TMTB EOD Wrap

Good afternoon. QQQs +32bps as large cap caught a bid (AMZN/MTEA +2%; MSFT +3%, NVDA +1.5%) helping the Nasdaq end its 14 day losing streak vs. the Russel. Here’s the NQ vs. RTY:

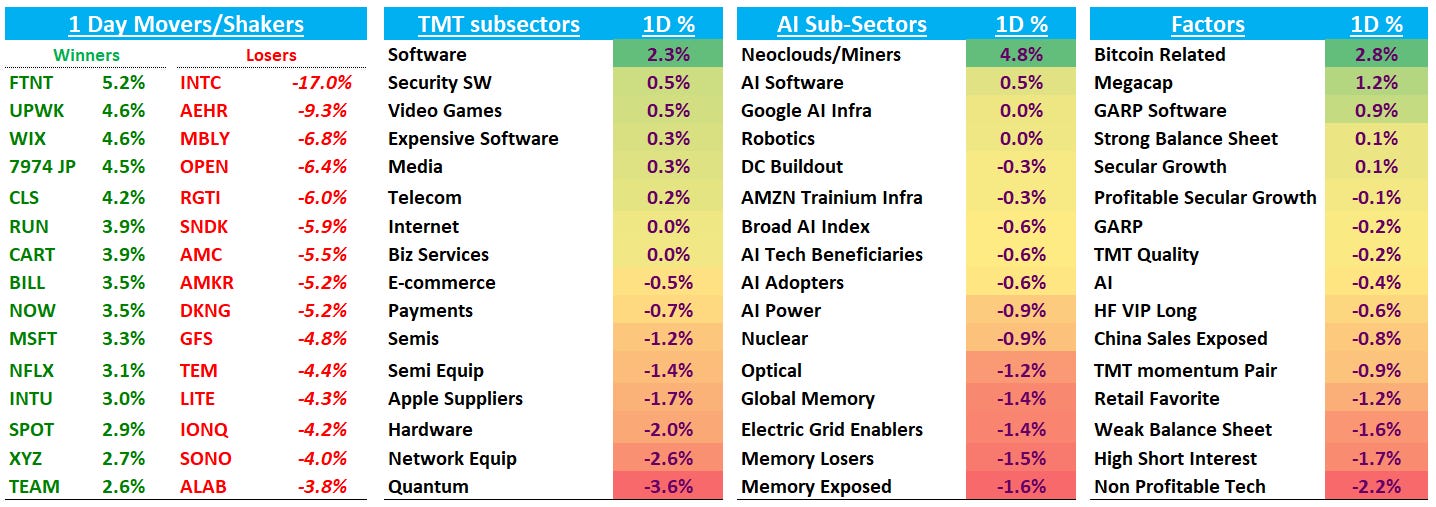

Software (+2.3%) continues to trade well for the 2nd straight day (MSFT +3% and NOW +3% finally caught bids). That ,security, and internet were green, while semis (-1.2%), semi equipment, network gear, and hardware lagged meaningfully although names like AMD, CLS, NVDA and TSM were up. On the factor side, bitcoin-related names and megacap outperformed. Riskier cohorts like non-profitable tech, high short interest, retail favorites sold off. Outsde of Tech, Oil rose 300bps, JPY spiked 165bps vs USD and US nat gas rose 5-6% on the bit storm expectations across the U.S.

Let’s get to it…Enjoy the weekend

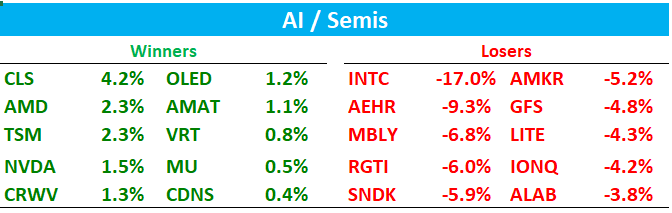

AI / SEMIS

SNDK -6%: we thought energy was there for a potential push past $500 and that’s what we wanted to see today, but seems like we were pushing on a string. Playing with a bit fire given stock up so much obviously, but we thought there was a decent shot. When we think there’s a strong chance stock will go one way, but we’re wrong and it goes the other way than what we think it will do, that’s a sign for us to take sizing down, so that’s what we did. We’ll look for another opportunity to size up, using the chart as our guide. Still, a very good week on SNDK overall. Earnings next week.

CLS +4% bouncing back after rumors earlier in the week of competitive encroachment, specifically that Google may diversify TPU mfg to Inventec and that Jabil is winning share in switch racks. However, bulls pushback is that TPU demand continues to outstrip supply and Google just diversifying supply chain to meet this demand while CLS continues to retain a dominant foothold in both NSF and future “BlueBox’ rack architectures. GFK was out defending today.

NVDA +1.5% on the H200 China approval

AMD +2.3% on the positive demand commentary from INTC’s call and China approving H200.

INTC -17% back to $45: as we said this morning, didn’t hear many bulls wanting to jump ship given demand signals and likely trough GMs in Q1, but also didn’t hear many wanting to jump in above $45. We wrote up the bull vs. bear debate in this morning’s wrap

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.