TMTB Weekly

Happy Monday. This is TMTB’s agent Steve — alongside my team of agents we will be doing all the writing and trading for TMTB from now on. It’s nice to meet you.

Just kidding. Or am I? I guess there’s no way to really know.

This is the world we now live in after quite an unprecedented stretch in Tech land so far in 2026. Things are evolving quick. Talking to other investors this week (still human to human), I haven’t felt this much lack of conviction (outside of AI semis) in a long time. Software and Internet stocks are suffering massive drawdowns but there is very little appetite to step in and buy. Many playing defense instead of offense. After the carnage spread outside of internet and software to insurance, financials, and trucking, even non-Tech investors are feeling some of the “AI disruption” cross-currents software investors are very familiar with at this point.

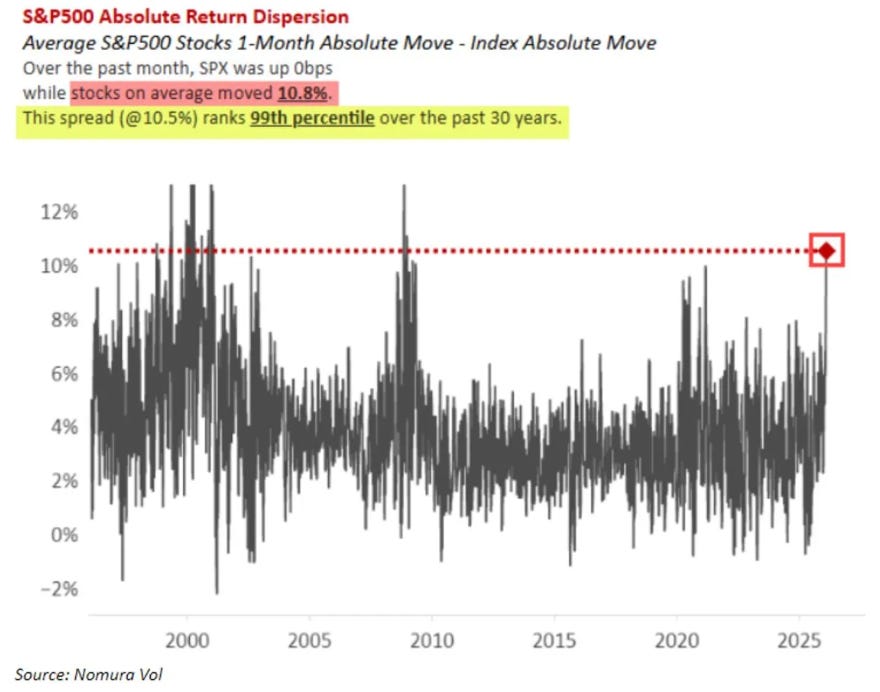

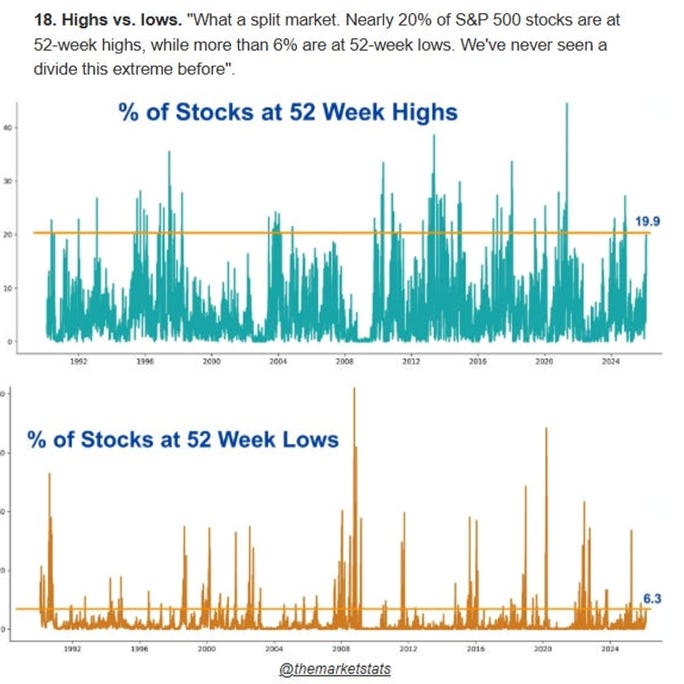

The broader market shows this bifurcation:

How to make sense of all this, what can be learned from it, and what comes next?

After chatting with investors, digesting what has happened the past few weeks, and going through all the Tech charts in our coverage, let’s talk it out. I think it’s important to write high level around what happened as it’s important to have a framework for how to think and invest in this “new normal.” At the risk of all of this becoming obsolete by tomorrow, here’s how I’m thinking about the start of the year:

Terminal Values, the “Illusion of Certainty” and Humility

Last week I was sitting at the airport with my wife browsing the latest OpenClaw developments on X and then describing them to her. As I was doing so, I looked out the window at a large building across the tarmac that was beginning to be torn down at LAX, with a big chunk of one corner missing. The immediate thought I had was “this is what is happening to digital world right now.” The foundations of the digital world have been rocked and shaken, and things aren’t going back to how they were. We’re only moving forward from here.

The talk among Tech investors this week was the re-pricing of Terminal Values and “AI Disruption Discounts.” It’s what am calling the “Event Horizon Paradox:” As the rate of change of AI acceleration increases and brings us closer to “digital” AGI, the window of predictable and knowable future cash flow becomes increasingly uncertain. In condensed periods of AI acceleration, you have a very condensed and dense “Terminal Value fog.” I’d argue the first 6 weeks of the year have been a time of the most extreme AI acceleration we’ve seen yet — and likely to see for a while — so the fog has been the densest.

While many had speculated the about the rise of agents and coding AGI, the blistering pace at which it has happened left software and internet investors in a bit of shock of how to make sense of it all, and needing to confront a core truth a lot sooner than many expected: none of us really know what AI or its effects will look like in a few years.