TMT Morning Wrap

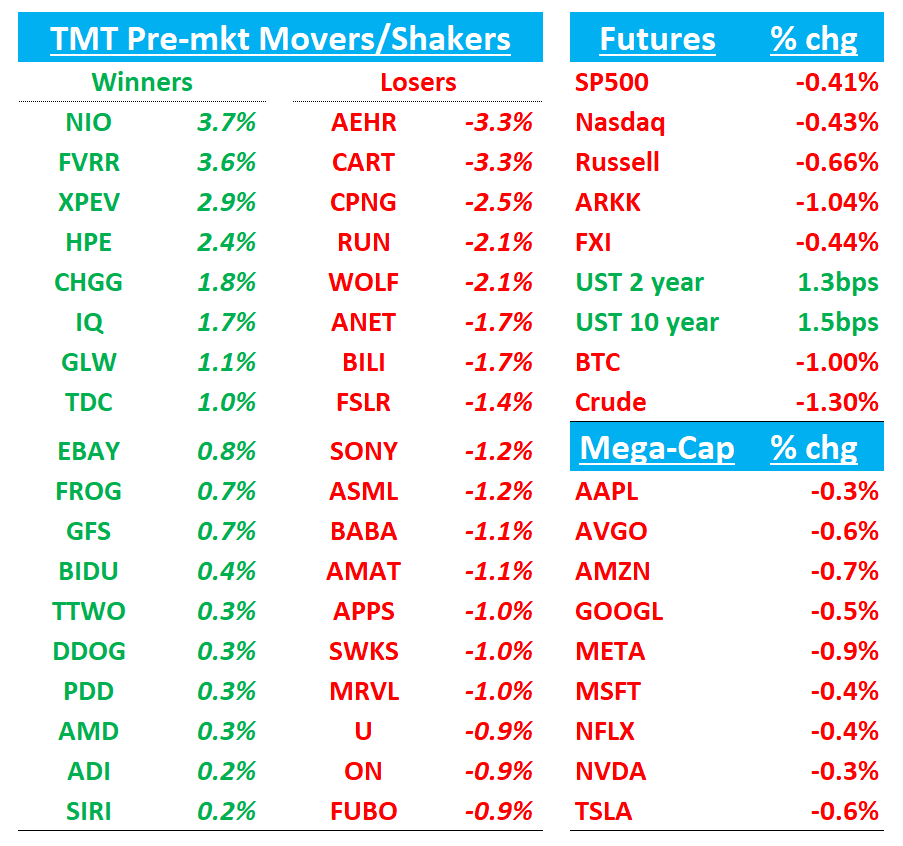

Good morning. Futures -35bps weak as investors continue to focus on Jackson Hole tomorrow.

WMT -3% on expectations miss but noted consumer remains “resilient”.. Also: "But as we replenish inventory at post tariff price levels, we've continued to see our costs increase each week. Which we expect will continue into the third and fourth quarters."

We get INTU and WDAY post-close.

BTC -1%. China -50bps. Yields ticking up 1-2bps across the curve.

I’ll be out this afternoon and tomorrow. Have a good rest of the week.

Let’s get to it!

NVDA: UBS Lifts PT to $205, Expects $54–55B FQ3 Revenue Guide

UBS raises its price target on Nvidia to $205 from $175 while reiterating a Buy, pointing to continued strength in data center demand. The firm forecasts FQ2 revenue around $46B, with FQ3 guidance likely in the $54–55B range excluding China, and potentially as high as $57B if China is included. Supply chain checks suggest compute could grow 20–25% q/q on a $35B base in FQ2, translating to $7–8B of incremental revenue in FQ3. Networking is less certain given reported 800G shortages, but UBS still expects ~$6B in FQ3 sales, nearly $1B higher q/q.

NVDA: Jefferies Highlights Blackwell Ramp ahead of the print

Jefferies’ Blayne Curtis notes the Blackwell ramp is progressing, though not as quickly as hoped post-Computex, with B300 layering expected in October. The firm notes October networking revenue could be up to $9B versus Street at $6.4B, while the overall guide could be capped near $53B given license constraints and Chinese government pressure on local firms to avoid Nvidia products. Jefferies notes client feedback shows investors are focused on guidance differences from Wistron, Quanta, and Hon Hai, with flat sales commentary from the former 2 raising concerns. Jefferies also highlights Sherman’s chip production checks, which now point to Blackwell GPU volumes rising to 1.5M in 3Q25 and 1.6M in 4Q25, suggesting Nvidia has room to meet or exceed DC expectations.

APP: Wells Fargo Lifts PT to $491 on Strong Web Ads Momentum

Wells Fargo raises its price target on AppLovin to $491 (from $480) after a deep dive into web advertising trends, highlighting multiple growth drivers ahead of broader availability in 2026. The firm notes July web traffic to APP advertisers jumped 40% y/y, double the pace seen in January, with clear evidence of incremental lift from the Applovin Pixel. While customer growth has slowed in recent months, Wells Fargo stresses that new signups are significantly larger in scale, with notable wins like ThredUp, Anker, and Ruggable. WF also sees considerable runway with existing attribution partners, as penetration remains low at just ~17% of domains.

APP: Loop Reiterates $650 PT, Calls Pullback a Buying Setup Ahead of Catalyst

Loop Capital reiterates its $650 price target on AppLovin, framing the recent pullback as an attractive entry point with a major growth catalyst just weeks away. The firm expects a steep ramp in both customer adoption and revenue, supported by what it sees as one of the most durable, high-margin business models in the sector. Loop also highlights the coming rise of third-party app stores, which they believe will expand acquisition spend among mobile game developers, with AppLovin positioned to capture an outsized share.

HPE: MS Upgrades to Overweight, PT $28 on Networking and AI Exposure

Morgan Stanley upgrades HPE to Overweight from Equal-Weight and raises its price target to $28, citing underappreciated upside from networking and AI-related exposure following the Juniper acquisition. The firm sees FY26 EPS at $2.51, implying ~18% upside to consensus, with EPS potentially growing to $2.70–$3.00 in FY27 as synergies take hold. MS argues that as investors better recognize the significance of HPE’s pro forma networking segment, multiples should expand above the current 8x level, and just 11x implies ~33% share upside. Looking ahead, MS highlights the October 15 Analyst Day as a major catalyst likely to provide long-term guidance that could help re-rate the stock and cites execution as main risk.

We said something similar in our weekly and EOD Monday:

Average HPE has been around 9-10x while JNPR has traded on average around 14-15x. Don’t think unreasonable pro-forma could trade at ~12x (I can sketch $3 in ‘27 EPS in a bull scenario)…~50%+ of EBIT becomes Networking post-deal. If we value Networking at ~13-14× (midpoint between CSCO-like low-teens and JNPR mid-teens) and the remaining Compute/Storage/Services at ~10× (in line with HPE history), the weighted P/E lands near 12x…Networking brings steadier mid-single to low-double-digit growth drivers (campus refresh, AI/DCF fabrics, SP/core), which lifts the consolidated growth/visibility profile above HPE stand-alone. Networking EBIT margins also > compute/storage while synergies should help as well. Co definitely needs to show they can execute though which remains big question mark for investors right now.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.