TMTB EOD Wrap

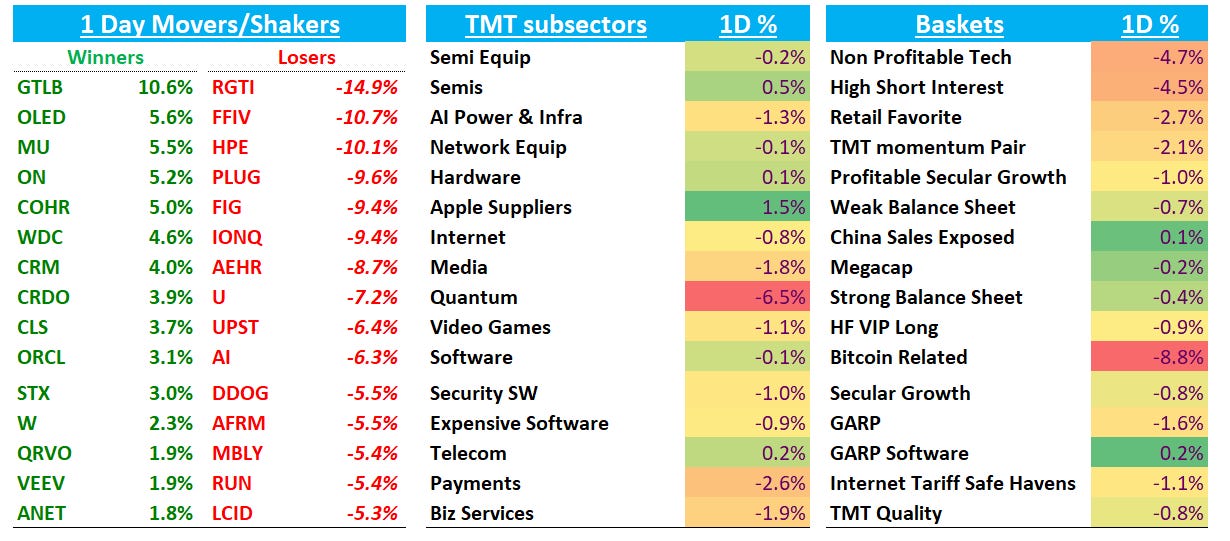

QQQs -37bps selling off throughout the day. Most pointed to weakness in regional banks for the broader market sell off: ZION’s negative credit update + fears around continued fall out from First Bands and Tricolor driving yields down 4-8bps across the curve. Some also pointing to the neg Tech price action, specifically on TSM -2% after a nice beat and raise while HPE -10% got punished on a mediocre analyst day. ORCL price action tomorrow should be interesting.

Despite TSM, AI Semis led the way higher with NVD A+1% and memory names continuing to rip, helped by some positive sell-side commentary on MU/Samsung.

Let’s get to the good stuff:

AI / SEMIS

MU +5.5% as DRAM prices continue to spike. Citi was out raising PT to $240 saying that DRAM is poised to become the next key component to secure long-term contracts across the AI supply chain, mirroring the trajectory seen with NVDA, AMD, and AVGO — they said peak EPS could reach $23 while UBS was out saying C26 EPS could be closer to $30 as they raised PT to $245. UBS also called out DDR gross margins surpassing HBM for the first time in years as capacity shifts to HBM. UBS also upgraded Samsung as part of their memory note

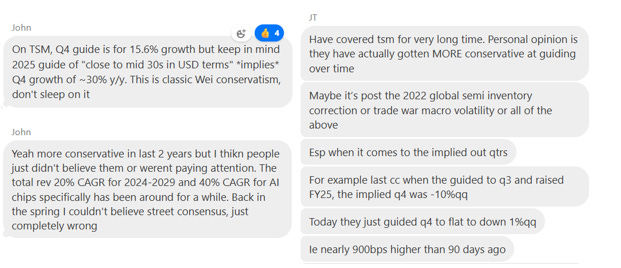

TSM -1.6% despite a down the fair way beat as margins came in higher than expected and positive AI commentary. Key quote:

“Recent developments in AI market continue to be very positive. The explosive growth in token volume demonstrates increasing consumer AI model adoption, which means more and more computation is needed, leading to more leading-edge silicon demand. Our conviction in the AI megatrend is strengthening. AI demand is stronger than we thought three months ago”

Quantum weaker: IONQ -9%; RGTI -15%

HDDs WDC +4.5% / STX+3.3%: Didn’t see much here other than strength in memory names and GOOGLs new video generation model Veo 3.1 gaining some traction which puts multi-modal back in the spotlight

CLS +3.5% as GS initiated at Buy with $340PT saying co. should CAGR EPS at 25% through 2029 as higher margin ODM server business expands.

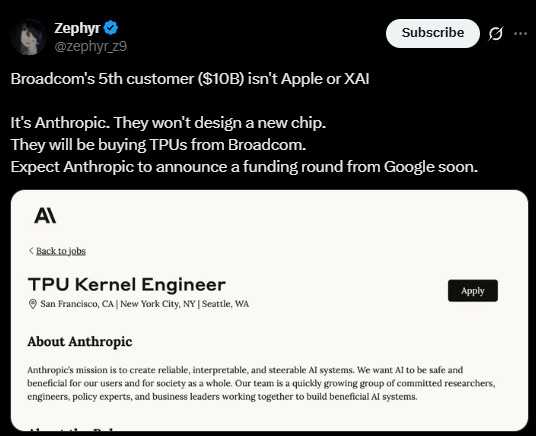

AVGO +80bps

Some good back and forth on the above in TMTB chat here

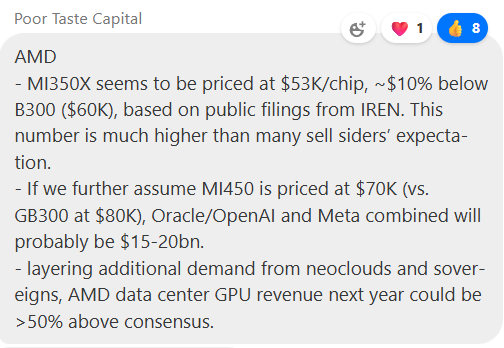

AMD -1.7%: Good flag from a TMTB reader on ASPs although big customers likely to pay a lot less:

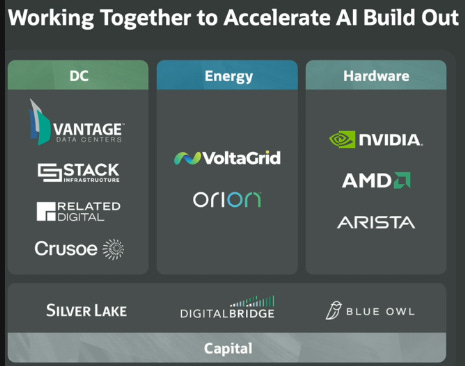

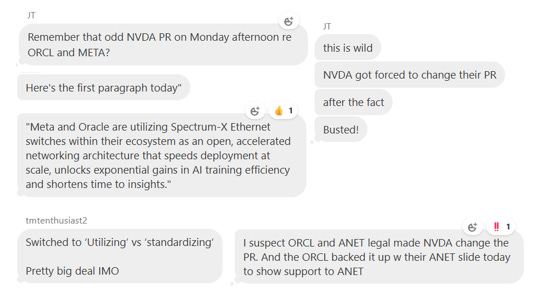

ANET +1.8% as ORCL confirmed ANET as a customer.

JT in TMTB chat was all over this on Monday when NVDA put out their ORCL/META Spectrum-X PR

CRWV +2% helped by ORCL’s 30-40% GM target

SOFTWARE

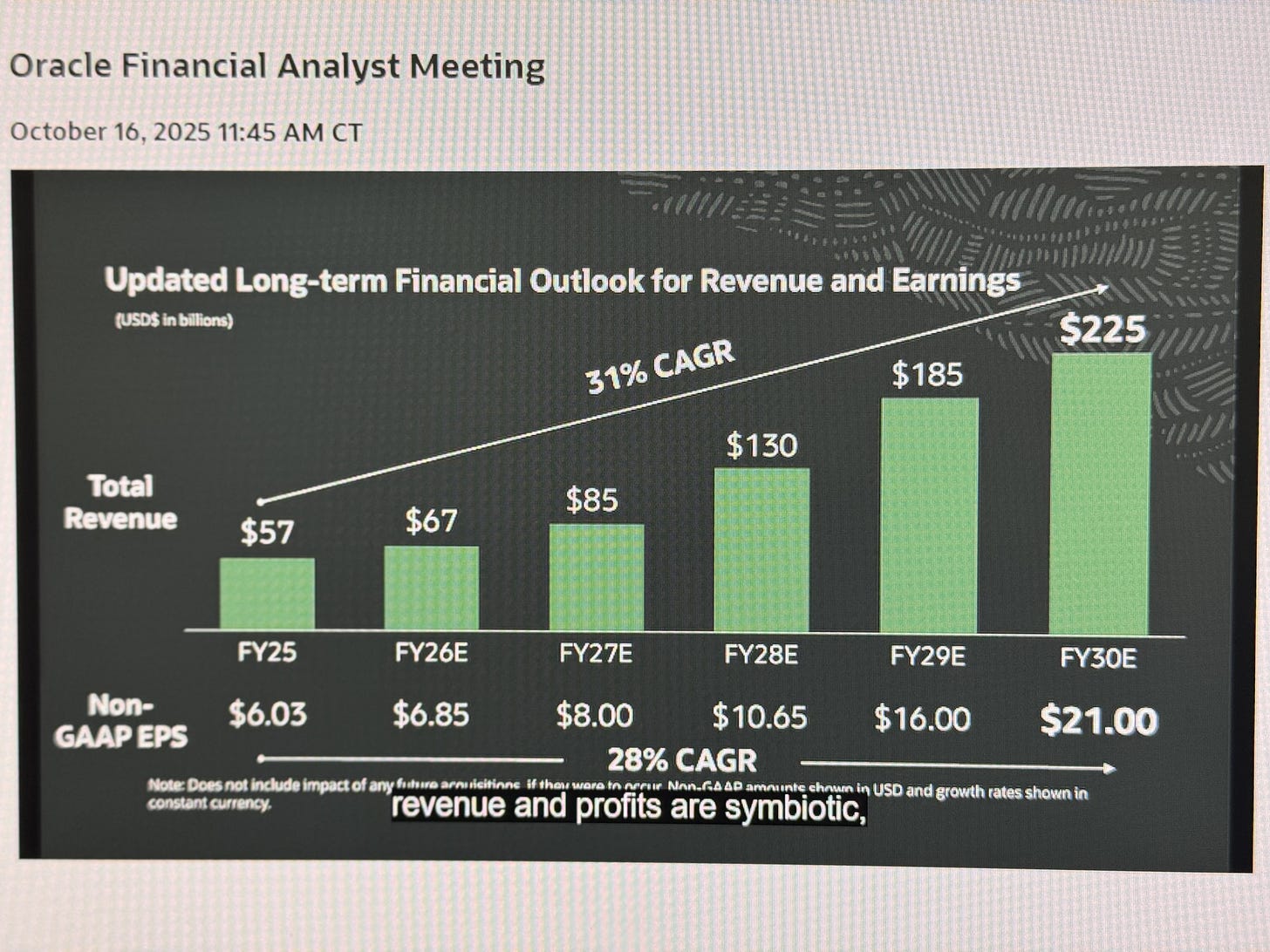

ORCL +3% although -2% in post market) after giving putting out a 30-40% GM target vs buyside at 25% and laying out the EPS table:

Buyside was about $20 in FY30 while sell side at 18.50 and most view this as conservative. The one nit being that FY28 guide of 10.65 is actually lower than the street at 11.21. Infra revs were raised from 18/32/73/114/144 to 18/34/77/129/166 from FY 26 - FY 29 (h/t JT). Most on the buyside don’t doubt that there is plenty of upside if these numbers are true (30x+ 29 EPS of $16 = $480+ (discounted back 2 years to ‘27 = $400) an example of the math I hear although bulls will throw out even higher numbers), but as with AMD, AVGO, NVDA still plenty of skepticism around OAI following through on the spend

Unclear to me what stock does tomorrow. We likely get a bunch of positive sell-side notes overnight raising numbers but lots of fast money long the name into the print while shorts had all covered. HPE sold off -10% on a mediocre analyst day: HPE is a much different co and the analyst day went much worse than ORCL, but set up into the event was similar. Regardless of the T+1 action, we think buyers step in here fairly quickly - the numbers and commentary were better than expected and still look conservative.

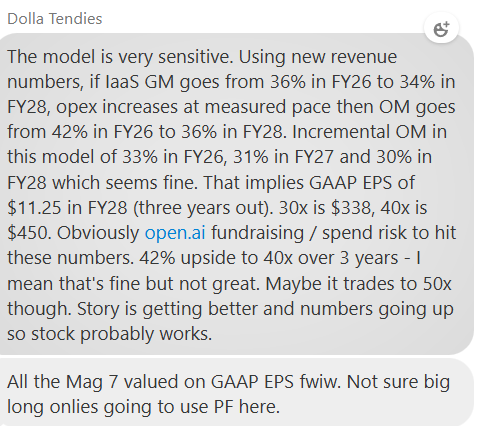

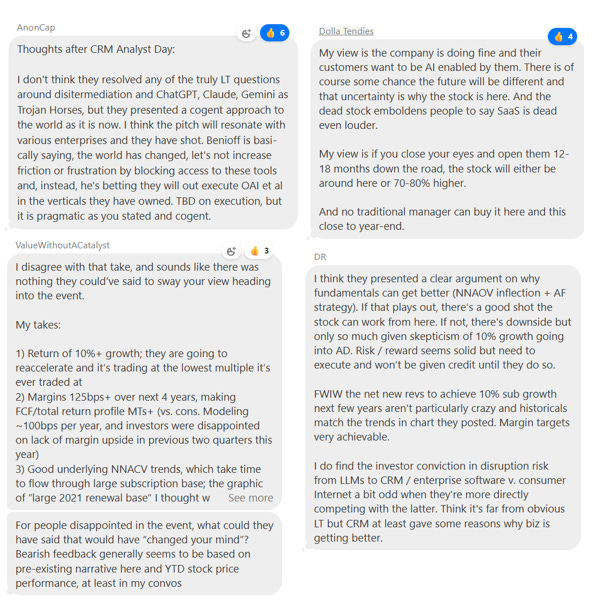

CRM +4% after a solid analyst day laying 10% CAGR over next 4 years and 40% margin target (up from 34%). Lots of skepticism on the stock still but wasn’t surprising to see it rally given sentiment. We posted the below in the Morning Wrap, but re-posting here as some good commentary from TMTB chat:

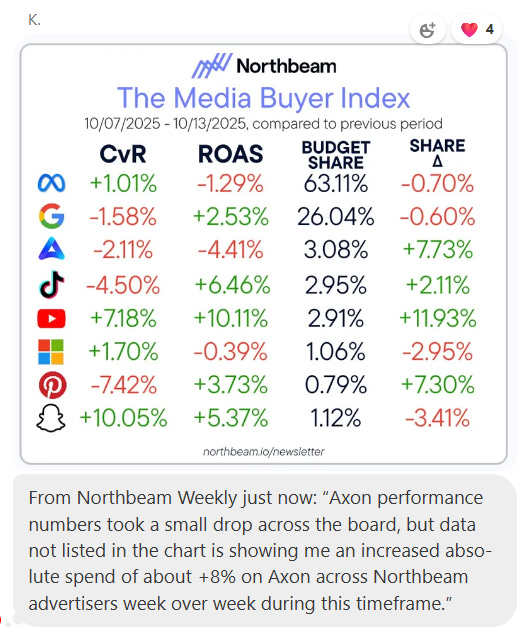

APP +50bps as MS had a positive recap of their call yesterday saying they believe APP can add 200–300 new non-gaming advertisers per month, potentially topping 1,000 by year-end versus roughly 600–700 today. Edgewater was out also positive in near-term revenue expansion. Northbeam data out today also points to spend beginning to improve:

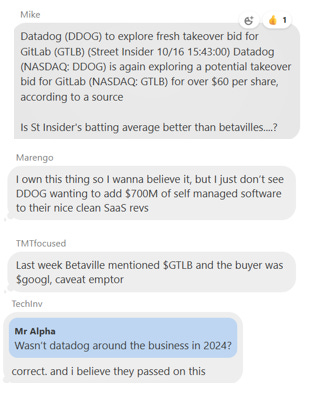

GTLB +10% on speculation DDOG exploring takeover bid

U -7% as Arete downgraded to neutral and Edgewater had a note out calling out the 2H Sept decel we have been hearing about, but also positive on continued ramp into Q4 and also saying IronSource no longer bleeding. Key quote from Arete dg: “Initial performance uplifts may become more gradual in 2H25, whilst Unity compiles developer-provided Runtime data via Unity 6.2. We lower our Grow forecasts slightly and are now ~2% below an elevated consensus in FY26 and FY27.”…I spoke to a reader who thinks the opposite, that runtime data should be the key enabler for the data flywheel and further improving the model. Checks mixed here - some positive ad consumption datapts in Oct vs Sept but still not hearing of improvement in early Oct vs 2H of Sept. Makes the print more binary and tougher set up…will have to see how last 2 weeks of Oct end

INTERNET

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.