TMTB: EOD Wrap

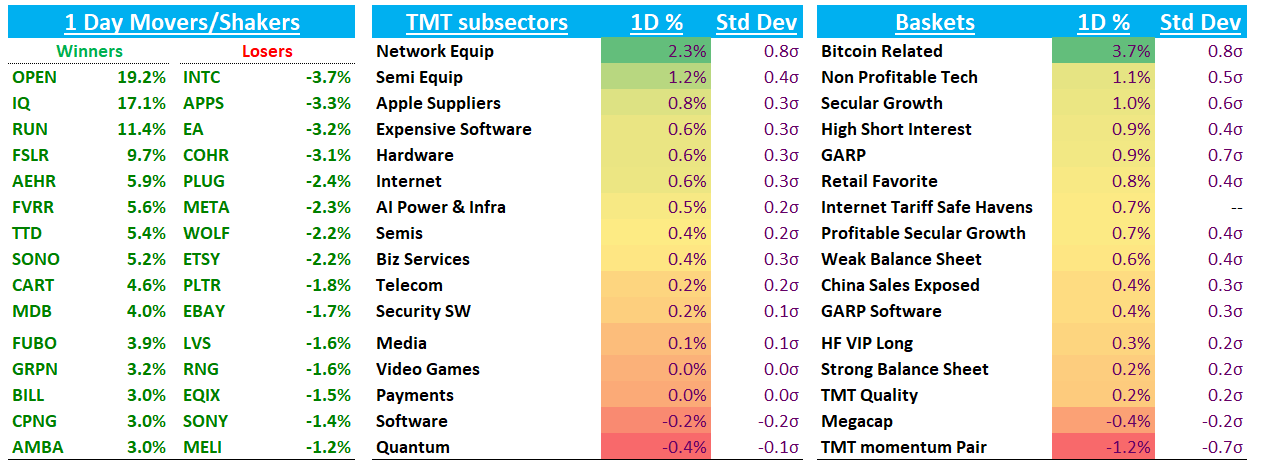

Good afternoon. Futures finished flat in a sleepy August Monday with yields rising 2bps across the curve. Fed expects continue to price ~20bps worth of cuts in Sept and ~2 cuts over the course of the final three meetings. We’ll see if those change post Jackson Hole on Friday.

We had a good idea thread here in TMTB chat. Lots of good discussion - the more contributions the better, so jump in!

Names in the “structural” short bucket caught a bid today: DUOL up double digits, FVRR +6%, TTD +5.5%, WIX +4%. Software has been acting a lot better over the last few days.

Otherwise, fairly quiet day - the next two big catalysts are Powell on Friday and NVDA earnings next week

Post-close, PANW +5% looks v. solid with beat across most important metrics: RPO +24% vs expects of 20-21% and NGS grew 32% about in line with bogeys. The Q1 RPO guide 23% above expects of 20% and NFS ARR guide 29%, slightly above. FY26 also looks good with NGS ARR 26-27% vs expects of 25% and raising FCF margins to 38-39% vs street at 37% and targeting 40% margins post-CYBR. Top line guide for 14% vs 13% bogey. RPO +17.5% about in line. Zir, co founder and CTO is retiring.

INTERNET

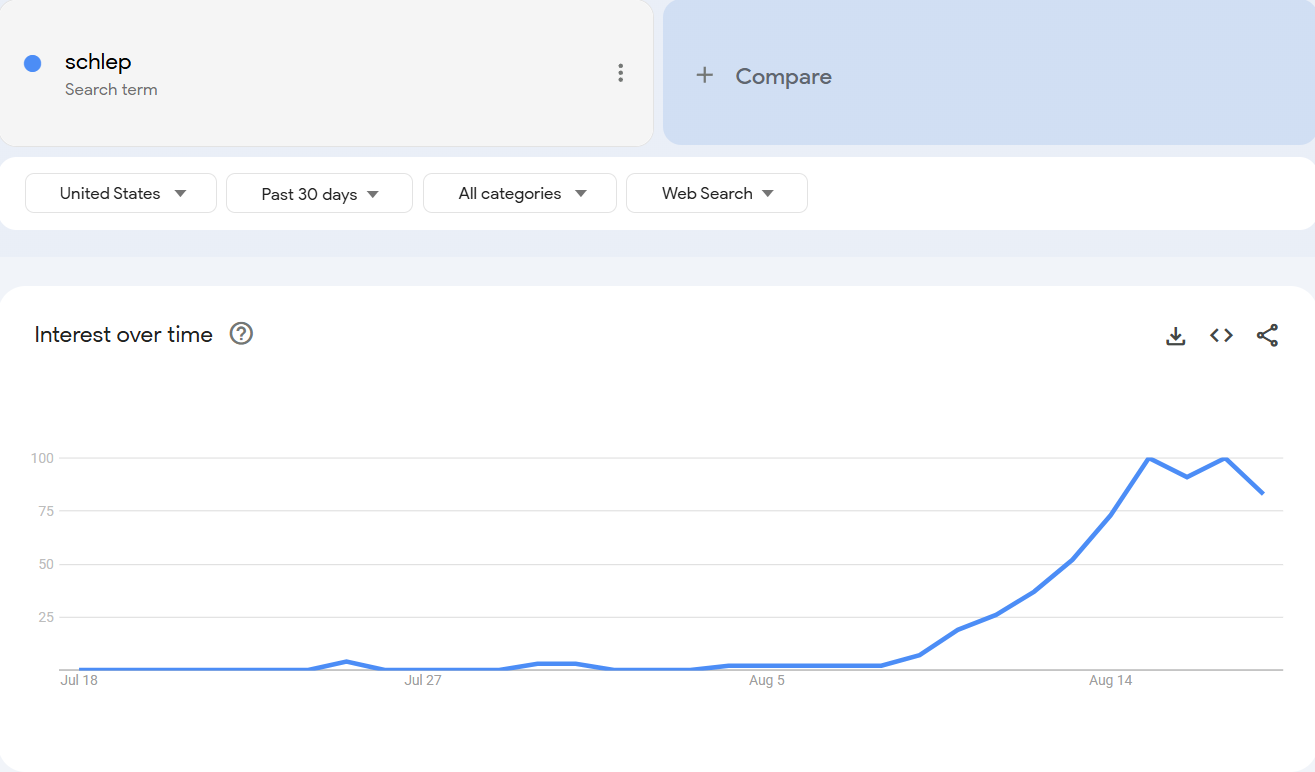

RBLX +2.3%: all quiet on the Schlep front and noise already dying down. Here’s Google trends:

Here’s how we framed it in our weekly yesterday:

Our base case remains the noise around this controversy blows over quickly (news coverages around social controversies tend to last 1-3 weeks), while longer-term concerns/publicity around child safety won’t go away soon and will continue to pop up here and there.

Added a 2wk Call spread today — likely get a positive 3p release late in the week (RoTrends/RoMonitor tracking to 65%-80% bookings QTD), which could act as a catalyst. Left tail risk remains more AGs piggyback on Louisiana or Trump admin gets involved - we think it’s a low probability event, but if you’re worried about that then hedging with OTM puts works. Hedgeye was out today adding stock as active long and Cowen raised estimates but refuses to budget on his sell rating.

DUOL +13% as Keybanc upgraded to Buy and Citi initiated at Buy with $400PT. Last week we wrote:

Stock now down 30%+ from top of the squeeze last week. Not a bad spot to take some off the table if you’re short, but the stock likes to ride the 20d (both higher and lower) so we’d use that as a guide for risk management as its possible stocks continues to trend down.

Well — the stock popped above 20d so we exited what remained and wait for a better set up going forward — we’re re-evaluating for now. . Still lean short on this given multiple structural headwinds and 3p checks continue to show net adds decelerating, but we always have a shorter leash on shorts, especially in a bull market. You can tell from the move today that positioning is stretched with many shorts in the name now.

META -2.2% - lots of questions on this but no great answer why stock was down 2%+. TheInformation was out talking about restructuring of super intelligence unit, some neg press around their AI chat bot, and a neg read-through to their glasses price cut which would imply more proclivity to take a hit on margins in reality labs. Also heard some employee RSU vesting that happens every few months.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.