TMTB Morning Wrap

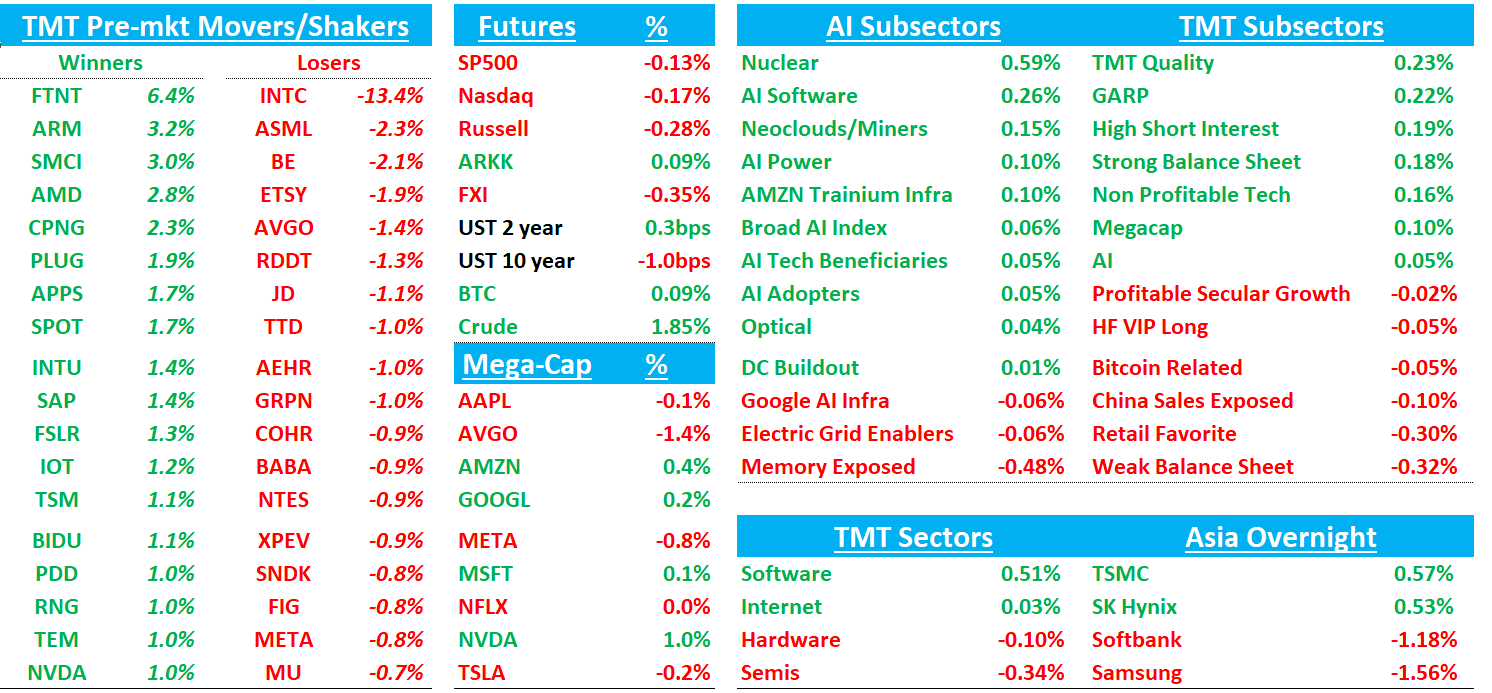

Good morning. QQQs -20bps to start this lovely Friday. Asia mainly up overnight: TPX +0.37%, NKY +0.29%, Hang Seng +0.45%, HSCEI +0.51%, SHCOMP +0.33%, Shenzhen +1.2%, Taiwan TAIEX +0.68%, Korea KOSPI +0.76%. BTC hovering around $89k. Yields are flattish. Fed Odds: Warsh at 44$ while Rieder has crept up to 35%.

NVDA +1%/AMD +3% up early on positive China H200 news.

We’ll hit INTC first then move onto the usual. Have a great Friday!

INTC: DecQ beat on revenue/EPS/GM but guided MarQ below Street (notably GM) as internal + external supply constraints keep them from fully meeting demand

Disappointing print for bulls given supply constraints/missteps (new $ to the stock getting a taste of the “old” INTC), but feedback this morning is don’t hear too many wanting to jump ship off the bull case given the positive demand signals from Agentic demand (good for AMD too), with $43-$45 level where many looking to defend. Great TMTB Chat thread here on the print

The #s:

DecQ Revenue $13.674B, -4.1% y/y (last q +2.8% y/y) vs Street $13.438B, -~5.8% y/y; GM 37.9% vs Street 36.5%….MarQ guide midpoint Revenue $12.2B, -3.7% y/y vs Street $12.565B, -~0.8% y/y; GM 34.5% vs Street ~36.1–36.5%… GM beat in DecQ (benefiting from lower inventory reserves), but Q1 GM guide to 34.5% reflects lower revenue, higher 18A mix, and product mix. Management described Q1 as the most acute period and guided for improvement as supply loosens

DCAI $4.737B, +8.9% y/y (last q -0.6% y/y) vs Street $4.421B, +~1.6% y/y while CCG $8.193B, -6.6% y/y (last q +4.6% y/y) vs Street $8.296B, -~5.4% y/y; …mgmt explicitly noted they are prioritizing internal wafers to data center and using more outsourced client wafers, which also has margin implications. Bulls interpret this as rational mix (follow demand/pricing); bears see it as evidence of fragile supply planning that can worsen competitive dynamics in client and server.

Key commentary: mgmt cited a market that moved from “tariff-driven uncertainty” in 1H to AI-driven demand constrained by supply in 2H, but also flagged that DRAM/NAND/substrate tightness + rising component pricing could weigh on the client market this year. Mgmt repeatedly framed results and guide as being constrained by internal capacity and external components rather than weak sell-through; they specifically said buffer inventory is depleted and that internal constraints are most acute in Q1, with improving supply starting Q2 and continuing through the year.

On foundry, INTC highlighted (1) shipping 18A products, (2) 18A yields improving steadily, (3) 14A on track with customers engaging and firm supplier decisions expected 2H26–1H27, and (4) advanced packaging differentiation (EMIB/EMIB‑T) with ramps beginning 2H26. Counterpoint: foundry losses remain large and many investors focus on when these milestones become material external revenue (and how much capex is needed once customers commit).

ON WFE Spend (h/t JT):

“what we're devoting more of our dollars to is tools, so we are ramping up tool spending quite a bit in 2026 relative to 2025 to address this supply shortfall as well, and in fact, every quarter, we're seeing kind of wafer start increases pretty much across the board across Intel 7, Intel 3, and 18A. So all three of them every quarter improve and get better to address the supply….we are aggressively getting tools on Intel 7, Intel 18A. That is happening. And we will be increasing our wafer starts as aggressively as possible on those nodes.”

Bull vs. Bear Debate:

Bulls say the print is less about demand weakness and more about a temporary “conversion problem” driven by supply and mix—i.e., demand is there (especially in servers/AI), but constrained capacity and component availability cap what can be shipped in the near term. From this view, the MarQ guide is a trough quarter: buffer inventory is depleted and the internal wafer mix shift toward servers doesn’t show up until late Q1, so the reported guide understates what the market would consume if supply were unconstrained. Customer announcements coming. Bulls point to management’s explicit expectation that supply improves beginning in Q2 and continues through the year, enabling a run-rate that’s better than seasonal thereafter. Bulls focus on a convergence of strategic milestones: (1) client products (Core Ultra Series 3 / Panther Lake) are now shipping on 18A with favorable early performance commentary; (2) DCAI is benefiting from AI infrastructure build-outs, with management emphasizing the CPU’s central role in inference-heavy AI data centers; (3) custom ASIC has reached >$1B annualized run-rate and management is explicitly leaning in to pursue a much larger TAM; and (4) foundry progress is tangible—18A products shipping, 14A on track with customers engaging and a defined decision window (2H26 into 1H27), plus advanced packaging (EMIB/EMIB‑T) emerging as a potentially meaningful revenue vector earlier than full-node external wafer ramps.. Above all, bulls say they have the biggest cheerleader in the country waiting to pump the stock if it goes down too much as INTC has become a strategic asset for the country.

Bears will say pretty bad print for a “good demand” situation and bulls are just playing for Trump tweets. They say the q exposes a more structural problem: Intel is in the middle of a strong server/AI cycle, yet it is constrained by its own capacity planning and yield ramps, effectively “missing the moment” when demand is best—an especially painful outcome for a vertically integrated company. From this view, supply constraints are not a benign, one-quarter speed bump; they can persist longer than bulls hope, forcing Intel to make allocation trade-offs (client vs server) that can worsen competitive dynamics and/or customer mindshare. Bears also highlight that management itself flagged not just internal constraints but industry-wide tightness in DRAM/NAND/substrates and rising component pricing, which could limit unit growth and keep the client market pressured, even if Intel’s own product line is improving. Strategically, bears accept that milestones are being met—but argue the timeline to monetize them remains long, while the financial drag is immediate. Foundry operating losses are still large, and even if customer engagement on 14A is “active,” the decision window is late (2H26 into 1H27) and the ramp to meaningful revenue is typically later still; meanwhile, the early 18A ramp is mix-dilutive and pressures gross margin in the near term.

Tech Research/News

NVDA: China Tells Alibaba, Tech Firms to Prep Nvidia H200 Orders

Chinese officials have told the country’s largest tech firms including Alibaba Group Holding Ltd. they can prepare orders for Nvidia Corp.’s H200 AI chips, suggesting Beijing is close to formally approving imports of components essential to running artificial intelligence.

SPOT: Goldman Sachs Upgrades to Buy, Cuts PT to $700 on Improved Risk/Reward

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.