TMTB EOD Wrap

Good afternoon. QQQs +12bps on a relatively slow day ahead of the Fed’s anticipated cut tomorrow. Rates rose slightly due to a hawkish JOLTs report and expectations for a hawkish shift in Fed forward guidance tomorrow.

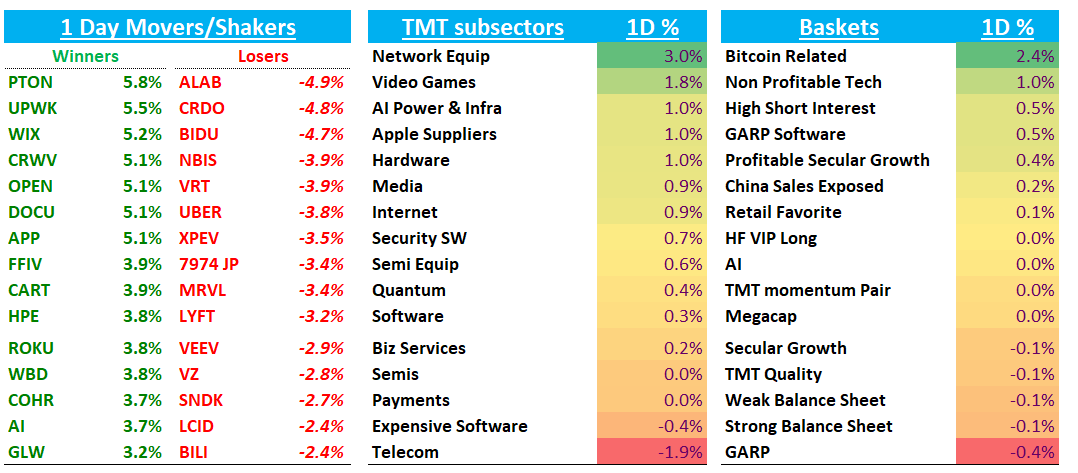

Sector/Factor breakdown: Network equipment led subsectors (+3.0%), helped by solid follow-through in enterprise and optical names, while AI power & infrastructure (+1.0%) also gained (GEV will help tomorrow here too). The SOX ended flat, masking dispersion within semis, while telecom (-1.9%) and expensive software (-0.4%) lagged. On a factor basis, value and short momentum factors outperforming — TMT Value Long rose +1.0% and S Momentum +0.8% — some mean-reversion after a strong run in long-duration and high-beta growth.

We sent out notes to the Gavin Baker ILTB podcast here. Definitely worth a read.

Let’s get to it…

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.