TMTB EOD Wrap

QQQs -30bps in a fairly boring headline session although price action underneath the surface continues to be more interesting. In Tech land, SaaSmagedon continued, which we think is part of a broader narrative infecting Tech right now — mainly, that companies that are viewed as secularly/structurally challenged in an AI-centric world will increasingly have trouble finding a bid.

We described this in our weekly yesterday:

Given the future unknowns and pace of AI advancements/adoption, we think Tech investors will find it hard to put any real credence on the “E” and so “P” (multiples) will dominate P/E.

We began to see that in the price action this week:

IT’s -30% post-earnings miss and follow through lower driving ACN/CTSH to new lows; WIX slicing to new lows after a beat + accel; EXPE’s anemic +4% reaction to a beat and raise; or DUOL giving back much of its squeeze after the ChatGPT5 demo which showed GPT5 create a language‑learning tool from a simple user request—including features like flashcards, a progress tracker, and a simple game.

If our thesis is true and this price action continues, we wouldn’t be surprised to see DUOL slice through its earnings gap to the downside. It’s not that the DUOL report was bad - bookings were a lot better than expected - it’s that “P” will outweigh “E” and for a company that’s trading at 100x P/E, that’s a lot of P!

The last 10 years have shown us how far multiples can stretch to the upside on perceived winners - just check out PLTR’s 200x FCF multiple. But us old tech-timers remember the days when “loser” multiples also got stretched to the downside. We think young-ins will begin to be exposed to that dynamic shortly!

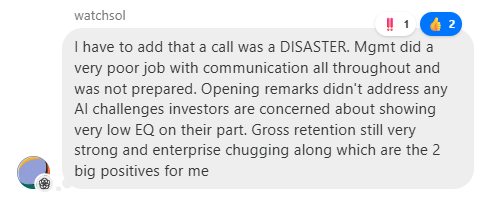

The price action today displayed more of the same, with no mercy for any company perceived to be at risk: WIX -6% to new lows. DUOL -8% slicing straight through its earnings gap. INTU -6%: another name we called out in our weekly. Let’s not forget MNDY -30%, talking about a “shifting landscape” in the PR after a less than impressive beat fueling concerns that SEO/GOOGL search issues and AI seat risk would continue to eat at its business. Here’s mgmt: “we are seeing some softness within the down-market due to the changes in the Google algorithm." The bear case here is that AI summaries/AI chatbots continue to eat at top of funnel acquisition for MNDY. Assuming 30% of MNDY’s organic clicks are wiped away by 2027, with 40% new customers coming from SEO today, that means net new ARR could fall from high 20s to mid-teens unless offset by paid spend.

Other companies that face SEO/Google search risk:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.