TMTB Morning Wrap

This will be our last post through Feb 6th — please see here for more details

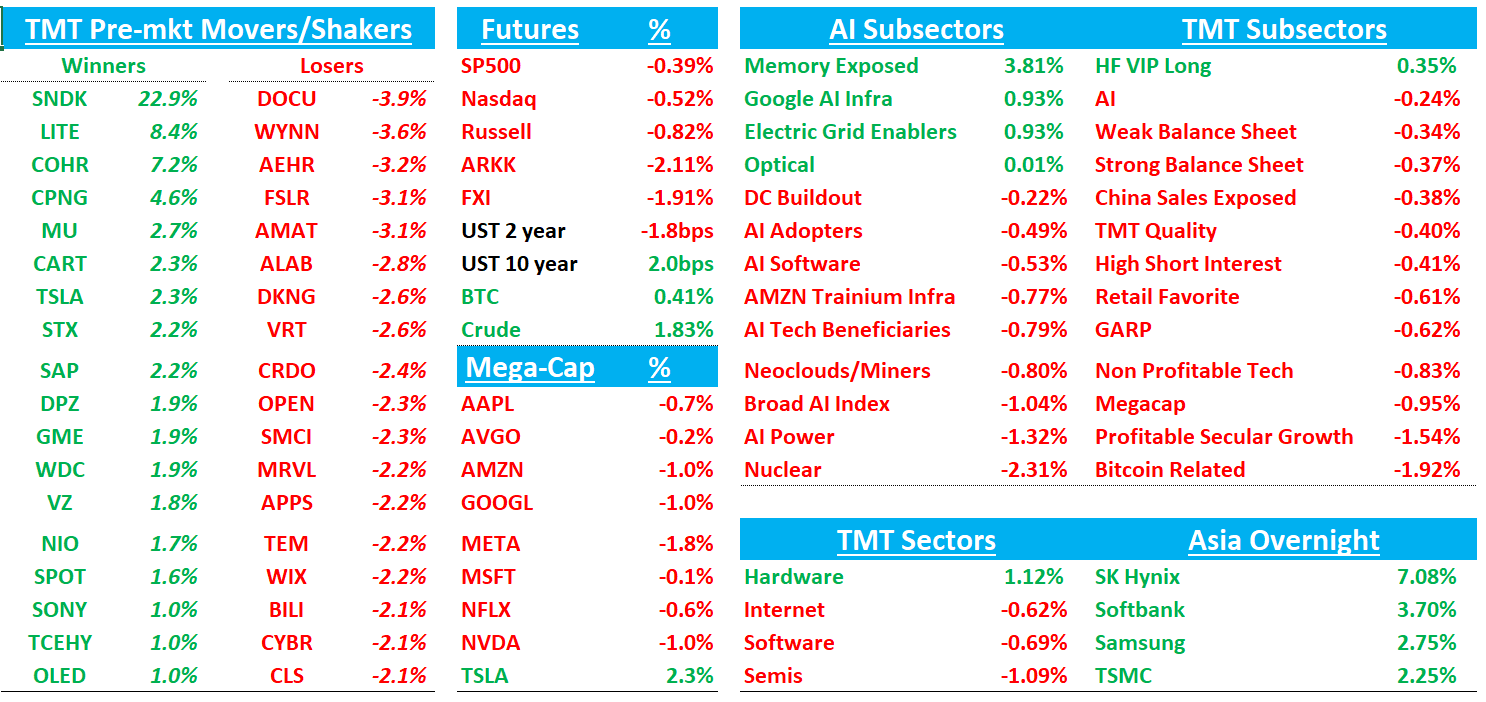

Good morning. Futures -40bps as Trump reportedly will go with Kevin Warsh as Fed Chair (not officially confirmed, but reported by NYTimes and others). Here’s VK:

He wasn’t the market’s first choice given his very hawkish views on QE (he has been quite dovish when it comes to the Funds Rate) and past comments about effecting a “regime change” at the Fed (it’s not clear what exactly that means, but there has NOT been the same type of clamoring in markets for a wholesale, revolutionary shift in the Fed as there has been at the White House, and investors are nervous about too much tinkering). There are also complicating factors, including Senate approval (Warsh should get through, but certain Republicans could slow the process given the Powell investigation) and institutional inertia (Trump and the media often frame the Fed conversation as if the chair is a potentate capable of dictating policy by edict, but that’s not the case – there is a committee, and several people have a say).

Stocks in Asia mainly down: TPX +0.59%, NKY -0.1%, Hang Seng -2.08%, HSCEI -2.47%, SHCOMP -0.96%, Shenzhen -0.78%, Taiwan TAIEX -1.45%, Korea KOSPI +0.06%. BTC down another 250bps to $82k.

We’ll hit SNDK and AAPL First, then the usual …

SNDK +21%: Absolutely crushed the March Q guide at $12-14 vs street at $5 and bogeys of $9. Buyside numbers going up to $100+ for CY27. Call extremely bullish and demand forecast doesn’t contemplate any incremental demand from KV Cache offload.

Stellar print - not much to say as the numbers and commentary said it all. Hearing some bullish $125+ CY27 EPS numbers this morning with buyside probably settling in around $100-$110. Bulls will say throw 10x on that, bears will say 5x peak EPS is more like it.

The #s / Key takeaways

FQ2'26 revenue of $3.03B, +61% y/y (last q +23% y/y) vs Street ~$2.67B, +42%, driven by a mid-30s% surge in ASPs despite low-single-digit bit growth. Non-GAAP EPS came in at $6.20 vs Street ~$3.49, fueled by gross margins expanding to 51.1% (vs Street ~42%).

FQ3 guidance the bright spot: revenue of ~$4.6B (+145% y/y) vs Street $2.9B and EPS of ~$13.00 vs Street ~$5.11, implying a continued massive step-up in pricing (57% at the midpoint)

Data Center revenue grew +64% q/q and +76% y/y, now representing ~15% of sales. Management expects Data Center to become the largest end-market for NAND in 2026, driven by "inference in particular" increasing storage content per deployment. They cited potential incremental demand from new AI architectures (like Nvidia's Rubin) of 75-100 EB in 2027, which is not yet in their base forecasts.

Print goes a long way cementing the critical narrative shift of the “structural evolution” and strategic importance of the NAND market (we wrote about it here). Management noted that contract pricing is changing rapidly, with terms set one month "wildly different" from just months earlier.

Mgmt highlighted a shift toward multi-year agreements with "firmer commitments" and prepayments to fund capex, moving away from transactional quarterly negotiations. One LTA with a prepayment was signed just after quarter-end, with more in the pipeline.

During the callback, management clarified that while reported bit growth was low (+LSD%), the massive revenue beat was driven by the "declining revenue contribution from non-prime bits," which distorts the metric; essentially, they are selling higher-value bits. They also revealed that customers are requesting "extraordinarily large supply allocations for 2027 and 2028," prompting the shift to LTAs with prepayments to ensure these requests are backed by real cash. Management confirmed one LTA with prepayment was signed immediately after quarter-end (hence not on the balance sheet yet) and noted that Q3 pricing guidance implies a >50% sequential increase because they are catching up to rapid market-wide price changes.

Key quotes:

"Enterprise SSD demand is accelerating across the ecosystem as AI workloads scale, with inference in particular driving a meaningful increase in NAND content per deployment."

NAND is now recognized as indispensable to the world's storage needs, driving a foundational shift in how commercial relationships... are structured."

"We are engaged in discussions with customers to evolve from quarterly negotiations towards multi-year agreements with firmer commitments on supply and pricing."

Supply certainty, longer planning horizons, and multi-year commitments are increasingly essential to support structural demand that extends beyond the traditional cyclical model.

Bull vs. Bear Debate:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.