TMTB Weekly

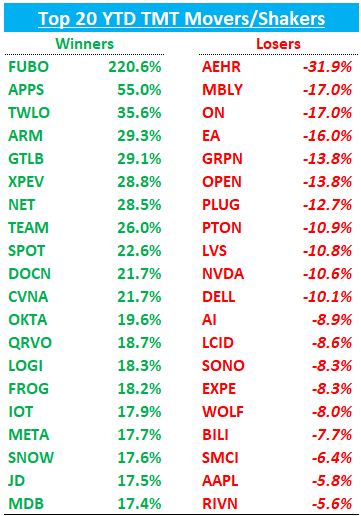

That was quite a first month in the markets! Despite all the choppiness, a yield scare, and a Chinese LLM entering the game, the QQQs are still up 2% for the year. As we suspected, 2025 has brought with it more turbulence in the overall index, but we continue to think the macro environment remains supportive for stocks - plenty of names up 15%+ so far in the year…

Idiosyncratic stories and beats/misses are being both rewarded and punished - this week we saw that on the long side with CLS and TEAM and on the short side with EA and NOW. While 2024 was an ideal backdrop for momentum—rates were in a sweet spot, sentiment was euphoric, and multiple expansion was rampant — we think 2025 will continue to be a good backdrop for stock picking (with a continued long bias).

We’ve been writing about the increasing dispersion in AI semis that started near the middle of last year. In 2023/early 2024, everything AI went up. As the AI supercycle has matured from infancy to childhood, investors have become increasingly selective about what to buy, which means winners are getting bid up more heavily (just check out CLS px action this week). This makes for a more discriminatory stock picking environment and a trend we think will continue.