TMTB Morning Wrap

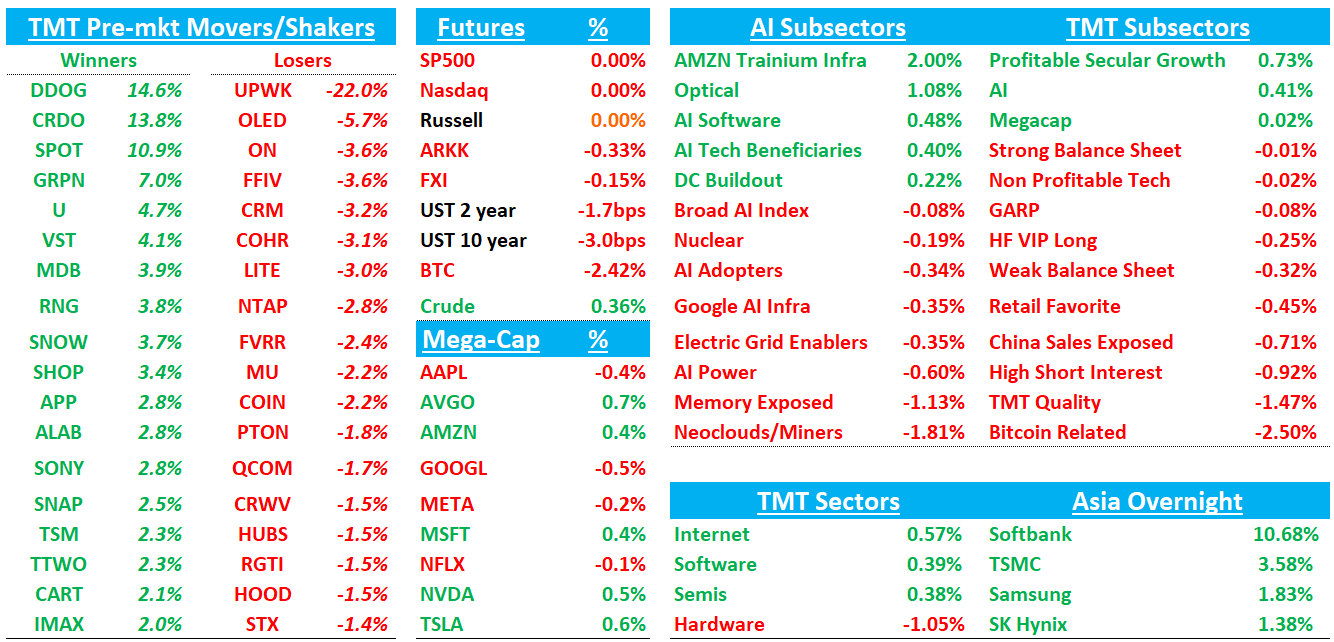

Good morning. Futures hovering around flat this morning. Asia generally green: TPX +1.9%, NKY +2.28%, Hang Seng +0.58%, HSCEI +0.81%, SHCOMP +0.13%, Shenzhen +0.05%, Taiwan TAIEX +2.06%, Korea KOSPI +0.07%,. Softbank was +10% as OpenAI sentiment continues to improve there (we think OAI sentiment continues to get better over the next month). Yields down 1-3 bps across the curve ahead of the jobs report on Wed. Fed expectations continue to be for 6/17 as next cut. Memory names early lagged in AI semis (MU -2% / SNDK -1%) although Asian memory names were up)

Got some better #s from SPOT and DDOG this morning. Positioning on the former much lighter than the latter heading into the print. We’ll cover those two first and some other earnings, then move onto the usual…

SPOT +8% looks solid with Q4’25 subs/MAUs and gross margin ahead of guide/street, and the big headline a much-stronger-than-feared Q1’26 gross margin guide.

GM upside the key point here as it helps alleviate some of the non-AI bear case that GMs were nearing a ceiling bc of the label step-ups. Lots more noise from bears recently who were using as funding short, so this should help alleviate some of that (we recapped the bull vs. bear debate in our EOD wrap yesterday). Some nitpicks hearing mainly around EBIT/Rev beat had some 1-time tailwinds and FCF miss.

Q4’25: Revenue €4.53B (+7% YoY; +13% FXN) vs Street €4.52B (GSe €4.50B). Premium revenue €4.01B vs Street €4.00B; Ad-supported €518M vs Street €519M. Premium subs 290M (+9M) vs Street 289M; MAUs 751M (+38M) vs Street 745M. Gross margin 33.1% vs Street 32.9%. Operating income €701M vs Street €645M (big beat). EPS €4.43 vs Street €2.63 (helped by items below-the-line).

Q1’26 guide: Revenue €4.50B vs Street €4.57B (includes ~670 bps FX headwind). Premium subs 293M vs Street 293M; MAUs 759M vs Street 753M. Gross margin 32.8% vs Street 32.3% Operating income €660M vs Street €658M

DDOG +7%: Strong Q4 print and better than expected Q1 and FY26 guide. FY26 margin/ebit guide main nitpick

Bulls will point to better than feared FY26 guide and strongest y/y quarterly guide in several years thinking revs should still land at 24-25% if all goes well. Bears pointing to EBIT margin and can maybe do some both implying that core growth (ex OAI natives) ~0-2 ppts below the HE of the guide (although all depends what you think AI Natives grow at). Positioning here generally leaned long into the print. Will be intg to see how it holds up today given software cross currents.

Q4 FY25

Revenue: $953m (+29% y/y) vs Street ~$917m (+4% beat) and vs company guide $912–916m

Non-GAAP op margin: ~24% vs Street ~24% (in line)

FCF: $291m (30.5% margin) vs Street $258m (~27% margin)

Billings: $1.262b (+33.5% y/y) vs Street $1.101b (+21% y/y)

Customer / retention: $100k+ ARR customers 4,310 (vs 4,060 prior qtr; +250 q/q), NRR ~120% (in line), total customers 32.7k (vs 32.0k prior)

Q1 FY26 guide

Revenue: $951–961m (mid $956m, ~+25.5% y/y) vs Street $935.9m (+2% above)

Non-GAAP op income: $195–205m (mid $200m) vs Street $212.5m (6% below)

Non-GAAP EPS: $0.49–0.51 (mid $0.50) vs Street $0.54 (7% below)

FY26 initial guide

Revenue: $4.06–4.10b (mid $4.08b, ~+19% y/y) vs Street $4.107b (1% below / ~21% y/y)

Non-GAAP op income: $840–880m (mid $860m) vs Street $958.6m (10% below)

Non-GAAP op margin: ~21% at midpoint vs Street ~23%

Non-GAAP EPS: $2.08–2.16 (mid $2.12) vs Street $2.41 (≈12% below)

Earnings Quick Hits:

CRDO +16% on a positive pre expecting $404-$408M vs prior guide of $335-$345M. Will do $08M in revs in Q3. Into Fy26/Fy27, expecting seq rev growth in MSD which implies >200% growth vs street ~+175%.

ENTG +12.7% on solid beat/raise. Q1 revs guided $805M vs $787.7M

UPWK -23% Q1 guide missed: rev $192–197M vs $200.5M Street and EPS $0.26–0.28 vs $0.34

CHGG -5% Q4 was “less bad” than feared: rev ~$72.7M vs ~$71M

But Q1 guide missed: rev $60–62M vs ~$64.6M Street

ON -4% on weaker 1Q guide due to non-core rev. Q1 guide was light: rev midpoint ~$1.49B vs ~$1.51B Street, tied to portfolio exits/non-core and inventory dynamics

GTM -14% on weaker 2026 growth. Q4 beat: rev $319.1M vs $309.3M and adj EPS $0.32 vs $0.28, but but outlook weaker: Q1 rev $306–309M vs $309M, and FY26 points to only ~~1% rev growth, below expectatoins

TECH RESEARCH/NEWS

SHOP: MoffettNathanson Upgrades to Buy on Selloff-Driven Entry; PT Raised to $150

MoffettNathanson upgrades Shopify to Buy from Neutral and lifts its price target to $150 from $122, citing an “unusually attractive entry point” following the recent drawdown. The firm views Shopify as a long-term AI commerce winner, arguing AI should be a net benefit rather than a competitive threat. The analyst adds that direct commerce continues to take share from Amazon, reinforcing Shopify’s strategic positioning.

Also got an upgrade at ATB (I believe a Canadian Bank) pointing to structural operating leverage, upside to high-teens FCF margins, and early potential from agentic commerce, with META’s ~1,000bp Q1/26 revenue acceleration seen as a positive read-through. ATB adds that Shopify’s value-to-growth profile stands out among large-cap SaaS, with FCF margins projected to approach ~18.8% in Q4 and move into the 20s over time.

TSM: +2% reported Jan sales +20% MoM / +37% YoY. Street has TSM sales +33% for the full qtr.

LNY last year was in Jan, this year in Feb so a bit of comp tailwind but still looks solid.

AMZN: Citizens Raises AWS Outlook on Faster GW Ramp; Reiterates Market Outperform, $315 PT

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.