TMTB Weekly

It’s the beginning of March, and the early signs of spring are in the air here in Cali: the big Oaks have started to flower, the glowing orange poppys are brightening up the hillsides, and the pitter patter sounds of Pod analysts pouring into the Palace for MS’s TMT Conference are echoing through SF.

All is good in Tech land as we head into one of the biggest conferences of the year (MS TMT schedule here, courtesy of @lucknowcapital on X)., which will be our first good post-Q4 read for many companies. However, the last 4 years haven’t been great for performance during MS TMT:

Yet just like spring is upon us, the start of 2024 has us feeling like a new season of Tech Investing is here, unlike anything we’ve seen in the 2000s. As we wrote Friday morning, if you haven’t realized we are in a new environment/paradigm of investing where the scarcity value and need for exposure for AI exposed names is driving bigger than expected moves, DELL +30% and NTAP +18% should be your wake-up call. Yes, this is the same DELL which used to be considered a sleepy stock just last year and the same NTAP which used to be considered a sleepy stock just last….Thursday. Yes, NTAP (and storage) is now being talked up as an AI beneficiary - things move quick!

Last week, we wrote about Jensen taking the reign from Powell as Market King. Every week that passes seems to bring more evidence that AI is moving quick and fast and this week’s talk du jour was Klarna, who posted stats for their new Open AI driven AI assistant, showing us a preview of the ROI companies outside of Tech might see:

This dovetails with our view of what we think AI means for asset prices, which we wrote about last week:

….let us not lose sight of our bigger picture view that AI will have a massively positive impact on productivity and asset prices. My friend reminded me last week that humans are incredibly bad at recognizing and comprehending exponential growth. Things will go faster and bigger than even the normal exponentiality we are used to thinking about as Tech investors. Why won’t cash rich and data-intensive mega caps continue to drive the market higher? Another good point the same friend mentioned: large companies are driving bigger TAMs while fixed costs are going lower - what other time has this happened before? Aren’t the implications of more AI lowering wage growth/higher employment that the Fed can keep its pedal off the tightening pedal? (Jensen takes the reign from Powell….does the Fed even matter as much anymore?) Bezos, OpenAI, NVDA investing $2B in Figure AI points to an end game where GPUs are being used to train every bit of information we can possibly capture (the FigureAI robot generates and consumes 50x more data per unit of time than LLMs) We are just at the beginning of this thing, just starting to hear stories outside of Tech using AI to increase productivity and lower costs. This all seems massively bullish for asset prices over the next 3-4 years.

Yes, there are likely to be fits and starts and shifts in sentiment that coincide with pullbacks (Yes it was only November when everyone was chirping about NVDA’s demand sustainability). This week’s extended sentiment could be a local top in AI (SMCI getting added to SP500…). There will be doubters along the way (check out Gavin’s thread here). But it’s our view any of these pullbacks will be key buying opportunities.

Back in the early Covid days, when an unprecedented pandemic hit a globally-connected modern society for the first time and the markets were in free-fall, I remember hearing other investors talk about expanding our imagination. That is: since this was something we had never experienced, we had to broaden our existing paradigms and ways of thinking about the markets to include a wider range of possibilities.

As investors (particularly Tech investors) under AI’s new regime, I think a similar broadening of our imagination would do us well. How does the world look like in 2-3 years? Then: if that’s how the world looks like in 2-3 years, standing from that point what will we think the world looks like in 5-6 years? And what does that mean for current multiples? Multiples are a way for us to try to value asset prices based on growth and risk. With AI potentially aiding interest rates in staying lower for longer, what does increasing evidence of AI-enabled ROIs do for what we can dream about earnings growth? At some point we’ll move from Wave 1 (semis benefitting from rapid expansion in chip demand + IT Cloud spend) and Wave 2 (increased demand for infrastructure) to Wave 3 (Increased ROI for companies outside of Tech what leverage AI to drive efficiency + top line gains). This progression won’t be linear and there will be plenty of overlap at any point in time: Klarna and META’s gains are early examples of Wave 3. It’s something we’ll be staying on top of in terms relative performance of the 3 buckets.

Yes, I get it. Stocks have moved hard and fast. NVDA is up 66% YTD and we are only 2 months into the year. Late this week, 1) a combination of investors looking at that 60%+ YTD # 2) seeing several software stocks miss (SNOW, WDAY, ZS, ESTC) and 3) seeing the magnitude of moves from “cheaper” names like NTAP and DELL, drove up some AI “laggards” (hard to call them laggards when up 20%+ for the year) to play catchup and we saw some big moves from AMD, MRVL, AVGO, MU, WDC, CIEN. Some of these software names aren’t really looking as attractive any more vs. semis: why take a risk on a 15x EV/Sales potential AI beneficiary like SNOW, when you can buy DELL at sub 10x FCF, CIEN at 15x FCF or AVGO at 22x. Or for that matter, why not just add to NVDA ahead of a big product release at sub 30x?

How to structure a portfolio in this new paradigm? We pitched names like AMD/NVDA/AVGO in our 2024 favorite ideas piece in December using our old framework of #s and P/E multiples we thought appropriate only to watch them all blow through our more bullish PTs by the beginning of Feb. How to capture a continued potential move up in these stocks while being mindful of drawdowns? An idea we have written about in the past that has been working for us is to segment out a % of the portfolio that is dedicated to long-term AI-winners (We think ~20% is a conservative %). In this bucket you handle trades like a long-only investors: very little trading around quarters, a lot of flexibility around valuation, more willing to take pain on pullbacks, etc. It allows one to be able to capture the potential large moves in AI names while being able to handle pullbacks as a 10-15% drawdown in this bucket equates to only ~2-% drawdown in the total portfolio. That doesn’t mean the rest of the portfolio can’t have other AI names, but the approach in this bucket is buy-and-hold (2-3 years), not gaming shorter/mid term moves.

Another thing that has stunned us is the continued earnings reactions to AI-exposed names. One of our favorite signs of emerging tops and bottoms here at TMTB is how stocks are reacting to earnings prints. The reactions we are seeing to AI-exposed names support the view that we are in the early innings of this AI led move. NVDA and DELL are two examples: you can argue both came in line with bullish buyside bogeys. Let’s assume we were the in market paradigm of yesteryear: given their recent performance, bullish sentiment positioning, and consensus AI beneficiary narrative what would an “inline with buyside bogeys” print mean for the stock reaction? I don’t think NVDA up 20% and DELL +30% was on anyone’s cards. We’ve written about the “AI faker” to “AI maker” trade being one of our favorites on earnings (NTAP +~20%), but just re-confirming the bullish thesis on AI names seems to be just as powerful.

It’s not just names that beat that are acting well. Frankly, we were surprised SNOW, a potential AI name with hair, wasn’t down more on its print. The stock was at 52 wk highs with no valuation support, had a big cut to product #s while competitors DDOG/CFLT beat, pulled their LT guide, potential competitive concerns (Databricks, MSFT…), expectations for acceleration being way off, and the CEO left. This was a big blow up. -18% feels like a win here.

Does this positive skewed r/r continue with the prints this week (CRWD, MDB, GTLB, MRVL, AVGO, CIEN)? All are arguably AI beneficiaries, but we saw last week how names with undemanding valuations have had a better time post-print. However, the market sniffed that out a bit on Friday hence the +7-8% moves in MRVL, AVGO, CIEN and 2-3% move dn in MDB/CRWD. Out of these, we like having exposure to AVGO, MRVL, MDB, GTLB in our long-term AI bucket, in that order.

What else are we watching in the markets?

Last week, we called out yields potentially showing some signs of peaking which would help IWM/ARKK like names (and that funding shorts were likely to rally into the MS TMT Conf). That proved prescient as IWM was up 5% this week. Despite the hotter than expected data (PCE, CPI) we have gotten over the last couple of weeks, yields have failed to make new highs (which tell us they might have peaked) and on Friday the 10-year crossed below the 10d and 21D moving averages:

The housing sector (XLRE) seems to be confirming:

The IWM chart looks to be breaking out of a two year range:

We wrote last week our two favorite horses to have exposure here are CVNA and HOOD, both which have good stories (see here for more details). CVNA was up 19% and HOOD up 15% this week, but we think they both still might have more juice left.

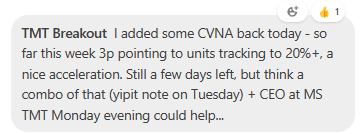

On CVNA, we had trimmed some early in the week given the big run up and were going to wait for the right time to add back if the opportunity presented itself. That opportunity came sooner than we expected and we wrote in the TMTB Chat Friday that we thought the set up for the next several days was good:

We’re hoping for another leg higher….3p data so far this week is tracking 20%+ for units, an acceleration from the mid-teens we have seen the last several weeks. In addition, the CEO is at MS TMT on Monday evening (tone was v bullish on the call) and Yipit usually puts out their CVNA report Tuesday morning, both of which could act as nice catalysts. We think meetings with mgmt will give investors more confidence that EBITDA can continue to grow through the rest of the year. Units are now tracking 11% for the q. In addition, tax refunds are lagging this year which is setting up for a nice y/y tailwind in March — tax refund season is usually a boon for the used car market.

CVNA guided Q1 to LSD y/y unit growth and “significantly higher than $100M in EBITDA.” With units tracking to 10-15% y/y growth, that could add an additional ~$35-40M to their guidance:

On top of that, you have $10-15M of one-time benefits from loan sales. The street is only at $113M and we think $170M is closer to reality. Given how CVNA phrased their guidance (“significantly higher than $100M in EBITDA”), we wouldn’t be surprised to see an early pre-announcement at some point in March. If they were smart, they’d couple it was an equity raise to pay down debt, which we think would be well received by the market.

Our main point of CVNA continues to be: if the data is accelerating, we think the stock will continue to work. If the rate of change or data turns, we aren’t afraid to cut our ties quickly. This isn’t a stock like META we are more longer-term wedded to.

On HOOD, we think it has a little more juice left than CVNA as the story just seems to be getting started: valuation is still undemanding, cash-rich balance sheet potential for better capital allocation, and it remains one of the best ways to have exposure to both an increase in BTC + retail trading.

With yields going lower and housing names looking like they want to run, another name we have on our radar is W. We think the stock is coiled, but 3p data continues to be weak. Any turn there, and we could potentially see a move higher quickly.

Some charts we liked this week….

Divergence in credit spreads…

Tech Landscape - Where do we stand heading into March?

In internet, META continues to be our favorite name. Here’s what we wrote the day of earnings, which still holds true for us:

This print is huge as it completely undercuts the main fear bears (let’s call them “funding shorts” bc I don’t think there are any real bears) had with META, which is decelerating revenue growth in 2H given tougher comps. Now the full year ‘24 rev number of 12% vs 16% in 2023 is looking way too low. Since Susan Li has taken over at CFO, META has come above the high end of their guide every print. If they put up a 30% number in Q1, why can’t they at least grow revs 25% for the year, a 9 pt accel over 2023?

…I still haven’t mentioned the $50B buyback (5% of mkt cap) and dividend, allowing divvy investors to own META.

‘24 EPS buyside numbers will go up to $22-23 vs $20-21 and ‘25 will go up to $26+. What multiple do you pay for META? Well, why shouldn’t the multiple expand given 1) accelerating top line growth 2) better operating leverage 3) stellar execution over the past year and 4) optionality around AI products/whatsapp/B2C monetization.

Let’s put a range of 22-25x on $26; that’s $575-$650, or 27-45% upside. Floor is 20x $23, $460. So r/r still VERY GOOD and still plenty to go imo…

With the stock at $500 and upside at $650 — $150 up and $40 down — we think the r/r is still exceptional. We are leaning closer to our 25x $26 bull case as we continue to believe investors will pay up for the scarcity value of AI plays. With META one of the few internet plays already showing significant ROI results from their AI investments, optionality from other monetization levers like Whatsapp and B2C, and top line acceleration in 2024, we believe the multiple will have support. The street is only at 26% y/y growth for Q1 and we think 30%+ is possible. The latest checks we got from a 3p boutique on Friday showed no slowdown in their momentum. We also think Zuck has cemented his place as one of best CEOs in Internet and with weaker prints from other advertising names (GOOGL/PINS/ROKU/DV/IAS), we think META stands alone at the top.

Yes, we aren’t alone, and the stock remains the most crowded and loved in TMT, but that hasn’t stopped it from working the last two years.

We continue to like AMZN as well. The stock is sneakily making new highs, we’ve gotten some 3p datapoints pointing to AWS acceleration (aided by some price increases) and we think once a more sustainably turn in AWS happens, AMZN will be lumped in as one of the better AI plays Meanwhile, the retail operating margin thesis is intact. The stock still has room to play catch up to pre-covid valuation and is on the verge of finally testing ATHs.

Despite NFLX beginning to hit the upper ranges of the bull’s trading range, it’s hard to bet against the stock when 3p data is pointing to a massive beat on net adds this q (12M vs. street at ~4-5M). Bulls are at $24-$25 in ‘25 and at 25x that’s $625. However, what bulls are really playing for is the eventual ARM inflection up/further price increases, which could drive $40-$50 FCF by 2028 on 60% FCF growth from 24-26. Could NFLX deserve a better multiple than 25x? You could argue that the streaming landscape has shifted for the better for NFLX and their drive for increased monetization changes their FCF profile, so yes that’s the uber bull case. My guess post-earnings was this could happen when we get a q where ARM finally inflects up, but the bull case seems to be playing out here sooner than expected.

SPOT and UBER are proving that even non-AI stocks can do well. UBER delivered at their analyst day in mid Feb and bulls will say that there is still significant upside to earnings in ‘25/’26 helped by advertising on mobility, mgmt is great and always beats the guide, and valuation isn’t stretched since its a FCF machine (a utility with 0 capex) and now returning cash to shareholders. The stock is still only 17x ‘26 P/FCF while growing FCF 40%+, and compared to others in internet, that’s a good value. We agree. Bears will point to competition, increased areas of investment, and automated driving as risks, but those don’t seem to be relevant at the moment.

SPOT continues to grind up as bulls think there is still more room to go on margins and plenty of pricing upside to pull. DASH bulls kept their dreams of $2B in EBITDA alive post-print and argue DASH is the next UBER with potential SP500 inclusuion on the docket later in the year. SHOP margin bull case took a bit of a hit following their results but 3p data continues to point to significant upside for GPV this q (CFO is at MS TMT this week).

With yields potentially making a move lower, we have our eye on housing. Out of Z, OPEN, RDFN, W, we think W is the most interesting as has the most fixed cost leverage in their model, and any turn in data is likely to drive significant EBITDA upside. Like CVNA, mgmt has done a great job right-sizing the business and is taking share, and if we were finally to see a turn in the data, this stock would move quickly. The bar is super low, but housing inventory is up dd over last year, so sellers might be finally entering the market again, potentially driving more buyers, which all need furniture. We think this merits at least a small starter position.

SNAP continues to lag after mgmt sucked in bulls before last quarter only to miss. Bulls will say that was a capitulation clearing, the miss was an expectations issue, they have AMZN partnership + app install rebuild in Q2, and EBITDA #s actually went up post-q. However, bears say this is now a show-me story and mgmt has a long way to go to repair their reputation.

PINS continues to be in the semi-dog house following their print. However, investors continue to believe the bull case is intact as 3p partnerships like AMZN and GOOGL will begin to ramp this q. CEO usually sounds good and will be at MS early this week. We continue to like the stock over the medium term and are using $35 as an add price, where we believe the r/r ($15 up / $5 down) is attractive.

Let’s move onto some less sexy and loved names. MTCH bulls continue to wait for the all elusive turn in Tinder net payer adds, which doesn’t seem to be coming any time soon.

Same story with ETSY as bulls wait for the elusive data turn. Like MTCH, we think there is a decent long hook if investors can get comfortable with a sustainable data turn: an activist involved which could help drive increased take-rate/capital allocation, marketing initiatives in 1H might drive upside in 2H, and ETSY would be a beneficiary of any ramped of rhetoric from Trump about banning/taxing China imports (ie, TEMU). However, bears are still in control while the data remains weak and will say ETSY is the next EBAY, isn’t cheap (7x ‘25 P/E), and continues to suffer from competitive (Temu, Shein) and structural issues that are unlikely to be solved any time soon.

Speaking of EBAY, sentiment seems to be turning better here as we thought last q’s print went a long way in helping bulls. EBAY pointed to an improved demand environment in Nov/Dec despite a slow start to the q and macro headwinds that still remain (recent work around delivery/faster shipping helped drive holiday spending). QTD has been choppy by mgmt expects GMV growth in Q3 and Q4 24. Mgmt feels confident about this as 1) focus categories scaling up 2) new opps/geos 3) and improvement in Gen AI/search). Bulls will say EPS/GMV beat was solid, # of active buyers has stabilized, first guide for margin improvement since 2020, and #s going up showing EBAY’s ability to manage cost and drive eps acceleration. The stock is cheap at <10x FCF in 25, and while the story isn’t v sexy, could be interesting for those looking for a “value” play.

CHWY 3p data has marginally turned over the last couple of weeks and bulls will say that revenue growth will trough in 1h24 and reaccelerate in the back half as customer growth stabilizes and Canada begins to ramp (3p has shown Canada buyers slowly ramping). Bulls will also point to high margin advertising builds both on and off site while the stock is only 15x ‘25 EBITDA. Bears will say AMZN is still gaining share and how can CHWY compete with them?

CART has been sneakily creeping up ahead of their lock up as 1) Sequoia made some large open market purchases a couple of weeks ago and 2) Investors are digesting if ARM can go up 100% ahead of their lock up, why can’t CART work as well? Bulls will point to low online grocery penetration, cheap valuation (low dd EBITDA multiple) potential for better margins while advertising and rake rate expands, while bears cite increased competition from AMZN, WMT, DASH, and UBER.

ROKU has failed to get a bid following their weaker Q as bears point to harder comps, weaker M&E spend, potential increased in competition driving higher spend, and after Vizio, unlikely that ROKU is an acquisition tgt at their current valuation. Bulls will say there is still plenty of EBITDA upside this year as long as advertising trends are stable.

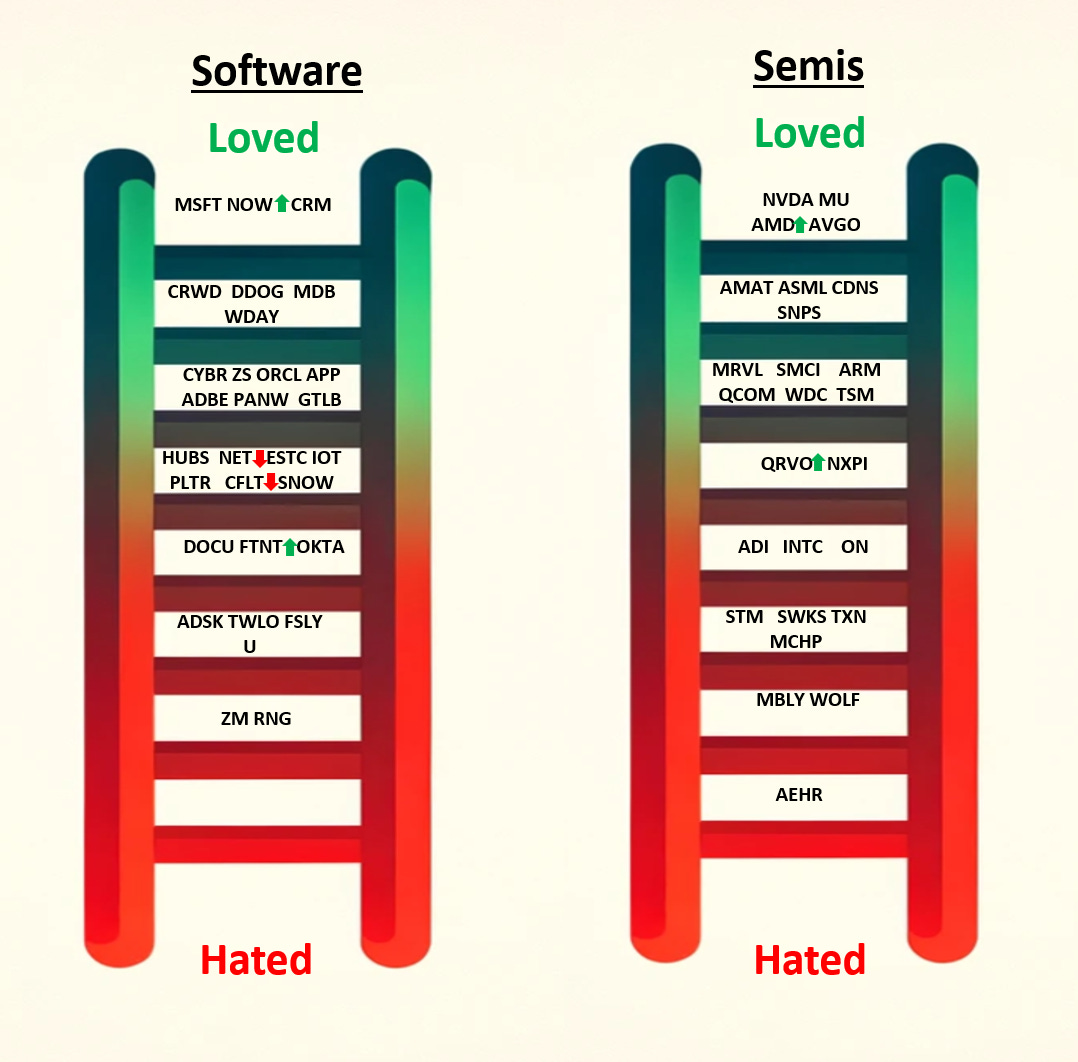

We touched on software and semis above and we’ll have more following the set of prints this week.

In Semis, let’s not complicate things — it’s AI vs. non-AI exposure.

In software, the themes we continue to pay attn to are 1) is sw security spend really slowing after a massive investment cycle over the last 2-3 years (“spending fatigue”) and are we entering a new era of price wars? PANW and ZS results seem to point to yes, but we came away from this week having warmed up to OKTA’s turnaround story 2) how much is spend shifting away from traditional IT spend in favor of AI.

This week, investors came away confused at whether SNOW was a real AI beneficiary and how much competition is a factor in the guide down vs. conservatism for the new CEO to beat and raise. We think the stock will remain a show-me story in the near-term, and think more interesting opportunities are DDOG and CFLT (which has a lot of room for the multiple to expand on accelerating growth).

Investors shook off a weak Q1 guide for CRM and cRPO and capital allocation was better (Along with MSFT and NOW, CRM continues to be one of our favorite LT sw compounders). WDAY results were worse although bulls will say the guide was conservative — the stuck hung in well post the q given expectations for SP500 inclusion. Since SMCI got the nod, we are likely to see some catch up to the downside early in the week.

That’s all for this week - see you tomorrow AM!

Bullish and Bearish Weekly Option Flow

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.