TMTB EOD Wrap

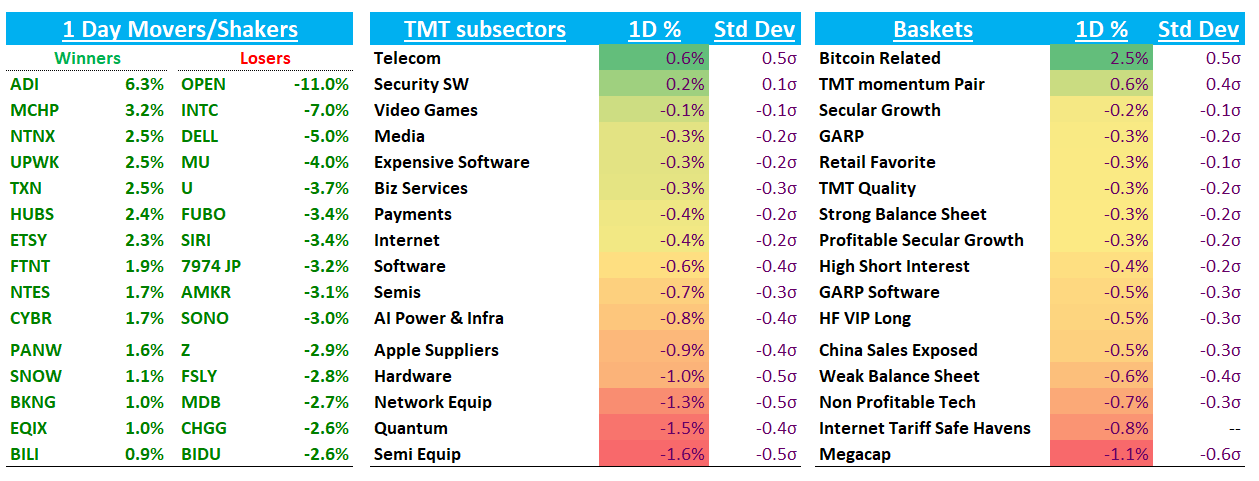

QQQs -60bps after being down more than 1% most of the morning. Not a huge factor day like the past few as TMT Momentum actually outperformed today. While momentum names were down early, saw some dip buying in some favored longs like NVDA and APP, both finishing near flat after being down MSD, putting in strong candles. Always good to see where the demand is on a day like today.

Software continues to outperform semis. BofA had an interesting stat in the sw vs semi price action.:

In the period, Aug 6-12, Software had a 2.5 standard deviation move vs AI to the downside

In the period, Aug 13-20, Software had a 2.25 standard deviation move vs AI to the upside.

We had our thoughts on this pullback yesterday afternoon here. We continue to just think garden variety pullback and healthy digestion as investors think about what Powell will say at Jackson hole on Friday. Macro wise, slow day today as yields finished flat to down and fed expects didn’t move much (still expecting 55bps worth of cuts over the final three meetings).

Pretty slow news day (yup - it’s late August), but let’s get to it…

SEMIS

Analogs rallied after ADI’s beat which was driven by industrial and auto. Versus a backdrop of an analog earnings season which wasn’t for the faint of heart, this was a much better result. Guidance was better with revenue of $3.0B and EPS of $2.22 vs. consensus at $2.83B/$2.03, supported by broad-based industrial growth and lean channel inventories. Industrial and consumer are expected to lead sequentially, while auto moderates after a strong Q3. ADI +6%; MCHP +3%; TXN +2.5%.

NVDA -14bps with a nice candle as well today. Bogeys settling in around $55B for the guide as we get closer to the print next week

MU: −4% on a Seoul press report claiming Samsung has been qualified for HBM4E, with pre-production by late August and mass production around November–December. The timing looks questionable given SK Hynix (March) and Micron (June) only just sampled 12-high HBM4. Jefferies came out pre-market and said they talked to Samsung IR who denied the report. MU remains headline-driven amid frequent Asia press noise. Why is this so important re: MU? Well, HBM4 pricing and margins hinge on whether Samsung can achieve strong yields on its 1C node, which would lift yields for both commodity DRAM and HBM. If Samsung ramps successfully, Nvidia can run the Apple-style playbook of pitting suppliers against each other—good for Nvidia’s leverage, more complicated for MU’s pricing power and '26 margins (eps). Pretty wide range on this one - bears will say HBM pricing pressure means close to 40% margins for MU and $10 in EPS while bulls say better demand will alleviate supply/demand imbalance and $14-$15 is possible. Also got dinged a bit by the US gov’t equity stake news…Don’t hear many investors with a ton of conviction on this one right now, and rightfully so.

Other AI names mixed: TSM -2%; ARM -2%; AVGO -1%; MRVL -1%

AMD -1% — will continue nibble under $160 here, but want to be patient.

CRWV -1.5%: Looking for the right r/r spot to get long here (the opportunity might present itself or might not). Our take in the chat today:

I've been trying to come up with a valuation r/r framework on this one, but nothing that I can gain confidence in and nothing overly convincing. Most important thing: still have to believe AI semi cycle + AI cycle vibes intact (which I do). For me, I'm left to use the chart to guide me in a good r/r entry point, which has usually worked for me in the past on names post-lock up.

INTC -7% on dilution fears as investors digested the news U.S. gov’t could take an equity stake in other subsidized chipmakers.

INTERNET

ETSY +2%: Didn’t hear much on this one - 3p data remains mixed QTD

RDDT - 4%: User data continues to hold up fine and initial investor checks point to a good start to revs QTD.

UBER -1.6%. presumably on the positive William Blair TSLA note which was pretty positive on their robotaxi experience. From this morning’s note: “Tesla’s ride felt smooth, human-like, and familiar—like a “ghost chauffeur”—executing turns and lane changes with patience and confidence, while pricing came in at half the cost of Uber. By contrast, Waymo’s service, though safe, felt more robotic, with audible lidar whirring and airline-style preambles detracting from the passenger experience.”

GOOGL -1% investors continue to wait for the Mehta decision any day now…

CVNA -1.6% as HTZ will sell some used vehicles online through AMZN Autos partnership, although doesn’t seem like any near-term impact likely given HTZ only launching in 4 cities and will take time to scale. Recent 3p data showed a dip into mid 30% growth in the latest week, but still tracking 5ppts+ above street for Q3.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.