TMTB EOD Wrap; AMD ALAB ANET LITE UPST First takes

QQQs -93bps. Fed expects continue to price in close to 80bps worth of cuts. Yields fell 2-4bps across the curve. On the macro front, Bessent said that trade announcements could arrive within days while Trump said he’d dictate terms in trade deals. Here’s Bloomberg:

US President Donald Trump said he would prescribe tariff levels and trade concessions for partners looking to avoid higher duties, appearing to move away from the idea that he would engage in back-and-forth negotiations.

“We’re going to put very fair numbers down, and we’re going to say, here’s — what this country, what we want. And congratulations, we have a deal. And they’ll either say ‘great,’ and they’ll start shopping, or they’ll say, ‘not good,’” Trump said Tuesday at the White House as he met with Canadian Prime Minister Mark Carney.

“It’s going to be a very fair number, it’ll be a low number. We’re not looking to hurt countries,” he added.

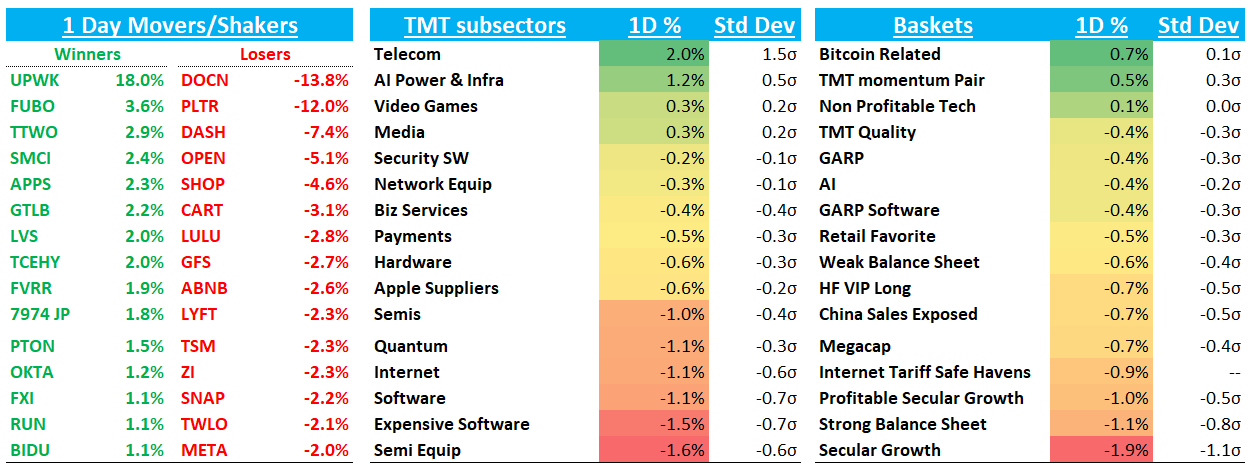

In Tech, price action seems to be getting worse on the edges, particularly in sw. PLTR-12% and DOCN -13% on prints that didn’t seem to merit dd declines. TWLO -2%following through down on a miss. In internet, not seeing follow through on beats (META) and follow through to the down on mixed prints (DASH, AMZN, RDDT). DASH was mixed today and did two acquisitions, but over the past couple of weeks tariff safe havens have been bought up aggressively. Still some strength out there: just check out TTWO, NFLX bouncing back yesterday and today, UBER, CRWV, etc. Even in sw, IBM/CHKP above pre-earnings miss prices. A lot of mixed signals, but a slight change in character from last couple of weeks. While the last couple weeks has shown that price action has favored longs on earnings prints, the last couple of days have shown the opposite.

MRVL -7% is down after postponing June 2025 investor day until 2026

Post-close earnings:

ALAB -3%: Beat and raise, though limited operating leverage and investors likely wanted a bit more upside on the q

PLTR showed today not a ton of appetite to buy high multiple stocks right now, so not surprising to see down a bit.

Demand trends were healthy across PCIe, Ethernet, and merchant GPU connectivity solutions. Management specifically called out, "strong demand for PCIe scale-up and Ethernet scale-out connectivity solutions in custom ASIC platforms, along with initial shipments for Scorpio P-Series and Aries 6 Retimers for merchant GPU-based platforms."

F1Q Revenue: $159.4M vs. Street $153M

F1Q Gross Margin: 74.9% vs. Street 74%

F1Q EPS: $0.33 vs. Street $0.285

F2Q Revenue Guide: $172.5M vs. Street $160M

F2Q Gross Margin Guide: 74% vs. Street 73.9%

F2Q EPS Guide: $0.325 vs. Street $0.30

AMD +4%: Solid quarter with upside across revenue and segment results (Gaming, Client and DC), though gross margin was hit by inventory charges tied to China export controls (ex-charge, margins would have beat at 54%, ahead of street)

Q2 Rev guide also ahead. Waiting to hear commentary around Mi3xx series and 2H momentum in the call, and any initial read on ‘26. Looks solid so far…

F1Q Revenue: $7.44B vs. Street $7.12B

F1Q Gross Margin: 54% adjusted vs. Street 53.9%

F1Q EPS: $0.96 vs. Street $0.94

Segments:

Data Center: $3.67B vs. Street $3.53B

Client: $2.29B vs. Street $2.05B

Gaming: $647M vs. Street $573M

Embedded: $823M vs. Street $855M (miss)

F2Q Revenue Guide: $7.4B vs. Street $7.22B

F2Q Gross Margin Guide: 43% (54% ex-China hit) vs. Street 54.5%

ANET - 7%: Beat-and-raise quarter with revenue, gross margin, and EPS all above expectations.

Looks inline to slightly better than bogeys. Waiting for the call to see if mgmt will lift FY guide and any color around front-end/back-end Ai targets. $1.5B buyback.

F1Q Revenue: $2.005B vs. Street $1.97B

F1Q Gross Margin: 64.1% vs. Street 63.3%

F1Q EPS: $0.65 vs. Street $0.59

F2Q Revenue Guide: $2.1B vs. Street $2.03B

F2Q Gross Margin Guide: 63% vs. Street 62.5%

F2Q Operating Margin Guide: 46% vs. Street 44.4%

$1.5B buyback was also authorized.

LITE +6%: Solid Q1 beating revs, GMs, and EPS

The Q4 guide also came in strong beating on EPS (inline on revs). Cloud and industrial markets led the strength.

"In Q3, we exceeded the high end of our guidance for both revenue and EPS, fueled by strong demand from cloud customers and a recovering networking market."

F3Q Revenue: $425M vs. Street $418M

F3Q Gross Margin: 35.2% vs. Street 34.5%

F3Q EPS: $0.57 vs. Street $0.50

F4Q Revenue Guide: $455M vs. Street $454M

F4Q EPS Guide: $0.75 vs. Street $0.64

UPST -18%: Solid Q1, but light of expects and Q2 guided below street at $225M vs street at $228M and expecting upside

Q1 Revs $213 vs street at $200 (a bit light as 3p was pointing to a 9-10% beat) and EBITDA $43M vs street at $27M

Q2 comp got 30ppts easer (vs 28ppts tougher in Q1), so given the accel in Q1 revs (11ppts), buyside expecting a bigger accel in Q2, but mgmt only guided to a 10ppts accel.

Now a ton of news flow out today outside of earnings so we’ll just call out a few things:

NFLX +30bps as the White House pulled back on foreign film tariff rhetoric and Clev was positive on ad opportunity

RBLX -1.5% as investors trimming near highs as Fornite likely will release their U.S. iOS app this week.

RDDT -6% following through to the downside after last week’s print. We wrote up our latest thoughts in our weekly, which can be summed up as the dreaded (for longs) cyclical + structural Tech short.

AMZN -70bps following through to the down as well.

UBER +50bps continues to act well as they announced they are expanding Robotaxi service to 15 more cities in the next 5 years and Waymo talked up scaling plans.

CRWV/NBIS +6%/5% as Neocloud led the way higher. Other AI names mixed: TSM -2%; MRVL -1% (-7% in post); AVGO -30bps, NVDA - 25bps, ARM +40bps; CLS +3%; VST +3%

PLTR -13%…Our view from this morning:

Updated chart we showed this morning:

TTWO +3% now about 1% off from where it was pre-GTA VI delay

TSLA - 2% on some worse European data

AAPL -20bps as Morgan Stanley said they think app store fears overblown…MS estimates US App Store at $11B revenue or 3% of total revenue or 7.5% of total net profit, which would all go to 0 in the worst case. To mitigate some impact, MS said not all users are likely to switch to third-party payments due to added friction, and AAPL could respond by raising prices for non-App Store services, introducing new incentives to retain users.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.