TMTB Morning Wrap

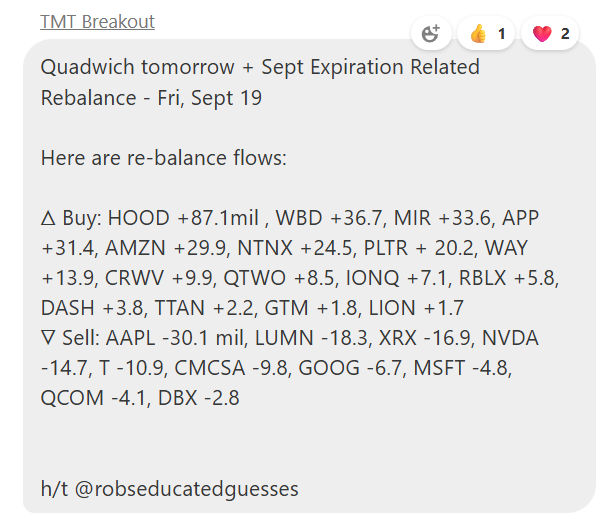

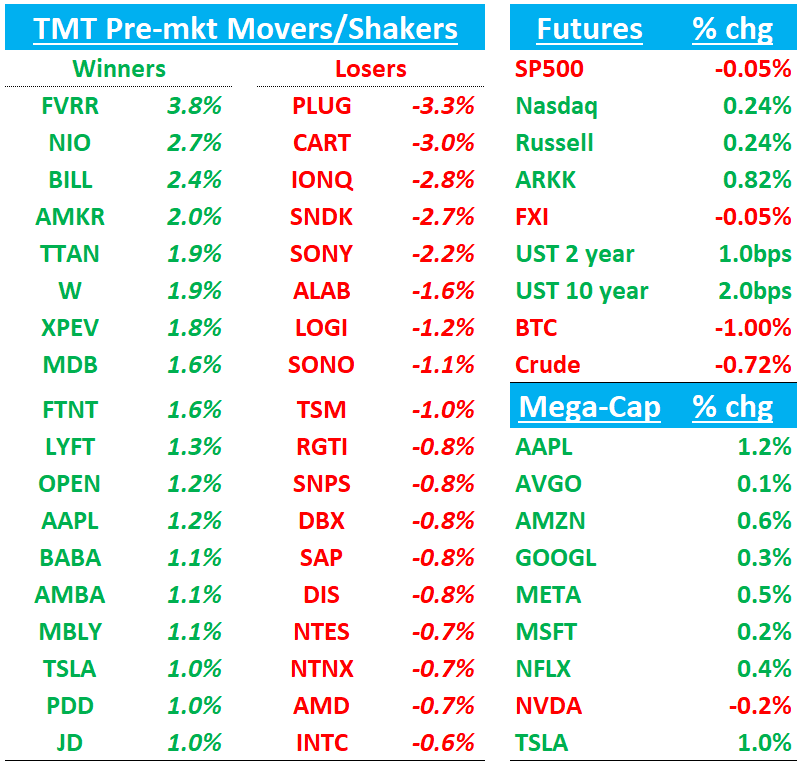

Good morning. Futures +25bps on Quadwich + rebalance day. BTC -1%; China flat; yields ticking slightly up.

We’ll hit on just a few items on the INTC/NVDA collab since we covered most of our thoughts in our EOD wrap yesterday. Then we’ll move onto the usual Research/News.

Happy Friday. Let’s get to it….

INTC/NVDA COLLAB

INTC: Morgan Stanley Calls Intel/Nvidia Deal Incremental, Not Transformational

Morgan Stanley says Intel’s collaboration with Nvidia is a constructive step, particularly for datacenter CPUs, but stresses that near-term benefits to semis are limited. The firm notes that extending NVLink connectivity to x86 platforms “reinforces the strategic role of x86,” though Nvidia’s investment in Intel doesn’t carry obvious financial upside without broader scope. For Intel, GS highlights that regaining some racks-scale CPU content is a win, though the addressable market is still small relative to the ~30M CPU units shipped each quarter. Nvidia shipping ~30k racks in 2025 equates to just a 5% or so contribution to Intel’s x86 share, the analyst points out. AMD looks less advantaged, as Nvidia’s tilt toward Intel validates x86 but does not create immediate catalysts for AMD. Finally, the firm says KLA could see modest upside if Intel’s capex accelerates toward $18B in 2026/27.

INTC: Citi Downgrades to Sell Despite $5B Nvidia Investment

Citi cuts Intel to Sell from Neutral, arguing that Nvidia’s $5B equity stake and CPU partnership won’t meaningfully improve Intel’s outlook. The firm says adding Nvidia graphics to Intel CPUs doesn’t change the performance equation versus AMD, since the processor remains the main driver. Citi also stresses that the AI CPU for Nvidia platforms targets a very limited TAM of just $1–2B, making the revenue opportunity negligible. While Intel shares have rallied ~50% on speculation of a foundry breakthrough, Citi pushes back, noting Intel’s manufacturing lags TSMC by years and the stock is already expensive. The new price target is raised modestly to $29 (from $24), equating to 1x Citi’s estimated book value.

Intel's Nvidia deal expected to be a mixed blessing for Asian chipmakers - Reuters

ALAB: Blair Sees Modestly Negative Readthrough; Morgan Stanley More Balanced; Baird says potential neg

Good discussion in TMTB chat here on the topic

Blair flags a mild negative readthrough for Astera Labs given its PCIe leadership, noting that NVLink integration into Intel CPUs could gradually displace PCIe in scale-up architectures. The firm stresses, however, that Astera’s growth focus is tied more to AI than legacy PCIe markets, softening the impact. Morgan Stanley takes a more measured stance, saying the Intel/Nvidia partnership extends NVLink Fusion into x86 systems, which could pressure ALAB’s PCIe attach but is too early to call definitive. The bank highlights that Astera is listed as a NVLink Fusion partner and could still see content opportunities, though the details remain uncertain and the timeline is likely several years out. Overall, MS emphasizes that the deal reinforces the rising importance of connectivity and rack-scale computing, and they remain constructive on ALAB’s long-term positioning. Baird says should a higher percentage of NVIDIA platforms shift to NVLink connections instead of PCIe connections between CPU and GPU, demand for the company's Aries PCIe retimers would likely be adversely affected.

TECH/RESEARCH

Samsung/MU -3.5%/Memory: Samsung clears Nvidia hurdle for 12-layer HBM3E supply, setting stage for HBM4 battle

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.