TMTB Morning Wrap

Futures -20bps rallying off the lows over the last couple hours as Trump doing some TACO’ing this morning saying high china tariffs of 100% won’t stand and that “I think we’ll be fine with China.” When asked, he confirmed he will meet with Xi in two weeks.

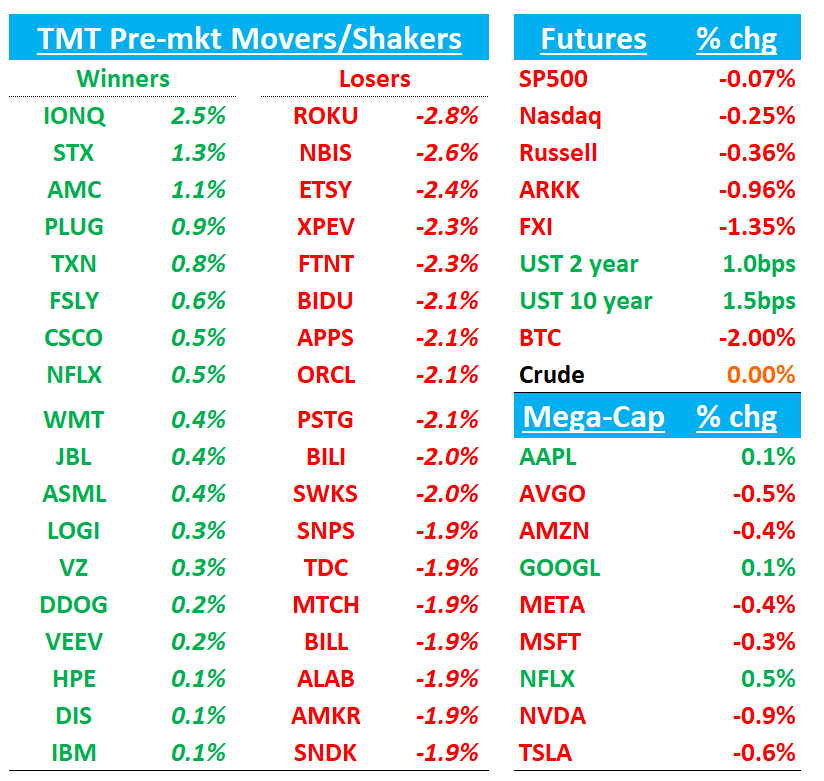

Risk off over night with global markets down across the board and VIX near 25 which is the highest level since April driven by regional bank concerns, China tensions, and US gov’t shutdown. Asia lower (SHCOMP -2%, HSI -2.5%, and HS TECH -4%), Europe trading weaker (SXXP -120ps, Euro Tech -140bps). BTC -2% continues to slide now down near $105k level. Yields up 1-2 bps across the curve

No EOD today as I’ll be on the road.

Relatively slow morning today. We’ll hit up ORCL -2% first then onto the usual…

ORCL

We discussed ORCL in our EOD wrap yesterday here. As expected, street generally positive this morning, raising numbers and PTs…Key pts are GMs guided to 30-40% vs buyside at 25%, FY30 EPS came in at $21 vs street at $18.50 and FY30 Rev tgt increased to $225B vs $199B. They took bookings > $500B with new $65bn in IaaS TCV signed in Q2 coming from 7 deals with 4 customers (none of them is OpenAI)…

Main nits I’m hearing today about why stock not up is 1) sell-the-news: fast-money was long into the event and shorts had covered. We saw two sell the news reactions yesterday - TSM and HPE and this is continuing the trend 2) EPS upside won’t come into later years - FY28 EPS actually guided below street and real upside in top line a few years out when inflection from AMD and AVGO happens.

Here a few quick snippets from the sell-side, although most sound the same so we we’ll just recap a couple…

ORCL: Stifel Says Shares May Pause After Strong Run; Keeps Buy and $350 PT

Stifel reiterates its Buy rating and $350 price target on Oracle following what the firm calls an “upbeat” analyst meeting during the AI World conference. The analyst notes Oracle raised its FY30 OCI revenue goal to $166B and disclosed RPO now exceeds $500B, reflecting demand that continues to outpace supply. However, shares slipped after hours as Oracle’s FY26/FY27 EPS targets ($8.00 and $10.65) came in slightly below expectations due to near-term scaling costs. Stifel says the stock will likely consolidate recent gains over the next few quarters as investors assess the company’s execution on operating income growth and AI-driven expansion plans.

ORCL: Guggenheim Raises PT to $400, Calls Oracle a “Decade Stock” on AI Tailwinds

Guggenheim reiterates its Buy rating on Oracle and lifts its price target to $400 (from $375), citing strengthened conviction following the 2025 Financial Analyst Day. The firm describes Oracle as a “decade stock” benefiting from powerful AI-driven secular trends and improved visibility into growth and profitability. Oracle now forecasts 31% revenue CAGR to $225B by FY30 and 28% EPS CAGR to $21, supported by raised OCI assumptions and stronger-than-expected AI infrastructure margins of 30–40%. Guggenheim says the company’s trajectory across cloud, AI, and infrastructure segments highlights a “generational shift,” positioning Oracle as a top long-term AI beneficiary. The firm sees a clear path toward accelerating revenue and sustainable profitability, underpinned by disciplined execution and robust IaaS economics.

Oracle Isn’t Answering the Hardest Questions About Its AI Plans

WSJ:

What Oracle didn’t say is how it expects to pay for the very expensive expansion of its network that will be needed to generate such returns. Powering AI workloads first requires pricey chips from companies like Nvidia and AMD, and the components to run them in data centers. The company’s capital expenditures exceeded its operating cash flow for the first time since 1990 in its latest fiscal year that ended in May.

Oracle’s ability to live up to its lofty projections will depend not just on the growth of customers like OpenAI and Elon Musk’s xAI, but also its own ability to scale up its networks to serve those businesses. That won’t be easy, or cheap. In a report last month, Morgan Stanley’s debt analysts projected a “sizable uptick in new bonds” from the software giant. And that is even after an $18 billion bond sale last month that will only cover about one-quarter of the company’s cash needs through 2028, the analysts said.

MU -3%: Micron to exit server chips business in China after ban, sources say

MU plans to stop supplying server chips to data centres in China after the business failed to recover from a 2023 government ban on its products in critical Chinese infrastructure, two people briefed on the decision said.

Micron was the first U.S. chipmaker to be targeted by Beijing - a move that was seen as retaliatory for a series of curbs by Washington aimed at impeding tech progress by China’s semiconductor industry.

AAPL: The South China Morning Post says that Apple’s new iPhone Air “sold out at all brick-and-mortar stores in Beijing within minutes of its launch in China on Friday.”

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.