TMTB EOD Wrap

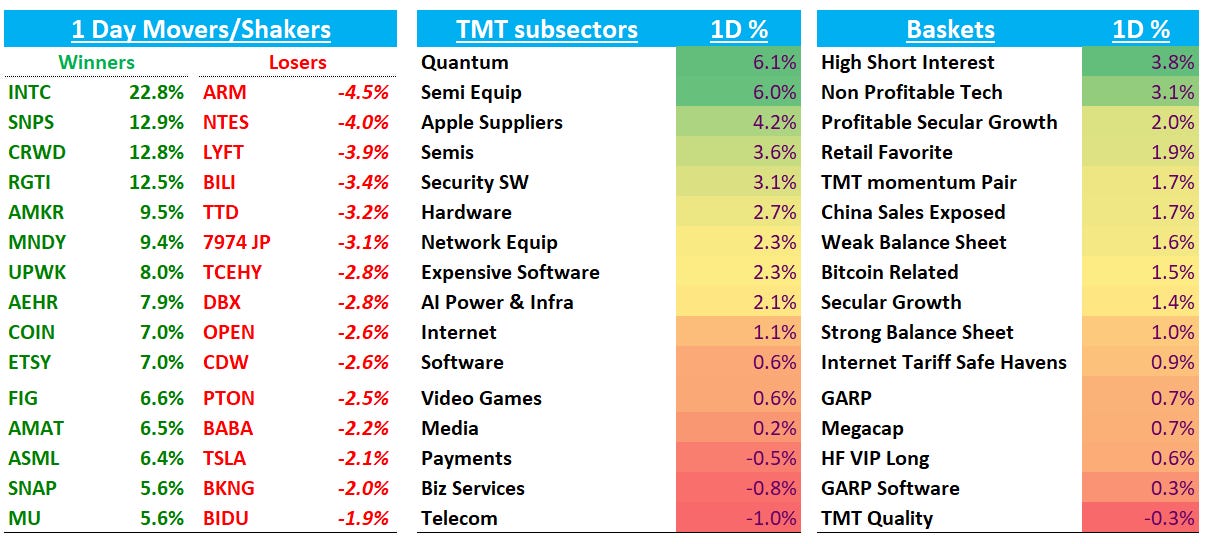

Good afternoon. QQQs +90bps continues its march higher hitting more new ATHs. Yields moved higher on strong jobless claim number this morning and a better Philly Fed #. Market continues to price in close to 2 cuts the rest of the year. VK puts it well:

the bulk of the day was spent digesting the FOMC decision from Wed with bulls celebrating the fact that both fiscal and monetary policy are now in stimulus mode while the AI mania continues, potentially creating a late-‘90s like atmosphere for the next 6-24 months (the big debate right now within US equities seems to be whether the appropriate analog is 1997-1998, in which case the party can continue for a while longer, or 1999-2000, with stocks about to hit a wall, and both sides of the argument have a strong case to make, which is why a clear consensus hasn’t emerged)

We side with the former analog because…well…it would be a lot more fun! The energy also seems to be there for a much bigger move higher at some point.

Speaking of fun, the fun continues in Tech Land with no shortage of major announcements over the last two weeks, with today’s being NVDA collab with INTC, which we go into below…

Price action continues to support risk moving further out the risk curve as seeing a lot of small/mid cap names go up triple digits and plenty of large cap names hitting very high RSIs (looking at you SNDK!). A new “AI stock” pops up every day.

One reader and friend described the environment as: "So many cool stories hard to kiss all the girls…”

Let’s get straight to it…

SEMIS

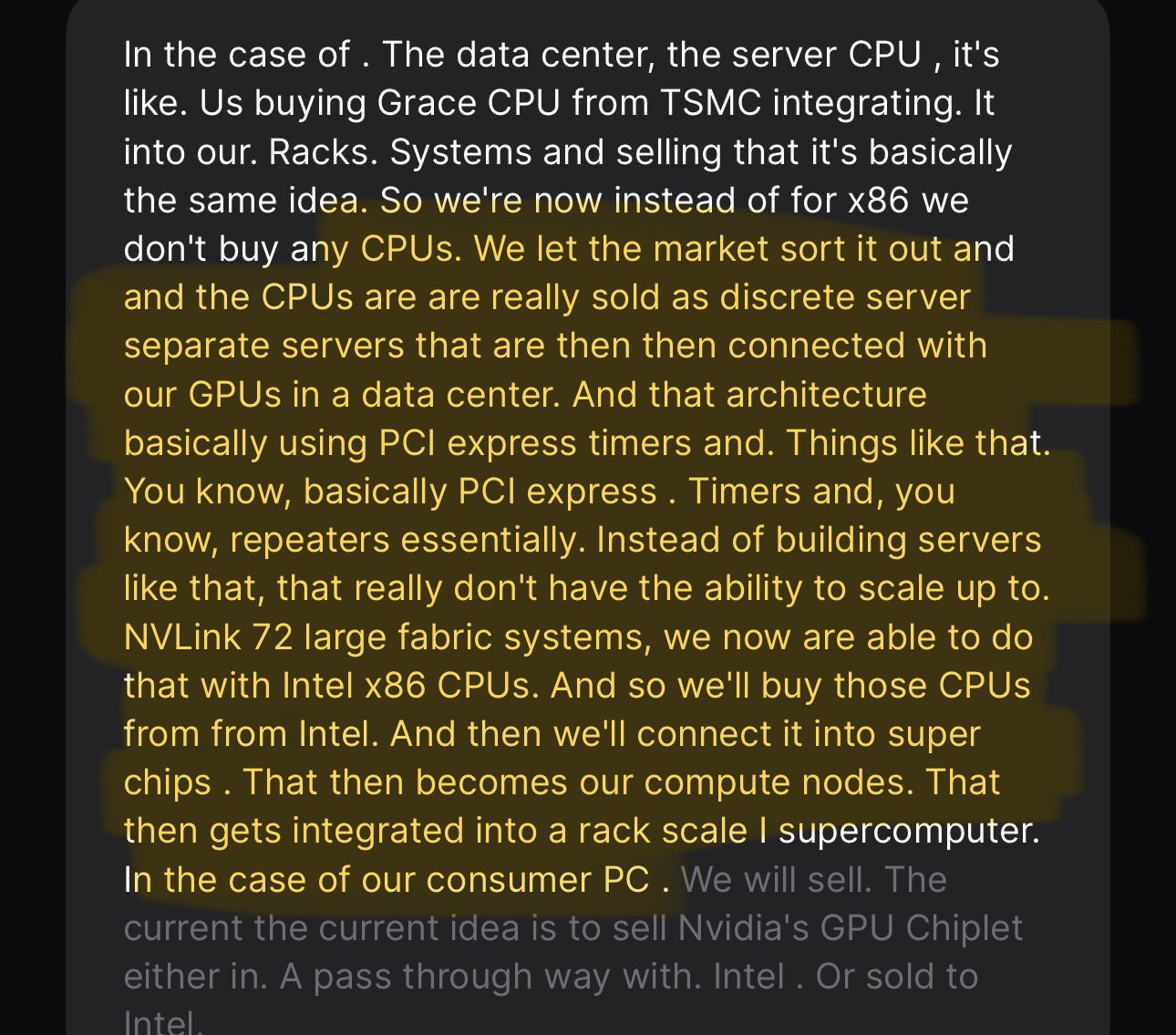

INTC +23% / NVDA +3.5%: Let’s get the most important news out of the way first. NVIDIA and Intel will co‑develop multiple generations of x86 CPUs for data‑center platforms (directly attached to NVLink) and PC SoCs that fuse Intel CPUs with NVIDIA GPU chiplets. NVIDIA will buy Intel server CPUs for its NVLink systems and sell/supply GPU chiplets that Intel packages into x86 SoCs.

A few key points that stood out from the call today: 1) NVDA confirmed chips involved with this collab would not be fabbed in an INTC foundry but also left door open to “future partnerships”; 2) NVDA indicated that it was not expecting any products from the collaboration before 2027 and wouldn’t commit to 2027 but did not exclude that possibility. 3) NVDA confirmed Trump admin had no involvement in this partnership (uh huh)

For INTC, this is viewed as another feather in the “too big to fail” narrative which has taken hold following the US Treasury and Softbank investment earlier and a big positive surprise. While there were some initial hopes that NVDA would be fabbing on IFS, companies denied that on the call — still, investors liked the positive comments around INTC”s advanced packaging on the call

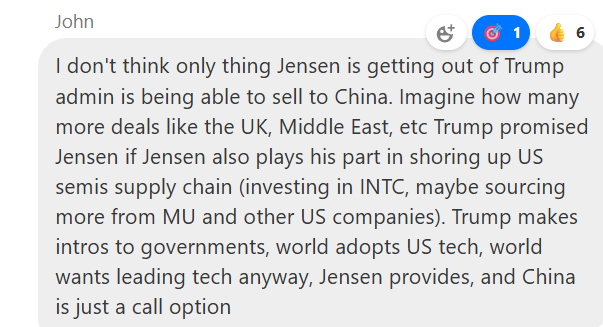

For NVDA +3.7%, we liked this take from John in TMTB Chat:

ARM -4% as announcement implies higher x86 share that some had originally expected although Jensen said twice on the call that they remain “fully committed” to the ARM partnership.

SNPS +13% as INTC pulling back from deal with them was biggest reason for the massive drop a couple weeks ago

ALAB +1% got dinged a bit mid day on these comments

The glass half empty take here is that as NVLink‑attached x86 nodes scale, reliance on PCIe retimers in NVDA racks should decline, a soft negative read‑through for retimer vendors, although If NVDA+INTC drives more racks while keeping CPU/IO on PCIe/CXL, ALAB wins on volume and richer Gen6/CXL content. Seems like a wash…unclear if any real impact

AMD -80bps with a nice comeback as the press conference alleviated some of the initial concerns that this was a big negative for AMD. The feedback I got from investors today was that stock trades on the GPU # and success of Mi3xx/Mi4xx rather than Gaming/CPU and that’s all that matters right now. We agree. Still, I would say it’sstill a slight negative as it gives NVDA a customized x86 CPU it could deploy which would compete with AMD’s x86 based Helios and Intel x86 SoC with an NVIDIA RTX GPU chiplet targets the integrated‑graphics laptop segment where AMD’s APUs have been competitive. Still not coming before 2027 and by then Mi4xx will be the main story. On that note it seems like this article from TrendForce which was also out today more important:

TrendForce reports that NVIDIA has recently pressed key component suppliers of its Vera Rubin server racks to upgrade product specifications, specifically requesting that HBM4 speed per pin be raised to 10 Gbps, as AMD gets set to launch its MI450 Helios platform in 2026. Although whether these upgrades can be achieved remains uncertain, SK hynix is expected to maintain its leading position as the largest supplier in the early mass-production phase of HBM4.

SNDK +5% with an RSI of 99 continues to grind up…MU +5%, WDC +4% and STX +1.5% not far behind

TSM +2% nice red to green reversal…

MRVL +4.5% ahead of Harlan’s meeting with CEO next week although heard some attribute this to the L AMD / S MRVL unwind, although haven’t really heard from many who have that trade on - i mean, the mental energy drain being involved in both of those names in a pair trade…

Quantum strong again: RGTI +13%; IONQ +2%

AVGO flat as have been hearing debate on whether the $10B really fits with OAI timing. Haven’t got a clear answer.

TIC +22% as our friend Citrini pitched it long. The gist was picks-and-shovels platform on the AI data-center and grid buildout, stock trades at a deep discount (<8x EBITDA vs peers mid-teens); cross-sell + cost synergies and a credible path toward ~20% EBITDA margins, near-term catalysts (updated guidance/Investor Day) and downside cushioned by sticky uptime-critical work, and backed by best in class operator Martin Franklin. Sounded pretty good to us. This was today’s new AI stock that we never knew existed…

INTERNET

RDDT +1.5%: Stock was strong as Piper and Citizens were out raising PT and read-through from the META approaching Media companies for AI licensing deals was positive. Someone in the chat asked about r/r up here today, here’s how I responded:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.