TMTB Weekly

Happy Sunday - hope everyone is enjoying their weekend. We’ll talk high level first, move onto some Tech Landscape thoughts and then dive into a couple ideas.

Let’s get to it…

Bigger Picture - Where do we stand as QQQs hit a new closing high?

I won’t spend too much time here as there isn’t much new to talk about - just pull up the chart of the QQQs and easy to see why:

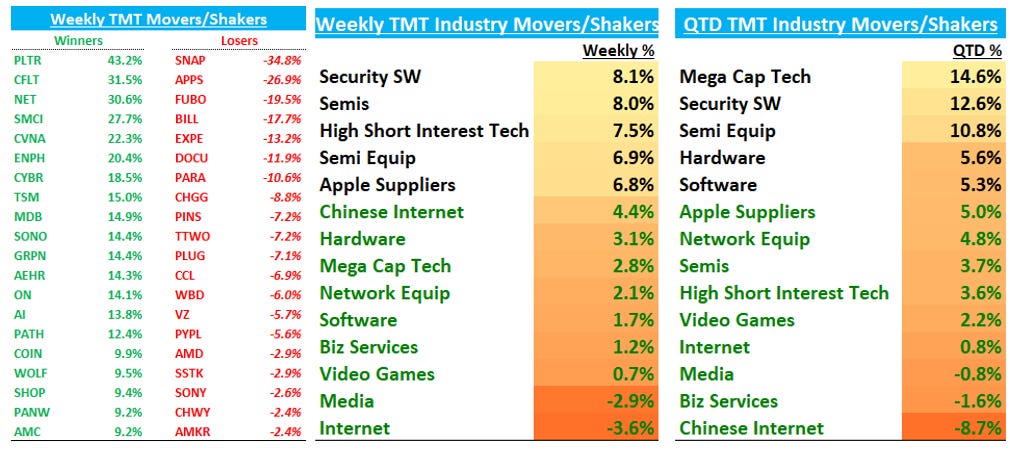

The QQQs hit new closing highs up 2% for the week while breadth improved — ARKK was up 6%, IWM +2.5%. Riskier assets like BTC are hitting new yearly highs again.

Some big moves already this year and it’s not even President’s day: Mega Cap Tech up 14% QTD - NVDA’s up 45%, META +30%, etc… lots of sw names up more than 20%. Everything’s turning up roses for Tech longs.

It’s easy to why — high level the macro narrative is supportive and exciting: You have improving econ data with the Fed potentially beginning to cut, inflation coming down with oil and Nat gas subdued, potential QT taper, decently strong consumer, and easing financial conditions buoyed by the stock market wealth effect. Oh yeah — all with the backdrop of potentially the biggest secular trend any of have ever seen.

From a bottoms up price perspective, there’s nothing that makes us want to leave our bullish stance and really not many tea leaves that make us nervous. Going through all TMT charts this weekend, lots of breakouts, lots of stocks above or crossing ST moving averages, leaders continue to lead, etc.

We think earnings reactions are reasonable/rationale, with the obvious skew to the long side if you have AI exposure (see NET PLTR or ARM this week). Some will say some of these moves aren’t justified, but here at TMTB we don’t have strong opinions on how the market should act, but rather we just read the tea leaves in front of our face to see what reality is telling us and what the most likely narrative investors will latch onto to will be. And the price action is telling us investors are clamoring for AI-exposed stocks, there’s a scarcity value there, and so the market is telling us to be more flexible with valuation in relation to these stocks (more on this later…).

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.