, but futures are rallying 1%+ as Trump said he would delay implementation of his 50% EU tariff from June 1st until July 9th (in line with the 90—day reprieve for other countries).

From a macro perspective, we still expect an upwards trending, although slightly choppy market and feeling better about the top-down narrative.

Perhaps the biggest change from the administration in the past week is not anything related to tariffs: they have made it clear they are abandoning efforts toward fiscal austerity and making a push to “run it hot.” Here’s our friend Eliant recapping:

Coming into the year, the administration pushed the narrative of cutting spending / reducing deficits whilst also reiterating that the economy was going to go through a ‘detox’ period, but instead, the administration has done a complete-180 and it kicked off with Bessent’s comments earlier on in the week this past week when he stated that the administration inherited a 6.7% deficit-to-GDP & because of that, the administration is focused on growing the economy faster than the debt to help stabilize Debt-to-GDP… again, in other words, Bessent is outright saying the administration wants to “run it hot” & or inflate their way out of this mess….In regard to plans to grow the economy, the administration plans to implement deregulatory efforts in the back-half of the year into ‘26

Here it is straight from Bessent:

We can both grow the economy and control the debt. What is important is that the economy grows faster than the debt. If we change the growth trajectory of the country, of the economy, then we will stabilize our finances and grow our way out of this.

Retired head of gov’t austerity Elon Musk confirmed as much with a tweet on Friday:

From IT spend headwind to IT spend tailwind…

This change is incrementally good for stocks in the near-term.

Not a surprise with this backdrop that BTC is taking off. Weve been calling out for a couple months now the better price action in BTC, namely risk off —> BTC acts as digital gold; risk on —> BTC acts as levered QQQs. Now you can add inflation hedge to a reason why BTC likely to have a sustained bid. We like this chart of Money Supply (forwarded 10 weeks) vs. BTC, which points to further gains.

From a macro bull vs. bear narrative perspective, to us it feels like the narrative has shifted in favor of the bulls:

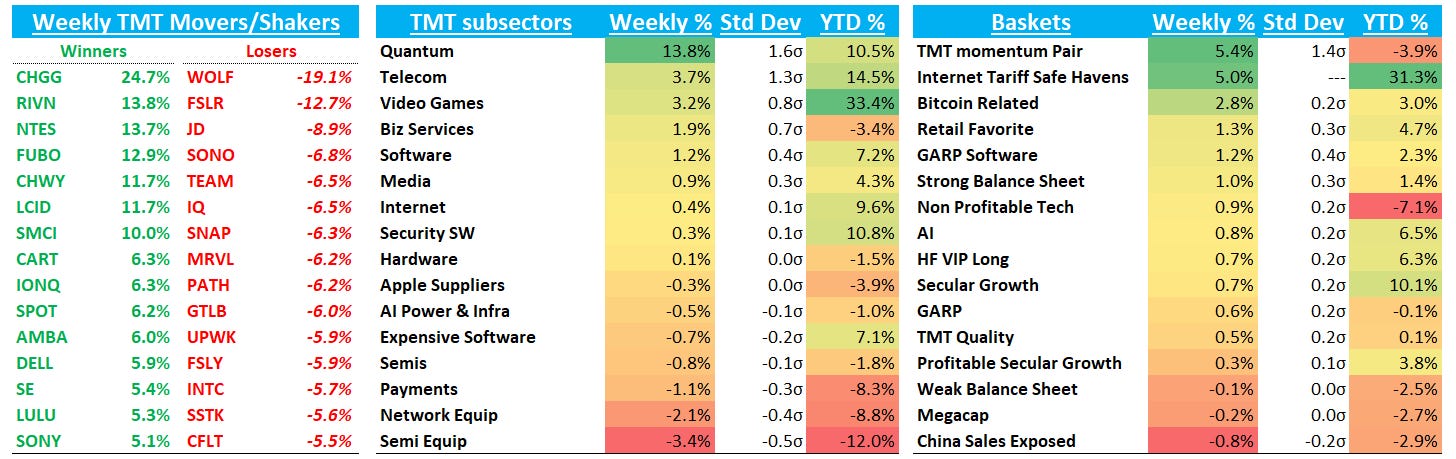

Bulls continue to point to bullish price action, Trump is saying buy stocks again and seems back to caring about the market direction, likely very healthy Q1 earnings, China and U.S. are de-escalating, potential for deals to get signed any day, admin’s focus shifting to tax cuts and de-regulation in 2H, Trump is back to “good for stocks” Trump as he says buy them, hard data still holding up (some better flash PMs this past week) pointing to no recession. DOGE is in rear view. Oil is at $60. Investors have significantly reduced net exposures, animal spirits seem to be back (look at CRWV, or Quantum and Nuclear this past week), and pain trade continues to be higher.

Bears will say the view that the worst of the tariff-related economic damage is behind us is premature as the true impact will now begin to filter through the data while pointing to companies like AAPL and AMZN where brunt of tariff hit will only begin to be felt after the June Q. Bears will say while tariff rates will go lower, they are poised to stay well above where they stood back in January, particularly China’s. Yields are breaking out. The impact of supply chain disruptions and increasing prices will begin to filter through the econ data over the next few months. The index is still expensive which leaves little room for error (22x+ EPS of $265).

Yup, feels like bull narrative stronger at this point…

Investors consensus seems to be that Tariffs will eventually settle in the 10% range for most countries. No one is believing any exorbitant tariff #s Trump puts out and for good reasons — look how quickly he backed down from the 50% threat. The market is acting as if this is the case — QQQs were down less than 1% on Friday, a pretty anemic reaction to the 50% EU / 25% AAPL threat. Back in early April, it would have been a 3%+ down day. This type of lower vol price action environment supports the case for higher gross. We think this environment should continue until we are at least a couple weeks away from July 9th deal-deadline (let’s call it mid/late June). In mid/late June, things get a little tricker as 1) 90 day deadline 2) prices start to increase in economy and 3) 2H guides for some tariff-impact companies might make set up into earnings tricky.

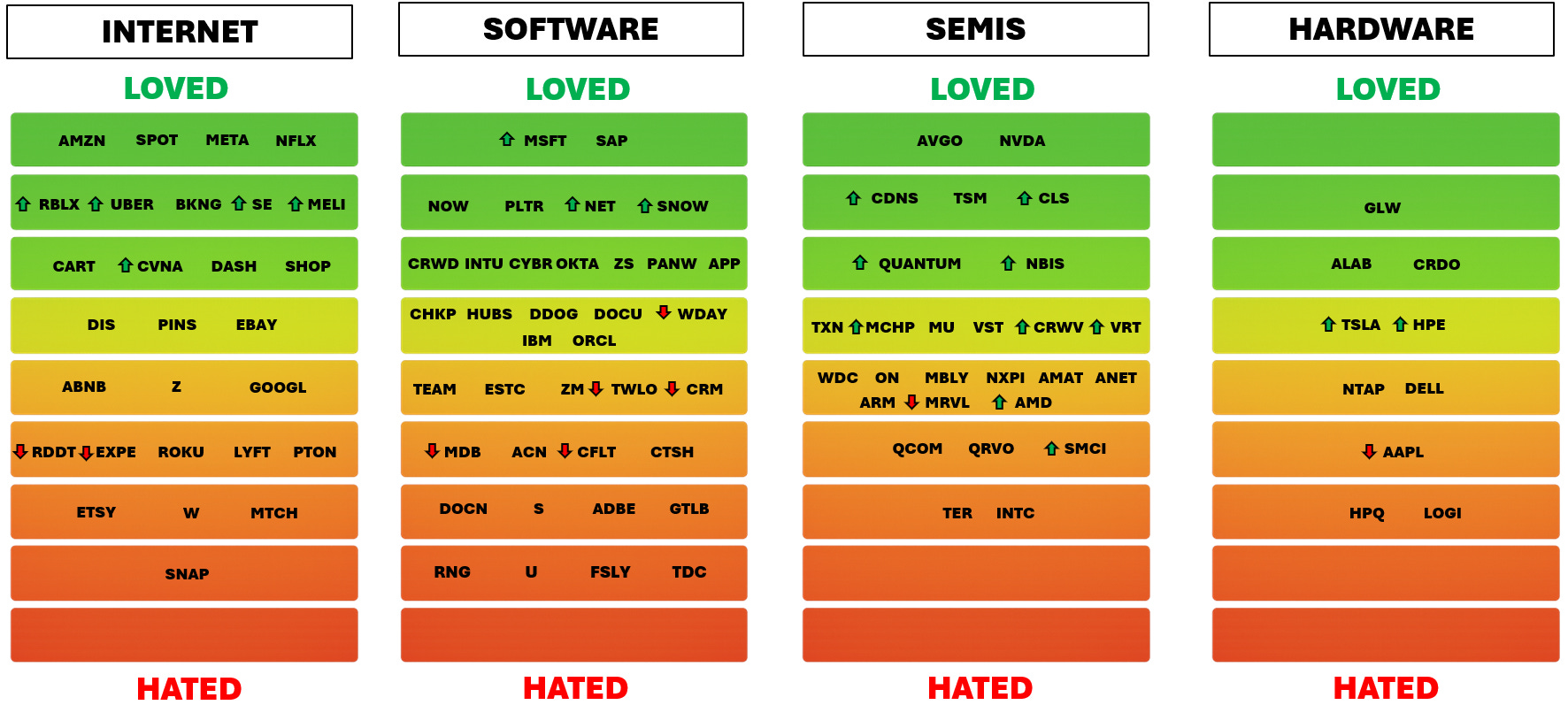

From a bottoms-up perspective, Tech sentiment has improved dramatically. Software earnings have been better. Plenty of internet stocks sitting near highs. My semi AI vibe check is as high as it’s been in what feels like over a year given all the good news over the past month.

Going through all the TMT charts this weekend, things looks fine to good. There are a few charts I have been calling out - PLTR, BTC, and CVNA - which are hovering right around their breakout areas, but those seem to be holding up ok for now and not breaking down. As long as these hold up, there aren’t many negative tea leaves to point to for a broader pull back in Tech.

PLTR

CVNA

BTC:

Tech Sentiment / Positioning Ladder

Here’s a preview for next week where when we’ll have a full Sentiment/Positioning Roundup, touching on the key debates on individual stocks…

Feedback welcome as always….

EARNINGS THIS WEEK

Let’s start with the main event: NVDA on Wednesday….