TMTB EOD Wrap

The positive news just keeps on coming for the AI supercycle — today it was NVDA (+4% to new ATHs) and OAI clinching a massive deal where NVDA will invest as much as $100B in OAI, which will help OAI build data centers with a capacity of at least 10 GW of power (Recall every GW of Power for NVDA is ~$40B in revs so this could be worth $300-$500B over time). It starts 2H’26 with Vera Rubin. Here’s more from Bloomberg;

The money will be provided in stages, with the first $10 billion coming when the deal is signed, according to people familiar with the matter. Nvidia is making the investment in cash and will receive OpenAI equity as part of the deal

Jensen: "10 GW or roughly 4-5 million GPU's, that's approximately in one project what we shipped all this year" (interview here on CNBC). Jensen explicitly said this is all incremental to anything being built by OCI, Azure, CRWV, etc

To us, this dovetails with our view and cements further evidence that the AI supercycle is different than any other as we are getting incredible visibility in demand further out than any other previous cycle, which means higher multiples than semi investors are typically used to - both for a name like NVDA and also for cyclical companies exposed to AI demand.

BofA: “Second, and perhaps more importantly, OpenAI will work with NVDA as a preferred strategic compute and networking partner. While no share is specified, the agreement on surface raises the competitive risks for other vendors including AVGO and AMD”…There had been some discussion after AVGO’s $10B OAI announcement around custom ASICs being the future, but today’s announcement shows that it’s a “compute bonanza” as Barclays put it, and general purpose silicon will run majority of OAI through at least 2030…. AVGO -1.6% on the day and AMD +1.5% after being up 3%+ at one point before the announcement. Enough $ to go around for everyone is our view…

BofA goes further, saying it’s a good strategic deployment of FCF:

NVDA's ~40-50% FCF margins on $200bn of topline implies the company will generate $100s of bn of FCF over the next few years. The alternative (beyond returning to investors) is to invest in the ecosystem to expand the size of the addressable opportunity that could multiply future benefits, or accelerate time to market for new products, and/or for geopolitical benefits (such as recent INTC investment).

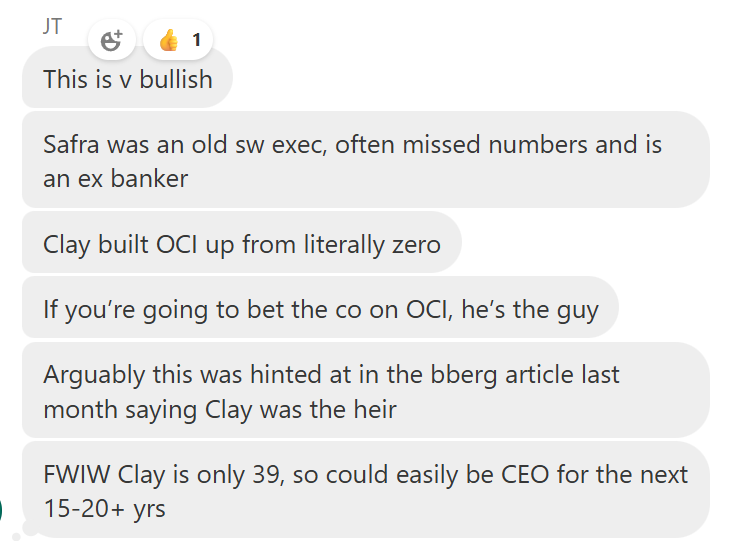

Some great back and forth in TMTB chat here…

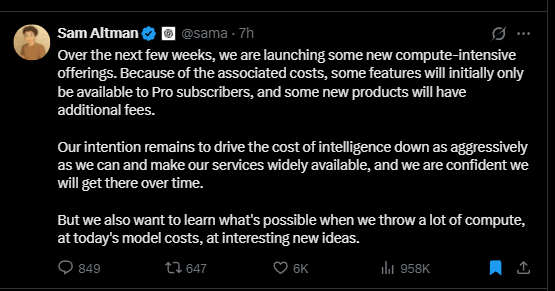

The pace of news isn’t slowing. We touched on the “AI velocity reset” in our weekly a couple weeks ago:

Quarter-long (or decade-long) arcs are showing up in the same week as better capability is driving ROI improvements which in turn is driving adoption acceleration. In other words: the “dizzying pace” of the last two years wasn’t the peak; it was likely just the on-ramp. And we don’t even have Blackwell trained clusters yet…

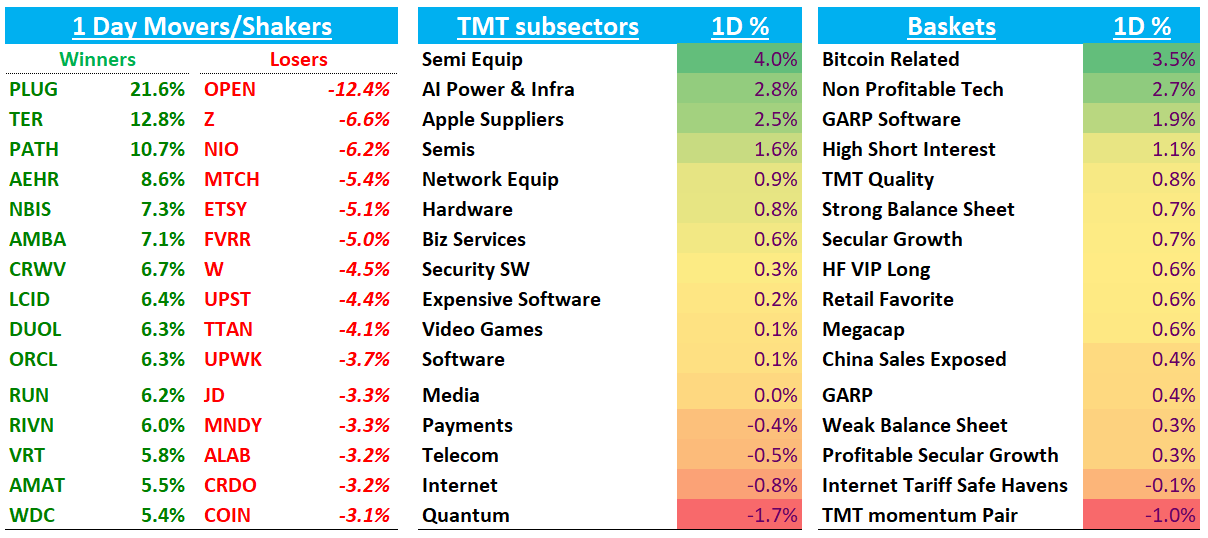

Lots of names up on the news:

ORCL +6% as the NVDA investment de-risks GPU supply for OpenAI, which in turn de-risks Oracle’s ability to fulfill/upsell its AI infrastructure commitments (capacity → revenue runway). OCI Head also promoted to co-CEO

Finally, more news that TikTok’s algorithm to be secured by ORCL.

CRWV +7% as this investment tightens OpenAI’s commitment to the NVDA stack, which is CoreWeave’s home turf — ie, adjacent NVDA-aligned GPU clouds are prime candidates for burst capacity, inferred training, and inference spillover. NBIS +7% hitting all time highs in sympathy as well.

AI Power VRT +6%, VST +3% GEV +3% as 10GW is roughly “ten nuclear reactors” worth of data-center draw and this announcements just cements that power is the big bottleneck. Risk continues to move out the curve for Power names as investors look for anything power related: PLUG +21%; BE +1.5%, FCEL +15%

Large cap internet sold off as was being used as a source of funds for AI names post the news:

META -1.6% despite being up 1% on a positive Barclays note which said Threads/Whatsapp could add $19B in incremental revs in ‘27 and a positive 3p report.

AMZN -1.6%/MSFT -70bps: Someone pitched me the idea that this could be the start of an OAI NVDA cloud. The investment does look like NVDA-financed, NVDA-stack “AI factories” with OpenAI as anchor tenant. Not sure what to make of it - any thoughts let me know...

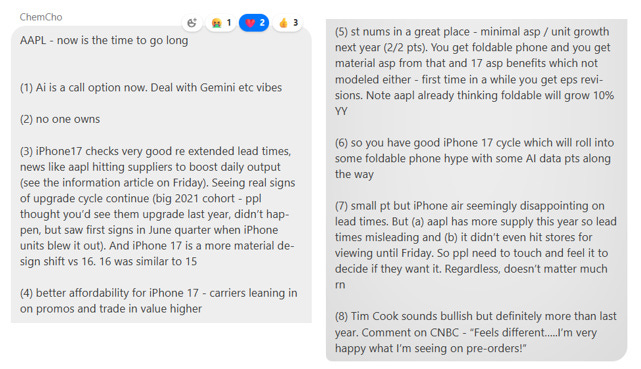

Helping the Internet Megacap as Source of funds was AAPL +4.3% as positive checks over the weekend came back stronger than expected. As is usually the case, a TMTB reader was all over the trade this weekend:

Nice one ChemCho!

Let’s get to it….

INTERNET

SHOP +2.5% to new highs as M-sci was positive saying GMV tracking MSD ahead of street — looks like no slowdown in the GMV acceleration thesis

TTD +4% despite Edgewater downgrading to underperform saying share loss will accelerate in 2026 as take rate pressure already starting

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.