TMTB WEEKLY: Tariffs, Earnings thoughts, AI semis, AMZN exemption impact?, UBER, NFLX Earnings

Let’s dive right in. Big news this weekend is the announcement on Friday evening that Trump admin is exempting smartphones, computers and other electrics from its so-called reciprocal tariffs. Here’s Bloomberg with some more detail:

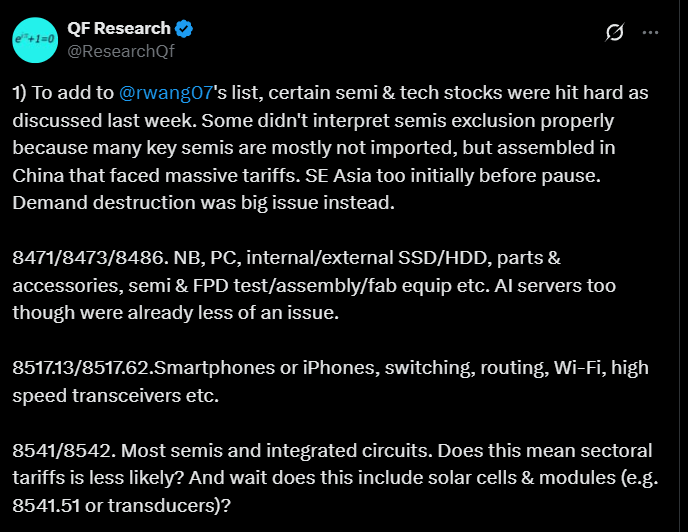

The exclusions, published late Friday by US Customs and Border Protection, narrow the scope of the levies by excluding the products from Trump’s 125% China tariff and his baseline 10% global tariff on nearly all other countries.

The exclusions apply to smartphones, laptop computers, hard drives and computer processors and memory chips as well as flat-screen displays. Those popular consumer electronics items generally aren’t made in the US.

The exemptions cover almost $390 billion in US imports based on official US 2024 trade statistics, including more than $101 billion from China, according to data compiled by Gerard DiPippo, associate director of the Rand China Research Center…

Trump on Saturday declined to elaborate on the exemptions but hinted at further developments on Monday.

“I’ll give you that answer on Monday. We’ll be very specific on Monday,” he told reporters on Air Force One. “We’re taking in a lot of money; as a country we’re taking in a lot of money.”

The tariff reprieve does not extend to a separate Trump levy on China — a 20% duty applied to pressure Beijing to crack down on fentanyl, including the shipment of precursor materials. Other previously existing levies, including those that predate Trump’s current term, also appear unaffected.

But the move also is aimed at laying the groundwork for new targeted sectoral tariffs that are likely to hit the industry.

The administration is expected to soon launch a new investigation into imports of semiconductors. That would eventually lead to the imposition of tariffs on chips within weeks or months. Those duties, like ones imposed recently on steel and aluminum, are likely to impose duties on products that include semiconductors as well as the chips themselves.

Trump’s sectoral tariffs have so far been set at 25%, though it’s not clear what his rate on semiconductors and related products would be.

Ok, 20% still applies on smartphones, PCs, etc. but much lower than the 125%+ announced on other goods. But we still have the uncertainty of not knowing how new sectoral will look like on semis and whether those will apply to smartphones as well. Lutnick adds to the fun this morning!

So what we can we say with certainty? Who knows! This seems like a decent take from @RihardJarc:

My take on this is that the U.S. knows that disrupting the supply of semis right now would be catastrophic for the country, so they want to do a separate system, where I expect the tariff rate to be low and not crazy like the reciprocal tariffs, but this new system is non-negotiable, so that onshoring is encouraged

Probably likely 25% like auto and other sectoral tariffs is our best guess.

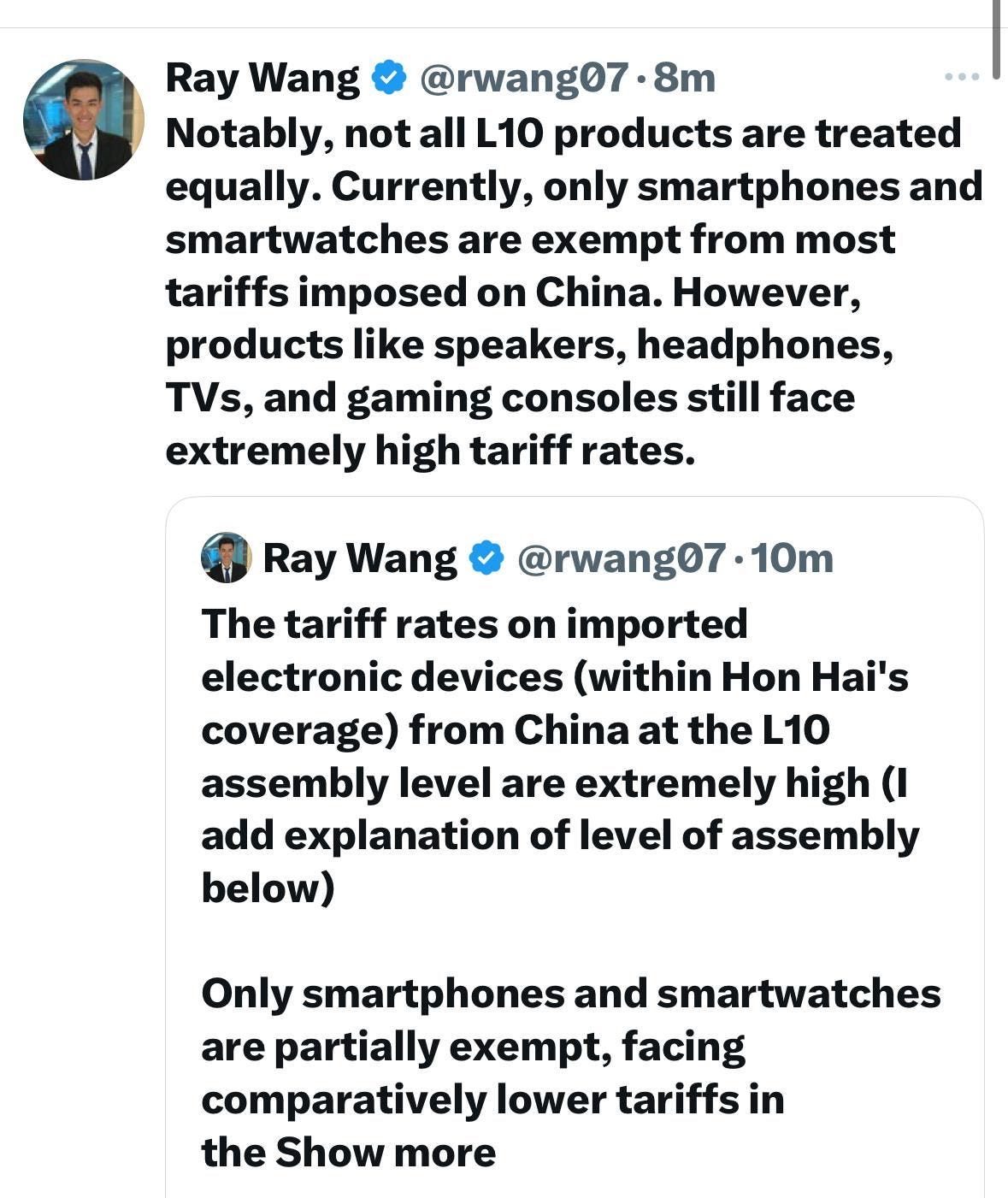

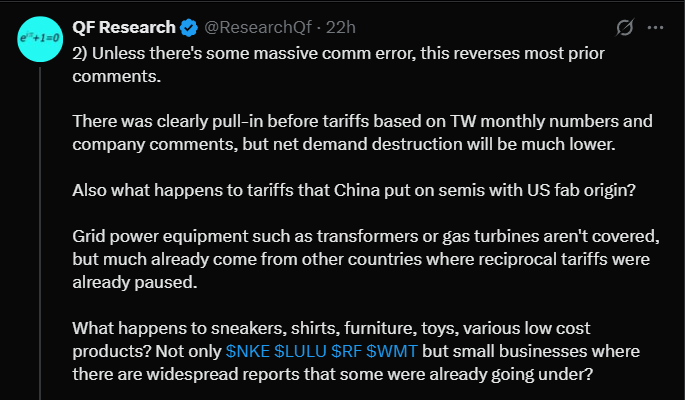

It seems like worst case has been taken off the table for now and things are moving in a slightly more positive direction. The overriding perception is that Trump blinked as he saw the potentially systemic knock-on effects the Tariffs would have on the market announcing his 90 day reprieve this week and more exemptions on Friday. So this saves a lot of big Tech companies, but many companies who import plenty of stuff from China that isn’t PC/Smartphone related are still subject to massive tariffs.

China’s response so far: “Whoever tied the bell to the Tiger must untie it”

Overall on the macro: tail risks have been removed and policy seems to be moving in the right direction, but we still worry about 1) a still significant tariff burden 2) geo-political and supply chain knock on effects from China spat 3) growth/macro slow down 4) rise in long end of the curve 5) continued shift away from US assets. Still there are other positives: we think we are behind the peak of chaos/uncertainty and while uncertainty still remains around sectoral tariffs, we are inching slowly to the point where hopefully businesses can re-gain a sense of certainty in terms of planning/confidence. Consumer confidence likely bounces near-term as well as the noise/chaos dies down a bit and DOGE looks to end in May. Trade deals ex-China likely get announced over the coming weeks. Tax cuts are on the horizon. And what happens if macro data starts to stabilize / come in better at same time policy uncertainty is decreasing? So there are upside risks too…

Our sense is some strength early in the week, but more chop (potentially upwards trending) and greater differentiation in individual stock performance going forward. We increased our gross/net a bit near the end of the week, and our plan is to continue to layer in gross/increase sizing a bit on trades as we go through earnings season in a measured manner, but always w strong eye on risk mgmt and remaining nimble/open-minded.

Some high-level thoughts as we head into one of the most uncertain Tech Earnings Season since the pandemic

This will be an unusual Tech earnings season: uncertainty hangs thick in the air with the risk of a Trump tweet or article changing the game completely, but one thing feels fairly settled: most companies will likely still offer some sort of guidance. Despite a softening macro picture, persistent trade friction with China, and still uncertainty around what happens after 90 days and future sectoral tariffs, I don’t think we’re back in early-pandemic territory where mass guidance withdrawals were standard fare. Mgmt teams are reading all the same news we are: Tail risks seem to have been taken off the table, the perception is that the administration is walking back Tariffs now after getting a mini-preview of the potential disastrous effects on the markets, meaning mgmt. teams have some sort of a framework on how to think about low end of guidance ranges.

However, there are still pockets of Tech which will remain more uncertain than others: the clear one is companies exposed to China. For example the China SIA news from Friday really muddies things for cos with US fabs like MCHP, TXN INTC, and MU. Or take LOGI for example who pulled their FY guide on Friday as 40% of its computer peripherals were produced in China, 44% which are bound for the US and they had taken the over 100% tariff rate into account. Its previous 2026 guide had only factored in a 20% US Tariff on China imports. Well the exemptions announced Friday don’t really include many peripherals, like speakers or keyboards.