TMTB Morning Wrap

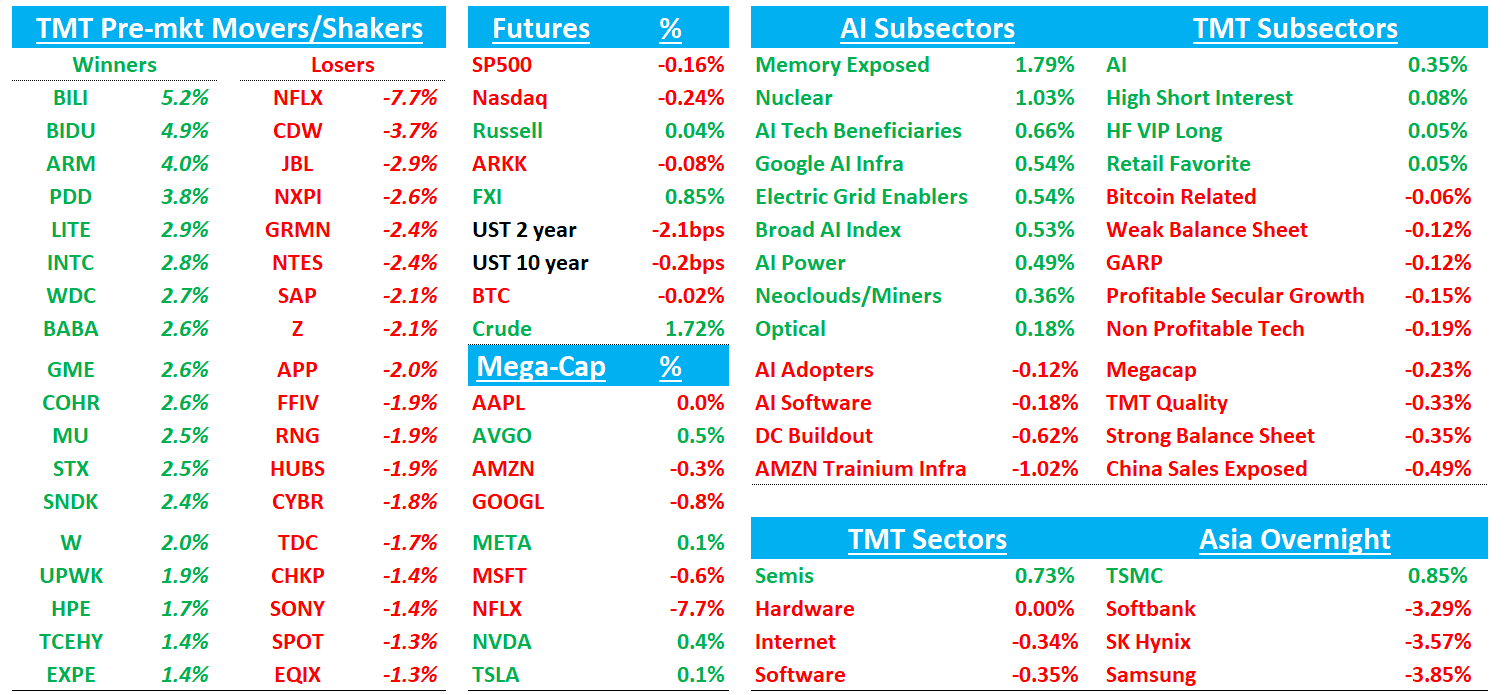

Good morning. Futures -30bp with yields flattish. 10 year yields in Japan are down 7bps. Asia mixed overnight: Asia saw mixed price action TPX -0.99%, NKY -0.41%, Hang Seng +0.37%, HSCEI +0.31%, SHCOMP +0.08%, Shenzhen +0.64%, Taiwan TAIEX -1.62%, Korea KOSPI +0.49%. Memory bifurcated with KIOXIA+8.5% (NAND), SAMSUNG+5%, HYNIX+1.8% vs Phison-5%, Nanya-7.7% (DRAM). BTC flattish.

Let’s get to it…

EARNINGS

NFLX -7.5% as Q4 beat slightly but ‘26 operating guide 6% below street

Op Inc margin guide main thing people pointing to this morning as the guide of 32% ex acquisition costs was below 32.6% street. NFLX expects ad rev to 2x in ‘26 (vs >2.5x growth in ‘25). Mgmt described Warner Bros acquisition as a “strategic accelerant” & cited confidence in gaining regulatory approval.

Not an exciting stock for anyone right now. Most feedback I heard this morning centers around mgmt not doing a great job explaining slowing engagement (+2% y/y in 2H despite a huge slate). Most eyeing 20x $3.75 in ‘27 = $75 as a level where investors would step in, but I don’t think anyone in the HF community wants to defend significantly until we get clarity on the deal. Doesn’t sound exciting either way so we won’t spend too much time on it.

TEL -4%: Solid Q although AI revs just tracking inline to slightly below FY26 target, guide in line

TEL beat on Dec-qtr results ($4.7B / $2.72 vs Street $4.52B / $2.54) and came in above its original FQ1 guide, with sales up 22% y/y (+15% organic) on strength in both Transportation and Industrial. Orders were a record $5.1B (1.1x book-to-bill) led by Energy and DDN. Transportation grew +10% y/y with 21.2% margins despite auto worries, while Industrial surged +38% y/y with 23.3% margins on AI-driven momentum; AI revs $450–500M vs $2B FY26 target. Mar-qtr guide ($4.7B / $2.65) is in-line on revenue and slightly ahead on EPS, implying ~13% y/y

TECH RESEARCH/NEWS

OpenAI: OpenAI Lines Up Advertisers, Reveals Key Details Ahead of Ads Launch

The Information reports that OpenAI has begun pitching chatbot ads to a select group of advertisers for an early February launch, notably charging based on ad views rather than the click-based model typical of search giants like Google. The outlet notes that OpenAI is asking for initial commitments of under $1 million each to test the format on free and lower-tier paid users in the U.S. The Information adds that this move is critical to OpenAI’s unprecedented effort to raise up to $100 billion, as it seeks to monetize its 900 million weekly active users without alienating them.

OpenAI: Google DeeMind CEO Hassabis questioned why OpenAI decided to move so early to place ads inside ChatGPT; “it’s interesting they’ve gone for that so early…maybe they feel they need to make more revenue”

NAND/DRAM/Memory: Morgan Stanley Flags DeepSeek Engram as Efficiency Lever

MS Asia points to DeepSeek’s Engram architecture as a way to extend scarce GPU capacity by decoupling “conditional memory” from compute, easing HBM constraints and lowering system costs, the firm says. The analyst notes Engram enables memory lookups without overloading HBM, implying higher commodity DRAM content [and NAND at scale] and reduced dependence on expensive HBM—particularly relevant for China given supply limits. The firm adds hybrid compute-memory designs outperform pure GPU scaling, with cost curves likely shifting from GPU toward memory. Looking ahead, DeepSeek’s V4 model is expected to demonstrate coding and reasoning gains using Engram, with benchmarks and inference cost data as key validation.

TMTB: We think Deepseek’s Engram architecture is flying somewhat under the radar, even among some semi specialists. We think it has massive implications for DRAM and also NAND demand at large scale. We went into this in our weekly Sunday, concluding with:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.