TMTB Weekly: Sentiment/Positioning/Narrative Roundup

Happy Sunday. QQQs +2% on the week. We won’t get into macro this week as not much has changed from last week: we still expect an upwards trending, somewhat choppy market and don’t see many tea leaves on why to back off that stance (BTC failed breakout is only thing I have my eye on).

We wrote last week about how the bull vs bear macro narrative had shifted in favor of the bulls given Trump admin now focused on “running it hot” instead of deficit reduction. This week, we think even more shifted away from bears as yields took a step back. Here’s what we wrote last week, which we think still holds:

Bulls continue to point to bullish price action, Trump is saying buy stocks again and seems back to caring about the market direction, likely very healthy Q1 earnings, China and U.S. are de-escalating, potential for deals to get signed any day, admin’s focus shifting to tax cuts and de-regulation in 2H, Trump is back to “good for stocks” Trump as he says buy them, hard data still holding up (some better flash PMIs this past week) pointing to no recession. DOGE is in rear view. Oil is at $60. Investors have significantly reduced net exposures, animal spirits seem to be back (look at CRWV, or Quantum and Nuclear this past week), and pain trade continues to be higher.

Bears will say the view that the worst of the tariff-related economic damage is behind us is premature as the true impact will now begin to filter through the data while pointing to companies like AAPL and AMZN where brunt of tariff hit will only begin to be felt after the June Q. Bears will say while tariff rates will go lower, they are poised to stay well above where they stood back in January, particularly China’s.

Yields are breaking out.The impact of supply chain disruptions and increasing prices will begin to filter through the econ data over the next few months. The index is still expensive which leaves little room for error (22x+ EPS of $265).Yup, feels like bull narrative stronger at this point…

Investors consensus seems to be that Tariffs will eventually settle in the 10% range for most countries. No one is believing any exorbitant tariff #s Trump puts out … This type of lower vol price action environment supports the case for higher gross. We think this bullish environment should continue until we are at least a couple weeks away from July 9th deal-deadline (let’s call it mid/late June). In mid/late June, things get a little tricker as 1) 90 day deadline 2) prices start to potentially increase in economy and 3) 2H guides for some tariff-impact companies might make set up into earnings tricky.

Ok, now that’s out of the way — let’s get to the good stuff:

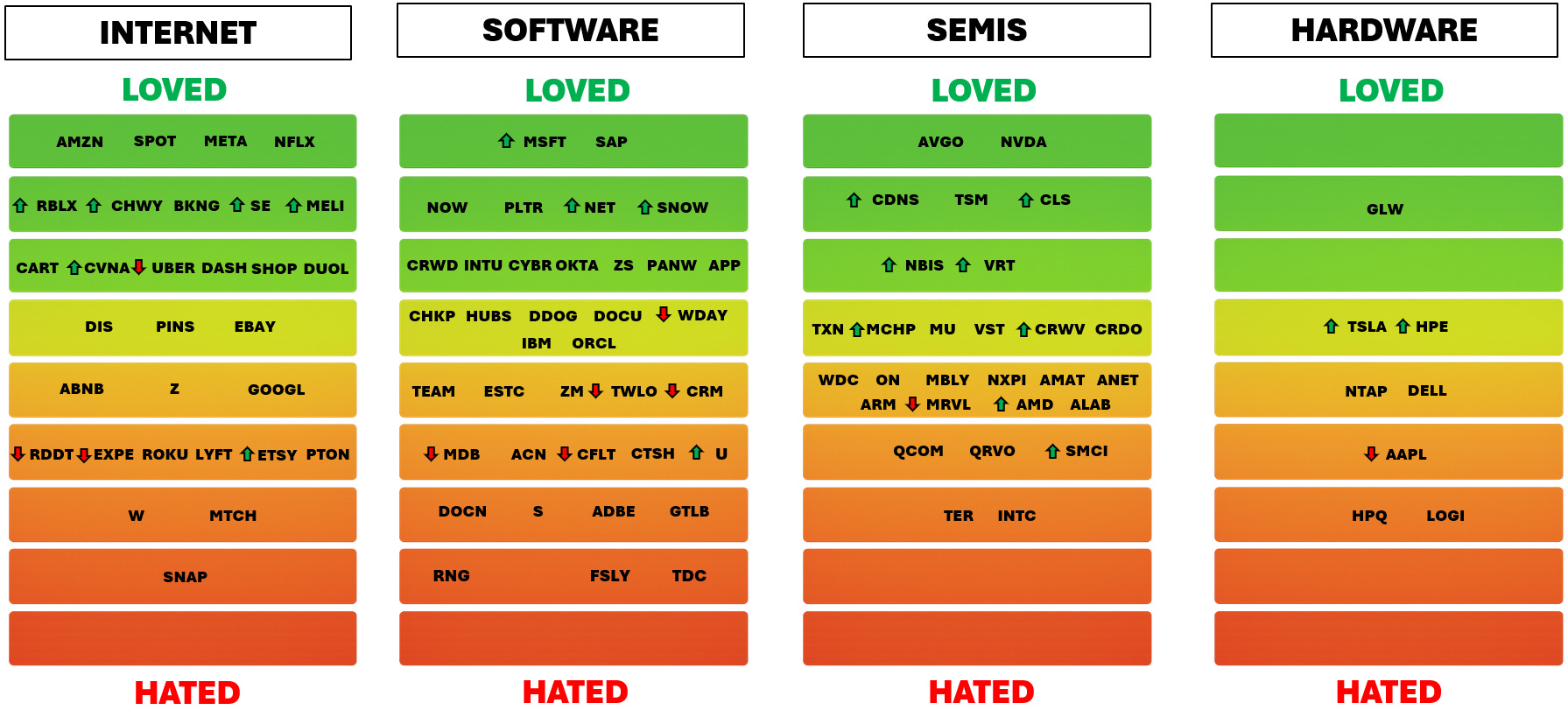

SENTIMENT/POSITIONING/NARRATIVE ROUNDUP

INTERNET

META continues to be one of the most crowded longs in internet and remains one of our favorite LT compounders showing it can drive significant ROI from their AI investments, nascent biz messaging, META AI, and Threads monetization, is the safest place to hide in ads, executing extremely well, and trades at a very reasonable multiple. Some concerns around Q3 guide given mgmt said Europe could see revenue friction from DMA tweaks and lack of operating margin expansion given higher depreciation as well as climbing headcount in technical roles to keep AI momentum. (This might flip in CY26 as mgmt has said AI doing increasing amounts of coding work). The other main worries here are increasing capex spend, cyclical ad spend and indirect China tariffs exposure (Shein/Temu/SMB spend), but for now those have taken a back seat. We don’t have a strong view on this one near-term. Assuming macro holds up, I can pencil in $30+ in Cy26 EPS and 25x is $750. 3p data seems to be calling for an inline quarter.

AMZN is in the same bucket — remains a crowded long and a favorite LT compounder, but we don’t have a strong view near-term. 3p pointing to a 3-4ppts NA and Int’l retail beat and Jassy has sounded positive on CNBC and shareholder meeting. AWS however still trending just in line-ish although 3p comps get easier throughout the rest of June. If we see a turn higher in AWS data, we would get more excited about sizing up. AWS CEO Garman sounded good on a Bloomberg interview sounding bullish on AI, huge year for migrations, inference usage exploding, etc. Medium/Long term bull case here remains eventual AWS acceleration in 2H as capacity constraints ease and continued operating leverage power in retail/AWS. Concerns center around lack of AWS accel yet + 17% growth looks pedestrian next to Azure’s mid 30s growth; 2H tariff impact on EBIT margins; extra Kuiper expenses and >$100B capex run rate.

SPOT sits near highs and continues to be one of the cleanest stories in internet and is crowded and loved for that very reason (as well as it not being exposed to tariffs). The stock acts like teflon and I don’t hear many bears on this one any longer. Stock is viewed as extremely recession resistant - I would argue even more so than NFLX. ….Bull case here remains: 1) Pricing power still under-monetised – the core plan remains cheaper than rivals in most developed markets, giving management plenty of room to nudge ARPU — we got news a month ago they were announcing a price increase in Europe 2) Multi-format flywheel – podcasts have proven the model; audiobooks and eventual learning courses extend listening hours and ad inventory 3) Marketplace leverage – two-sided platform tilts negotiating power away from labels as indies and self-serve tools scale 4) Margin runway - new formats will continue to drive GM - Every extra point of GM drops almost entirely to the bottom line…Other catalysts: Q2/Q3 Staged rollout of Deluxe / Superfan tiers (higher-quality audio, exclusive drops), Second wave of regional price increases once new tiers establish value perception, and Audiobook expansion into high-income EU/Asia markets with à-la-carte upsell. Sounds pretty good to me.

NFLX is near highs and falls in the same bucket as SPOT and remains a favorite/loved story in internet not exposed to tariffs and viewed as very recession resistant. Bull case centers on a best in class co/mgmt team, great 2H content slate and continued ARPU expansion as Ad-tier ramps up. Bulls are near $40 in $27 and say slap a 35x multiple on that = $1,400

GOOGL debate continues to rage between bulls and bears although I have been hearing more bulls as of late. The AI narrative here seems very much like a barbell to us. On one side, you have the potential likely cannibalization of traditional search revs from Gen AI. On the other side, you have GOOGL ramping up AI monetization and a company with immense scale and resources that seems to be shipping more and better AI product with Sergey back.

We stay away both on the long and short side as the set up seems a bit too muddied. The trade into I/O, coupled with bottomed out sentiment and better 3p data was where the easy money was made (we missed it.). The 3p dataset is a bit mixed: Yipit showing better search revs but I’ve seen other data that isn’t as positive. Yipit saying GCP tracking below. Youtube a wild card. We get the next Yipit search rev update this Friday, which will encompass the last 3 weeks and will probably set the tone for the remainder of the q. Risk/Reward here seems $145/150 at the bottom $190 on the up so skews up slightly. Probably doesn’t go under $145 unless search gets worse. We like simple and clear and this one doesn’t fit the bill right now, so we pass.

Some of the more interesting stories/debates in internet right now are in non-Mega-cap names:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.