TMTB Weekly

I hope everyone is enjoying their long weekend. Not much new to add on the macro front this week. The environment continues to feel solid for stocks to us: subdued inflation, steady econ growth, fed easing cycle near the end but still intact, new biz friendly administration helping drive deregulation/increased biz confidence, yields have come off and the 10 year sits below 4.5%, oil close to $70, USD 5% off its highs, China has turned a corner, and an AI supercycle that is still intact. News out of Washington seems subdued as market has shaken off the slow drip of tariff headlines as most view is as predominantly a negotiating tactic. There looms some new uncertainty around DOGE and the impact of cuts. We continue to think macro releases will have outsized impacts on the market, although the market looked through a hotter CPI this week.

This all makes for a choppy but upward trending market…QQQs finally broke out of the range they’ve been in since Mid-Dec to close at all-time highs:

A few other things we’re watching:

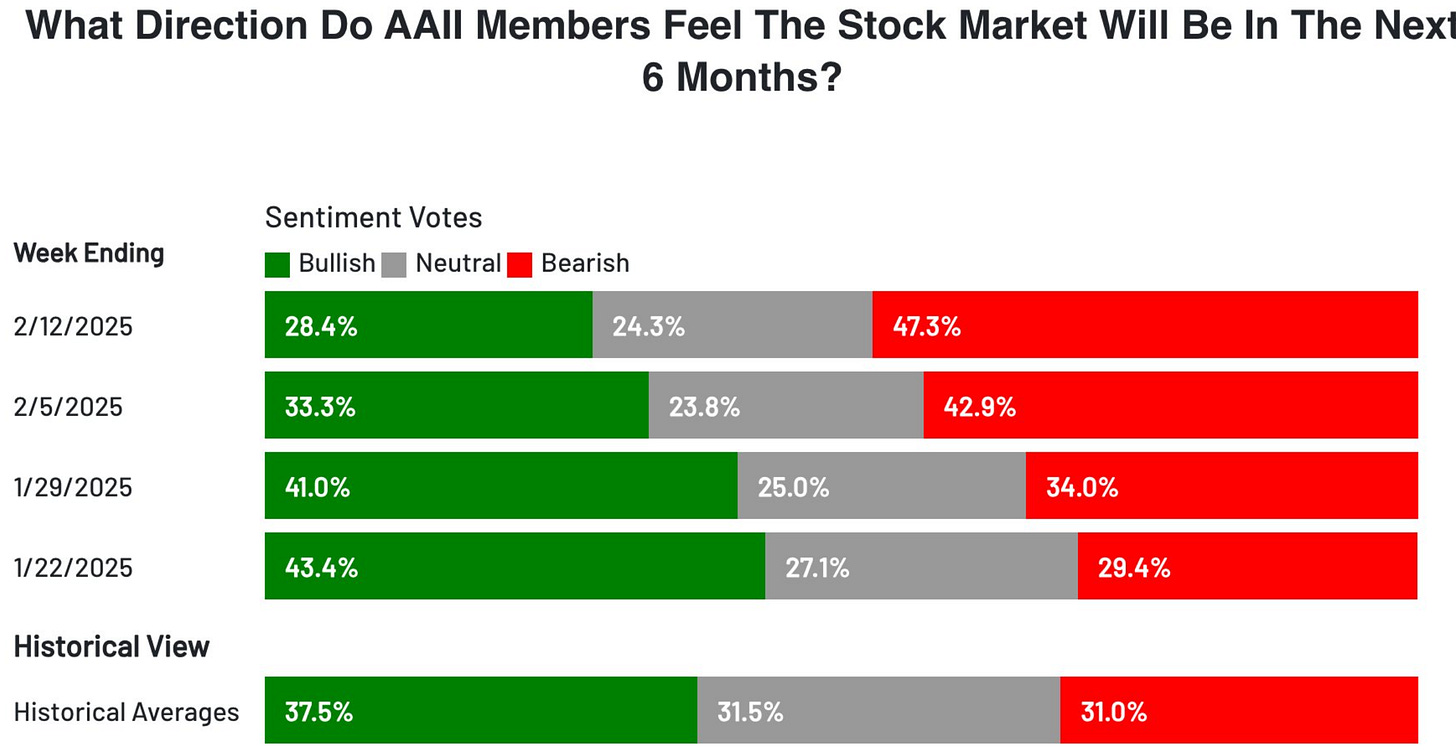

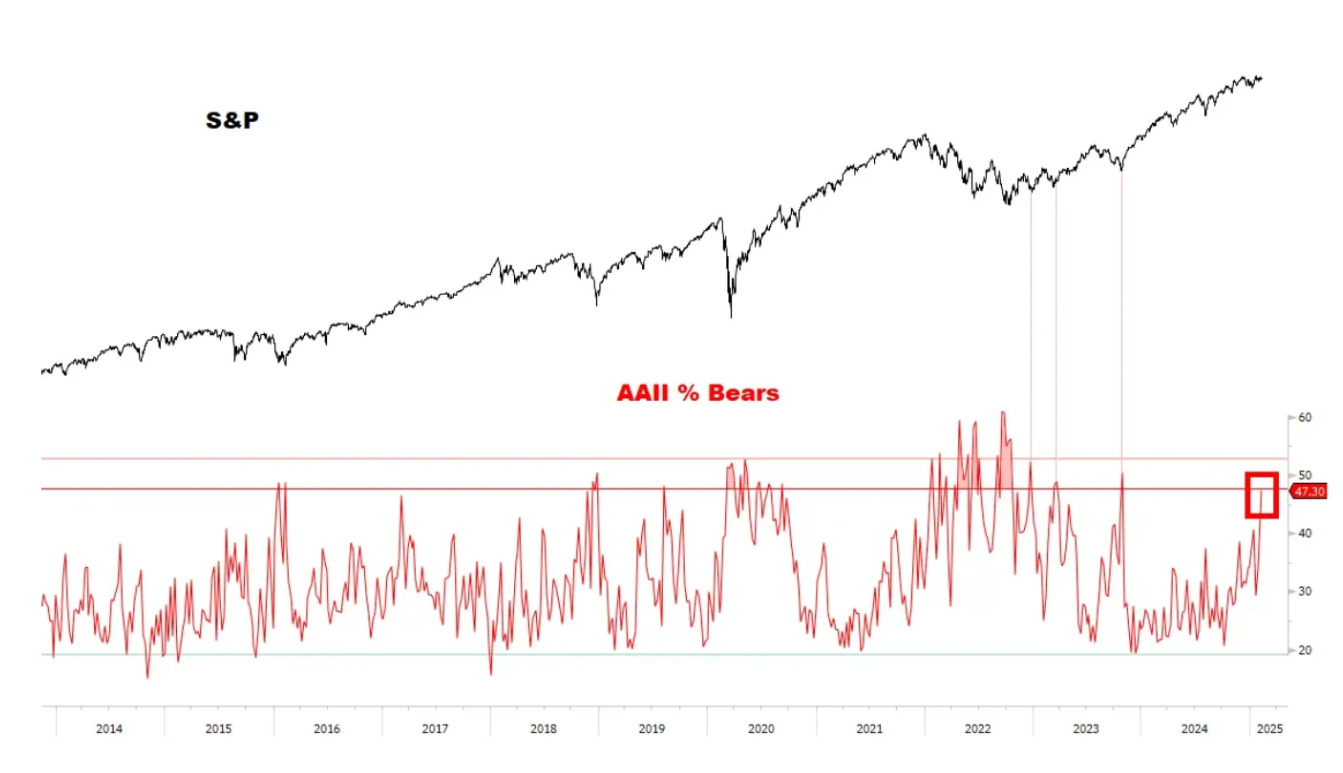

Despite stocks near highs, sentiment indicators remain mixed, with AAII showing lowest % of bulls since November:

Usually more bullish than bearish, however:

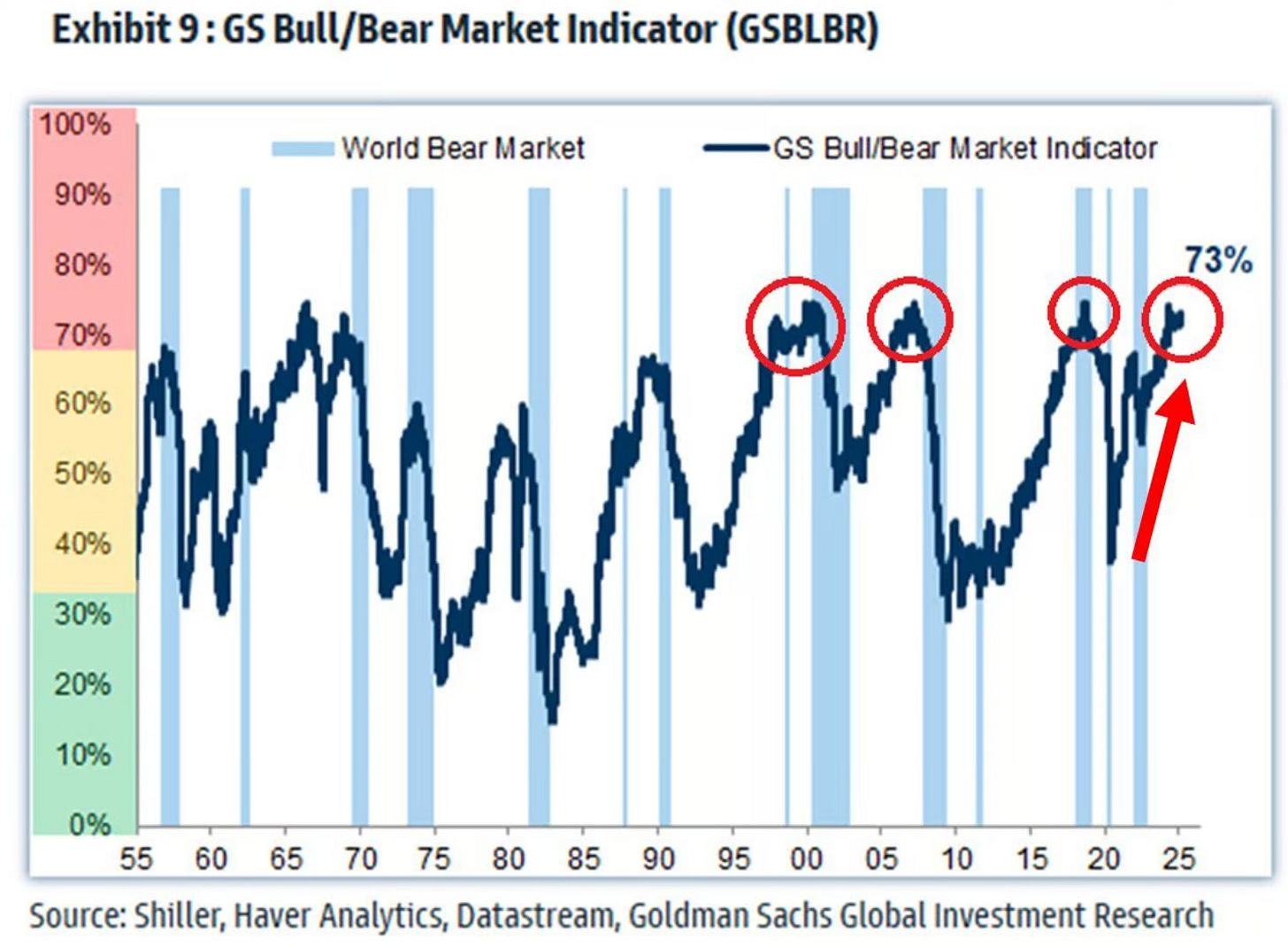

Other indicators pointing to more bullish sentiment:

Breadth is improving…

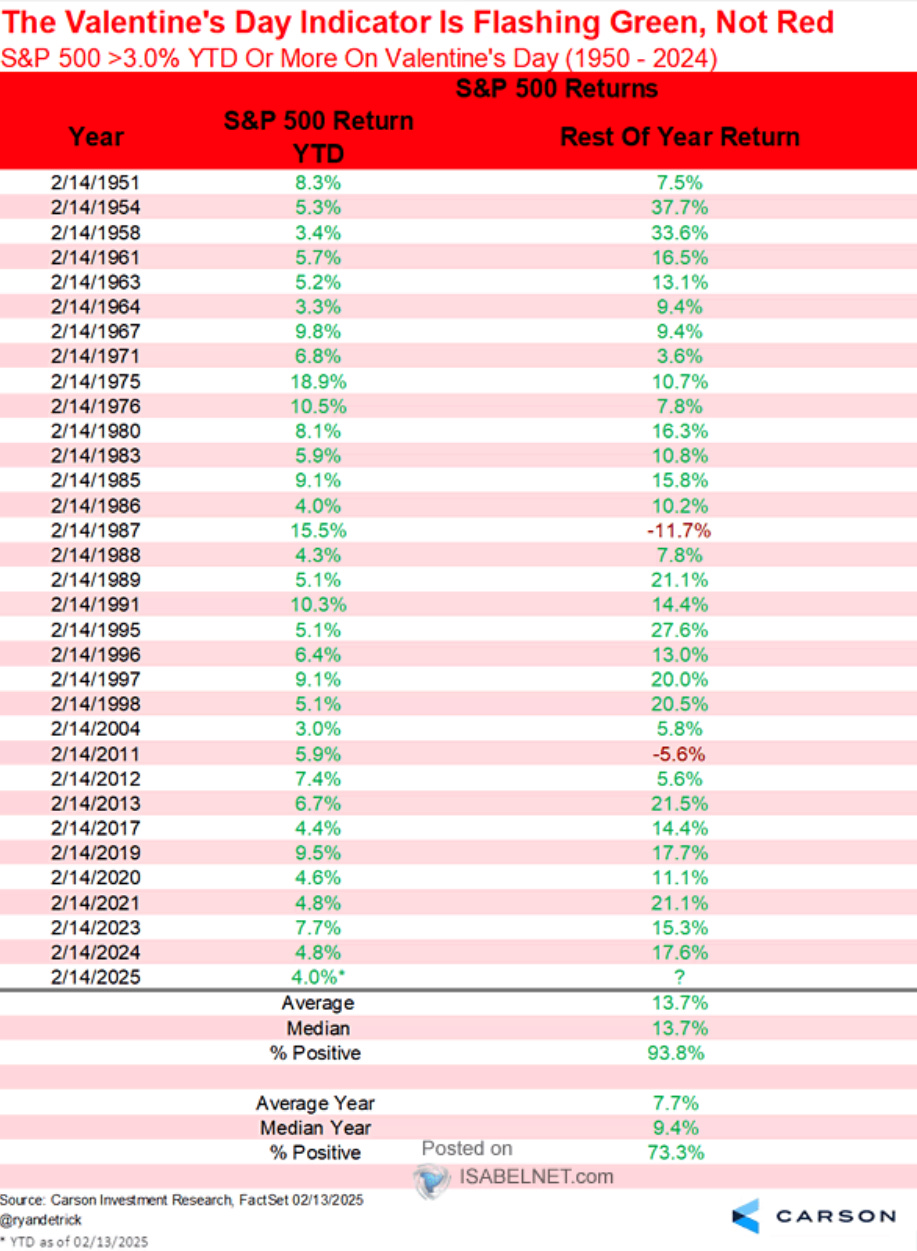

A good start to the year usually means more positive returns ahead:

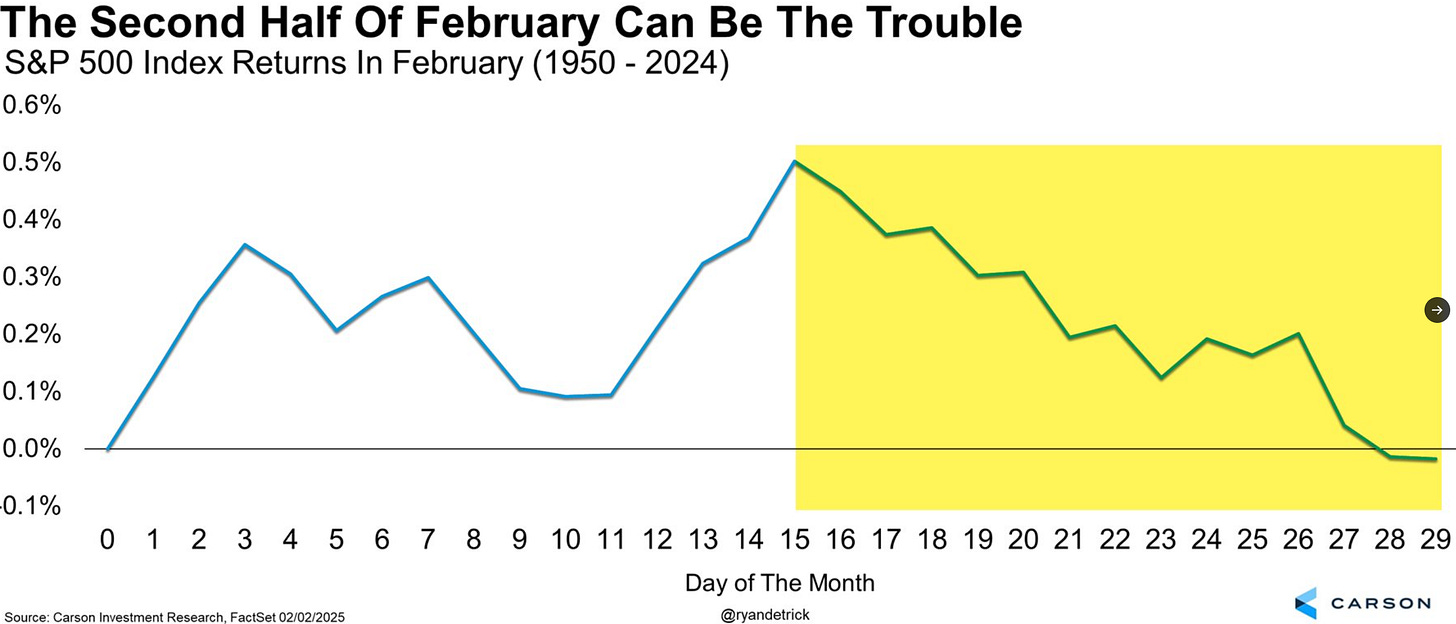

2H of February usually seasonally weak:

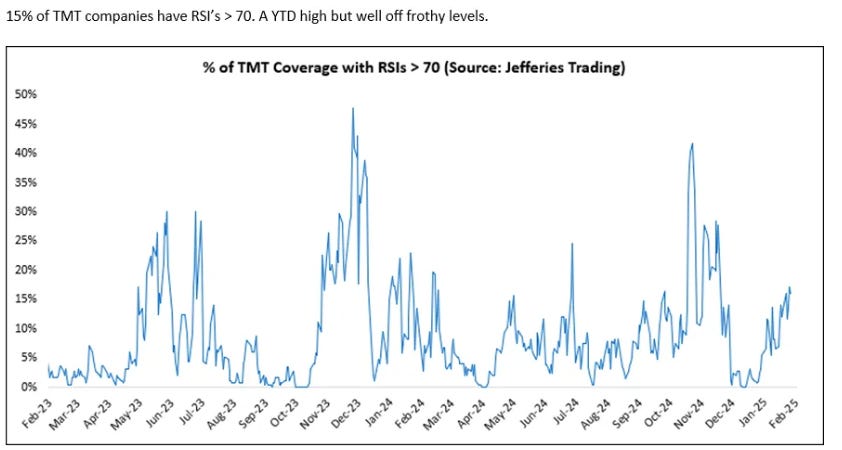

Moving onto Tech…

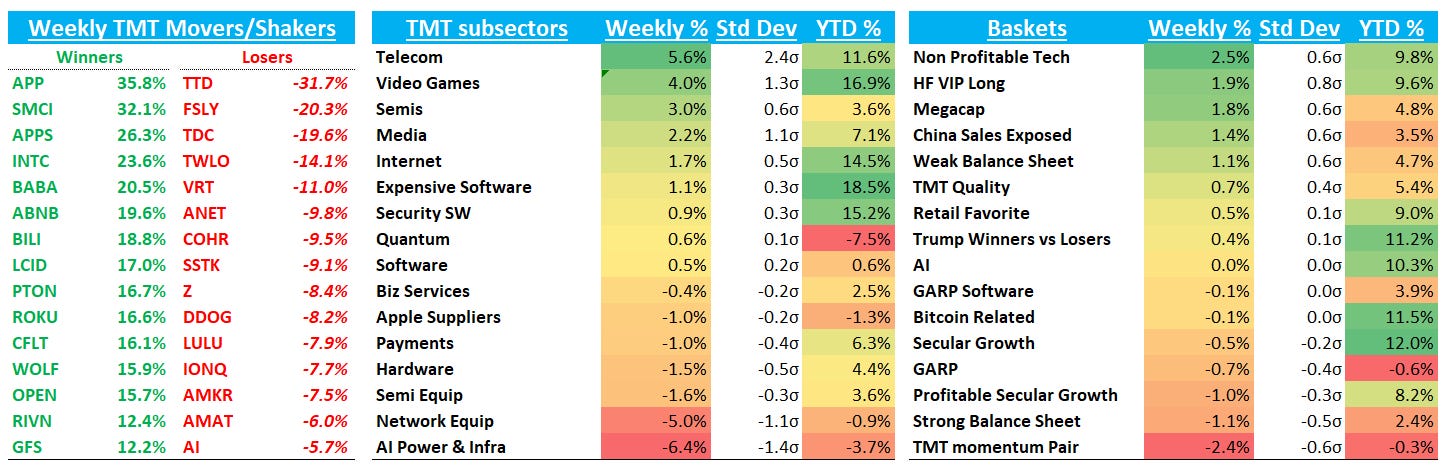

Price action underneath the surface continues to be positive for Tech, but we’re seeing increasing bifurcation in performance of winners vs. losers. This earnings season has shown clean stories with upside to #s and top-line acceleration are following through on earnings - SPOT, META, TEAM, NET, APP, PLTR while misses are following through to the downside or lagging: TTD, BILL, NOW, MSFT to name a few. We think ROKU - accelerating #s, undemanding valuation / #s, decent story - will likely see some follow through early in the week while DDOG has landed in the HF funding short camp and now a show-me story after initial Fy25 growth disappointed and investors focused on AI-native spending/procurement behavior headwinds (eg OpenAI) along with lack of margin upside. We like DDOG long-term as think observability tailwinds should allow growth to re-accel at some point in ‘25, but near-term we think stock remains in the HF funding short camp vs. more near-term ownable names like SNOW, NET, and CFLT.

INTC: More news over the weekend as WSJ reporting AVGO, TSM weighing possible INTC Deal: