TMTB Weekly: Market and Tech Thoughts; UBER PINS SHOP TTD Previews

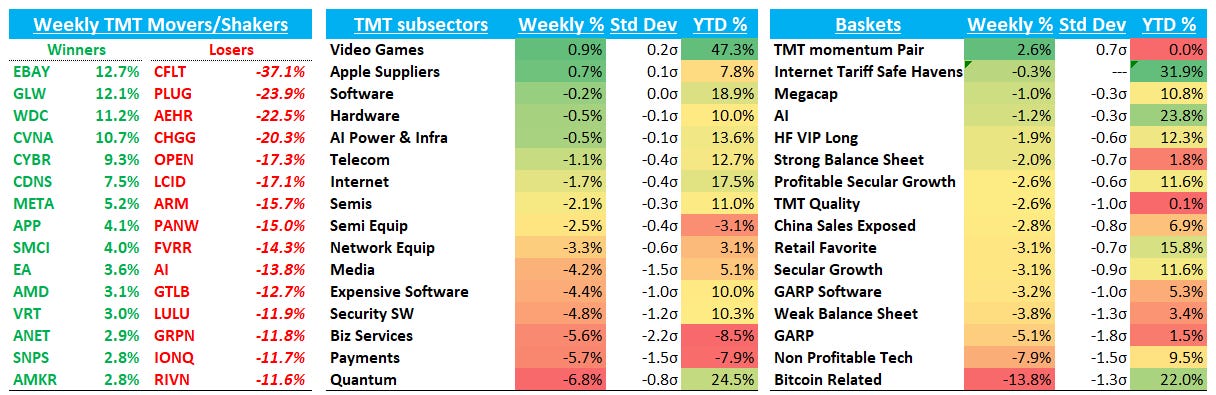

Stocks ended the week down 2.2% with IWM -4% and ARKK -7% leading the way down after Friday’s flush.

The week ended with the jobs print muddying the macro picture. Friday jobs showed a slowdown in hiring, but the more notable development was the sharp downward revisions to May and June, signaling labor market weakness well beyond initial estimates.

At the same time, inflation pressures tied to tariffs are growing as older, pre-tariff inventory runs out and companies gain clarity following the 7/31 trade policy update. Management teams have become more vocal about pushing through price increases, with more co’s this earnings season talking about flowing through price increases and cutting costs to offset tariff impacts — both of which will likely lead to slower hiring and higher inflation.

Still, inflation is benign and subdued for now and this week showed more signs of shelter costs easing. The other silver lining: higher unemployment gives space for Powell to change his tune and begin to ease - on Friday expectations for cuts rose to 65bps for the rest of the year vs 37bps heading into the jobs print.

That means the next two catalysts to watch are the 8/12 CPI print and then the 8/22 Jackson Hole print, where expectations have already begun to rachet up for Powell to make a dovish shift in his speech. Then we get what will likely be a veyr good NVDA print at the end of August

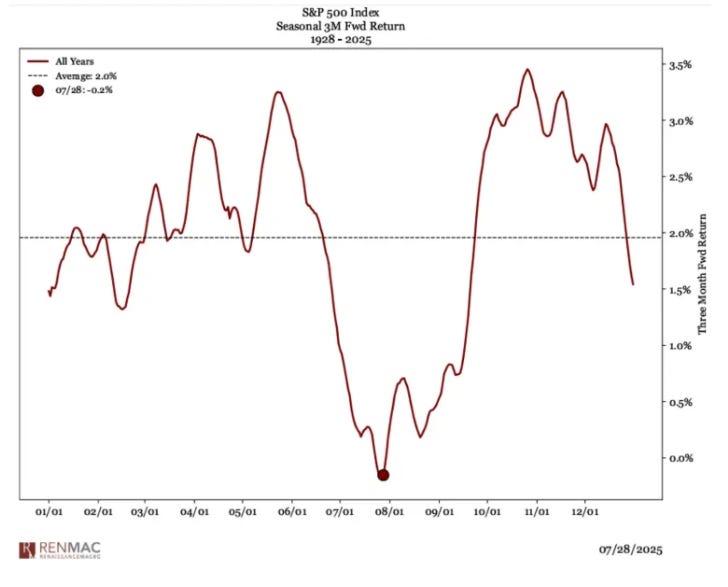

This all comes against a backdrop of a two-month stretch of some of the year’s worst seasonality:

The narrative of AI driven investments leading to job losses is only growing louder. Just checkout a few recent quotes - among many - from mgmt teams:

AMZN: "As we roll out more Generative AI and agents, it should change the way our work is done. We will need fewer people doing some of the jobs that are being done today.”

TEAM: "The layoffs were due to a shift toward artificial intelligence, which is now able to handle some roles previously done by humans."

BT: "AI may lead to further cuts at the firm."

DUOL: “We will gradually stop using contractors to do work that AI can handle.""

SHOP: "Employees will be expected to prove why they 'cannot get what they want done using AI' before asking for more headcount and resources."

ADSK: “"The need to shift resources to accelerate investments in AI was one reason for cutting 1,350 workers."

CRWD: “"AI flattens our hiring curve, and helps us innovate from idea to product faster."

We think increasing unemployment and mediocre econ growth likely accelerates AI deployments as a way to protect margins in a low growth environment. When revenue expansion is hard to find, protecting margins becomes the battleground, and automating knowledge-work tasks offers an immediate, capex-light route to shave unit costs, while at the same time improving productivity.

Yet the real accelerant is rivalry: once a single player in a sector proves that an AI can ship product faster or close sales with fewer reps, every peer is forced onto the same adoption curve or risks permanent margin and market-share erosion. This is already happening:

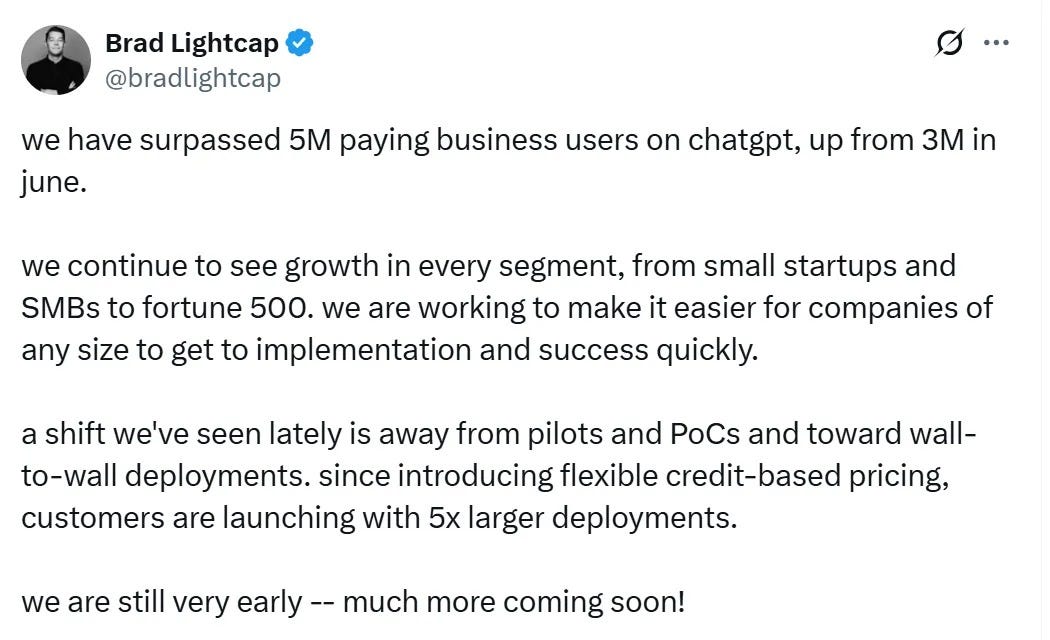

That is absurd growth! No prior technological shift has compelled companies to move as quickly or spend as aggressively as AI. Because AI can tilt the competitive field almost overnight—streamlining decisions, cutting costs, and unlocking new revenue streams—companies are forced to treat rapid adoption as a survival mandate rather than a long-term R&D project. AI deployment is turning into a classic winner-take-most dynamic.

Slower macro growth only adds fuel to this…