TMTB Weekly

What a week! Not only did we have a firehose of earnings with bigger realized that implied moves (35% of TMT stocks have moved >10% this earnings season), but plenty of noise underneath the surface with software price action fanning fears of AI disintermediation as the AI winners vs. losers gap continued to widen. And ChatGPT5 landed late in the week. Who said August was supposed to be slow?

Let’s start with macro land quickly. A quiet week as expected on the macro front, as we head into a busier week with CPI for Jul on Tuesday morning and US PPI for July on Thursday morning, which will set up the trajectory/narrative heading into Powell’s speech at Jackson Hole on 8.21.

VitalKnowledge lays out the 3 macro questions facing investors right now:

1) how much further will tariffs push goods prices higher in the coming months?; 2) will the bulk of tariff-related inflation get offset by housing and non-shelter services disinflation/deflation?; and 3) was the Jul jobs report a fluke, or is the employment market in the midst of a pronounced softening phase?

The releases this week will give us some color on #1 and #2.

Macro vs. AI

In the intersection of macro and AI, this week we heard increasing noise of AI displacing jobs following the weak unemployment print.

Last week, we wrote that while this might be negative for the labor market, the implications for AI spend were positive:

We think increasing unemployment and mediocre econ growth likely accelerates AI deployments as a way to protect margins in a low growth environment. When revenue expansion is hard to find, protecting margins becomes the battleground, and automating knowledge-work tasks offers an immediate, capex-light route to shave unit costs, while at the same time improving productivity.

Yet the real accelerant is rivalry: once a single player in a sector proves that an AI can ship product faster or close sales with fewer reps, every peer is forced onto the same adoption curve or risks permanent margin and market-share erosion.

No prior technological shift has compelled companies to move as quickly or spend as aggressively as AI. Because AI can tilt the competitive field almost overnight—streamlining decisions, cutting costs, and unlocking new revenue streams—companies are forced to treat rapid adoption as a survival mandate rather than a long-term R&D project. AI deployment is turning into a classic winner-take-most dynamic.

That’s the first-order effects, but what about the 2nd and 3rd order effects of a slowing macro and increasing unemployment? We think they are less positive.

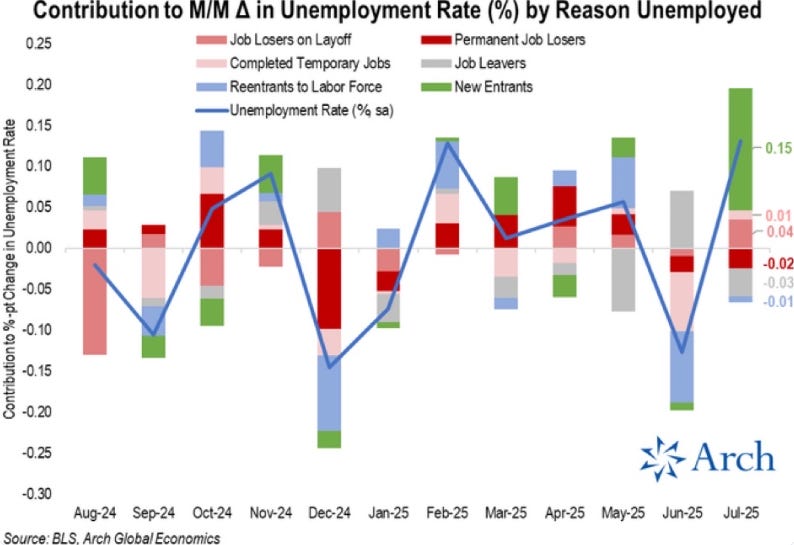

It’s always important to pay attention to broader cultural narratives in terms of the AI hype cycle. The data underlying the unemployment report shows that that the spike in unemployment was largely driven by new entrants, mostly job seekers which are trying to enter a market disrupted by AI and slow demand:

And here’s a headline from the NYTimes this weekend:

I spoke to an AI Snr executive at a gov’t consulting firm this weekend, and he told me that DOGE is still very much active in the gov’t and looking to modernize systems with a heavy focus on AI. He told me his firm replying to RFPs from the gov’t with proposals that require only 10% of the developers/manpower vs. a couple years ago.

Yes, the first order effects of a slowing economic environment are positive: companies look to spend more to raise margins and stay competitive.

However, the second and third order effects might be less positive if AI job losses trigger reputational, cultural or policy responses: highly visible AI layoffs create PR and morale issues (think DUOL backlash earlier this year). Worse yet: a significant rise in unemployment begins to impact the top line of companies (our view is that cyclical trumps secular/structural in the short-term, and let’s not forget a company like META is at its core a cyclically exposed ad company).

We think the first and second order effects are still down the road and not yet market moving — file them away for another time. But we always like to try to think 2 or 3 steps ahead and map out potential narratives/market paths. The AI Hype Cycle has seen a couple of decent sized blips over the last two years - mainly centered around peak AI capex fears. We think those days are largely over as investors have come to appreciate the insatiable demand from hyperscalers + sovereigns + AI natives; instead, we think the next downdraft in the AI Hype Cycle will likely be catalyzed by cultural backlash from AI job losses, ironically spurred by increased agentic AI spend at enterprises.

Let’s rewind to the more positive first order effects…

Last week we concluded:

We think the HOT AI Summer likely turns into a HOT AI Fall/Winter. We also think a slower macro widens the performance gap between AI winners and non-AI winners.

That seemed to play out this week and we still think it’s true. We had some thoughts on SaaSmageddon here.

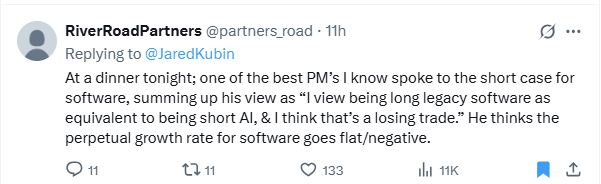

We think we are entering a prolonged market environment where companies perceived as AI losers will face significant multiple compression. The last time we had such a ripe era of structural/secular shorts in Tech was in the post-iPhone era where mobile ended up disrupting companies like Blackberry, Nokia, Kodak, Printers, taxis (UBER), etc.

Easy, simple, powerful narratives are very hard to disprove in Tech. The software example:

Given the future unknowns and pace of AI advancements/adoption, we think Tech investors will find it hard to put any real credence on the “E” and so “P” (multiples) will dominate P/E.

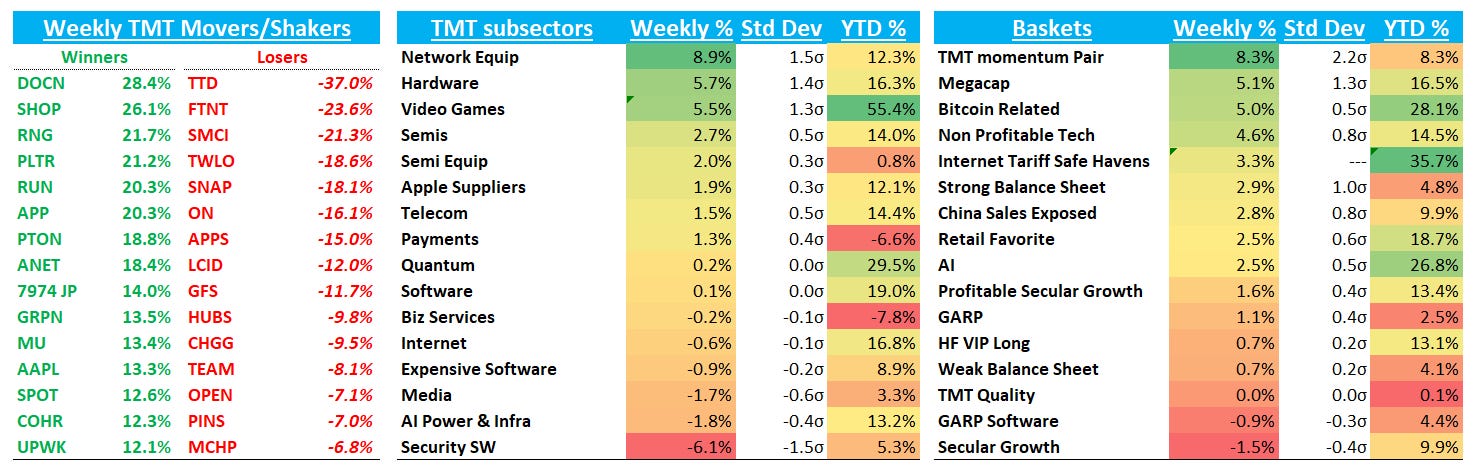

We began to see that in the price action this week: