TMTB EOD Wrap

Despite the good Tariff news on Friday, still seeing co’s with little to no tariff + China outperform. For example, in internet, EBAY +2.3% / MELI +2% / CART +1.5% / NFLX +1.4% / SPOT +1% / DASH +75bps all out-performed as they have been since “Liberation Day.” We wrote yesterday in our weekly we think this trend continues as long as there is still Tariff uncertainty. As our friend Citrini posted on X a couple weeks ago: “Time is a circle” — Back in the 1930s there was sustained outperformance from Tariff “winners” or “safe havens.” One example he gave:

On the macro front, fairly slow day after weekend news. Fed’s Waller had somewhat dovish comments saying he viewed inflationary implications of Trump’s tariffs as transitory (where have I heard this before?) and said Trump tariffs were “one of the biggest shocks to affect the US economy in decades” while predicting slower growth later this year.

Stocks selling off a little after the close as news out that U.S. SECRETARY OF COMMERCE INITIATED SECTION 232 NATIONAL SECURITY INVESTIGATION OF IMPORTS OF SEMICONDUCTORS AND SEMICONDUCTOR MANUFACTURING EQUIPMENT…Pharma also on the docket.

Yields fell 7-15bps across the curve in a welcome reprieve. BTC +1.5%. China +1.5%. Dollar fell another 50bps.

Let’s get to the recap…

Internet

NFLX +1.5%:

AMZN -1.5% as MS and DB cut numbers. We had thoughts yesterday on why we thought stock might underperform early in the week given low electronics exposure, De minimus exemption back on, and the L AMZN / S AAPL trade needing to be unwound:

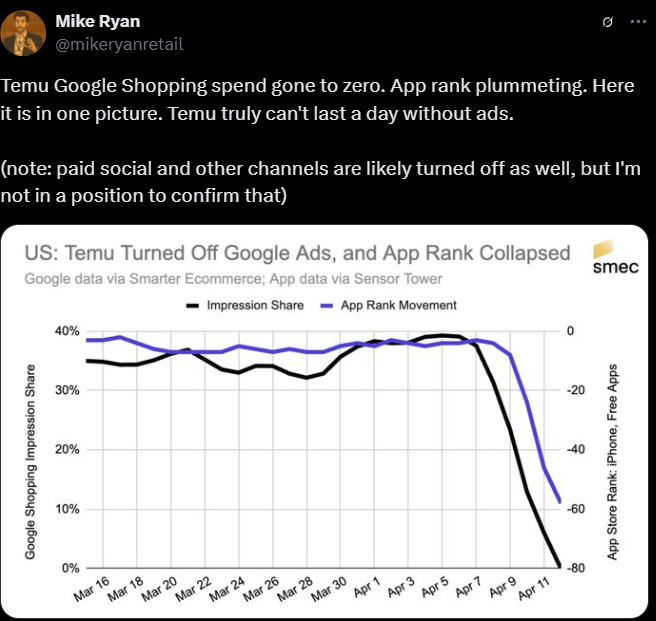

Ad names weak today: Saw GS and Citi cut numbers but wasn’t much new - the group has been underperforming as of late given high macro sensitivity. Heard Edgewater might have been negative as well but didn’t see the note myself so take it with a grain of salt (I’ll pass along deets if I see them). Also see chart below on Temu/Shein lowering spend… META -2.2% also hurt as FTC trial started today . Could just be my wife’s and my algorithm, but I feel like a lot of the ads I see on instagram are fashion/retail items that have high likelihood of being made in China (haven’t seen any specific #s around ad exposure there, but just passing along a TMTB proprietary check)… PINS -2%; RDDT -3%; TTD -3%. The one bright spot was GOOGL +1.2% — didn’t see much for outperformance other Jefferies saying this in their note after takeaways from Cloud Next: Google is leveraging DOGE relationships with one AI leader noting "25 is really our year to go deeper into Fed.” Also, among the AI crowd, GOOGL getting some good reviews on their recent product launches.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.